Global Dental Equipment Market Size, Trends & Analysis - Forecasts to 2029 By Product (Dental Radiology Equipment, Dental Lasers, Dental Surgical Navigation Systems, CAD/CAM Equipment, Dental Chairs, and Others), By End User (Hospitals, Dental Clinics, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

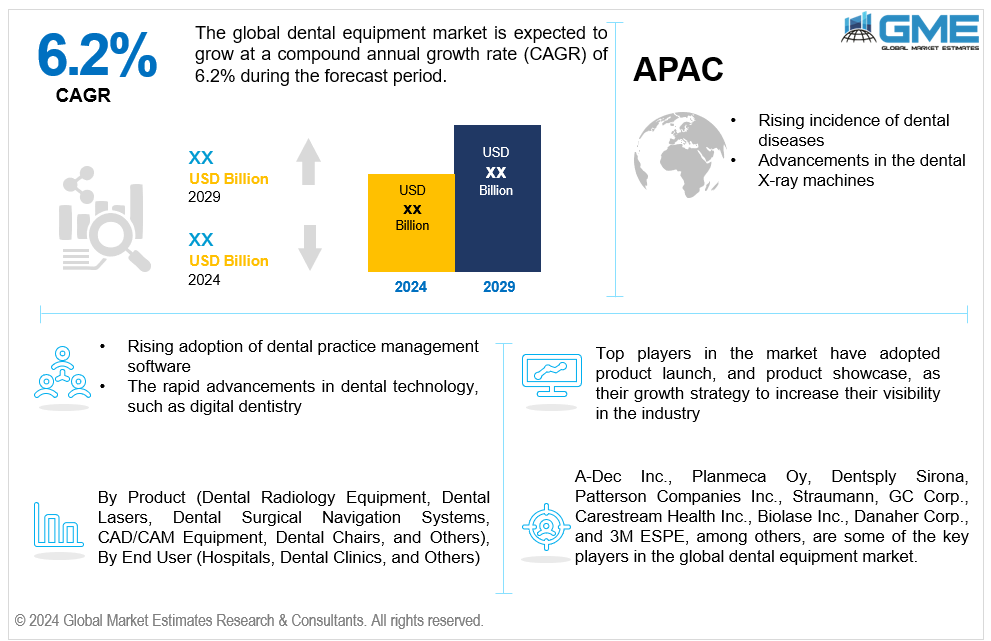

The global dental equipment market is estimated to exhibit a CAGR of 6.2% from 2024 to 2029.

The primary factors propelling the market growth are the increasing incidence of dental diseases and advancements in dental X-ray machines. As the prevalence of conditions such as dental caries, periodontal disease, and oral cancer rises, there is a growing demand for comprehensive dental care. This surge necessitates the use of advanced dental instruments and dental devices for precise diagnosis and effective treatment. Additionally, the need for routine dental care is boosting the market for dental supplies, ensuring that clinics and practices are well-equipped with essential materials. The rising number of patients requiring tooth replacements also fuels the demand for dental implants, which offer long-term solutions for tooth loss. Specialized dental tools are crucial for addressing complex dental issues, further propelling market growth. Moreover, the expanding range of dental products, including preventive and therapeutic items, supports ongoing oral health maintenance, underscoring the overall impact of dental disease prevalence on market dynamics. For instance, according to a March 2022 report from the World Health Organization (WHO), there are an estimated 3.5 billion cases of oral disorders have been reported globally, and over 10.0% of the world's population suffers from severe periodontal (or gum) disease, which can lead to tooth loss.

The rising adoption of dental practice management software, along with the rapid advancements in dental technology, such as digital dentistry, are expected to support the market growth. Dental practices are undergoing a transformation owing to advancements in digital instruments and procedures that improve patient outcomes, speed, and precision. For instance, dental scanners are revolutionizing the way dental impressions are taken, providing accurate digital models that streamline the creation of crowns, bridges, and other restorations. The integration of advanced dental units with digital controls and multi-functional capabilities optimizes dental procedures, improves workflow, and improves patient comfort. Similarly, the development of sophisticated dental appliances, such as digital orthodontic devices and sleep apnea treatment solutions, is expanding treatment options and improving effectiveness. Moreover, modern dental machinery like CAD/CAM systems and 3D printers are enabling the on-site production of customized dental prosthetics, reducing turnaround times and enhancing the overall quality of care.

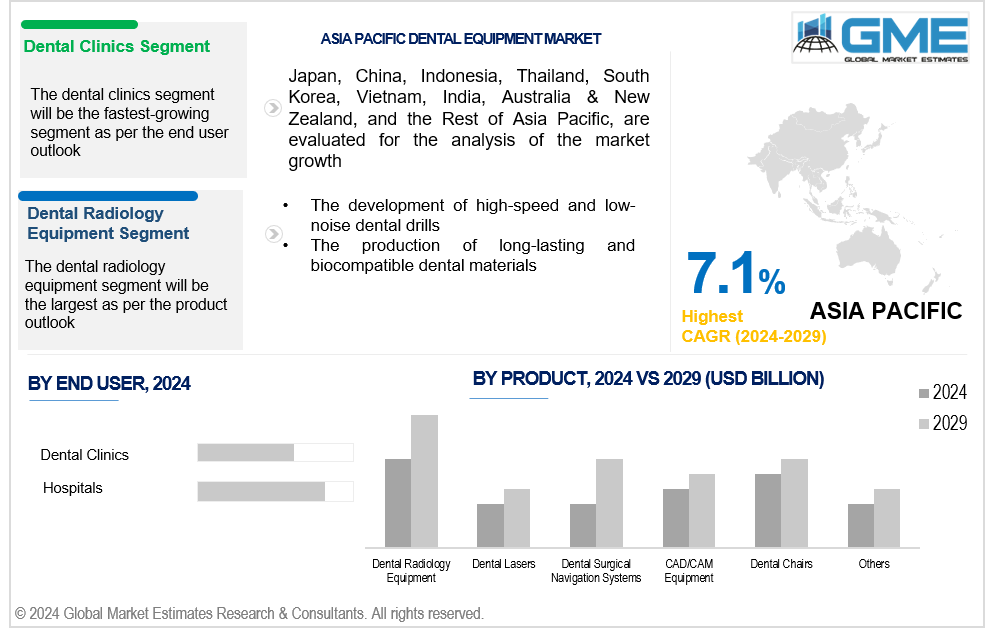

The development of high-speed and low-noise dental drills, coupled with the production of long-lasting and biocompatible dental materials, propel market growth. Restorements that are both long-lasting and visually beautiful require high-quality materials, such as sophisticated composites and ceramics. These materials require precise handling and fabrication, boosting the demand for specialized dental laboratory equipment that can process and create custom dental solutions effectively. The longevity and safety of these materials also necessitate rigorous hygiene protocols, thus increasing the need for reliable dental sterilization equipment to ensure all tools and materials remain uncontaminated. Additionally, the use of biocompatible materials in various dental consumables, including bonding agents and impression materials, is critical for patient safety and treatment success.

The development and integration of cutting-edge technology in dental equipment, such as artificial intelligence (AI), robotics, and 3D printing, presents significant growth opportunities. These innovations can increase accuracy, shorten treatment times, and benefit patients in more ways than one. Moreover, the demand for aesthetic dental operations like veneers, teeth whitening, and smile makeovers is rising, creating lucrative opportunities for cosmetic dental equipment.

However, the high cost of advanced dental equipment and technology and a lack of skilled professionals may impede market growth.

The dental radiology equipment segment is expected to hold the largest share of the market over the forecast period. Dental diagnostics are increasingly accurate, efficient, and safe due to ongoing advancements in dental radiology technology, including the creation of digital radiography, cone-beam computed tomography (CBCT), and 3D imaging systems. As a result of these improvements, more dental clinics are implementing radiological equipment.

The dental surgical navigation systems segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Due to the advantages of minimally invasive dental procedures, like less discomfort for patients, faster recovery periods, and fewer complications, their popularity is growing. With the use of accurate guiding, surgical navigation systems enable these minimally invasive operations.

The hospitals segment is expected to hold the largest share of the market over the forecast period. Hospitals usually provide a wide range of dental services, such as intricate surgical operations, emergency care, and specialty treatments. This extensive service requires a wide range of dental equipment.

The dental clinics segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Offering specialist treatments like orthodontics, cosmetic dentistry, and implantology is the main emphasis of many dental clinics. The increasing need for sophisticated and customized dental equipment for these specialty services fuels the growth of the market.

North America is expected to be the largest region in the global market. With ongoing developments in digital dentistry, imaging systems, CAD/CAM technology, and dental lasers, North America is at the forefront of dental technology innovation, which is fueling regional market growth.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The region's market is growing for several reasons, including supportive government policies, the presence of major industry players, including GC Corp and Yoshida Dental Mfg Co., Ltd., and a rise in the need for dental procedures. Additionally, the availability of a large pool of qualified dentists and affordable treatments support the growth of the dental equipment industry in the Asia Pacific region.

A-Dec Inc., Planmeca Oy, Dentsply Sirona, Patterson Companies Inc., Straumann, GC Corp., Carestream Health Inc., Biolase Inc., Danaher Corp., and 3M ESPE, among others, are some of the key players in the global dental equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Planmeca announced a strategic partnership with BEGO, a CAD/CAM pioneer with over 20 years of 3D printing expertise. The innovative materials developed by BEGO for printing dental restorations have been successfully verified for the Planmeca Creo C5 dental 3D printer, utilizing the joint expertise of both companies.

In June 2023, A-Dec revolutionized dental technology by launching its digitally connected dental chair and transport system, A-dec 300 Pro and A-dec 500 Pro delivery systems, in the North America.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DENTAL EQUIPMENT MARKET, BY Product

4.1 Introduction

4.2 Dental Equipment Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Dental Radiology Equipment

4.4.1 Dental Radiology Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Dental Lasers

4.5.1 Dental Lasers Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Dental Surgical Navigation Systems

4.6.1 Dental Surgical Navigation Systems Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 CAD/CAM Equipment

4.7.1 CAD/CAM Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Dental Chairs

4.8.1 Dental Chairs Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL DENTAL EQUIPMENT MARKET, BY END USER

5.1 Introduction

5.2 Dental Equipment Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Hospitals

5.4.1 Hospitals Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Dental Clinics

5.5.1 Dental Clinics Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL DENTAL EQUIPMENT MARKET, BY REGION

6.1 Introduction

6.2 North America Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Product

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Product

6.2.3.1.2 By End User

6.2.3.2 Canada Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Product

6.2.3.2.2 By End User

6.2.3.3 Mexico Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Product

6.2.3.3.2 By End User

6.3 Europe Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Product

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Product

6.3.3.1.2 By End User

6.3.3.2 U.K. Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Product

6.3.3.2.2 By End User

6.3.3.3 France Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Product

6.3.3.3.2 By End User

6.3.3.4 Italy Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Product

6.3.3.4.2 By End User

6.3.3.5 Spain Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Product

6.3.3.5.2 By End User

6.3.3.6 Netherlands Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End User

6.4 Asia Pacific Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Product

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Product

6.4.3.1.2 By End User

6.4.3.2 Japan Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Product

6.4.3.2.2 By End User

6.4.3.3 India Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Product

6.4.3.3.2 By End User

6.4.3.4 South Korea Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Product

6.4.3.4.2 By End User

6.4.3.5 Singapore Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Product

6.4.3.5.2 By End User

6.4.3.6 Malaysia Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End User

6.4.3.7 Thailand Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End User

6.4.3.8 Indonesia Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Product

6.4.3.7.2 By End User

6.4.3.9 Vietnam Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Product

6.4.3.8.2 By End User

6.4.3.10 Taiwan Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Product

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Product

6.4.3.11.2 By End User

6.5 Middle East and Africa Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Product

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Product

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Product

6.5.3.2.2 By End User

6.5.3.3 Israel Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Product

6.5.3.3.2 By End User

6.5.3.4 South Africa Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Product

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Product

6.5.3.5.2 By End User

6.6 Central and South America Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Product

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Product

6.6.3.1.2 By End User

6.6.3.2 Argentina Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Product

6.6.3.2.2 By End User

6.6.3.3 Chile Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Dental Equipment Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 A-Dec Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Planmeca Oy

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Dentsply Sirona

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Patterson Companies Inc.

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Straumann

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 GC CORP.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Carestream Health Inc.

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Biolase Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Danaher Corp.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 3M ESPE

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

2 Dental Radiology Equipment Market, By Region, 2021-2029 (USD Mllion)

3 Dental Lasers Market, By Region, 2021-2029 (USD Mllion)

4 Dental Surgical Navigation Systems Market, By Region, 2021-2029 (USD Mllion)

5 CAD/CAM Equipment Market, By Region, 2021-2029 (USD Mllion)

6 Dental Chairs Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

9 Hospitals Market, By Region, 2021-2029 (USD Mllion)

10 Dental Clinics Market, By Region, 2021-2029 (USD Mllion)

11 Others Market, By Region, 2021-2029 (USD Mllion)

12 Regional Analysis, 2021-2029 (USD Mllion)

13 North America Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

14 North America Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

15 North America Dental Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

16 U.S. Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

17 U.S. Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

18 Canada Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

19 Canada Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

20 Mexico Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

21 Mexico Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

22 Europe Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

23 Europe Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

24 EUROPE Dental Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

25 Germany Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

26 Germany Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

27 U.K. Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

28 U.K. Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

29 France Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

30 France Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

31 Italy Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

32 Italy Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

33 Spain Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

34 Spain Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

35 Netherlands Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

36 Netherlands Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

37 Rest Of Europe Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

38 Rest Of Europe Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

39 Asia Pacific Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

40 Asia Pacific Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

41 ASIA PACIFIC Dental Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

42 China Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

43 China Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

44 Japan Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

45 Japan Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

46 India Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

47 India Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

48 South Korea Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

49 South Korea Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

50 Singapore Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

51 Singapore Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

52 Thailand Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

53 Thailand Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

54 Malaysia Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

55 Malaysia Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

56 Indonesia Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

57 Indonesia Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

58 Vietnam Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

59 Vietnam Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

60 Taiwan Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

61 Taiwan Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

62 Rest of APAC Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

63 Rest of APAC Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

64 Middle East and Africa Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

65 Middle East and Africa Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

66 MIDDLE EAST & AFRICA Dental Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

67 Saudi Arabia Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

68 Saudi Arabia Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

69 UAE Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

70 UAE Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

71 Israel Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

72 Israel Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

73 South Africa Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

74 South Africa Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

77 Central and South America Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

78 Central and South America Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

79 CENTRAL AND SOUTH AMERICA Dental Equipment Market, By COUNTRY, 2021-2029 (USD Mllion)

80 Brazil Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

81 Brazil Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

82 Chile Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

83 Chile Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

84 Argentina Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

85 Argentina Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

86 Rest Of Central and South America Dental Equipment Market, By Product, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Dental Equipment Market, By End User, 2021-2029 (USD Mllion)

88 A-Dec Inc.: Products & Services Offering

89 Planmeca Oy: Products & Services Offering

90 Dentsply Sirona: Products & Services Offering

91 Patterson Companies Inc.: Products & Services Offering

92 Straumann: Products & Services Offering

93 GC CORP.: Products & Services Offering

94 Carestream Health Inc.: Products & Services Offering

95 Biolase Inc.: Products & Services Offering

96 Danaher Corp., Inc: Products & Services Offering

97 3M ESPE: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Dental Equipment Market Overview

2 Global Dental Equipment Market Value From 2021-2029 (USD Mllion)

3 Global Dental Equipment Market Share, By Product (2023)

4 Global Dental Equipment Market Share, By End User (2023)

5 Global Dental Equipment Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Dental Equipment Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Dental Equipment Market

10 Impact Of Challenges On The Global Dental Equipment Market

11 Porter’s Five Forces Analysis

12 Global Dental Equipment Market: By Product Scope Key Takeaways

13 Global Dental Equipment Market, By Product Segment: Revenue Growth Analysis

14 Dental Radiology Equipment Market, By Region, 2021-2029 (USD Mllion)

15 Dental Lasers Market, By Region, 2021-2029 (USD Mllion)

16 Dental Surgical Navigation Systems Market, By Region, 2021-2029 (USD Mllion)

17 CAD/CAM Equipment Market, By Region, 2021-2029 (USD Mllion)

18 Dental Chairs Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global Dental Equipment Market: By End User Scope Key Takeaways

21 Global Dental Equipment Market, By End User Segment: Revenue Growth Analysis

22 Hospitals Market, By Region, 2021-2029 (USD Mllion)

23 Dental Clinics Market, By Region, 2021-2029 (USD Mllion)

24 Others Market, By Region, 2021-2029 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global Dental Equipment Market: Regional Analysis

27 North America Dental Equipment Market Overview

28 North America Dental Equipment Market, By Product

29 North America Dental Equipment Market, By End User

30 North America Dental Equipment Market, By Country

31 U.S. Dental Equipment Market, By Product

32 U.S. Dental Equipment Market, By End User

33 Canada Dental Equipment Market, By Product

34 Canada Dental Equipment Market, By End User

35 Mexico Dental Equipment Market, By Product

36 Mexico Dental Equipment Market, By End User

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 A-Dec Inc.: Company Snapshot

40 A-Dec Inc.: SWOT Analysis

41 A-Dec Inc.: Geographic Presence

42 Planmeca Oy: Company Snapshot

43 Planmeca Oy: SWOT Analysis

44 Planmeca Oy: Geographic Presence

45 Dentsply Sirona: Company Snapshot

46 Dentsply Sirona: SWOT Analysis

47 Dentsply Sirona: Geographic Presence

48 Patterson Companies Inc.: Company Snapshot

49 Patterson Companies Inc.: Swot Analysis

50 Patterson Companies Inc.: Geographic Presence

51 Straumann: Company Snapshot

52 Straumann: SWOT Analysis

53 Straumann: Geographic Presence

54 GC CORP.: Company Snapshot

55 GC CORP.: SWOT Analysis

56 GC CORP.: Geographic Presence

57 Carestream Health Inc. : Company Snapshot

58 Carestream Health Inc. : SWOT Analysis

59 Carestream Health Inc. : Geographic Presence

60 Biolase Inc.: Company Snapshot

61 Biolase Inc.: SWOT Analysis

62 Biolase Inc.: Geographic Presence

63 Danaher Corp., Inc.: Company Snapshot

64 Danaher Corp., Inc.: SWOT Analysis

65 Danaher Corp., Inc.: Geographic Presence

66 3M ESPE: Company Snapshot

67 3M ESPE: SWOT Analysis

68 3M ESPE: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global Dental Equipment Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Dental Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS