Global Digital Experience Platform Market Size, Trends & Analysis - Forecasts to 2029 By Deployment Type (On-premise and Cloud), By End User (Retail, IT and Telecom, BFSI, Healthcare, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

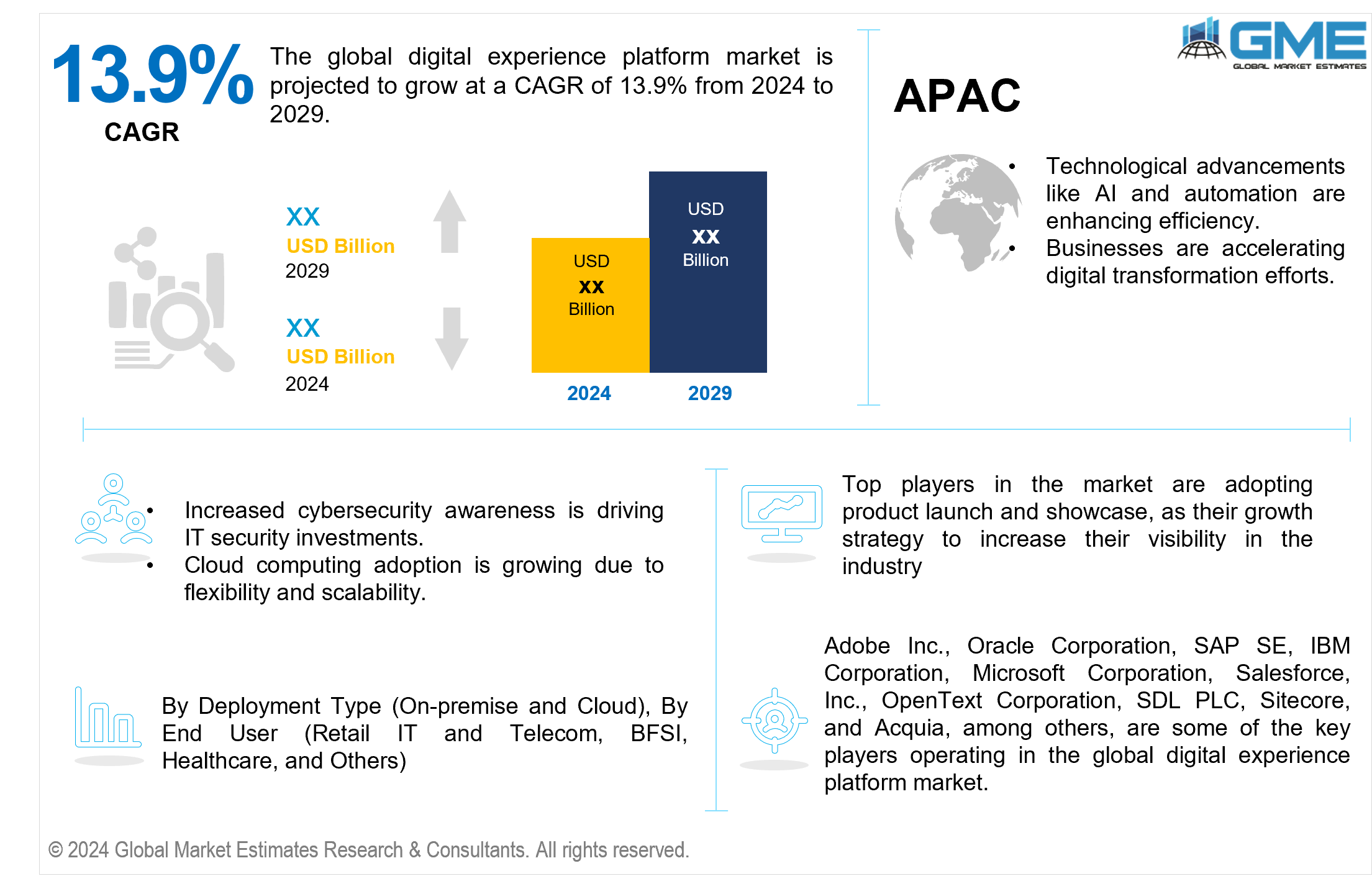

The global digital experience platform market is projected to grow at a CAGR of 13.9% from 2024 to 2029.

The growing requirement for effective customer experience management is the major factor contributing to the growth of the digital experience platform (DXP) market. When organizations prioritize personalized experiences, DXPs enable omnichannel engagement, allowing for seamless digital customer journeys across numerous touchpoints. DXPs enable enterprises to deliver consistent and contextually relevant information by combining customer data platforms (CDP) and content management systems (CMS), resulting in increased customer engagement. Furthermore, the development of real-time customer engagement capabilities within DXPs enables organizations to respond quickly to consumer requests, considerably improving the user experience (UX).

The introduction of marketing automation into DXP solutions is another factor of market growth. These systems make multichannel marketing tactics more efficient by automating repetitive operations, evaluating customer behavior, and delivering tailored advertising. The integration of advanced analytics and insights technologies into DXPs enables firms to assess and optimize the impact of their marketing initiatives in real-time customer interaction. Furthermore, the digital transformation movement has encouraged businesses to use DXP software to remain competitive. This transformation comprises the integration of numerous digital tools and platforms to ensure a consistent and streamlined client experience.

DXP market trends show a rising preference for DXP vendors who provide complete solutions. As businesses strive for better digital customer experiences, the demand for scalable and flexible DXP implementation services grows. The emphasis on DXP integration with existing systems and platforms is critical for firms looking to improve their digital strategies. Furthermore, DXP providers' ability to properly handle client data and deliver personalized experiences across channels sets them apart.

Constraint in the digital experience platform (DXP) market is the high implementation cost, which can be restrictive for small and medium-sized businesses (SMEs). The costs of integrating advanced DXP solutions and training staff might hinder uptake, particularly for firms with tight budgets.

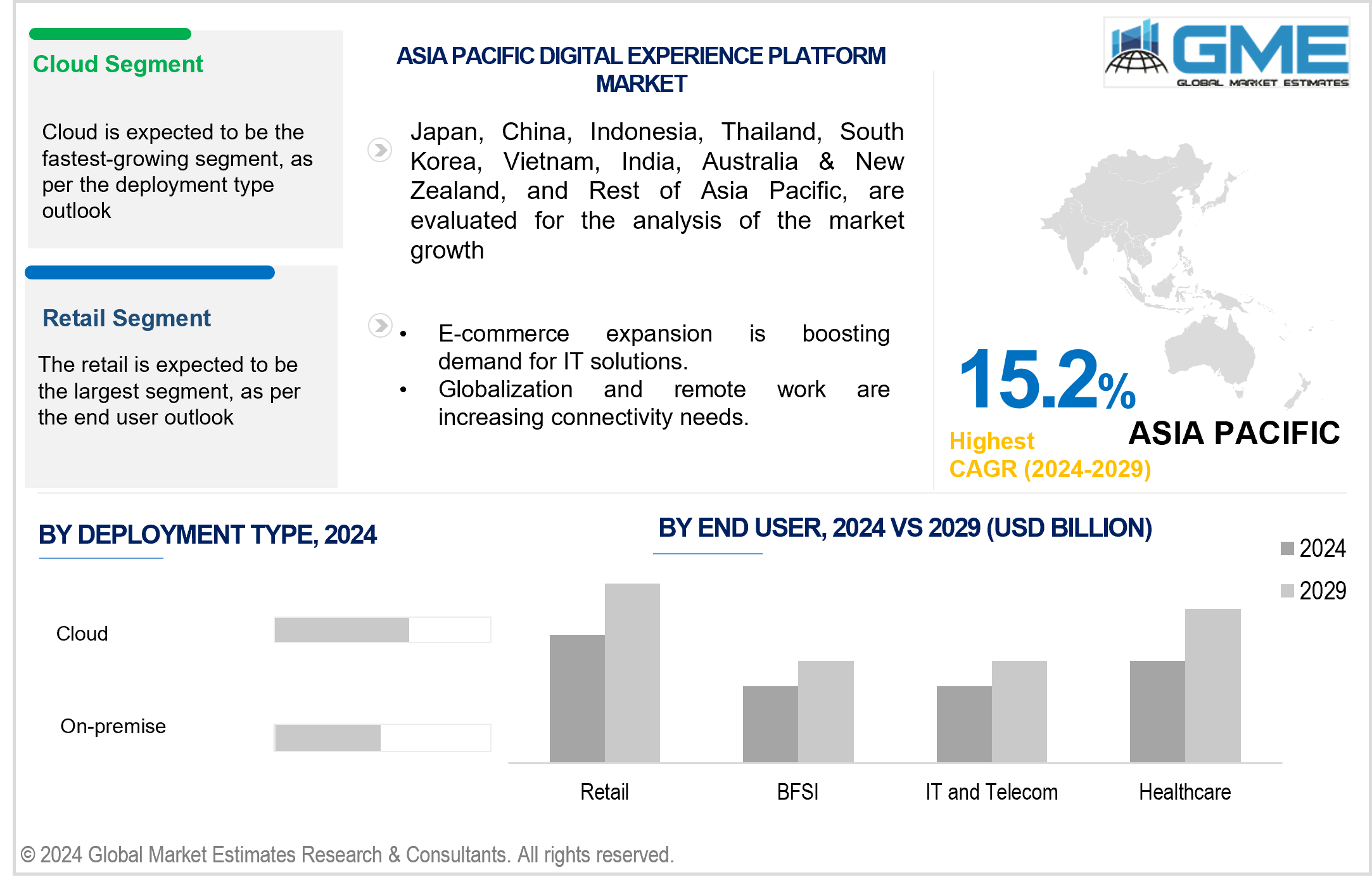

The cloud segment is expected to hold the largest market share and is expected to be the fastest-growing segment from 2024 to 2029. This is due to its scalability, cost-efficiency and flexibility. Cloud-based DXPs facilitate swift implementation and smooth connection with current systems, enabling companies to adjust to evolving client demands promptly. Furthermore, cloud solutions provide improved security, ongoing updates, and remote access to tools and data, which makes them a desirable choice for businesses looking to improve their digital experience capabilities.

For instance, in March 2024, at the Adobe Summit, Adobe announced significant innovations in its Adobe Experience Platform to enhance data-driven personalization at scale. A key highlight is the introduction of the Adobe Experience Platform AI Assistant, which utilizes generative AI to provide a conversational interface for answering technical questions, automating tasks, and generating new customer journeys and audiences. This AI Assistant aims to boost productivity and democratize access across teams, ensuring brands can deliver tailored omnichannel experiences effectively.

The BFSI segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is due to the sector's increasing focus on digital transformation. The adoption of DXP solutions is driven by the need for real-time data analysis, individualized financial services, improved client experience, and strong security measures. These solutions help BFSI companies remain competitive in a fast-changing digital market by streamlining processes and enhancing client interaction.

The retail segment is expected to hold the largest share of the market. The segment's growth is due to its high demand for personalized customer experiences and omnichannel engagement. Retailers use DXP technologies to deliver tailored marketing campaigns, evaluate consumer behaviour in real time, and seamlessly link online and physical channels. This increases sales, fosters brand loyalty, and improves consumer satisfaction, making DXP essential for preserving a competitive edge in the retail sector.

North America is expected to be the largest region in the global market. High digital adoption rates and substantial expenditures on customer experience solutions are the primary reasons boosting market growth in this region. Demand is driven by the existence of significant DXP providers, a thriving ecosystem of digital marketing agencies, and a strong emphasis on individualized customer interactions.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the growing attempts to digitize a variety of industries, increasing internet penetration, and rising use of mobile technology. Governments and corporations are investing significantly in digital transformation projects in Asia Pacific countries. The need for improved customer experiences and effective digital marketing tactics catered to the region's dynamic consumer base creates a favorable environment for DXP adoption.

Adobe Inc., Oracle Corporation, SAP SE, IBM Corporation, Microsoft Corporation, Salesforce, Inc., OpenText Corporation, SDL PLC, Sitecore, and Acquia, among others, are some of the key players operating in the global digital experience platform market.

Please note: This is not an exhaustive list of companies profiled in the report.

In June 2024, SAP SE announced its plan to acquire WalkMe Ltd. for approximately USD 1.5 billion, marking a strategic move to enhance its digital adoption platform (DAP) capabilities. WalkMe specializes in guiding users through complex workflows across multiple applications to increase software adoption and productivity.

In April 2024, Oracle unveiled new artificial intelligence (AI) capabilities within its Oracle Fusion Cloud Customer Experience (CX) suite to enhance sales, marketing, and service operations. These advancements are designed to automate tasks, improve customer satisfaction, and accelerate deal cycles for organizations.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DIGITAL EXPERIENCE PLATFORM MARKET, BY END USER

4.1 Introduction

4.2 Digital Experience Platform Market: End User Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Retail

4.4.1 Retail Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 IT and Telecom

4.5.1 IT and Telecom Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 BFSI

4.6.1 BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Healthcare

4.7.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Others

4.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL DIGITAL EXPERIENCE PLATFORM MARKET, BY DEPLOYMENT TYPE

5.1 Introduction

5.2 Digital Experience Platform Market: Deployment Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 On-premise

5.4.1 On-premise Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Cloud

5.5.1 Cloud Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL DIGITAL EXPERIENCE PLATFORM MARKET, BY REGION

6.1 Introduction

6.2 North America Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By End User

6.2.2 By Deployment Type

6.2.3 By Country

6.2.3.1 U.S. Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By End User

6.2.3.1.2 By Deployment Type

6.2.3.2 Canada Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By End User

6.2.3.2.2 By Deployment Type

6.2.3.3 Mexico Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By End User

6.2.3.3.2 By Deployment Type

6.3 Europe Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By End User

6.3.2 By Deployment Type

6.3.3 By Country

6.3.3.1 Germany Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By End User

6.3.3.1.2 By Deployment Type

6.3.3.2 U.K. Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By End User

6.3.3.2.2 By Deployment Type

6.3.3.3 France Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By End User

6.3.3.3.2 By Deployment Type

6.3.3.4 Italy Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By End User

6.3.3.4.2 By Deployment Type

6.3.3.5 Spain Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By End User

6.3.3.5.2 By Deployment Type

6.3.3.6 Netherlands Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By End User

6.3.3.6.2 By Deployment Type

6.3.3.7 Rest of Europe Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By End User

6.3.3.6.2 By Deployment Type

6.4 Asia Pacific Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By End User

6.4.2 By Deployment Type

6.4.3 By Country

6.4.3.1 China Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By End User

6.4.3.1.2 By Deployment Type

6.4.3.2 Japan Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By End User

6.4.3.2.2 By Deployment Type

6.4.3.3 India Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By End User

6.4.3.3.2 By Deployment Type

6.4.3.4 South Korea Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By End User

6.4.3.4.2 By Deployment Type

6.4.3.5 Singapore Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By End User

6.4.3.5.2 By Deployment Type

6.4.3.6 Malaysia Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By End User

6.4.3.6.2 By Deployment Type

6.4.3.7 Thailand Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By End User

6.4.3.6.2 By Deployment Type

6.4.3.8 Indonesia Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By End User

6.4.3.7.2 By Deployment Type

6.4.3.9 Vietnam Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By End User

6.4.3.8.2 By Deployment Type

6.4.3.10 Taiwan Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By End User

6.4.3.10.2 By Deployment Type

6.4.3.11 Rest of Asia Pacific Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By End User

6.4.3.11.2 By Deployment Type

6.5 Middle East and Africa Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By End User

6.5.2 By Deployment Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By End User

6.5.3.1.2 By Deployment Type

6.5.3.2 U.A.E. Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By End User

6.5.3.2.2 By Deployment Type

6.5.3.3 Israel Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By End User

6.5.3.3.2 By Deployment Type

6.5.3.4 South Africa Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By End User

6.5.3.4.2 By Deployment Type

6.5.3.5 Rest of Middle East and Africa Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By End User

6.5.3.5.2 By Deployment Type

6.6 Central and South America Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By End User

6.6.2 By Deployment Type

6.6.3 By Country

6.6.3.1 Brazil Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By End User

6.6.3.1.2 By Deployment Type

6.6.3.2 Argentina Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By End User

6.6.3.2.2 By Deployment Type

6.6.3.3 Chile Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By End User

6.6.3.3.2 By Deployment Type

6.6.3.3 Rest of Central and South America Digital Experience Platform Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By End User

6.6.3.3.2 By Deployment Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Adobe Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Oracle Corporation

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 SAP SE

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Microsoft Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Salesforce, Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 IBM

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 OpenText Corporation

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 SDL PLC

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Sitecore

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Acquia

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

2 Retail Market, By Region, 2021-2029 (USD Million)

3 BFSI Market, By Region, 2021-2029 (USD Million)

4 IT and Telecom Market, By Region, 2021-2029 (USD Million)

5 Healthcare Market, By Region, 2021-2029 (USD Million)

6 Others Market, By Region, 2021-2029 (USD Million)

7 Global Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

8 On-premise Market, By Region, 2021-2029 (USD Million)

9 Cloud Market, By Region, 2021-2029 (USD Million)

10 Regional Analysis, 2021-2029 (USD Million)

11 North America Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

12 North America Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

13 North America Digital Experience Platform Market, By COUNTRY, 2021-2029 (USD Million)

14 U.S. Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

15 U.S. Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

16 Canada Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

17 Canada Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

18 Mexico Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

19 Mexico Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

20 Europe Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

21 Europe Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

22 Europe Digital Experience Platform Market, By Country, 2021-2029 (USD Million)

23 Germany Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

24 Germany Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

25 U.K. Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

26 U.K. Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

27 France Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

28 France Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

29 Italy Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

30 Italy Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

31 Spain Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

32 Spain Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

33 Netherlands Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

34 Netherlands Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

35 Rest Of Europe Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

36 Rest Of Europe Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

37 Asia Pacific Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

38 Asia Pacific Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

39 Asia Pacific Digital Experience Platform Market, By Country, 2021-2029 (USD Million)

40 China Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

41 China Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

42 Japan Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

43 Japan Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

44 India Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

45 India Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

46 South Korea Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

47 South Korea Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

48 Singapore Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

49 Singapore Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

50 Thailand Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

51 Thailand Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

52 Malaysia Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

53 Malaysia Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

54 Indonesia Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

55 Indonesia Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

56 Vietnam Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

57 Vietnam Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

58 Taiwan Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

59 Taiwan Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

60 Rest of APAC Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

61 Rest of APAC Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

62 Middle East and Africa Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

63 Middle East and Africa Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

64 Middle East and Africa Digital Experience Platform Market, By Country, 2021-2029 (USD Million)

65 Saudi Arabia Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

66 Saudi Arabia Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

67 UAE Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

68 UAE Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

69 Israel Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

70 Israel Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

71 South Africa Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

72 South Africa Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

73 Rest Of Middle East and Africa Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

74 Rest Of Middle East and Africa Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

75 Central and South America Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

76 Central and South America Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

77 Central and South America Digital Experience Platform Market, By Country, 2021-2029 (USD Million)

78 Brazil Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

79 Brazil Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

80 Chile Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

81 Chile Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

82 Argentina Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

83 Argentina Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

84 Rest Of Central and South America Digital Experience Platform Market, By End User, 2021-2029 (USD Million)

85 Rest Of Central and South America Digital Experience Platform Market, By Deployment Type, 2021-2029 (USD Million)

86 Adobe Inc.: Products & Services Offering

87 Oracle Corporation: Products & Services Offering

88 SAP SE: Products & Services Offering

89 Microsoft Corporation: Products & Services Offering

90 Salesforce, Inc.: Products & Services Offering

91 IBM: Products & Services Offering

92 OpenText Corporation : Products & Services Offering

93 SDL PLC: Products & Services Offering

94 Sitecore, Inc: Products & Services Offering

95 Acquia: Products & Services Offering

96 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Digital Experience Platform Market Overview

2 Global Digital Experience Platform Market Value From 2021-2029 (USD Million)

3 Global Digital Experience Platform Market Share, By End User (2023)

4 Global Digital Experience Platform Market Share, By Deployment Type (2023)

5 Global Digital Experience Platform Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Digital Experience Platform Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Digital Experience Platform Market

10 Impact Of Challenges On The Global Digital Experience Platform Market

11 Porter’s Five Forces Analysis

12 Global Digital Experience Platform Market: By End User Scope Key Takeaways

13 Global Digital Experience Platform Market, By End User Segment: Revenue Growth Analysis

14 Retail Market, By Region, 2021-2029 (USD Million)

15 IT and Telecom Market, By Region, 2021-2029 (USD Million)

16 BFSI Market, By Region, 2021-2029 (USD Million)

17 Healthcare Market, By Region, 2021-2029 (USD Million)

18 Others Market, By Region, 2021-2029 (USD Million)

19 Global Digital Experience Platform Market: By Deployment Type Scope Key Takeaways

20 Global Digital Experience Platform Market, By Deployment Type Segment: Revenue Growth Analysis

21 On-premise Market, By Region, 2021-2029 (USD Million)

22 Cloud Market, By Region, 2021-2029 (USD Million)

23 Regional Segment: Revenue Growth Analysis

24 Global Digital Experience Platform Market: Regional Analysis

25 North America Digital Experience Platform Market Overview

26 North America Digital Experience Platform Market, By End User

27 North America Digital Experience Platform Market, By Deployment Type

28 North America Digital Experience Platform Market, By Country

29 U.S. Digital Experience Platform Market, By End User

30 U.S. Digital Experience Platform Market, By Deployment Type

31 Canada Digital Experience Platform Market, By End User

32 Canada Digital Experience Platform Market, By Deployment Type

33 Mexico Digital Experience Platform Market, By End User

34 Mexico Digital Experience Platform Market, By Deployment Type

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 Adobe Inc.: Company Snapshot

38 Adobe Inc.: SWOT Analysis

39 Adobe Inc.: Geographic Presence

40 Oracle Corporation: Company Snapshot

41 Oracle Corporation: SWOT Analysis

42 Oracle Corporation: Geographic Presence

43 SAP SE: Company Snapshot

44 SAP SE: SWOT Analysis

45 SAP SE: Geographic Presence

46 Microsoft Corporation: Company Snapshot

47 Microsoft Corporation: Swot Analysis

48 Microsoft Corporation: Geographic Presence

49 Salesforce, Inc.: Company Snapshot

50 Salesforce, Inc.: SWOT Analysis

51 Salesforce, Inc.: Geographic Presence

52 IBM: Company Snapshot

53 IBM: SWOT Analysis

54 IBM: Geographic Presence

55 OpenText Corporation : Company Snapshot

56 OpenText Corporation : SWOT Analysis

57 OpenText Corporation : Geographic Presence

58 SDL PLC: Company Snapshot

59 SDL PLC: SWOT Analysis

60 SDL PLC: Geographic Presence

61 Sitecore, Inc.: Company Snapshot

62 Sitecore, Inc.: SWOT Analysis

63 Sitecore, Inc.: Geographic Presence

64 Acquia: Company Snapshot

65 Acquia: SWOT Analysis

66 Acquia: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Digital Experience Platform Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Experience Platform Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS