Global Dual Fuel Heat Pumps Market Size, Trends & Analysis - Forecasts to 2026 By Component (Heat Pump, Gas), By Application (Residential, Light Commercial), By Distribution Channel (Direct, Through Retailers, Online), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Emerging trends for energy efficient electronic appliances along with rising demand for effective heating and cooling systems in residential and light commercial spaces will drive the Dual Fuel Heat Pumps Demand. These systems are highly impactful and suitable for in home installations. Less energy consumption and easy installation in limited spaces are key factors to drive demand in residential applications.

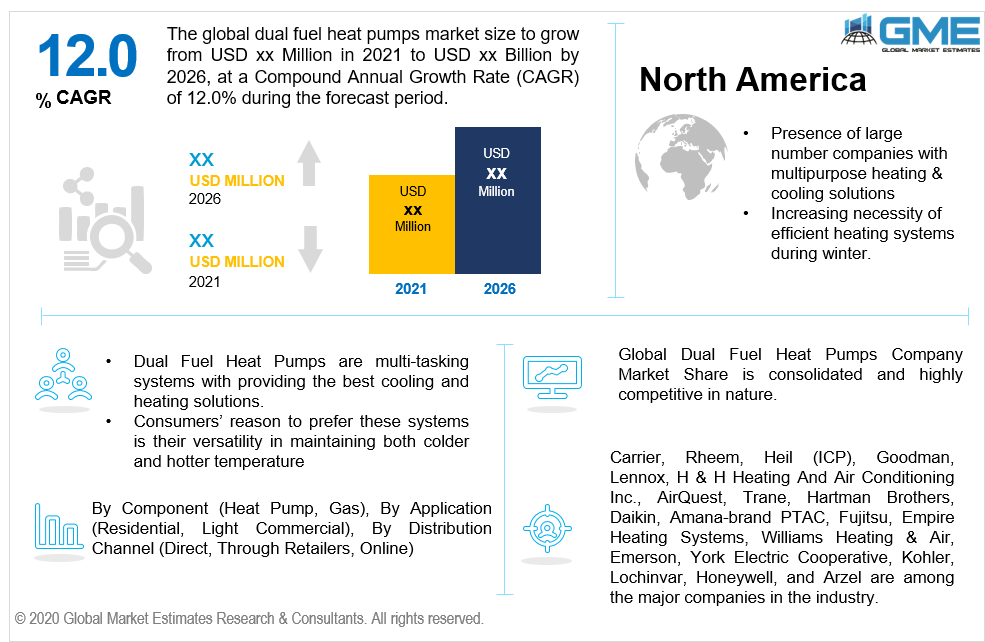

Dual Fuel Heat Pumps are multi-tasking systems with providing the best cooling and heating solutions. They are highly preferred in geographies with extreme colder temperatures. Consumers’ reason to prefer these systems is their versatility in maintaining both colder and hotter temperatures which avoids the necessity to purchase different systems for a different purpose.

Heat pump and gas are the two major components in the Dual Fuel Heat Pumps Market. These systems are proven to be highly effective and capable of maintaining the cooling and heating environment depending on the weather conditions.

These air conditioning systems use heat pumps in the cool environment and switch to gas during the freezing point or really cold temperatures. Dual Heat Pumps are a small solution for countries with extreme weather conditions.

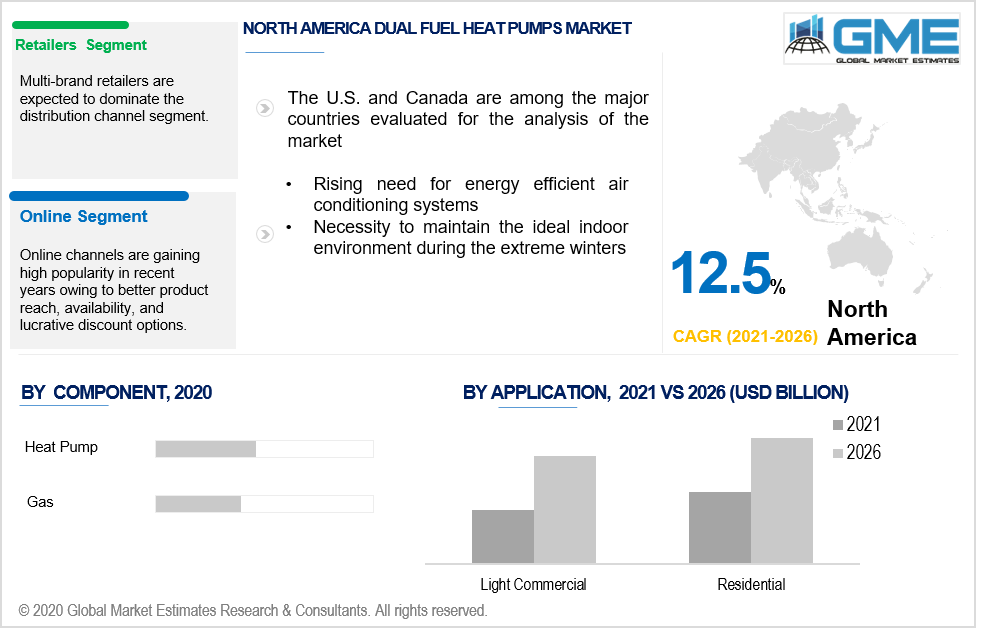

By application, the industry is divided into residential and light commercial segments. The residential segment dominated the revenue share and accounted for more than 60% of the revenue share in 2019. Increasing consumer spending on energy efficient electronics along with economical pricing are the key success factors to drive demand in this segment.

The light commercial applications involved small scale offices, restaurants, cafes, and book stores which have limited space and can not accumulate the industrial size conditioning systems. Dual Fuel Heat Pumps are gaining high adoption in these kinds of premises due to their size, performance, and suitability.

By distribution channel, the industry is segmented into direct sales channels, retailers, and online. Multi-brand retailers are expected to dominate the distribution channel segment. Presence of a wide variety of brands along with facility to get instant product comparison with respect to price, ratings, performance, and appearance. The direct sales channel includes the exclusive dealership of the single brand product. There is a niche group of customers who prefer to purchase from these stores due to their loyalty and trust towards a single brand of products.

Online channels are gaining high popularity in recent years owing to better product reach, availability, and lucrative discount options. The segment is projected to witness fastest growth up to 2026.

Europe Dual Fuel Heat Pumps Market will lead the global revenue in the coming years. Changing climatic conditions along with the rising need for energy efficient air conditioning systems to maintain the environment are among the key prime factors to induce demand in this region. Countries with severe temperatures that drop during the winters are the major consumers of these products. High requirements during the winters to regulate the temperature along with installation and functionality make the product suitable for these countries.

North America Dual Fuel Heat Pumps will observe the highest growth and share by 2026. The presence of a large number of companies with multipurpose solutions along with the necessity of efficient heating systems during winter will proliferate the regional demand. The U.S. and Canada are the major contributors in this region. Also, high spending on energy efficient products along with support from the government to promote sustainable products will support the regional product penetration.

Asia Pacific will witness notable growth up to 2026. The product is beneficial for geographies with freezing point temperature during the winters. Economical, efficient, effective, and low operating costs are among the major factors to drive demand in this region.

Global Dual Fuel Heat Pumps Company Market Share is consolidated and highly competitive in nature. Brand recognition and preference to multinational brands before purchase is highly noted among consumer buying behavior. Product development pertaining to performance enhancement along with better product reach are among the noted key strategies.

Carrier, Rheem, Heil (ICP), Goodman, Lennox, H & H Heating And Air Conditioning Inc., AirQuest, Trane, Hartman Brothers, Daikin, Amana-brand PTAC, Fujitsu, Empire Heating Systems, Williams Heating & Air, Emerson, York Electric Cooperative, Kohler, Lochinvar, Honeywell, and Arzel are among the major companies in the industry.

Please note: This is not an exhaustive list of companies profiled in the report.

Streamlined supply chain networks and dealerships along with efficient after-sale services are the top priorities of the manufacturers.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Duel Fuel Heat Pumps industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Component overview

2.1.3 Application overview

2.1.4 Distribution channel overview

2.1.5 Regional overview

Chapter 3 Duel Fuel Heat Pumps Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Duel Fuel Heat Pumps Market, By Component

4.1 Component Outlook

4.2 Heat pump

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Gas

4.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Duel Fuel Heat Pumps Market, By Application

5.1 Application Outlook

5.2 Residential

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Light commercial

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Duel Fuel Heat Pumps Market, By Distribution Channel

6.1 Distribution channel Outlook

6.2 Direct

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Through retailers

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Online

6.4.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 Duel Fuel Heat Pumps Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market size, by country 2019-2026 (USD Million)

7.2.2 Market size, by component, 2019-2026 (USD Million)

7.2.3 Market size, by application, 2019-2026 (USD Million)

7.2.4 Market size, by distribution channel, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market size, by component, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market size, by component, 2019-2026 (USD Million)

7.2.6.2 Market size, by application, 2019-2026 (USD Million)

7.2.6.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market size, by country 2019-2026 (USD Million)

7.3.2 Market size, by component, 2019-2026 (USD Million)

7.3.3 Market size, by application, 2019-2026 (USD Million)

7.3.4 Market size, by distribution channel, 2019-2026 (USD Million)

7.3.5 Germany

7.2.5.1 Market size, by component, 2019-2026 (USD Million)

7.2.5.2 Market size, by application, 2019-2026 (USD Million)

7.2.5.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market size, by component, 2019-2026 (USD Million)

7.3.6.2 Market size, by application, 2019-2026 (USD Million)

7.3.6.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market size, by component, 2019-2026 (USD Million)

7.3.7.2 Market size, by application, 2019-2026 (USD Million)

7.3.7.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market size, by component, 2019-2026 (USD Million)

7.3.8.2 Market size, by application, 2019-2026 (USD Million)

7.3.8.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market size, by country 2019-2026 (USD Million)

7.4.2 Market size, by component, 2019-2026 (USD Million)

7.4.3 Market size, by application, 2019-2026 (USD Million)

7.4.4 Market size, by distribution channel, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market size, by component, 2019-2026 (USD Million)

7.4.5.2 Market size, by application, 2019-2026 (USD Million)

7.4.5.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market size, by component, 2019-2026 (USD Million)

7.4.6.2 Market size, by application, 2019-2026 (USD Million)

7.4.6.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market size, by component, 2019-2026 (USD Million)

7.4.7.2 Market size, by application, 2019-2026 (USD Million)

7.4.7.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market size, by component, 2019-2026 (USD Million)

7.4.8.2 Market size, by application, 2019-2026 (USD Million)

7.4.8.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market size, by component, 2019-2026 (USD Million)

7.4.9.2 Market size, by application, 2019-2026 (USD Million)

7.4.9.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market size, by country 2019-2026 (USD Million)

7.5.2 Market size, by component, 2019-2026 (USD Million)

7.5.3 Market size, by application, 2019-2026 (USD Million)

7.5.4 Market size, by distribution channel, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market size, by component, 2019-2026 (USD Million)

7.5.5.2 Market size, by application, 2019-2026 (USD Million)

7.5.5.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market size, by component, 2019-2026 (USD Million)

7.5.6.2 Market size, by application, 2019-2026 (USD Million)

7.5.6.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market size, by country 2019-2026 (USD Million)

7.6.2 Market size, by component, 2019-2026 (USD Million)

7.6.3 Market size, by application, 2019-2026 (USD Million)

7.6.4 Market size, by distribution channel, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market size, by component, 2019-2026 (USD Million)

7.6.5.2 Market size, by application, 2019-2026 (USD Million)

7.6.5.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market size, by component, 2019-2026 (USD Million)

7.6.6.2 Market size, by application, 2019-2026 (USD Million)

7.6.6.3 Market size, by distribution channel, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market size, by component, 2019-2026 (USD Million)

7.6.7.2 Market size, by application, 2019-2026 (USD Million)

7.6.7.3 Market size, by distribution channel, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive analysis, 2020

8.2 Carrier

8.2.1 Company overview

8.2.2 Financial analysis

8.2.3 Strategic positioning

8.2.4 Info graphic analysis

8.3 Rheem

8.3.1 Company overview

8.3.2 Financial analysis

8.3.3 Strategic positioning

8.3.4 Info graphic analysis

8.4 Heil (ICP)

8.4.1 Company overview

8.4.2 Financial analysis

8.4.3 Strategic positioning

8.4.4 Info graphic analysis

8.5 Goodman

8.5.1 Company overview

8.5.2 Financial analysis

8.5.3 Strategic positioning

8.5.4 Info graphic analysis

8.6 Lennox

8.6.1 Company overview

8.6.2 Financial analysis

8.6.3 Strategic positioning

8.6.4 Info graphic analysis

8.7 H & H Heating And Air Conditioning Inc.

8.7.1 Company overview

8.7.2 Financial analysis

8.7.3 Strategic positioning

8.7.4 Info graphic analysis

8.8 AirQuest

8.8.1 Company overview

8.8.2 Financial analysis

8.8.3 Strategic positioning

8.8.4 Info graphic analysis

8.9 Trane

8.9.1 Company overview

8.9.2 Financial analysis

8.9.3 Strategic positioning

8.9.4 Info graphic analysis

8.10 Hartman Brothers

8.10.1 Company overview

8.10.2 Financial analysis

8.10.3 Strategic positioning

8.10.4 Info graphic analysis

8.11 Daikin

8.11.1 Company overview

8.11.2 Financial analysis

8.11.3 Strategic positioning

8.11.4 Info graphic analysis

8.12 Amana-brand PTAC

8.12.1 Company overview

8.12.2 Financial analysis

8.12.3 Strategic positioning

8.12.4 Info graphic analysis

8.13 Fujitsu

8.13.1 Company overview

8.13.2 Financial analysis

8.13.3 Strategic positioning

8.13.4 Info graphic analysis

8.14 Empire Heating Systems

8.14.1 Company overview

8.14.2 Financial analysis

8.14.3 Strategic positioning

8.14.4 Info graphic analysis

8.15 Williams Heating & Air

8.15.1 Company overview

8.15.2 Financial analysis

8.15.3 Strategic positioning

8.15.4 Info graphic analysis

8.16 Emerson

8.16.1 Company overview

8.16.2 Financial analysis

8.16.3 Strategic positioning

8.16.4 Info graphic analysis

8.17 York Electric Cooperative

8.17.1 Company overview

8.17.2 Financial analysis

8.17.3 Strategic positioning

8.17.4 Info graphic analysis

8.18 Kohler

8.18.1 Company overview

8.18.2 Financial analysis

8.18.3 Strategic positioning

8.18.4 Info graphic analysis

8.19 Lochinvar

8.19.1 Company overview

8.19.2 Financial analysis

8.19.3 Strategic positioning

8.19.4 Info graphic analysis

8.20 Honeywell

8.20.1 Company overview

8.20.2 Financial analysis

8.20.3 Strategic positioning

8.20.4 Info graphic analysis

8.21 Arzel

8.21.1 Company overview

8.21.2 Financial analysis

8.21.3 Strategic positioning

8.21.4 Info graphic analysis

The Global Dual Fuel Heat Pumps Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Dual Fuel Heat Pumps Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS