Global Door and Window Automation Market Size, Trends & Analysis - Forecasts to 2026 By Component (Operators, Sensors & Detectors, Access Control Systems, Control Panels, and Switches), By Product (Industrial Doors, Pedestrian Doors, and Automated Windows), By End-User (Residential Buildings, Airports, Education Buildings, Healthcare, Hotels & Restaurants, Industrial Production Units, Public Transit Systems, Commercial Buildings, Entertainment Centers, and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Automated doors and windows are predominantly compatible with cutting-edge technologies and are especially preferred for residential properties, banks and financial institutions, and government offices. These automatic doors and windows are significantly used in office buildings to ensure the employees' complete protection. In addition, they are connected to fire systems that provide automatic evacuation routes during unexpected critical circumstances to meet the building's protection requirements.

The growing popularity of automatic technologies has increased the demand for home automation systems. This indicates that the door and window automation industry has a strong growth opportunity in the coming years. Capital investments for door and window automation infrastructure improvements have grown as disposable income has increased. In emerging economies of APAC, infrastructure spending is also growing. These developing economies' political stability and economic growth help to draw significant foreign investment and remove infrastructure bottlenecks in these areas. This, along with economic prosperity in developing countries such as the United States, the United Kingdom, and Germany, increases demand for smart homes with automated doors and windows.

Control devices in smart homes manage the operation of doors and windows. Automation of door and window systems improves living room comfort, stability, and convenience. Rising real estate investment is another important driver. The construction of door and window control systems is prohibitively expensive, and their ongoing maintenance necessitates the use of highly qualified individuals. As a result, high costs are expected to be a constraint for the door and window automation market.

Demand for door and window control systems is expected to rise during the forecast period due to a growth in the number of buyers of consumer electronic products. Electronic devices can be used to lock and unlock doors and windows in smart homes, offering security and contentment. Furthermore, the use of automatic technologies indoor and window systems saves space. Doors and windows are closed and opened for the optimum number of cycles with the assistance of advanced technology, paving the way for energy savings. Saving electricity eventually contributes to cost savings, which is expected to bring industry growth prospects over the forecast period. Owing to its convergence with emerging technology for usability, comfort, security, and protection, the demand for door and window automation is expected to expand rapidly throughout the forecast period.

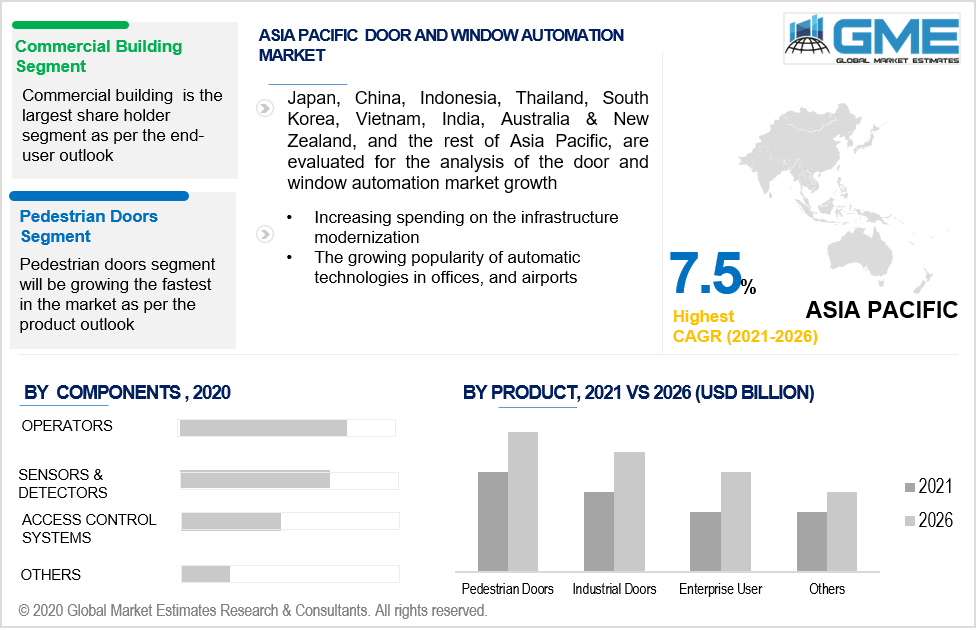

Depending on the component the market is categorized as operators, sensors & detectors, access control systems, control panels, and switches. Operators are leading in this segment because they are commonly used in automatic door and window systems. An operator is useful for opening and closing the door with ease and at a constant tempo. It is widely used in any commercial structure, retail store, or industrial environment. Furthermore, access control devices, such as smart cards, biometric readers, and video monitoring systems, are rapidly being used to satisfy the need for safety and protection in a variety of workplaces, banks, and financial institutions, among others. As a result, the demand for access control devices is projected to grow at a significant rate.

Depending on the products, the market is categorized as industrial doors, pedestrian doors, and automated windows. Pedestrian doors are leading in this segment due to the growing need for protection at the entrance to the house, workplaces, and businesses. Moreover, automated pedestrian doors are widely used in commercial structures, department stores, and public assessment premises to satisfy high traffic and safety standards. They can be very effective in managing lateral traffic conditions, such as using one door for entrance traffic and another for exit traffic.

Depending on the end-user, the market is categorized as residential buildings, airports, education buildings, healthcare, hotels & restaurants, industrial production units, public transit systems, commercial buildings, entertainment centers, and others. The commercial buildings are leading in this segment, since these styles of automatic doors are so prevalent in shopping centers, government departments, and banks and finance corporations, the commercial buildings segment has the largest market share. Automated doors are extremely useful for the aged and mentally impaired. These doors and windows are linked to control applications that are activated in response to fire alerts. As a result of the high level of protection that automatic doors and windows provide, demand for them is growing.

As per the geographical analysis, the market can be classified into North America (the U.S., Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. Due to the extremely strong prevalence of automation technologies in the industry, the market in North America accounts for a significant portion of the overall market in terms of sales. Furthermore, rising infrastructure investment is intended to assist the development of the target market in this area. Over the forecast period, the Asia Pacific market is predicted to rise significantly in terms of growth and record the highest CAGR. The increasing proliferation of door and window automation in airports, workplaces, and medical centers is a major factor influencing the target market's expansion. Furthermore, growing infrastructure, particularly in developed economies, is expected to generate revenue opportunities for major players in the Asia Pacific region.

Assa Abloy, Boon Edam, Navetsco Corporation, Geze GmbH, dormakaba Group, Stanley Black & Decker, Inc., Came S.p.A., Gera, Schneider Electric, Siemens AG, Honeywell International Inc., Allegion Plc, ABB Ltd., and Insteon among others are the major players in the door and window automation market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Door and Window Automation Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Product Overview

2.1.4 End-User Overview

2.1.5 Regional Overview

Chapter 3 Door and Window Automation Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Need for Providing Accessibility to Elderly and Disabled People

3.3.1.2 Growing Demand for Security and Safety Concerns in the Hospitality Sector

3.3.1.3 Increasing Infrastructure Spending

3.3.2 Industry Challenges

3.3.2.1 High Installation and Maintenance Costs

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Product Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Door and Window Automation Market, By Component

4.1 Component Outlook

4.2 Operators

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Sensors & Detectors

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Access Control Systems

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Automated Windows

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Door and Window Automation Market, By Product

5.1 Product Outlook

5.2 Residential Buildings

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Airports

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Education Buildings

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Healthcare

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Hotels & Restaurants

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Industrial Production Units

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 Public Transit Systems

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

5.9 Commercial Buildings

5.9.1 Market Size, By Region, 2019-2026 (USD Million)

5.10 Entertainment Centers

5.10.1 Market Size, By Region, 2019-2026 (USD Million)

5.11 Others

5.11.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Door and Window Automation Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Component, 2019-2026 (USD Million)

6.2.3 Market Size, By Product, 2019-2026 (USD Million)

6.2.4 Market Size, By End-User, 2019-2026 (USD Million)

6.2.5 U.S.

6.2.5.1 Market Size, By Component, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.2.6 Canada

6.2.6.1 Market Size, By Component, 2019-2026 (USD Million)

6.2.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Component, 2019-2026 (USD Million)

6.3.3 Market Size, By Product, 2019-2026 (USD Million)

6.3.4 Market Size, By End-User, 2019-2026 (USD Million)

6.3.5 Germany

6.2.5.1 Market Size, By Component, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.6 UK

6.3.6.1 Market Size, By Component, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.7 France

6.3.7.1 Market Size, By Component, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.7.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.8 Italy

6.3.8.1 Market Size, By Component, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.8.3 Market Size, By End-User, 2019-2026 (USD Million)

6.3.9 Spain

6.3.9.1 Market Size, By Component, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2019-2026 (USD Million)

6.3.10 Russia

6.3.10.1 Market Size, By Component, 2019-2026 (USD Million)

6.3.10.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.10.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Component, 2019-2026 (USD Million)

6.4.3 Market Size, By Product, 2019-2026 (USD Million)

6.4.4 Market Size, By End-User, 2019-2026 (USD Million)

6.4.5 China

6.4.5.1 Market Size, By Component, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.4.6 India

6.4.6.1 Market Size, By Component, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.7 Japan

6.4.7.1 Market Size, By Component, 2019-2026 (USD Million)

6.4.7.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.7.3 Market Size, By End-User, 2019-2026 (USD Million)

6.4.8 Australia

6.4.8.1 Market Size, By Component, 2019-2026 (USD Million)

6.4.8.2 Market size, By Product, 2019-2026 (USD Million)

6.4.8.2 Market size, By End-User, 2019-2026 (USD Million)

6.4.9 South Korea

6.4.9.1 Market Size, By Component, 2019-2026 (USD Million)

6.4.9.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.9.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Component, 2019-2026 (USD Million)

6.5.3 Market Size, By Product, 2019-2026 (USD Million)

6.5.4 Market Size, By End-User, 2019-2026 (USD Million)

6.5.5 Brazil

6.5.5.1 Market Size, By Component, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5.6 Mexico

6.5.6.1 Market Size, By Component, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2019-2026 (USD Million)

6.5.7 Argentina

6.5.7.1 Market Size, By Component, 2019-2026 (USD Million)

6.5.7.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.7.2 Market Size, By End-User, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Component, 2019-2026 (USD Million)

6.6.3 Market Size, By Product, 2019-2026 (USD Million)

6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

6.6.5 Saudi Arabia

6.6.5.1 Market Size, By Component, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.5.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6.6 UAE

6.6.6.1 Market Size, By Component, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.6.3 Market Size, By End-User, 2019-2026 (USD Million)

6.6.7 South Africa

6.6.7.1 Market Size, By Component, 2019-2026 (USD Million)

6.6.7.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.7.2 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Assa Abloy

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Boon Edam

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Navetsco Corporation

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Geze GmbH

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 dormakaba Group

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Stanley Black & Decker, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Came S.p.A.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Gera

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Schneider Electric

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Siemens AG

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Honeywell International Inc.

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Allegion Plc

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 ABB Ltd.

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Insteon

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Door and Window Automation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Door and Window Automation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS