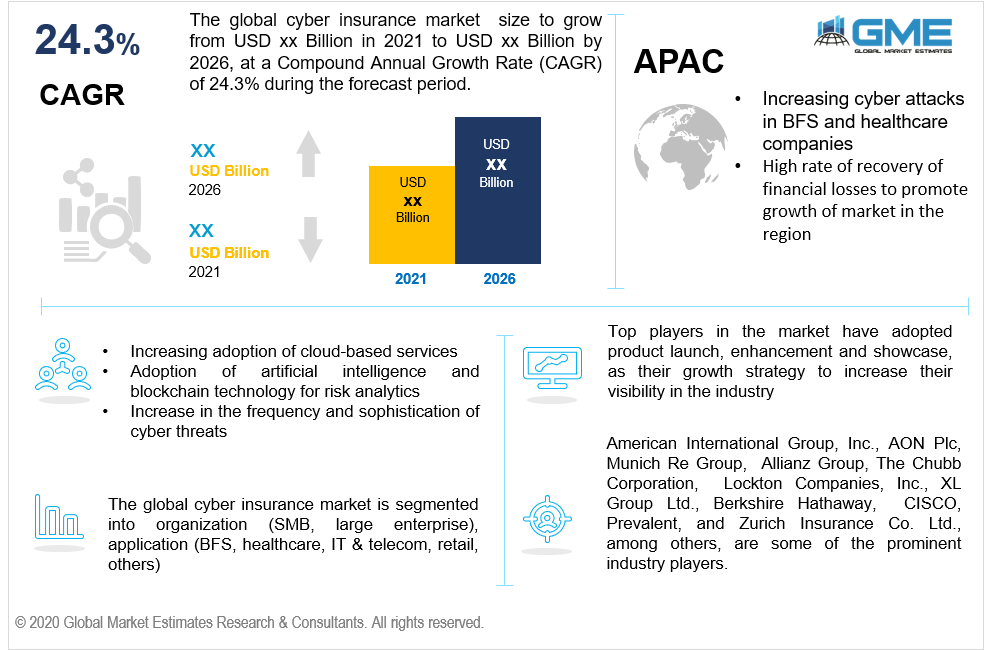

Global Cyber Insurance Market Size, Trends, and Analysis- Forecasts to 2026 By Organization (SMB, Large Enterprise), By Application (BFS, Healthcare, IT & Telecom, Retail, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), Company Market Share and Competitor Analysis

Today, the global economy is witnessing a significant surge in business activities, and the revenues earned. Businesses across the world are extensively dealing with advanced technology and digitalization, which undoubtedly enhances the service deliverance and efficiency; however, it is highly vulnerable to various data breaching techniques, which puts the businesses at risk.

Cyber insurance in such data breaching situations assists these businesses to protect sensitive customer data like security codes, credit card numbers, account numbers, and sensitive details. Despite placing a high priority on cybersecurity and other data leakages in their highly digitalized operations and dependence on the internet, companies have nonetheless been victims of cybercrime and data hacking. Equifax had to lose over a billion dollars in legal fees as a result of the data leak. These data leaks or breaches can be expensive to handle if not insured and can lead to less profitability and trust issues among customers.

Cyber insurance aids organizations in recovering data that has been compromised as well as providing financial assistance to manage the damages suffered. According to surveys, 7.5 billion dollars in premium cyber insurance were purchased by various enterprises and corporations around the world by 2020. Studies have pointed out that today the increasing reliability of businesses on the Internet of Things (IoT) and other technologies have increased the risk of generating loopholes in the systems that can leak the databases.

Increased use of personal mobile and other electronic devices through company networks has higher chances of causing virus attacks that can hack or data breach the company details, leading to cybercrime. Data breaching activities and cybercrime are drastically increasing today, especially in specific industries like healthcare and financial services.

These cyber insurance policies cover various aspects like notifying the company as well as the customers about cybercrime or data breaching. These insurances also enable the companies to restore and recover the lost or compromised data/ personal information of the affected customers, enable the businesses to repair and recover their hacked computer systems, and cover legal fines and fees.

The conventional and traditional policies cannot significantly cover the data compromised and lost in these cyber-attacks and only enable the businesses to secure their computer systems. However, the newly drafted cyber insurances can cover the gap between the conventional policies and the requirements of modern companies and enable businesses to recover the lost sensitive databases. In today’s global business market, cyber-attacks are extremely uncertain and can have varying impacts on companies.

Countries all across the world have taken precautions in response to the current COVID-19 outbreak. Many firms are exploring ways to allow their staff to work from home while schools are closed and communities are advised to stay at home. As a result, the use of video communication platforms has increased.

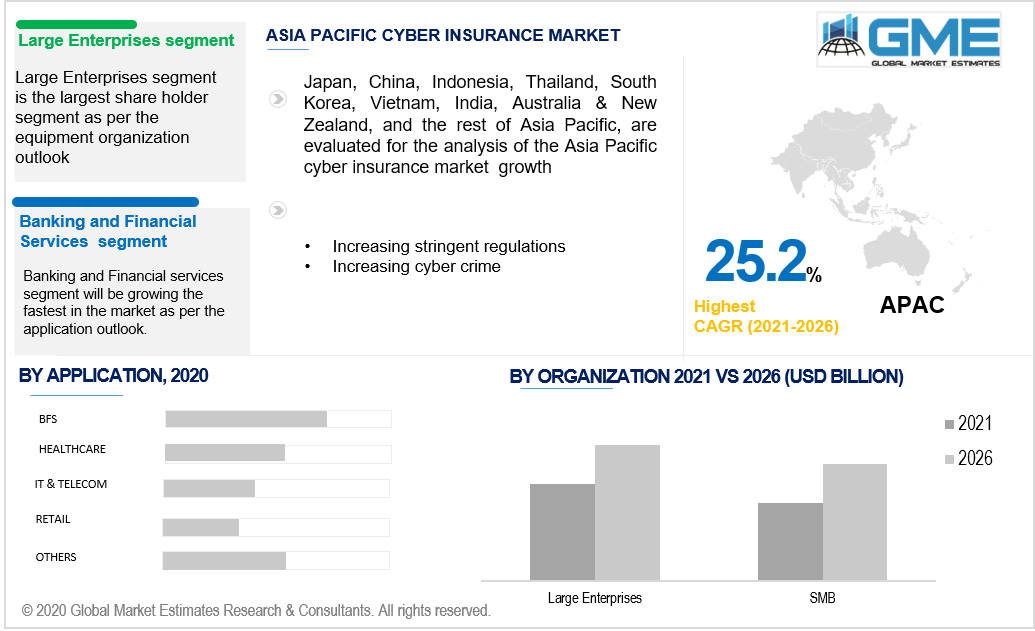

Large Enterprises are the dominant adopters of cyber insurances. All companies across the various markets are vulnerable to data breaching and cyber-attacks, especially today, with such advancing digitalization and the Internet of Things; however, the large enterprises are at higher risks as compared to the small and medium-sized enterprises.

These large enterprises are high investors in cloud-based software, artificial intelligence, and other advanced technologies and also have a higher customer base, which makes them more likely to experience cyber-attacks and data breaching activities. A higher customer base and clients from across the nation and foreign countries certainly require the large enterprises to utilize platforms that enable storing big data, which is sensitive and of utmost importance for the operation of the businesses. Thus, to avoid the risk of losing this sensitive data and incurring legal fees, these large enterprises across various industries have highly purchased cyber insurance policies, which enable them to maintain cybersecurity and tackle these risks smartly.

Small and Medium-sized enterprises with comparatively low cybersecurity solutions and investments are more vulnerable to risks and cyber-attacks. However, the awareness about the availability of cyber insurance policies is gradually encouraging small and medium-sized enterprises to adapt and purchase these insurance policies to avoid getting penalized and incurring legal charges for not being able to protect the customer’s data.

Based on the application segment the market is segmented into banking and financial services, healthcare, IT & telecom, and retail, among others. BFSI services are the most prominent industries applying cyber insurance policies in their businesses. These banking and financial services carry highly sensitive and private customer data like account numbers, credit card details, transactions made, individual amounts held by various customers in these banking and financial institutions, and many others that are at extreme risks of data breaching and leakages.

North America dominates and has the largest share in the cyber insurance market. The countries in North America have numerous amounts of Banking and Financial service industries and have a prominent healthcare industry, which has extensively invested in cyber insurance policies to safeguard their businesses. Countries like the USA and Canada have high IT infrastructure and other advanced digitalization, which had generated many cybercrime incidences and massive losses for the companies. 9 out of 10 cybercrime cases were mainly reported from the USA-based businesses compared to the rest of the world, which have compelled the governments in the North American region to bring stringent regulation for investing in cyber insurance.

Asia Pacific region is expected to witness fast growth in the cyber insurance market during the forecast period. Countries like India, Japan, South Korea, and China have been undergoing extreme technological transformations, which are being applied in various industries like banking and finance, healthcare, telecom, and the retail industry. Large-scale businesses in these industries carrying big datasets have also been experiencing many cyber-attacks and data leakages, causing enormous losses for the companies. Countries like India, to prevent such losses and leakages of sensitive data, are implementing regulations like the Personal Data Protection Bill, which was introduced in 2019. Another country in the APAC area, Japan, has enacted the Act of Personal Information Protection (APPI); under this amendment, the government plans to charge a maximum penalty of 100 million JPY if enterprises fail to invest in cyber insurance and are subject to cyber-attacks. Many other countries within the APAC region have come up with similar regulations and acts to encourage businesses to adapt themselves to cyber insurance policies and avoid losses.

American International Group, Inc., Prevalent, CISCO, Microsoft, CYE, AON Plc, Munich Re Group, Allianz Group, The Chubb Corporation, Lockton Companies, Inc., XL Group Ltd., Berkshire Hathaway, and Zurich Insurance Co. Ltd, among others, are some of the prominent industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Cyber Insurance Market Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Organization Size Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Cyber Insurance Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing cyber threats

3.3.1.2 High rate of recovery of financial losses to promote the growth of the market

3.3.2 Industry challenges

3.3.2.1 Data privacy concerns

3.4 Prospective Growth Scenario

3.4.1 Organization Size Overview

3.4.2 Application Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cyber Insurance Market, By Application

4.1 Application Outlook

4.2 BFS

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Healthcare

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 IT & Telecom

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Retail

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Cyber Insurance Market, By Organization Size

5.1 Beverage Type Outlook

5.2 SMB

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Large Enterprises

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Cyber Insurance Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Billion)

6.2.2 Market Size, By Application, 2019-2026 (USD Billion)

6.2.3 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.2.4.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.2.5.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Billion)

6.3.2 Market Size, By Application, 2019-2026 (USD Billion)

6.3.3 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.4.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.5.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.6.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.7.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.8.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2019-2026 (USD Billion)

6.3.9.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Billion)

6.4.2 Market Size, By Application, 2019-2026 (USD Billion)

6.4.3 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.4.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.5.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.6.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.7.2 Market size, By Organization Size, 2019-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2019-2026 (USD Billion)

6.4.8.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Billion)

6.5.2 Market Size, By Application, 2019-2026 (USD Billion)

6.5.3 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.4.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.5.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.5.6.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Billion)

6.6.2 Market Size, By Application, 2019-2026 (USD Billion)

6.6.3 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.4.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.5.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2019-2026 (USD Billion)

6.6.6.2 Market Size, By Organization Size, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 AON Plc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 American International Group, Inc.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Allianz Group

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Berkshire Hathaway

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Lockton Companies, Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 The Chubb Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Munich Re Group

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 XL Group Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Zurich Insurance Co. Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 CISCO

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Cyber Insurance Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cyber Insurance Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS