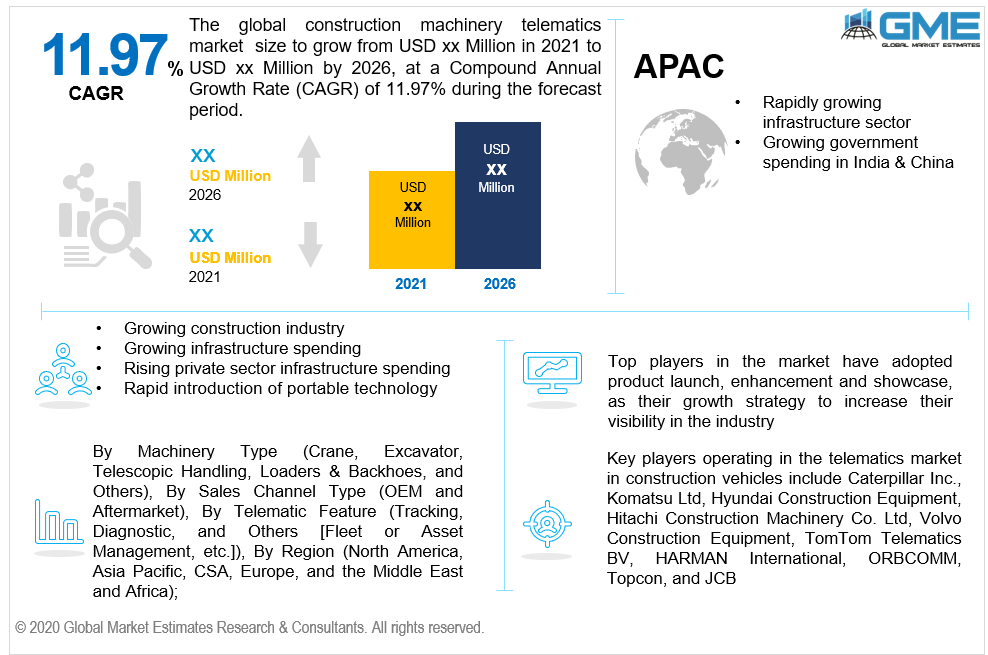

Global Construction Machinery Telematics Market Size, Trends, and Analysis - Forecasts To 2026 By Machinery Type (Crane, Excavator, Telescopic Handling, Loaders & Backhoes, and Others), By Sales Channel Type (OEM and Aftermarket), By Telematic Feature (Tracking, Diagnostic, and Others [Fleet or Asset Management]), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The construction machinery telematics market is likely to expand over the forecast period, attributable to determining forces including increased construction projects and growing infrastructure investments. The emergence of smart cities, as well as government measures to assist them, are also expected to drive market expansion. Telematics provides several advantages, including asset location, in which telematics data tracks equipment activities on site, and it also informs car owners of repair and maintenance schedules by supplying data points. Telematics also uses GPS systems to monitor the operator's performance and lower the risk of robbery. As a result, the construction vehicle telematics market is expected to grow during the forecast period. Construction vehicle demand is expected to be fuelled by the growth of the construction sector, growing infrastructure spending, rising private sector infrastructure spending, which involves investing in road and airport construction, and the expansion of the real estate industry over the forecast period.

Complex features and extra pricing associations, on the other hand, make fleet operators reluctant of integrating technology into business processes. If the number of interactions between construction machinery telematics systems and ERP systems grows, the risk of data loss and privacy issues grows. The rapid introduction of portable technology, like smartphones, and advanced driver-assistance systems (ADAS) features, such as collision avoidance systems and proximity detector warnings, in construction machinery has also strengthened the use of telematics. As a result of massive developments in the smart commercial and residential building industry, as well as government policies supporting the manufacturing industry, the construction machinery telematics market is expected to witness a significant growth rate.

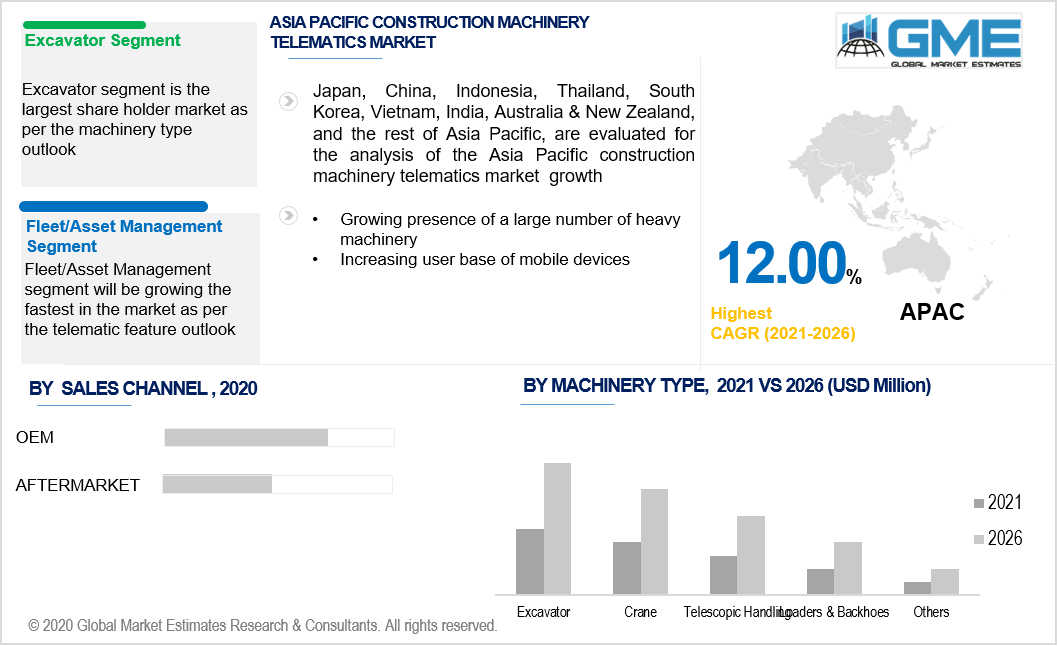

Based on machinery type, the construction machinery telematics market has been segmented into excavators, loaders, & backhoes, cranes, telescopic handling, and others. The excavators' segment is foreseen to lead in the market. Gradually, convenience features from larger machines have begun to filter down into smaller excavators. Telematics is one of the primary technologies that is advancing in compact excavators. As a consequence, telematics systems are gaining increasing popularity amongst owner-operators as well as major transport providers. Full-sized excavators incorporated novel technology and capabilities, like telematics, during the previous decade, making them increasingly productive and fuel economical. Fleet management, remote diagnostics, GPS monitoring, and protection are all possible with telematics technology. At the moment, the majority of telematics customers are large-scale excavator fleet operators that bank on this information to aid them to run their machinery and operations more effectively. One of the primary benefits of telematics in excavators is effective proactive deployment. For example, if an excavator is resting at a location for a prolonged time and if the inactive machinery may be used at other locations.

Based on sales channel type, the construction machinery telematics market has been segmented into OEM and aftermarket. OEM has a bigger share of the market. Telematics services have been adopted by the majority of large construction equipment manufacturers. At least for heavy machines, OEM telematics systems are now generally factory-installed by default. In terms of the amount of CE telematics devices deployed worldwide, Caterpillar and Komatsu are the dominant construction equipment OEMs. Construction is a massive enterprise with a diverse range of equipment. Building and structural work, underwater, road construction, and other power plants, and marine construction, among other things, all require a huge number of large and small machines. Construction projects entail a variety of tasks. Massive volumes of earth digging and excavation, compacting and leveling, dosing, hauling, grading, placing of building materials (e.g., concrete, bricks), and so on. Thus, these aforementioned factors lead to the supremacy of the OEM segment.

Based on telematic features, the construction machinery telematics market has been segmented into tracking, diagnostic, and others. Others include fleet or asset management is presumed to be the leader. Construction firms incorporate effective and productive construction fleet management in order to see continued expansion. The method of directing, planning, and monitoring construction fleet assets in order to enhance and maximize company activities is known as construction fleet management. Dispatchers, fleet vehicles, operators, and other stakeholders are also included. Construction fleet management allows businesses to gain insight and leverage their fleet operations, helping them to better understand and develop this important business feature. Enhance productivity & workflow, driver behavior analysis, enhance invoicing, optimize fleet vehicle & operator efficiency, and improved budgeting & estimating are the four main advantages of construction fleet management systems.

North America is anticipated to be the biggest market for construction equipment telematics, because of the region's notable players, strong infrastructure, and significant frequency of implementation of breakthrough technologies. The Asia-Pacific market is anticipated to grow at the fastest CAGR during the forecast period. The increasing construction industry in the region, the presence of a large number of heavy machinery, and the increasing user base of mobile devices are all big factors that will help drive the demand. The Asia-Pacific region has a rapidly-growing infrastructure sector, attributed to high government spending in China and India, both of which depend on construction and infrastructure to strengthen their economies and generate employment.

Key players operating in the telematics market in construction vehicles include Caterpillar Inc., Komatsu Ltd, Hyundai Construction Equipment, Hitachi Construction Machinery Co. Ltd, Volvo Construction Equipment, TomTom Telematics BV, HARMAN International, ORBCOMM, Topcon, and JCB.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2018, JCB launched a new version of its LiveLink telematics system, which will enable mixed fleet operators to control all of their plants and equipment with one network.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Construction Machinery Telematics Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Machinery Type Overview

2.1.3 Sales Channel Type Overview

2.1.4 Telematic Feature Overview

2.1.5 Regional Overview

Chapter 3 Global Construction Machinery Telematics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Construction Projects

3.3.1.2 Growing Infrastructure Investments

3.3.2 Industry Challenges

3.3.2.1 Complex features

3.4 Prospective Growth Scenario

3.4.1 Machinery Type Growth Scenario

3.4.2 Sales Channel Type Growth Scenario

3.4.3 Telematic Feature Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Machinery Type Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Construction Machinery Telematics Market, By Machinery Type

4.1 Machinery Type Outlook

4.2 Crane

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Excavator

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Telescopic Handling

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Loaders & Backhoes

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Construction Machinery Telematics Market, By Sales Channel Type

5.1 Sales Channel Types Outlook

5.2 OEM

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Aftermarket

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Construction Machinery Telematics Market, By Telematic Feature

6.1 Telematic Feature Outlook

6.2 Tracking

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Diagnostic

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Others

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Quantum Dot Display Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.2.3 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.2.4 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.2.5.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.2.6.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.3 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.4 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.5.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.6.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.7.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.8.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.9.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.3.10.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.3 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.4 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.5.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.6.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.7.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.8.2 Market size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.4.9.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.5.3 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.5.4 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.5.5.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.5.6.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.5.7.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.6.3 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.6.4 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.6.5.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.6.6.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Machinery Type, 2019-2026 (USD Million)

7.6.7.2 Market Size, By Sales Channel Type, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Telematic Feature, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Caterpillar Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Big Komatsu Ltd

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Hyundai Construction Equipment

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Hitachi Construction Machinery Co. Ltd

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Volvo Construction Equipment

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 TomTom Telematics BV

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 HARMAN International

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 ORBCOMM

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Topcon

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 JCB

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Construction Machinery Telematics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Construction Machinery Telematics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS