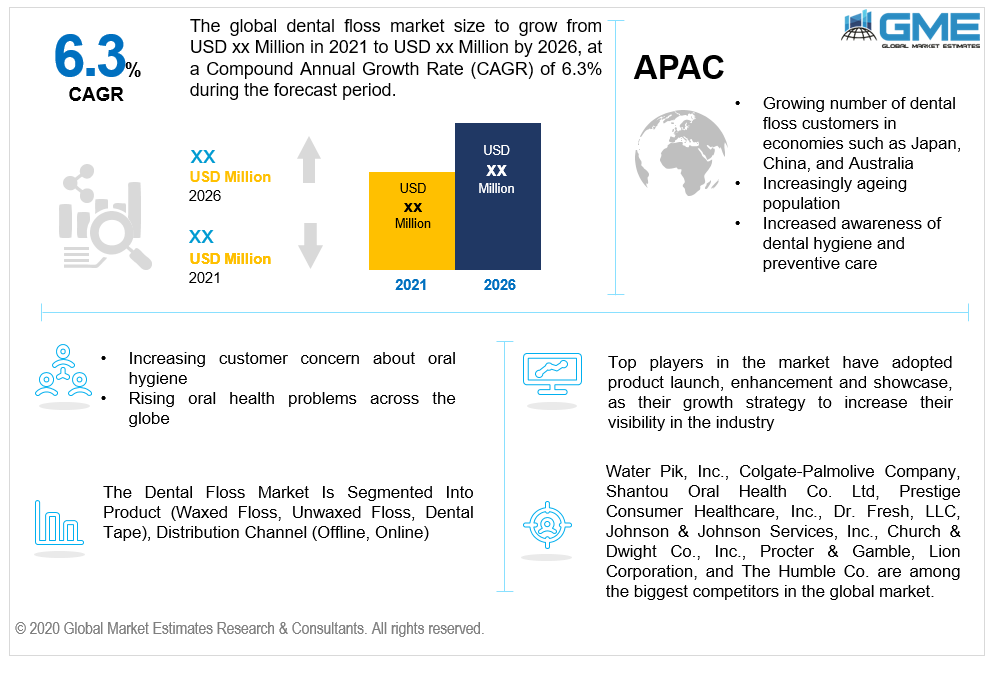

Global Dental Floss Market Size, Trends, and Analysis- Forecasts To 2026 By Product (Waxed Floss, Unwaxed Floss, Dental Tape), By Distribution Channel (Offline, Online), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Dental floss is a vital aspect of maintaining healthy mouth. Dental floss is used to remove dirt, food residue, and a bacteria coating that is stuck between the teeth and cannot be dissolved by brushing. It comes in the shape of a waxed or unwaxed string or ribbon. Various flavours of dental floss are also available. Mint, cinnamon, bubble-gum, and basic flavours of dental floss are available. Reusable floss is becoming more common these days. Dental floss is expected to increase in popularity as people are inclining towards using home based dental products.

A major factor driving the market is increasing customer concern about oral hygiene and growing demand for oral care products as a result of rising oral health problems. Adoption of convenient and easy-to-use products is being aided by the widespread use of tobacco products, which may have negative impacts on oral health. This factor is also likely to raise the demand for dental floss in the immediate future.

Flossing can help avoid plaque build-up, which can lead to oral diseases like dental caries and gingivitis. Dental problems like bad breath, gum inflammation, and cavities are anticipated to spur the demand for interdental cleaning items like dental floss. A significant part of the teeth is below the gum line, which is out of reach of a standard toothbrush. This will add to plaque build-up and a variety of dental issues. Plaque is dissolved and the interdental region is washed using interdental floss, tapes, brushes, and other items. Consumers are urged to reflect on oral hygiene because of its important position in a person's physical appearance.

During the forecast period, the dental floss market is projected to be led by the growing geriatric population and basic oral hygiene techniques. Because of its efficacy and compactness, countries with the largest number of elderly citizens, such as Germany and Japan, are predicted to see increased acceptance of the product. Furthermore, branding campaigns and the launching of those products under well-known oral care labels are projected to boost the global market significantly. Dental floss will increase in popularity as people spend more money on dental and oral products to stop having to get dental surgery. Another big trend in the dental floss market is an increase in revenue via the e-commerce platform.

However, the availability of alternatives, like dental picks, is the major restraint for the market growth.

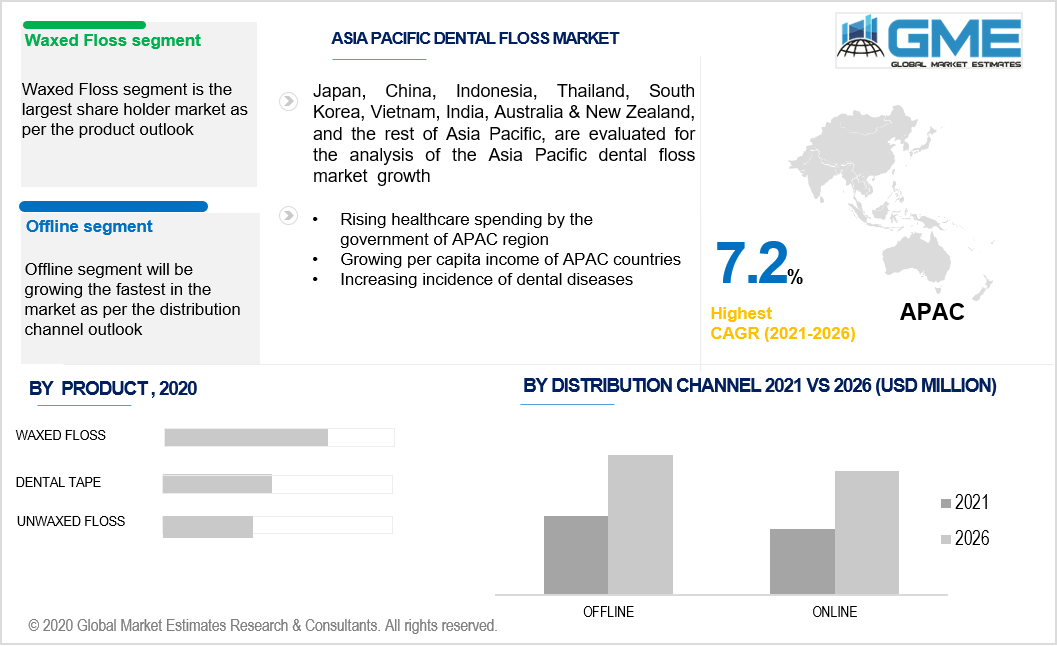

During the forecast period, waxed dental floss is predicted to hold a large market share. The primary driver of this segment's development is the rise in oral health problems. Waxed dental floss has added advantages because it contains natural oils and enzymes that help to remove plaque effectively. These are also available with a polymer coating that avoids shredding and makes plaque removal easy. Natural wax additives are being used by producers to create all-natural dental floss. Dental floss made of three natural waxes, beeswax, carnauba, and jojoba, with no artificial preservatives, added sugars, or colour is available from firms like Tom's of Maine, Inc.

During the forecast period, dental tape is estimated to rise with the highest CAGR. These tapes, also called wide floss, are prescribed for those who have bridgework or a larger gap between their teeth than the average person. Dental tapes are normally wider and flatter than ordinary floss, and they come in waxed and unwaxed forms. As a consequence, it is anticipated to be commonly used as a floss replacement during the projected span.

Based on the distribution channel, the market has been categorized into the offline channel and online channel. The largest distribution platform is offline and will account for a substantial portion of the market over the forecast period. People are increasingly seeking specialized dental services as the rate of oral disease rises. From 2021-2026, this factor is expected to lead to the development of the offline distribution channel. Throughout the projected era, the category is predicted to retain its domination. Higher revenue is being aided by easy access to merchandise in supermarkets and pharmacies, among other places. Producers are focusing on creating innovative and new products that make dental flossing more appealing and manageable. They concentrate on improving the product's convenience and safety, particularly for the gums.

Because of the rising number of mobile users and smartphones with active internet providers, the online distribution channel is expected to rise at the fastest CAGR during the forecast period. Many e-commerce and online shopping applications, such as Amazon, Flipkart, Walmart, and eBay, make buying oral care items quick and convenient for consumers. The region's online distribution channel is being driven by rapid urbanization and industrial growth in India, China, and other Asian nations. The increased availability of a wide variety of goods on online platforms, as well as door-to-door delivery services, are expected to boost segment growth in the coming years.

Throughout the forecast period, North America is predicted to retain the largest share of the dental floss market. Factors such as the growing incidence of oral diseases and the well-established healthcare system are projected to drive the demand in this region forward. Furthermore, the number of geriatric communities requiring routine dental check-ups and assistance is steadily increasing.

Besides that, increasing public awareness of the significance of oral hygiene to overall health in the nation is propelling business growth. The American Dental Association (ADA) is also known for helping to raise awareness about the importance of good oral hygiene among American citizens. By providing private health insurance benefits that reduce consumers' out-of-pocket rates for health and dental facilities, the Protection and Affordable Care Act (PACA) has helped to create a structured and competitive market for health insurance. The market is anticipated to expand substantially during the projected period as a result of the above factors.

The demand in the APAC region is expected to rise at the fastest rate due to the growing number of dental floss customers in economies such as Japan, China, and Australia. The Asia Pacific region is expected to expand due to an increasingly ageing population and increased awareness of dental hygiene and preventive care. Customers in the region are expected to be encouraged to concentrate on oral hygiene and invest in emerging technology for improved dental treatment by public awareness campaigns. Due to rising healthcare spending, growing per capita income of APAC customers, changing habits, and increased dental care awareness, the Asia Pacific except Japan dental floss market is projected to expand at a high pace over the forecast period.

Water Pik, Inc., Colgate-Palmolive Company, Shantou Oral Health Co. Ltd, Prestige Consumer Healthcare, Inc., Dr. Fresh, LLC, Johnson & Johnson Services, Inc., Church & Dwight Co., Inc., Procter & Gamble, Lion Corporation, and The Humble Co. are among the biggest competitors in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Dental Floss Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Dental Floss Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing customer concern about oral hygiene and growing demand for oral care products as a result of rising oral health problems

3.3.2 Industry Challenges

3.3.2.1 Availability of alternatives in the market

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Dental Floss Market, By Product

4.1 Product Outlook

4.2 Waxed Floss

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Unwaxed Floss

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Dental Tape

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Dental Floss Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Online

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Offline

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Dental Floss Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Product, 2016-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2016-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2016-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Product, 2016-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Product, 2016-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2016-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2016-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2016-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Product, 2016-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2016-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2016-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Product, 2016-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2016-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2016-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Water Pik, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Colgate-Palmolive Company

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Shantou Oral Health Co. Ltd

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Prestige Consumer Healthcare, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Dr. Fresh, LLC

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Johnson & Johnson Services, Inc

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Church & Dwight Co., Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Procter & Gamble

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Lion Corporation

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Dental Floss Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Dental Floss Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS