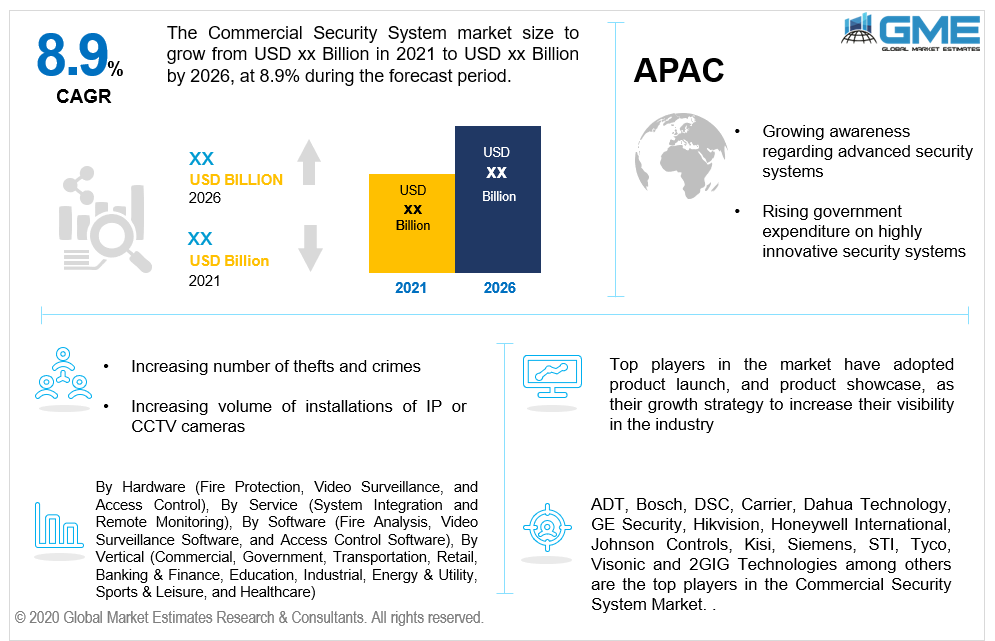

Global Commercial Security System Market Size, Trends & Analysis - Forecasts to 2026 By Hardware (Fire Protection, Video Surveillance, and Access Control), By Service (System Integration and Remote Monitoring), By Software (Fire Analysis, Video Surveillance Software, and Access Control Software), By Vertical (Commercial, Government, Transportation, Retail, Banking & Finance, Education, Industrial, Energy & Utility, Sports & Leisure, and Healthcare), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The commercial security system is a dedicated environment that is present in any establishment where there are potential chances of theft, danger to the place, or any other crime. The system keeps a check on all the activity going on in that place throughout the day or 24 X 7 with the help of the internet. Constant monitoring is done with the help of an innovative designed system and the data is being recorded and stored on a particular server. This is also helpful for places where there is no physical or human security present to look out for the process or the safety. If there is any kind of danger, an alarm rings and immediately a signal is sent on the main server so that the individual monitoring the system can immediately inform the concerned person to avoid any kind of loss whether in terms of monetary or human life.

In a commercial set up there can be various security systems such as smoke or a fire, which automatically activate the alarm after someone feels a potential danger. An example of this is the Notifier Commercial Alarm System by Honeywell which has the most advanced smoke detection system present in it which has both alarm and voice alert systems. The average cost of setting up of commercial security system is approximately USD 3000 comprising a CCTV or an IP camera, a control system, etc.

The factors driving this market are, the increasing number of theft and crimes in commercial complexes, mishappenings, and unavoidable accidents in industries. Also, an increasing number of installations of IP or CCTV cameras at residential complexes, industries, streets, railways, and bus stations are further increasing the demand. Ever-growing innovations and modifications by security system companies in their product for better experience and output is also a leading driver. The requirement of extremely high-end security systems in armed forces for national security and banks or government offices to avoid any kind of security breach is the key driver responsible for the overall growth.

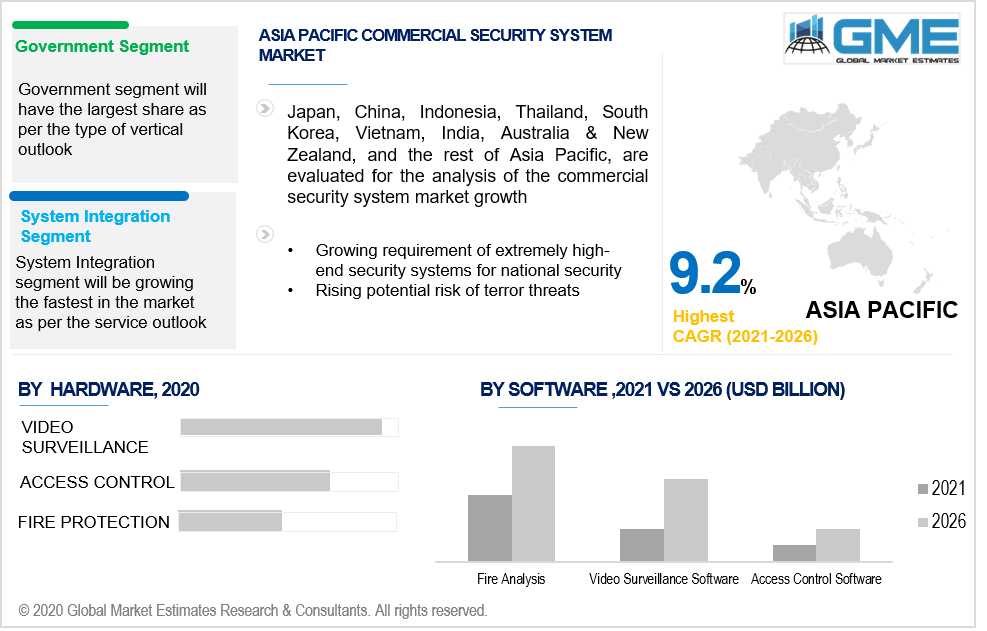

Based on hardware the commercial security system market can be segregated into fire protection, video surveillance, and access control. Video surveillance is having the highest market share as per the hardware segment is concerned owing to the better monitoring system with AI-based device video devices. The ability of AI to interpret photographs and sounds from livestream detection and monitoring sources, as well as its potential to use image processing techniques to identify faces, devices, and activities, among other things, is propelling worldwide growth.

Based on services the commercial security system market can be segregated into system integration and remote monitoring. System integration is dominating the market owing to its compact facility and is exceptionally reliable as its control system is designed in a way that doesn’t need any kind of monitoring.

Based on software the commercial security system market can be segregated into fire analysis, video surveillance software, and access control software. Fire analysis software has the highest market share as per software segment because of the emergence of advanced devices and the introduction of strict fire safety legislation globally.

Based on the vertical, the commercial security system market can be segregated into commercial, government, transportation, retail, banking and finance, education, industrial, energy and utility, sports and leisure, and healthcare. The use of commercial security systems has the largest implementation in government organizations owing to the increasing concerns over safety and attacks.

As per the geographical analysis, the market of Commercial Security System Market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. North America is dominating this market owing to the world-class security system present in its military and even in private sectors. Moreover, increased crime rate and disruption of activities in the region is a key driver. The commercial security market is being influenced by the growing importance of monitoring frameworks in various applications due to the benefits of remote control and standardized resource use. Also, an increase in the volume of safety breaches is leading to continued strict responses to threats and hazards. Asia Pacific is anticipated to record the highest CAGR owing to the rise in demand for advanced security or monitoring systems at the commercial level.

ADT, Bosch, DSC, Carrier, Dahua Technology, GE Security, Hikvision, Honeywell International, Johnson Controls, Kisi, Siemens, STI, Tyco, Visonic, and 2GIG Technologies among others are the top players in the commercial security system market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Commercial Security System Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Hardware Overview

2.1.3 Service Overview

2.1.4 Software Overview

2.1.5 Vertical Overview

2.1.6 Regional Overview

Chapter 3 Commercial Security System Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Ever-growing innovations and modifications by security

systems companies

3.3.1.2 Requirement of extremely high-end security systems in

armed forces for national security

3.3.2 Industry Challenges

3.3.2.1 High installation and maintenance cost

3.4 Prospective Growth Scenario

3.4.1 Hardware Growth Scenario

3.4.2 Service Growth Scenario

3.4.3 Software Growth Scenario

3.4.4 Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Commercial Security System Market, By Hardware

4.1 Hardware Outlook

4.2 Fire Protection

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Video Surveillance

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Access Control

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Commercial Security System Market, By Service

5.1 Service Outlook

5.2 System Integration

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Remote Monitoring

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Commercial Security System Market, By Software

6.1 Software Outlook

6.2 Fire Analysis

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Video Surveillance Software

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Access Control Software

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Commercial Security System Market, By Vertical

7.1 Vertical Outlook

7.2 Commercial

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Government

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Transportation

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Retail

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

7.6 Banking and Finance

7.6.1 Market Size, By Region, 2019-2026 (USD Million)

7.7 Education

7.7.1 Market Size, By Region, 2019-2026 (USD Million)

7.8 Industrial

7.8.1 Market Size, By Region, 2019-2026 (USD Million)

7.9 Energy and Utility

7.9.1 Market Size, By Region, 2019-2026 (USD Million)

7.10 Sports and Leisure

7.10.1 Market Size, By Region, 2019-2026 (USD Million)

7.11 Healthcare

7.11.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Commercial Security System Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Million)

8.2.2 Market Size, By Hardware, 2019-2026 (USD Million)

8.2.3 Market Size, By Service, 2019-2026 (USD Million)

8.2.4 Market Size, By Software, 2019-2026 (USD Million)

8.2.5 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Software, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Software, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Vertical, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Million)

8.3.2 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.3 Market Size, By Service, 2019-2026 (USD Million)

8.3.4 Market Size, By Software, 2019-2026 (USD Million)

8.3.5 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Service, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Software, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Million)

8.4.2 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.3 Market Size, By Service, 2019-2026 (USD Million)

8.4.4 Market Size, By Software, 2019-2026 (USD Million)

8.4.5 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Software, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Software, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Software, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.9.2 Market size, By Service, 2019-2026 (USD Million)

8.4.9.3 Market size, By Software, 2019-2026 (USD Million)

8.4.9.4 Market size, By Vertical, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Service, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Software, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Million)

8.5.2 Market Size, By Hardware, 2019-2026 (USD Million)

8.5.3 Market Size, By Service, 2019-2026 (USD Million)

8.5.4 Market Size, By Software, 2019-2026 (USD Million)

8.5.5 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Software, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Software, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Software, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Million)

8.6.2 Market Size, By Hardware, 2019-2026 (USD Million)

8.6.3 Market Size, By Service, 2019-2026 (USD Million)

8.6.4 Market Size, By Software, 2019-2026 (USD Million)

8.6.5 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Software, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Software, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Vertical, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Hardware, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Service, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Software, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Vertical, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 ADT

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Bosch

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 DSC

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Carrier

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Dahua Technology

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 GE Security

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Hikvision

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Honeywell International

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Johnson Controls

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Kisi

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Siemens

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 STI

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Tyco

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Visonic

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 2GIG Technologies

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

The Global Commercial Security System Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Commercial Security System Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS