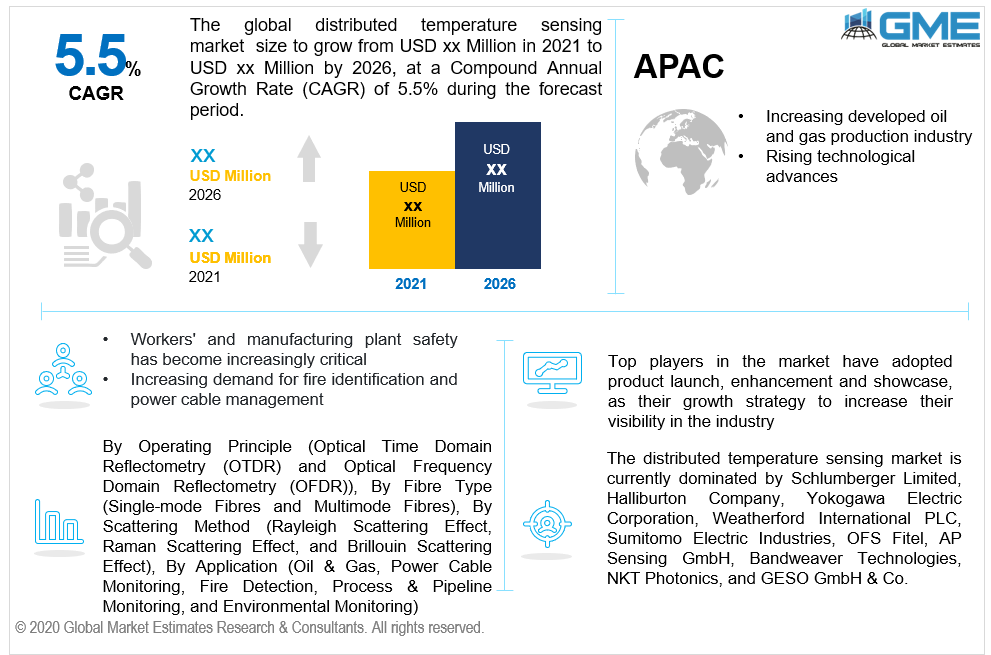

Global Distributed Temperature Sensing Market Size, Trends, and Analysis - Forecasts To 2026 By Operating Principle (Optical Time Domain Reflectometry (OTDR) and Optical Frequency Domain Reflectometry (OFDR)), By Fibre Type (Single-mode Fibres and Multimode Fibres), By Scattering Method (Rayleigh Scattering Effect, Raman Scattering Effect, and Brillouin Scattering Effect), By Application (Oil & Gas, Power Cable Monitoring, Fire Detection, Process & Pipeline Monitoring, and Environmental Monitoring), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The expanding demand for workforce labour safety, the dependability of DTS systems/sensors for detecting and surveillance activities in hostile environments, and the expanding usage in the oil and gas sector are driving the expansion of this market. Improving safety standards and supporting government regulations for leak detection, as well as the increased usage of data-driven analytics, give significant potential for the expansion of the distributed temperature sensing market.

The vital data provided by DTS, on the other hand, is not being properly used, which could limit productivity and lead to potential complications. DTS provides data that can be used in a variety of operations to improve overall efficiency, and if this data is not used correctly, it can result in significant losses. DTS systems' development is also constrained by their high initial costs. The distributed temperature sensing market is expected to develop rapidly as the oil and gas industry expands its subsea operations.

The minimal operational costs of the global DTS market are driving its expansion. Furthermore, DTS systems are secure to be used in dangerous areas including those with explosive gas atmospheres and many others, making these sensors appropriate to be used in industrial sensing applications. Such considerations may drive the need for DTS systems, hence increasing the global market's growth throughout the forecast period. Furthermore, numerous market participants are employing effective methods such as technical development and product introduction to expand their worldwide presence.

Depending on the operating principle, the market is categorized as, OTDR and OFDR. The demand for the optical time-domain reflectometry (OTDR) operating principle is foreseen to be the highest. Bigger colour displays are popular in optical time-domain reflectometry (OTDR), which has a mainframe that can be equipped with multi-function plug-in units to conduct certain fibre measurement tasks. OTDR has higher precision, a wider temperature spectrum, and a better instrument resolution than OFDR.

Depending on the fibre type, the market is categorized as, single-mode fibres and multimode fibres. Multimode fibres are likely to account for the largest share of the market. The light-carrying core of multimode fibres is relatively wide. These are commonly used in DTS applications and come in core sizes of 50m and 62.5m. The light rays that are emitted are allowed to travel down several pathways throughout the fibre. The broad core diameter aids in the propagation of more optical power across the fibre. Since there are several modes present, the signal disperses, resulting in more power loss than a single-mode cable, limiting the signal carrying capability in terms of the distance covered.

Depending on the scattering method, the market is categorized as, Rayleigh scattering effect, Raman scattering effect, and Brillouin scattering effect. The Rayleigh scattering effect is estimated to dominate because of its precision in measuring physical parameters and its ability to maintain the equilibrium between a spectrum in which it detects the physical parameters, this scattering method is commonly favoured. High sensitivity is the primary factor behind the segment's rapid development. For shifts in parameters like strain, pressure, temperature, and others, the sensor has nearly equal sensitivity. This scattering method is often used to monitor the propagating effect, which assists in the analysis of different parameters.

Depending on the application, the market is categorized as, oil & gas, power cable monitoring, fire detection, process & pipeline monitoring, and environmental monitoring. The oil and gas segment is projected to have the largest market share. DTS technology has become an essential component of the oil and gas sector. DTS systems aid in continual, real-time down-hole surveillance, which helps to improve facility operating and economic efficiency. This allows reservoirs engineers to acquire a better knowledge of the infusion and output dynamics, allowing them to optimise output and enhance recovery, ultimately leading to greater profitability. As a result, there is a growing emphasis on implementing technology to improve the performance of brownfield operations. Data analysis obtained by DTS systems can offer supplementary data on the good behaviour, such as flow volume inside a specific area of the well.

North America will be the largest revenue contributor to the DTS market during the forecast period. Improved use of DTS systems by manufacturers, as well as processes and pipeline management solutions, will fuel market development in North America. Furthermore, increased demand for fire identification and power cable management would support the development of the DTS market in the area.

Throughout the forecast period, the distributed temperature sensing market in APAC is predicted to develop at the fastest CAGR. The growing building activity throughout the world, as well as the developing network of power transmission cables in technologically sophisticated APAC nations like China and India, are driving the expansion of the DTS market in this area. Some of the key nations supporting the expansion and evolution of the DTS market in this area include India, China, South Korea, and Australia. The involvement of various oil and gas businesses in APAC is also propelling the DTS market in this area's growth.

The distributed temperature sensing market is currently dominated by Schlumberger Limited, Halliburton Company, Yokogawa Electric Corporation, Weatherford International PLC, Sumitomo Electric Industries, OFS Fitel, AP Sensing GmbH, Bandweaver Technologies, NKT Photonics, and GESO GmbH & Co.

Please note: This is not an exhaustive list of companies profiled in the report.

In 2019, AP Sensing teamed with Energinet, a Danish Transmission Operator, in November 2019. AP Sensing will provide a monitoring solution for the Kriegers Flak transmission system as part of this agreement. AP Sensing uses nine Distributed Acoustic Sensing (DAS) devices and six Distributed Temperature Sensing (DTS) devices to monitor a total of 300 kilometres. These DTS devices, which have a range of 30-50 km and 1-4 channels, are used for thermal profiling and detecting thermal anomalies.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Distributed Temperature Sensing Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Operating Principle Overview

2.1.3 Fibre Type Overview

2.1.4 Scattering Method Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Global Distributed Temperature Sensing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Expanding Demand for Workforce Labour Safety

3.3.1.2 Expanding Usage in the Oil And Gas Sector

3.3.2 Industry Challenges

3.3.2.1 Complex Detection And Troubleshooting System Of DTS

3.4 Prospective Growth Scenario

3.4.1 Operating Principle Growth Scenario

3.4.2 Fibre Type Growth Scenario

3.4.3 Scattering Method Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Distributed Temperature Sensing Market, By Operating Principle

4.1 Operating Principle Outlook

4.2 Optical Time Domain Reflectometry (OTDR)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Optical Frequency Domain Reflectometry (OFDR)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Distributed Temperature Sensing Market, By Fibre Type

5.1 Fibre Type Outlook

5.2 Single-mode Fibres

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Multimode Fibres

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Distributed Temperature Sensing Market, By Scattering Method

6.1 Scattering Method Outlook

6.2 Rayleigh Scattering Effect

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Raman Scattering Effect

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Brillouin Scattering Effect

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Distributed Temperature Sensing Market, By Application

7.1 Application Outlook

7.2 Oil & Gas

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Power Cable Monitoring

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Fire Detection

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

7.6 Process & Pipeline Monitoring

7.6.1 Market Size, By Region, 2019-2026 (USD Million)

7.7 Environmental Monitoring

7.7.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Distributed Temperature Sensing Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.2.3 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.2.4 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.2.5 Market Size, By Application, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.2.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.2.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.3 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.4 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.5 Market Size, By Application, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.9.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.10.4 Market Size, By Application, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.3.11.4 Market Size, By Application, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.3 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.4.4 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.4.5 Market Size, By Application, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.4.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.4.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.4.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.9.2 Market size, By Fibre Type, 2019-2026 (USD Million)

8.4.9.3 Market size, By Scattering Method, 2019-2026 (USD Million)

8.4.9.4 Market size, By Application, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.4.10.4 Market Size, By Application, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.5.3 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.5.4 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.5.5 Market Size, By Application, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.5.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.5.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.5.8.4 Market Size, By Application, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.6.3 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.6.4 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.6.5 Market Size, By Application, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.6.6.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.6.7.4 Market Size, By Application, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Operating Principle, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Fibre Type, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Scattering Method, 2019-2026 (USD Million)

8.6.8.4 Market Size, By Application, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Schlumberger Limited

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Halliburton Company

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Yokogawa Electric Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Weatherford International PLC

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Sumitomo Electric Industries

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 OFS Fitel

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 AP Sensing GmbH

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Bandweaver Technologies

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 NKT Photonics

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 GESO GmbH & Co.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

The Global Distributed Temperature Sensing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Distributed Temperature Sensing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS