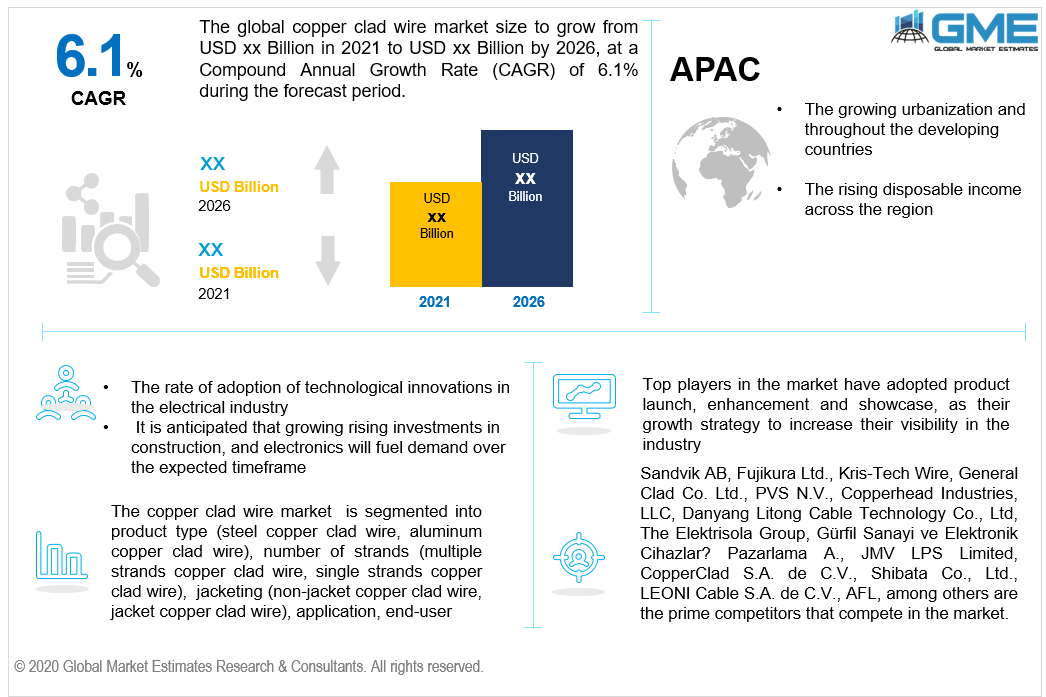

Global Copper Clad Wire Market Size, Trends, and Analysis - Forecasts To 2026 By Product Type (Steel Copper Clad Wire, Aluminum Copper Clad Wire), By Number of Strands (Multiple Strands Copper Clad Wire, Single Strands Copper Clad Wire), By Jacketing (Non-Jacket Copper Clad Wire, Jacket Copper Clad Wire), By Application (Voice Coils, Television Cables, Power Distribution Cables, RF Antennas), By End-User (Transportation, Power & Energy, General Industrial, Consumer Electronics, Construction, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Copper clad wire, or CCW, is a form of wire consisting of a solid metal core covered by a copper sheet to improve the overall performance of the wire. It should not be confused with an alloy, as the method of making copper-coated wires is known as cladding. Copper-clad cables are an appropriate method that is cost-effective for transmitting signals over small distances. The longer the gap, however, the more probable signal loss will occur. Also, copper cladding increases the conductivity and gives the product weldability. Of the total copper-clad wire cross-sectional area, nearly 10 percent is copper clad. The copper cladding differs between 10 percent and 15 percent by volume, depending on the final product's desired diameter.

The rate of adoption of technological innovations in the electrical industry, especially among producers of wires and cables, is relatively low. For a brief amount of time, therefore, the copper-clad wire has faced confusion before being generally embraced across industries. Copper clad wires are projected to occur substantial demand in the upcoming years, with their proven advantages compared to pure copper wires. For beginners, copper-clad aluminum is found to have 55 percent higher resistance to direct current. This results in the conversion of energy to heat, reducing the total amount of energy transferred. However, these are expected to be reduced significantly over the forecast period with further R&D investment funds.

The high price of copper is another factor significantly contributing to the development of the market for copper-clad wire. Owing to the high demand for copper as a conductor, the price tag associated with it is about 3-4 times the value of aluminum. The broad acceptance of the product has recently attracted the attention of many wire and cable producers in the electrical industry. Also, as the copper-clad cable industry environment is still in its evolutionary phase, it is anticipated that the introduction of new producers to the market will face comparatively less competition.

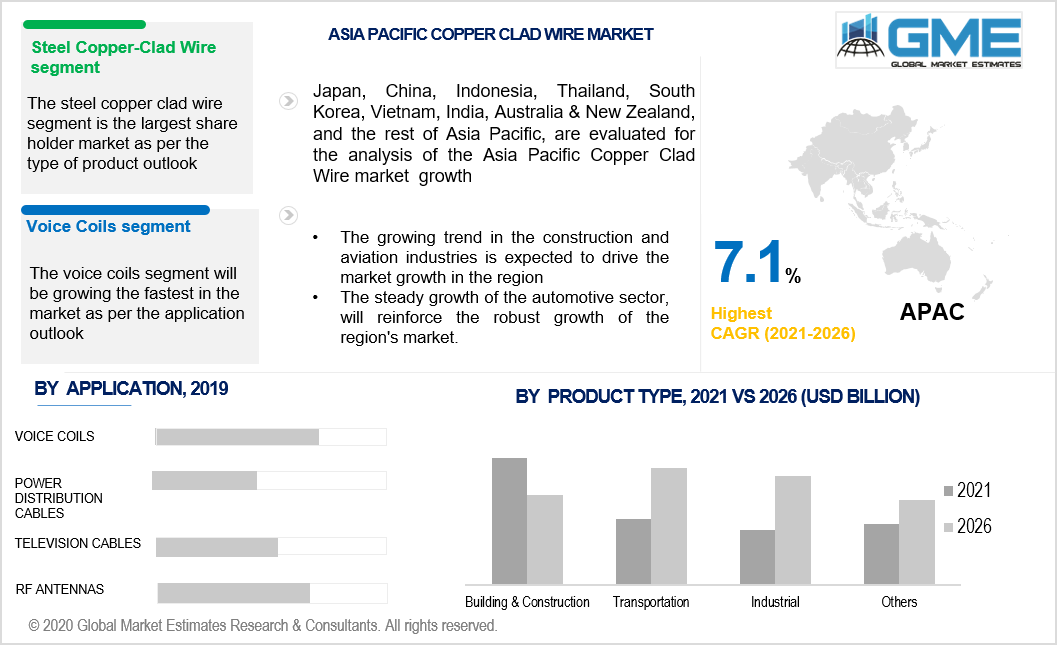

In 2019, the steel copper-clad wire segment accounted for the largest share of the revenue. A bi-metallic product is used primarily in the wire industry. Copper-clad steel (CCS) blends the high mechanical strength of steel with the conductivity and corrosion resistance of copper. The copper-coated steel wire can be produced bare or electroplated using gold, solder, tin, nickel, and silver. This type of copper-clad wire finds its applications in hardware, medical, motor, and magnetic assemblies, and power supplies and conversion. Usually, the core material is low carbon steel and is usually used as either the grounding wire or the co-axial cable inner conductor. Copper-coated steel is made with ASTM B-452 standards with 40 percent conductivity in two tempers hard and softly drawn.

The aluminum copper-clad wire is anticipated to grow over a substantial CAGR during the projected timeframe. The copper-clad aluminum wire consists of an internal aluminum core and external copper cladding as an electrical conductor. This conductor's primary applications revolve around specifications for weight reduction. In these applications, high-quality coils such as speech coils in headphones or portable speakers are used; high-frequency coaxial applications like RF antennas and cable television and power cable delivery wire are used. Copper-clad aluminum wire features include: less costly than pure copper wire, higher strength than aluminum lighter than pure copper, excellent electrical conductivity than pure aluminum.

During the forecast era, the voice coils segment is anticipated to boost at a high CAGR. Copper-clad steel wire is frequently used in certain antennas for RF conducting wires. The skin effect gives a low impedance at a higher frequency to RF transmission lines with heavy copper-cladding, similar to that of a solid copper cable.

In the expected timeframe in terms of sales, the Asia-Pacific region is the leading market shareholder and also indicates a significant CAGR rate over the forthcoming years. Moreover, the manufacturing of automotive vehicles, combined with the steady growth of the automotive sector, will reinforce the robust growth of the region's market.

Furthermore, the North American region is the second-largest market shareholder in the projected sales period, led by Asia-Pacific. It is driven by factors that have contributed to the market, due to the strict pollution regulations in the United States and the development of the construction sector in Mexico. Middle East & Africa is one of the regions where, over the long term, the copper-clad wire will potentially generate beneficial opportunities for market players.

Danyang Litong Cable Technology Co., Ltd, Sandvik AB, Fujikura Ltd., Kris-Tech Wire, General Clad Co. Ltd., Copperhead Industries, LLC, Gürfil Sanayi ve Elektronik Cihazlar? Pazarlama A., JMV LPS Limited, CopperClad S.A. de C.V., The Elektrisola Group, Shibata Co., Ltd., PVS N.V., LEONI Cable S.A. de C.V., AFL, among others are the prime competitors that compete in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2020, Sandvik AB successfully acquired CGTech, a US-based company recognized as the market leader in software for numerical control simulation (NC/CNC) optimization and verification.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Copper Clad Wire Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Copper Clad Wire Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS