Global Concentrated Milk Fat Market Size, Trends, and Analysis- Forecasts To 2026 By Product (Organic and Conventional), By Application (Bakery & Confectionery, Dairy Products, Nutraceuticals, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

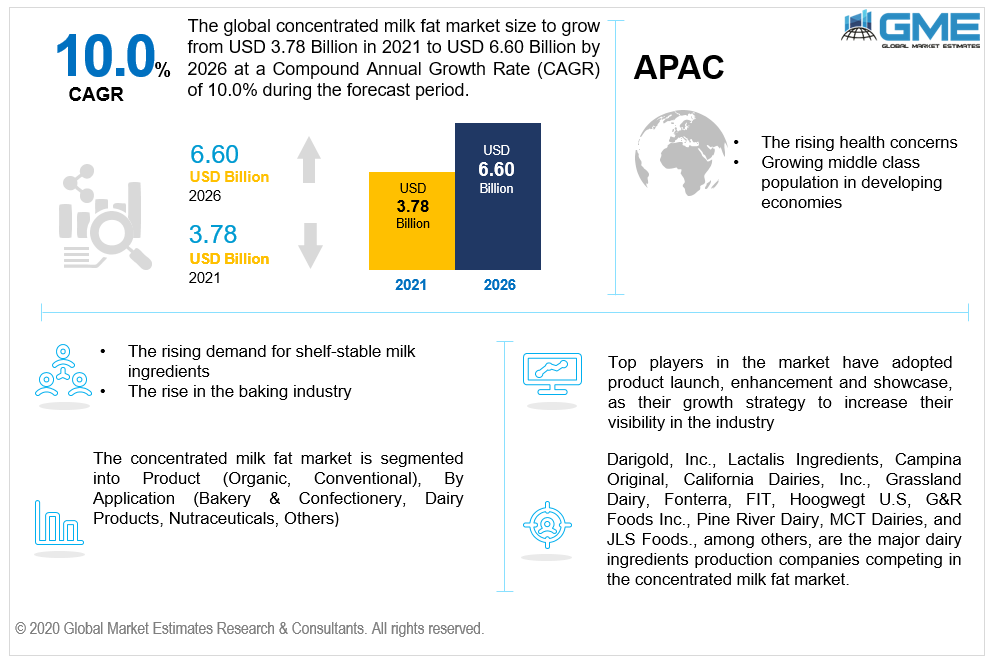

The global concentrated milk fat market is estimated to be USD 3.78 billion in 2021 and is projected to reach USD 6.60 billion with CAGR 10.0% from 2021 to 2026. Factors like the increasing requirement of concentrated milk fat in the food and beverage industry, rising demand for shelf-stable milk ingredients, technological advancements, increasing disposable income, the rapid development of application industries, rising health concerns, ease of transportation and storage, a rise in the baking industry, new product developments, stringent government rules, and regulations, resistance to high-pressure conditions, availability of a diversity of applications, increasing investments, increased shelf life of products, rising funding for research, enhancing the flavor, consistency, and texture of food products, an increasing number of programs and initiatives, the rising trend of organic products, reduced moisture content, increased affordability and availability of milk and allied products, helpful in the prevention of heart and skin diseases, high application potential in the bakery and confectionary industry and significant growth of the dairy industry, are expected to increase demand for the concentrated milk fat market. However, there are factors as well in the market that restrict or hinder the growth of the market, which include increasing demand for low-fat dairy products, lack of knowledge, the rise of lactose tolerance among consumers, development of alternative fat-free food products, lack of awareness in developing economies, mass closure of foodservice industries during the pandemic, and growing awareness of the adverse health effects of the excessive consumption of fats.

Because concentrated milk fat has an extended shelf lifetime, unlike milk and cream, it is widely employed in the food and beverage industries. It, moreover, lowers service provider expenses, which are among the important aspects likely to fuel growth in the global concentrated milk fat market. Concentrated milk fats are being routinely employed in the manufacture of food and dairy products. The rising requirement for concentrated milk fat is being driven by the soaring intake of these foods. Additionally, escalating dairy product usage in countries such as the United States, China, and India is fueling an expansion in the global concentrated milk fat market.

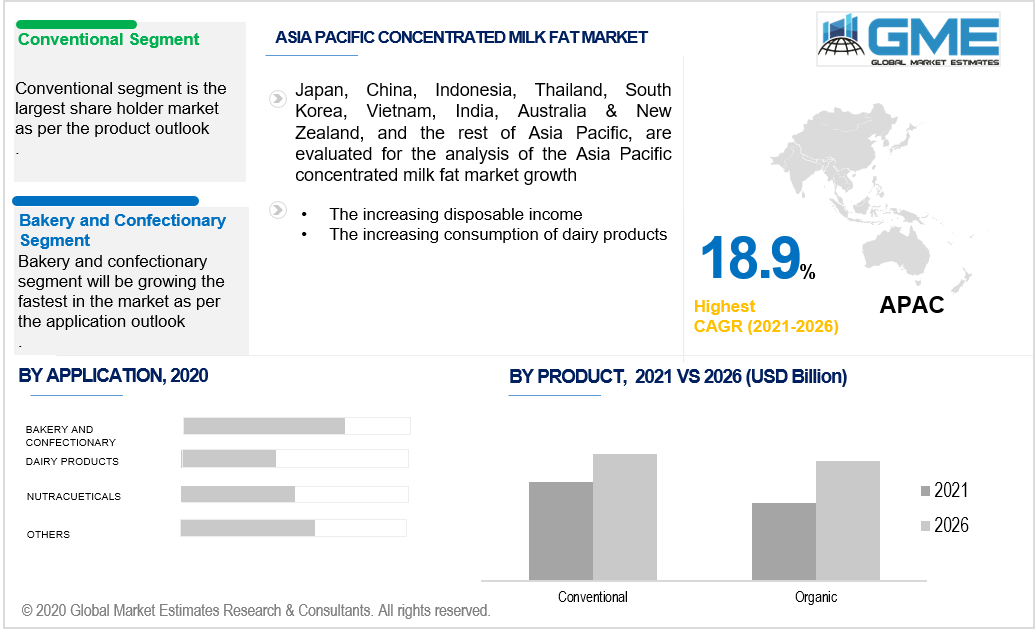

According to the product segment, the two categories include organic and conventional. The category of the conventional segment is the largest shareholder over the forecast period. Conventional food products are those where chemical fertilizers are used to promote the growth of the plant. They are made using pesticides and chemical herbicides. It has attracted the largest share of the market for the following reasons, including high nutritional value, reduction in food waste, convenience, rising use for dairy purposes, the availability of a large consumer base, rapid urbanization, easier preservation, ability to prevent gut health problems, antiviral and antifungal properties, growing need for convenience among consumers, longer shelf life, growing per capita consumption of packaged and processed food products, cost-efficient, extensively used for frying purposes, and wide availability and accessibility.

However, the organic segment will grow the fastest in the market. Organic food products are food products that are grown with the help of synthetic chemicals, complying with the standards of organic farming. This segment will be growing the fastest because of the availability of fresh food products, reduced risks of eczema, environment-friendly, improves overall health, presence of higher vitamin level, rising health concerns, inclination towards building a stronger immune system, and rising awareness regarding health & fitness.

According to the application analysis, the four segments are bakery & confectionery, dairy products, nutraceuticals, and others. The bakery & confectionery segment is predicted to foster the highest share in the market due to finer flavor and texture, better prices, use of concentrated milk products in bakeries and confectionaries, availability of a variety of choices, use of lesser resources, increased tourism, and traveling, the rising level of venture funding’s, growing consumption of confectionery and bakery products, besides being highly being preferred by the people. However, the dairy segment will be the fastest-growing segment in the market due to factors like growing demand in various countries, increasing demand for additives, providing enhanced bone density, the potential for growth, high concentration of vitamins and minerals, a high source of calcium, rising customer satisfaction, cost-efficient, and improved blood pressure.

As per the geographical analysis, the market of concentrated milk fat can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central and South America. The market for North America will be dominant due to the presence of a large number of core market players, rising demand for milk fat in the processing of dairy products, increasing investments, quick adoption of the latest technologies and devices, the presence of adequate reimbursement policies, growing consumption of bakery products, favorable government initiatives, advancement in technology, the presence of skilled professionals, rising demand for ice creams and other desserts, higher adoption among end-user industries, rising demand for reconstituted milk products, and the constant launch of advanced products. Organic milk fat concentrates are being driven by the rising demand for wholesome and ecological products in developed countries such as North America and Europe. Developments and novel product innovations, including reduced cholesterol and enriched concentrated milk fats, are likely to drive market expansion.

However, the Asia Pacific region will grow the fastest due to the rising middle-class population, highest import value, strong demand for shelf-stable milk, rise in per capita intake of dairy items, increasing growth opportunities, growing health awareness, rising disposable income, in addition to India being the largest producer of milk in the world.

Darigold, Inc., Lactalis Ingredients, Campina Original, California Dairies, Inc., Grassland Dairy, Fonterra, FIT, Hoogwegt U.S, G&R Foods Inc., Pine River Dairy, MCT Dairies, and JLS Foods, among others, are the major dairy ingredients production companies competing in the concentrated milk fat market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Concentrated Milk Fat Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Concentrated Milk Fat Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The Increased Affordability and Availability of Milk and Allied Products

3.3.1.2 The High Application Potential in The Bakery and Confectionary Industry

3.3.2 Industry Challenges

3.3.2.1 The Increasing Demand for Low-Fat Dairy Products

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Concentrated Milk Fat Market, By Product

4.1 Product Outlook

4.2 Organic

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Conventional

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Global Concentrated Milk Fat Market, By Application

5.1 Application Outlook

5.2 Bakery & Confectionery

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Dairy Products

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Nutraceuticals

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Global Concentrated Milk Fat Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Product, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Product, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Product, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application,2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Product, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Product, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Darigold, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Lactalis Ingredients

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Campina Original

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 California Dairies, Inc

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Grassland Dairy

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Fonterra

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Hoogwegt U.S., Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Pine River Dairy

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 MCT Dairies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 JLS Foods

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Other Companies

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

The Global Concentrated Milk Fat Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Concentrated Milk Fat Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS