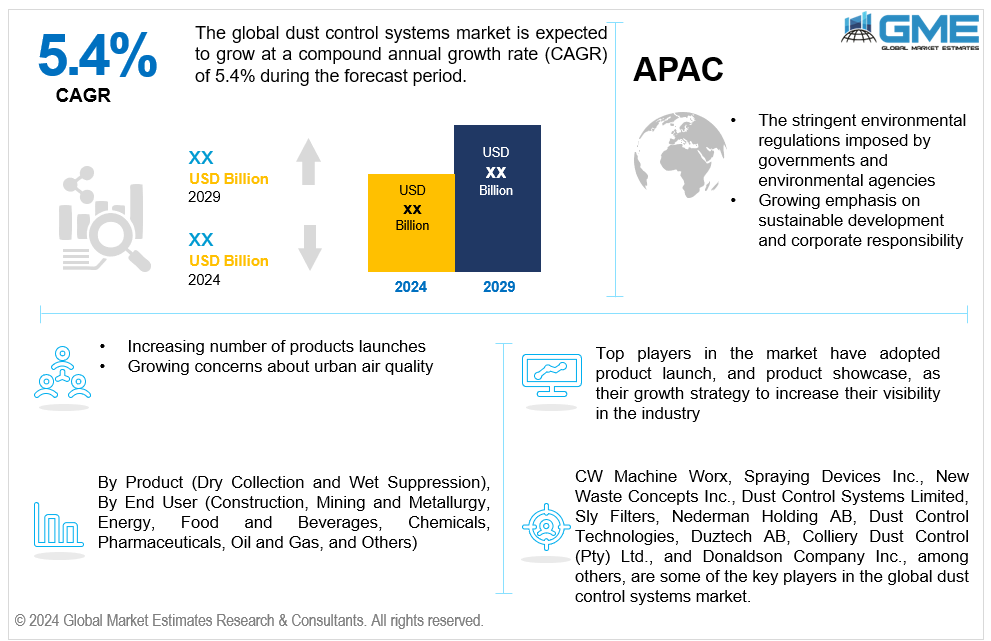

Global Dust Control Systems Market Size, Trends & Analysis - Forecasts to 2029 By Product (Dry Collection and Wet Suppression), By End User (Construction, Mining and Metallurgy, Energy, Food and Beverages, Chemicals, Pharmaceuticals, Oil and Gas, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global dust control systems market is estimated to exhibit a CAGR of 5.4% from 2024 to 2029.

The primary factors propelling the market growth are the stringent environmental regulations imposed by governments and environmental agencies and the growing emphasis on sustainable development and corporate responsibility. Regulations requiring industries to follow particular emission limits and pollution control measures are enforced by governments and environmental authorities. The need for dust control systems will rise due to companies having to abide by these rules to avoid fines and legal repercussions. Moreover, governments and environmental agencies often launch initiatives and programs to address specific environmental concerns, including air pollution from dust emissions. For instance, the Health and Safety Executive (HSE) initiated a campaign to prevent dust inhalation on construction sites in June 2022.

The increasing number of product launches and growing concerns about urban air quality are expected to support the market growth. Innovation and technical developments are frequently highlighted with the introduction of a new product. These developments could be enhanced filtration techniques, more intelligent monitoring and control systems, or more effective dust control systems. These developments can attract clients seeking increased effectiveness and performance, hence propelling market growth. For instance, the Oizom Smart Dust Monitoring system manufacturer introduced a dust suppression system with automation features in November 2022. These features included industrial emission, dust suppression, construction, dust quality research, and monitoring of air quality for industries.

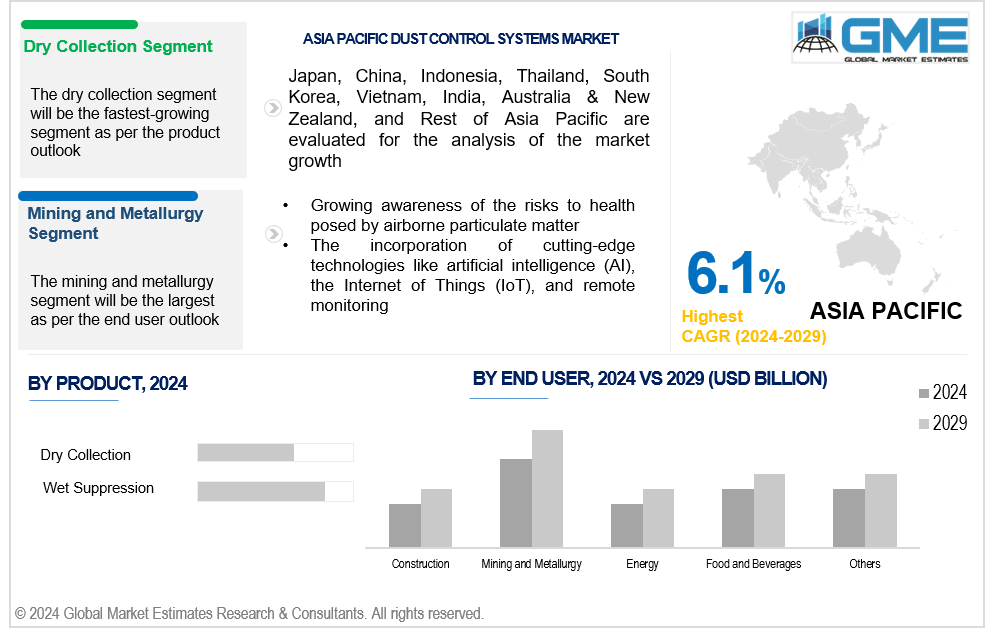

The market growth is also driven by growing awareness of the health risks posed by airborne particulate matter and by incorporating cutting-edge technologies like artificial intelligence (AI), the Internet of Things (IoT), and remote monitoring. Dust control systems can benefit from integrating IoT sensors to monitor various factors in real time, including environmental conditions, equipment performance, air quality, and dust levels. Artificial intelligence algorithms can use this data to analyze and adjust the functioning of the dust management system, ensuring optimal efficacy and efficiency. As a result, there is improved dust suppression, less energy used, and less maintenance required.

By offering dust management solutions that are both flexible and modular, companies can meet the unique demands of various environments, applications, and industries. Providing adaptable solutions specific to the difficulties and limitations each customer faces can increase client happiness and loyalty. Additionally, companies can reach a wider audience, expedite sales processes, and offer dust control products and services conveniently by adopting e-commerce platforms and digital marketing tactics. Digitalization also makes data-driven insights and consumer engagement easier, promoting companies' growth and efficiency.

However, the high price of cutting-edge products and the lack of awareness in emerging economies hinder market growth.

The wet suppression segment is expected to hold the largest share of the market over the forecast period. Dusty roads, heaps, conveyors, and material handling operations are just a few examples of the many applications for wet suppression systems. They can be tailored to meet the needs of specific applications and are sufficiently adaptable to work in various operating environments. Moreover, by employing water or water-based solutions to suppress dust particles and keep them from becoming airborne, wet suppression systems are very effective at reducing the amount of dust emissions. This method works especially well in dust-producing industries, including demolition, building, and mining.

The dry collection segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Increased filtration media, sophisticated electrostatic precipitators, and high-efficiency cyclones are a few examples of technological developments that have enhanced the performance and dependability of dry collection systems. These developments have increased the appeal of dry collection systems to enterprises looking for sustainable and affordable dust management solutions.

The mining and metallurgy segment is expected to hold the largest share of the market over the forecast period. Processes related to mining and metallurgy entail handling and processing substantial amounts of raw materials, such as ores, minerals, and metals. These operations produce significant amounts of dust particles, endangering the health and welfare of surrounding people and workers. As a result, there is a critical need for effective dust control measures in the mining and metallurgy industry.

The oil and gas segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The environmental impact of the oil and gas sector, particularly the air pollution caused by dust emissions, is drawing increasing attention to it. Stringent environmental regulations and emission limitations are being implemented by regulatory bodies in an effort to reduce air pollution and safeguard human health. Consequently, to show their commitment to the environment and to complying with rules, oil and gas corporations are investing in dust control technologies.

North America is expected to be the largest region in the global market. The growing emphasis on sustainability and environmental stewardship across industries and the growing mining activities are driving the market growth in the North American region. For instance, according to the Federal Reserve, in February 2024, mining production in the United States rose by 1.43% compared to the same month in the previous year.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Dust particles in the air seriously endanger the health of local communities and workers. The Asia Pacific region's occupational health and safety standards prioritize safeguarding workers against respiratory illnesses and other conditions brought on by exposure to dust. Companies are spending significant amounts on dust control technologies to lower health-related liabilities and provide safer working environments.

CW Machine Worx, Spraying Devices Inc., New Waste Concepts Inc., Dust Control Systems Limited, Sly Filters, Nederman Holding AB, Dust Control Technologies, Duztech AB, Colliery Dust Control (Pty) Ltd., and Donaldson Company Inc., among others, are some of the key players operating in the global dust control systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Camfil Air Pollution Control (APC) launched the Gold Series Timer (GST), the newest dust collection controller. GST is a straightforward and efficient method of regulating pulse-jet cleaning in industrial dust collection systems, such as baghouses.

In March 2021, the world-renowned material processing and lifting equipment manufacturer, Terex, introduced "Aquamist by Terex," a dust suppression technology. The "Aquamist by Terex" dust suppression system uses a high-capacity misting fan that creates finely separated water droplets in a size range of 10-150 micron diameter, which is an improvement over conventional jets or water-sprays to manage the build-up of dust and better protect workers on job sites.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DUST CONTROL SYSTEMS MARKET, BY PRODUCT

4.1 Introduction

4.2 Dust Control Systems Market: Product Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Dry Collection

4.4.1 Dry Collection Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Wet Suppression

4.5.1 Wet Suppression Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL DUST CONTROL SYSTEMS MARKET, BY END USER

5.1 Introduction

5.2 Dust Control Systems Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Construction

5.4.1 Construction Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Mining and Metallurgy

5.5.1 Mining and Metallurgy Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Energy

5.6.1 Energy Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Food and Beverages

5.7.1 Food and Beverages Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Chemicals

5.8.1 Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Pharmaceuticals

5.9.1 Pharmaceuticals Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Oil and Gas

5.10.1 Oil and Gas Market Estimates and Forecast, 2021-2029 (USD Million)

5.11 Others

5.11.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL DUST CONTROL SYSTEMS MARKET, BY REGION

6.1 Introduction

6.2 North America Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Product

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Product

6.2.3.1.2 By End User

6.2.3.2 Canada Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Product

6.2.3.2.2 By End User

6.2.3.3 Mexico Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Product

6.2.3.3.2 By End User

6.3 Europe Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Product

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Product

6.3.3.1.2 By End User

6.3.3.2 U.K. Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Product

6.3.3.2.2 By End User

6.3.3.3 France Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Product

6.3.3.3.2 By End User

6.3.3.4 Italy Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Product

6.3.3.4.2 By End User

6.3.3.5 Spain Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Product

6.3.3.5.2 By End User

6.3.3.6 Netherlands Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Product

6.3.3.6.2 By End User

6.4 Asia Pacific Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Product

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Product

6.4.3.1.2 By End User

6.4.3.2 Japan Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Product

6.4.3.2.2 By End User

6.4.3.3 India Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Product

6.4.3.3.2 By End User

6.4.3.4 South Korea Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Product

6.4.3.4.2 By End User

6.4.3.5 Singapore Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Product

6.4.3.5.2 By End User

6.4.3.6 Malaysia Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End User

6.4.3.7 Thailand Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Product

6.4.3.6.2 By End User

6.4.3.8 Indonesia Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Product

6.4.3.7.2 By End User

6.4.3.9 Vietnam Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Product

6.4.3.8.2 By End User

6.4.3.10 Taiwan Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Product

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Product

6.4.3.11.2 By End User

6.5 Middle East and Africa Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Product

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Product

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Product

6.5.3.2.2 By End User

6.5.3.3 Israel Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Product

6.5.3.3.2 By End User

6.5.3.4 South Africa Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Product

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Product

6.5.3.5.2 By End User

6.6 Central and South America Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Product

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Product

6.6.3.1.2 By End User

6.6.3.2 Argentina Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Product

6.6.3.2.2 By End User

6.6.3.3 Chile Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Dust Control Systems Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Product

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 CW Machine Worx

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Spraying Devices Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 New Waste Concepts Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Dust Control Systems Limited

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Sly Filters

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 NEDERMAN HOLDING AB

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Dust Control Technologies

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Duztech AB

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Colliery Dust Control (Pty) Ltd.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Donaldson Company Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & SegWet Suppressiontation

8.2 Information ProcureWet Suppressiont

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

2 Dry Collection Market, By Region, 2021-2029 (USD Mllion)

3 Wet Suppression Market, By Region, 2021-2029 (USD Mllion)

4 Global Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

5 Construction Market, By Region, 2021-2029 (USD Mllion)

6 Mining and Metallurgy Market, By Region, 2021-2029 (USD Mllion)

7 Energy Market, By Region, 2021-2029 (USD Mllion)

8 Food and Beverages Market, By Region, 2021-2029 (USD Mllion)

9 Chemicals Market, By Region, 2021-2029 (USD Mllion)

10 Pharmaceuticals Market, By Region, 2021-2029 (USD Mllion)

11 Oil and Gas Market, By Region, 2021-2029 (USD Mllion)

12 Others Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

15 North America Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

16 North America Dust Control Systems Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

18 U.S. Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

19 Canada Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

20 Canada Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

21 Mexico Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

22 Mexico Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

23 Europe Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

24 Europe Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

25 EUROPE Dust Control Systems Market, By COUNTRY, 2021-2029 (USD Mllion)

26 Germany Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

27 Germany Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

28 U.K. Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

29 U.K. Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

30 France Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

31 France Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

32 Italy Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

33 Italy Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

34 Spain Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

35 Spain Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

36 Netherlands Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

37 Netherlands Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

38 Rest Of Europe Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

39 Rest Of Europe Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

40 Asia Pacific Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

41 Asia Pacific Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

42 ASIA PACIFIC Dust Control Systems Market, By COUNTRY, 2021-2029 (USD Mllion)

43 China Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

44 China Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

45 Japan Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

46 Japan Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

47 India Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

48 India Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

49 South Korea Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

50 South Korea Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

51 Singapore Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

52 Singapore Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

53 Thailand Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

54 Thailand Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

55 Malaysia Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

56 Malaysia Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

57 Indonesia Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

58 Indonesia Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

59 Vietnam Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

60 Vietnam Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

61 Taiwan Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

62 Taiwan Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

63 Rest of APAC Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

64 Rest of APAC Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

65 Middle East and Africa Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

66 Middle East and Africa Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

67 MIDDLE EAST & ADRICA Dust Control Systems Market, By COUNTRY, 2021-2029 (USD Mllion)

68 Saudi Arabia Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

69 Saudi Arabia Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

70 UAE Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

71 UAE Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

72 Israel Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

73 Israel Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

74 South Africa Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

75 South Africa Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

78 Central and South America Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

79 Central and South America Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

80 CENTRAL AND SOUTH AMERICA Dust Control Systems Market, By COUNTRY, 2021-2029 (USD Mllion)

81 Brazil Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

82 Brazil Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

83 Chile Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

84 Chile Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

85 Argentina Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

86 Argentina Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Dust Control Systems Market, By Product, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Dust Control Systems Market, By End User, 2021-2029 (USD Mllion)

89 CW Machine Worx: Products & Services Offering

90 Spraying Devices Inc.: Products & Services Offering

91 New Waste Concepts Inc.: Products & Services Offering

92 Dust Control Systems Limited: Products & Services Offering

93 Sly Filters: Products & Services Offering

94 NEDERMAN HOLDING AB: Products & Services Offering

95 Dust Control Technologies : Products & Services Offering

96 Duztech AB: Products & Services Offering

97 Colliery Dust Control (Pty) Ltd., Inc: Products & Services Offering

98 Donaldson Company Inc.: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Dust Control Systems Market Overview

2 Global Dust Control Systems Market Value From 2021-2029 (USD Mllion)

3 Global Dust Control Systems Market Share, By Product (2023)

4 Global Dust Control Systems Market Share, By End User (2023)

5 Global Dust Control Systems Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Dust Control Systems Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Dust Control Systems Market

10 Impact Of Challenges On The Global Dust Control Systems Market

11 Porter’s Five Forces Analysis

12 Global Dust Control Systems Market: By Product Scope Key Takeaways

13 Global Dust Control Systems Market, By Product Segment: Revenue Growth Analysis

14 Dry Collection Market, By Region, 2021-2029 (USD Mllion)

15 Wet Suppression Market, By Region, 2021-2029 (USD Mllion)

16 Global Dust Control Systems Market: By End User Scope Key Takeaways

17 Global Dust Control Systems Market, By End User Segment: Revenue Growth Analysis

18 Construction Market, By Region, 2021-2029 (USD Mllion)

19 Mining and Metallurgy Market, By Region, 2021-2029 (USD Mllion)

20 Energy Market, By Region, 2021-2029 (USD Mllion)

21 Food and Beverages Market, By Region, 2021-2029 (USD Mllion)

22 Chemicals Market, By Region, 2021-2029 (USD Mllion)

23 Pharmaceuticals Market, By Region, 2021-2029 (USD Mllion)

24 Oil and Gas Market, By Region, 2021-2029 (USD Mllion)

25 Others Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Dust Control Systems Market: Regional Analysis

28 North America Dust Control Systems Market Overview

29 North America Dust Control Systems Market, By Product

30 North America Dust Control Systems Market, By End User

31 North America Dust Control Systems Market, By Country

32 U.S. Dust Control Systems Market, By Product

33 U.S. Dust Control Systems Market, By End User

34 Canada Dust Control Systems Market, By Product

35 Canada Dust Control Systems Market, By End User

36 Mexico Dust Control Systems Market, By Product

37 Mexico Dust Control Systems Market, By End User

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 CW Machine Worx: Company Snapshot

41 CW Machine Worx: SWOT Analysis

42 CW Machine Worx: Geographic Presence

43 Spraying Devices Inc.: Company Snapshot

44 Spraying Devices Inc.: SWOT Analysis

45 Spraying Devices Inc.: Geographic Presence

46 New Waste Concepts Inc.: Company Snapshot

47 New Waste Concepts Inc.: SWOT Analysis

48 New Waste Concepts Inc.: Geographic Presence

49 Dust Control Systems Limited: Company Snapshot

50 Dust Control Systems Limited: Swot Analysis

51 Dust Control Systems Limited: Geographic Presence

52 Sly Filters: Company Snapshot

53 Sly Filters: SWOT Analysis

54 Sly Filters: Geographic Presence

55 NEDERMAN HOLDING AB: Company Snapshot

56 NEDERMAN HOLDING AB: SWOT Analysis

57 NEDERMAN HOLDING AB: Geographic Presence

58 Dust Control Technologies : Company Snapshot

59 Dust Control Technologies : SWOT Analysis

60 Dust Control Technologies : Geographic Presence

61 Duztech AB: Company Snapshot

62 Duztech AB: SWOT Analysis

63 Duztech AB: Geographic Presence

64 Colliery Dust Control (Pty) Ltd., Inc.: Company Snapshot

65 Colliery Dust Control (Pty) Ltd., Inc.: SWOT Analysis

66 Colliery Dust Control (Pty) Ltd., Inc.: Geographic Presence

67 Donaldson Company Inc.: Company Snapshot

68 Donaldson Company Inc.: SWOT Analysis

69 Donaldson Company Inc.: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Dust Control Systems Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Dust Control Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS