Global Complementary and Alternative Medicine Market Size, Trends, and Analysis - Forecasts To 2026 By Intervention (Botanicals [Ayurveda, Apitherapy, Bach Flower Therapy, Naturopathic Medicine, Traditional Chinese Medicine, Traditional Korean Medicine, Traditional Japanese Medicine, Traditional Mongolian Medicine, Traditional Tibetan Medicine, and Zang Fu Theory], Mind Healing [Autosuggestion, Hypnotherapy, Neuro-linguistic Programming, Self-hypnosis, Spiritual Mind Treatment, and Transcendental Meditation], Body Healing [Acupressure, Acupuncture, Alexander Technique, Auriculotherapy, Autogenic Training, Chiropractic Treatment, Cupping Therapy, Kinesiology, Osteomyology, Osteopathy, Pilates, Qigong, Reflexology, and Yoga], External Energy [Magnetic Therapy, Bio-magnetic Therapy, Magnetic Resonance, Radionics, Reiki, Therapeutic Touch, and Chakra Healing], and Sensory Healing [Music Therapy, Aromatherapy, Sonopuncture, and Sound Therapy]), By Distribution Method (Direct Sales, E-sales, and Distance Correspondence), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Complementary and alternative medicine (CAM) is a category of drug used to treat diseases that cannot be treated with traditional medicine. Complementary medicine is a therapy that is used in conjunction with conventional disease treatment but is not regarded as standard treatment. Health practitioners such as psychiatrists, physiotherapists, and others use them to administer nutritional supplements rather than traditional medications. Allopathic drugs and biomedicines are terms used to describe complementary medicine. Alternative medicine, in its most basic form of drug that is used instead of traditional medicine. Treatment of jaundice with herbs, a balanced diet containing multivitamins, and the use of home remedies are all instances of alternative medicines.

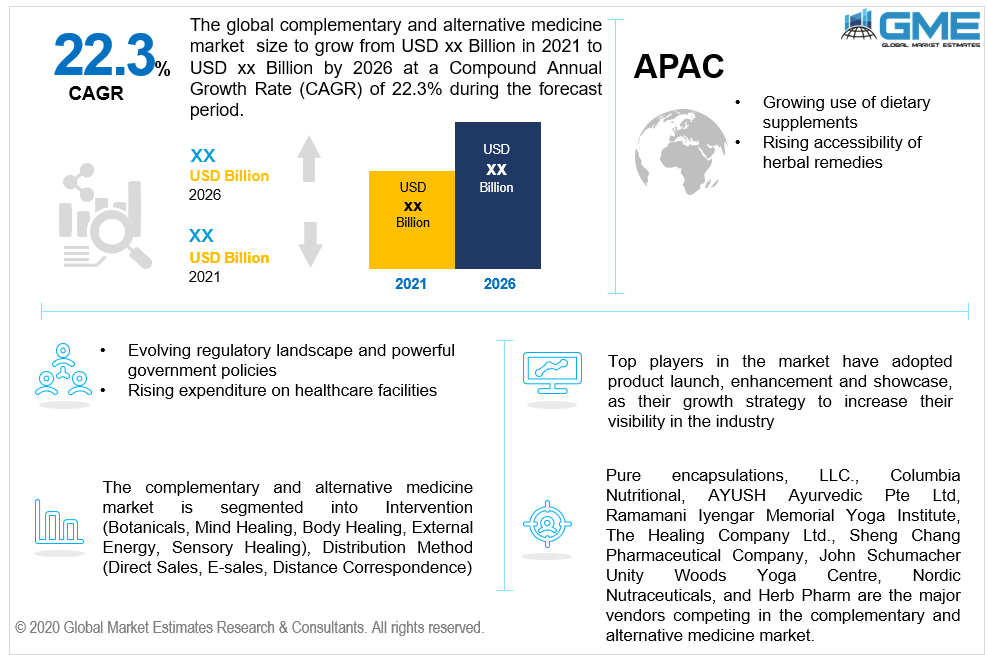

The global complementary and alternative medicine sector holds the highest share in the global healthcare market. The market is expected to grow significantly because of the evolving regulatory landscape and powerful government policies, leading to the creation of stronger transnational links through healing channels that bind global, local, and national trends in alternative medicine. Furthermore, government programs examining norms relating to the right to health in all its aspects are expected to bolster treatment providers' and consumers' interest in the field of alternative and complementary medicine. Government programs, such as increased targeted spending, the establishment of government hospitals, and the issuance of recommendations to make proper use of complementary and alternative medications, all help to drive demand for integrative health and complementary medicine treatments (CAM).

Medical tourism, which draws individuals from all over the globe and allows them to pursue world-class alternative medical care, is now being promoted by regulatory authorities. In several Indian states, for example, regulatory agencies have invested heavily in the standardization and production of alternative healthcare centers. A government agency called the "Ministry of Ayush" has been established to oversee homeopathy, yoga, naturopathy, and Ayurveda education, research, product creation, and other services in India.

Furthermore, the current research project concerned with the use of alternative medicines for the care of COVID-19 patients is expected to gain momentum globally. Traditional medical options for COVID-19 patients are being promoted by governments all over the world; however, it is critical to adhere to the traditional research guidelines established for all other drugs. This pattern has arisen as a result of research into the capability of medicinal herbs to provide efficacious care to COVID-19 patients, and it is anticipated to have a beneficial effect on the complementary and alternative medicine market's development. However, the lack of scientific evidence to back up herbal medicine professionals' assertions has become a stumbling block for alternative medicine professionals. Nevertheless, it is anticipated that substantial support for clinical trials for complementary and alternative medicine will be beneficial. Moreover, collaborative support from the government and leading players of this market will be sufficient to address this drawback.

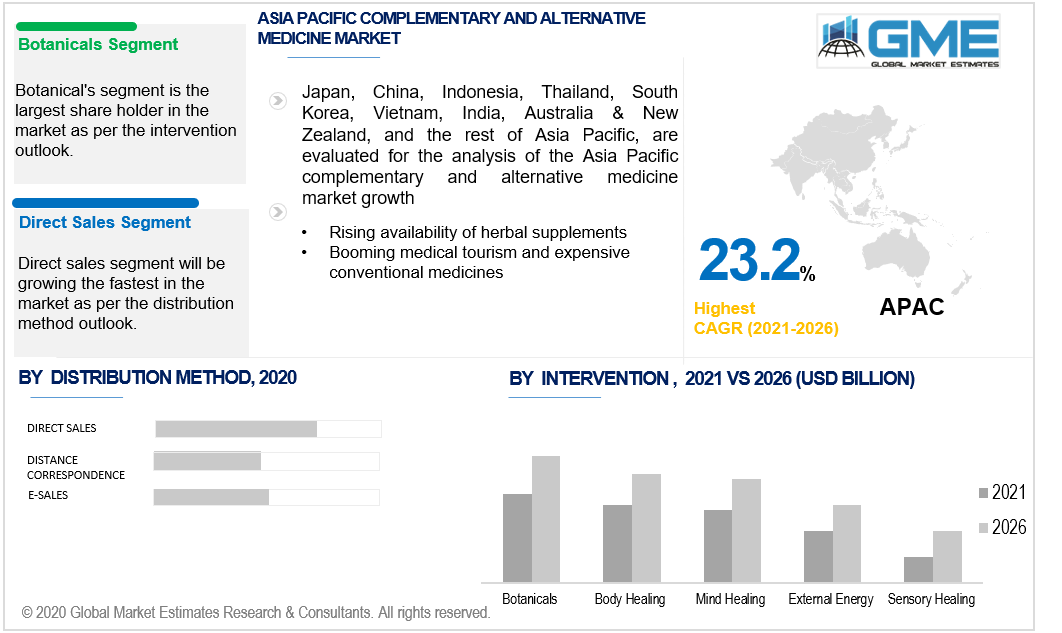

Depending on the intervention, the market is categorized as, botanicals, mind healing, body healing, external energy, and sensory healing. Traditional herbal medicine or botanicals dominated the market, contributing to the largest proportion. Botanicals are the most often used complementary and alternative drugs in both emerging and advanced nations. Botanicals are further segmented as ayurveda, apitherapy, bach flower therapy, naturopathic medicine, traditional Chinese medicine, traditional Korean medicine, traditional Japanese medicine, traditional Mongolian medicine, traditional Tibetan medicine, and zang-fu theory. Globally all of these are used in the form of homeopathic medications, herbal supplements, and other organic products. They are widely used in most nations as nutritional supplements in addition to traditional medicines and food.

Certain products, such as medicinal oils and tea, have become incredibly common in developing nations. Medicinal herbs and plants have gained prominence as a result of their ability to be manufactured and shipped in a variety of forms, including ointments, tablets, teas, whole herbs, and syrups. Ayurvedic products are widely used in nations like China and India, and this trend is projected to continue, thus fuelling this segment's expansion.

Depending on the distribution method, the market is categorized as, direct sales, E-sales, and distance correspondence. Due to the extreme meteoric growth in medical tourism, direct sales contributed to a substantial proportion of the market share. Healthcare offered by direct sales is projected to dominate the complementary and alternative medicine market. This pattern is strengthened by government support to expand medical services and encourage alternative medicines. To broaden their enterprises, numerous regional Ayurveda and acupuncture professionals and organizations are looking at the direct distribution of complementary medicine and alternative treatments. These organizations focus on the relationship between doctors and patients, as well as treatment methods that boost profits.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. Europe is anticipated to hold a dominant position in this market because of the growth of medical tourism and the high cost of traditional medicines. Complementary and alternative medicine, which includes a broad variety of treatments that are less reliant on modern drugs, such as acupuncture, has hit the mainstream target market in Europe. Botanicals are widely used as nutritional supplements in nations including Germany and France. Furthermore, the customer understanding of the emergence of successful alternative and supplementary drugs, as well as the advantages they have, is projected to fuel the growth of the European market.

Post-2000, Norway has seen a substantial rise in the number of hospitals providing complementary and alternative medicine, particularly acupuncture. Acupuncture treatments were available in more than 40 percent of Norwegian clinics as early as 2008. Furthermore, in both in-patient and outpatient clinical settings in Norway, acupuncture continues to be the commonly used and desired complementary and alternative medicine therapy. Thus, boosting the demand in the European region.

Asia Pacific is expected to account for the highest share of CAGR throughout the forecast period. The number of alternative medication professionals in the area has increased significantly. The demand for herbal remedies in the Asia Pacific nations has been studied in several types of research. These studies conducted focused on analyses of variables such as medicinal plant usage, accessibility, and affordability across the region, thereby fostering the market’s development. Expanded use of dietary supplements, quick accessibility of herbal remedies, and also being the homeland of many medicinal therapies, are the few factors due to which Asia-Pacific is projected to witness the highest growth in the global complementary and alternative medicine market.

Pure encapsulations, LLC., Columbia Nutritional, AYUSH Ayurvedic Pte Ltd, Ramamani Iyengar Memorial Yoga Institute, The Healing Company Ltd., Sheng Chang Pharmaceutical Company, John Schumacher Unity Woods Yoga Centre, Nordic Nutraceuticals, and Herb Pharm are the major players competing in the complementary and alternative medicine market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Complementary and Alternative Medicine Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Intervention Overview

2.1.3 Distribution Method Overview

2.1.4 Regional Overview

Chapter 3 Complementary and Alternative Medicine Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Booming medical tourism and expensive conventional medicines

3.3.1.2 Easy availability of herbal supplements

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Intervention Growth Scenario

3.4.2 Distribution Method Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Distribution Method Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Complementary and Alternative Medicine Market, By Intervention

4.1 Intervention Outlook

4.2 Botanicals

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Mind Healing

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Body Healing

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 External Energy

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Sensory Healing

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Complementary and Alternative Medicine Market, By Distribution Method

5.1 Distribution Method Outlook

5.2 Direct Sales

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 E-sales

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Distance Correspondence

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Complementary and Alternative Medicine Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Intervention, 2019-2026 (USD Million)

6.2.3 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.3 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.3 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.7.2 Market size, By Distribution Method, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Intervention, 2019-2026 (USD Million)

6.5.3 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Intervention, 2019-2026 (USD Million)

6.6.3 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Intervention, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Method, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Pure Encapsulations, LLC

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Columbia Nutritional

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 AYUSH Ayurvedic Pte Ltd

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Ramamani Iyengar Memorial Yoga Institute

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 The Healing Company Ltd.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Sheng Chang Pharmaceutical Company

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 John Schumacher Unity Woods Yoga Centre

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Nordic Nutraceuticals

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Herb Pharm

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Complementary and Alternative Medicine Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Complementary and Alternative Medicine Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS