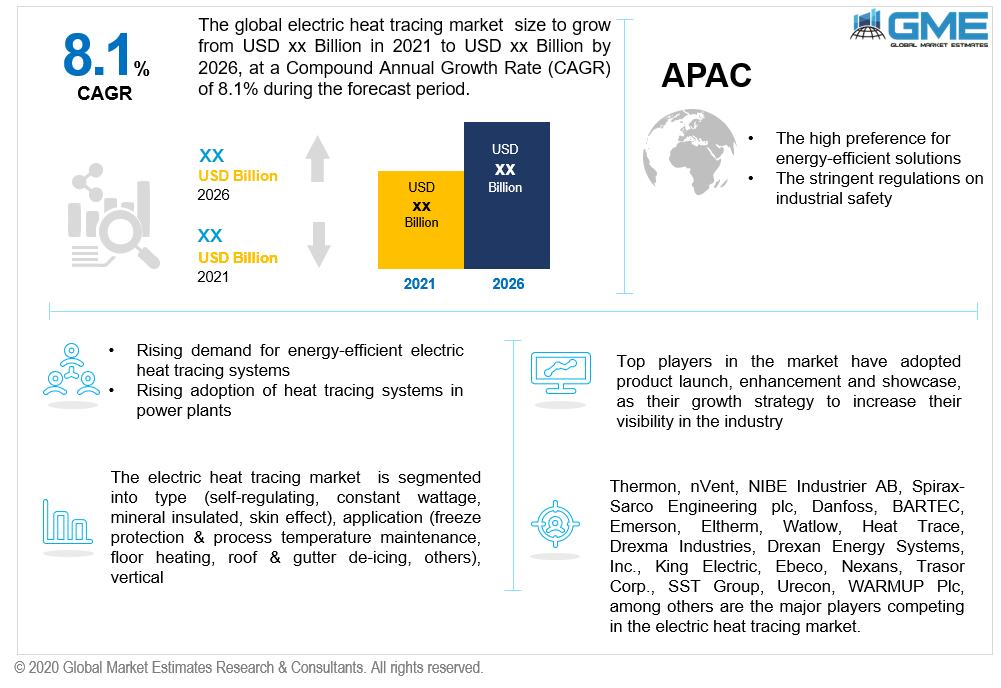

Global Electric Heat Tracing Market Size, Trends & Analysis - Forecasts to 2026 By Type (Self-Regulating, Constant Wattage, Mineral Insulated, Skin Effect), By Application (Freeze Protection & Process Temperature Maintenance, Floor Heating, Roof & Gutter De-Icing, Others), By Vertical (Oil & Gas, Chemical, Commercial, Residential, Power & Energy, Food & Beverages, Pharmaceuticals, Water & Wastewater Management, Others), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The factors propelling this market’s growth are lower maintenance and operation costs, swelling demand for electric heat tracing energy-efficient systems, and a fast shift of preference from traditional techniques to electric heat tracing systems. The primary purpose of adopting electric heat tracing systems is to compensate for the heat loss and sustain the process temperature. The increasing outlay on evolving oil or gas pipeline infrastructures, along with growing health, environmental, and safety apprehensions on the same, is the reason for fast-tracking the advancement of the global Electric Heat Tracing market. Moreover, organizations' growing concentration across industries on enhancing the efficiency of operational improvements by switching to a more automated monitoring and control solution is anticipated to propel the global Electric Heat Tracing market.

COVID-19 is predicted to have a negative influence on the electric heat tracing market in 2020. Because the oil and gas industry is expected to be one of the most impacted in 2020, participants in this industry are working on lowering CAPEX, which will have an impact on the electric heat tracing market. Several new and ongoing oil and gas projects have also been delayed.

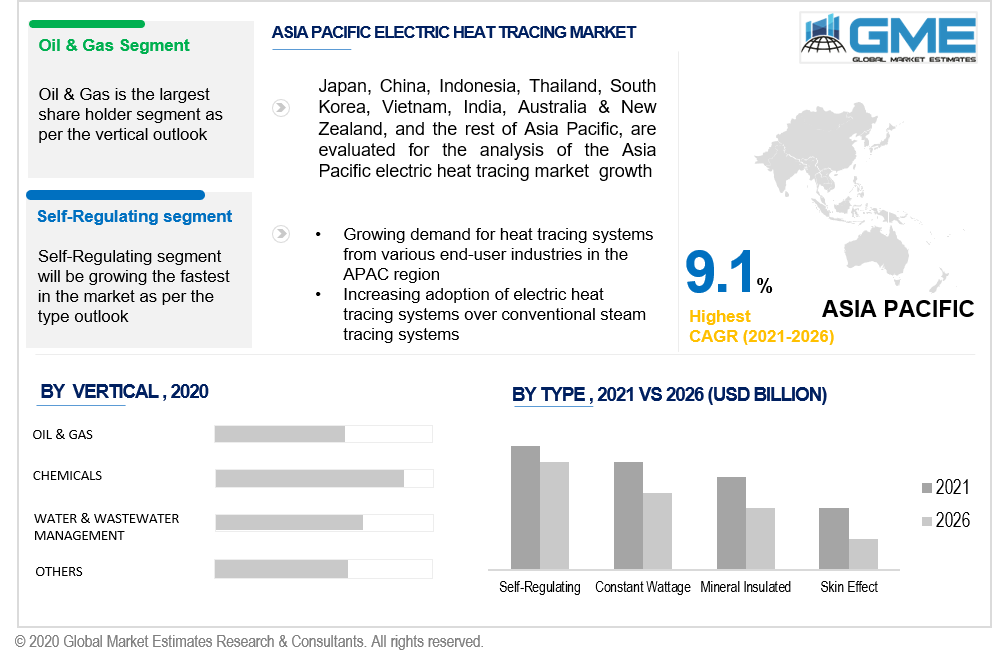

Based on the type, the market is segmented into four segments including self-regulating, constant wattage, mineral-insulated, and skin effect. The self-regulating segment is projected to be the fastest-growing one in the next few years. These self-regulating cables are perfect for frost-prevention installations and temperature maintenance due to their feature of producing more heat in cold conditions and producing less heat when warm. The heat level is automatically tuned with the increase or decrease in the temperatures. These cables offer several advantages over other heat tracing lines, like increased safety, higher efficiency, less maintenance, and ease of installation.

Based on the application the market is segmented into four segments including freeze protection & process temperature maintenance, floor heating, roof & gutter de-icing, and others. The freeze protection & process temperature maintenance segment is expected to lead the market in the forecast period. It is essential as freezing damages pipes and equipment. In low-temperature conditions, it becomes vital for end-user industries to ensure the protection of their pipelines and preserve the vessels and tanks from freezing. Moreover, in this application, usually, it is required that fluids like acids, fuel oil, and fertilizers are maintained at a high temperature.

Based on the vertical the market is segregated into nine segments including oil & gas, chemical, commercial, residential, power & energy, food & beverages, pharmaceuticals, water & wastewater management, and others. The oil & gas segment is expected to dominate the market in the estimated time frame. In both upstream and downstream applications, heat tracing is used with the oil and gas sector to aid in the processing, transportation, and freeze protection of energy products. In this industry, electric heat tracing systems are implemented in numerous applications like viscosity control, process temperature maintenance, and freeze protection. The upcoming oil & gas projects in the next few years across the globe will drive up the demand for electric heat tracing systems significantly.

North America Electric Heat Tracing market is expected to dominate the overall industry revenue share. The driving factors responsible for the growth are a shift to electric heat tracing systems in huge numbers, expansion and advancements of the oil & gas industry and chemical projects, high preference for energy-efficient solutions, and stringent regulations on industrial safety. Moreover, cold weather for months in these nations, the replacement of traditional heat tracing systems with electric heat tracing systems, the extension of oil and gas production pipelines, residential industries, and new oil and gas pipeline construction projects, are a few of the significant driving reasons for the growing market.

Furthermore, due to increasing urbanization and rising oil/gas pipeline infrastructure, Asia Pacific has been regarded as the fastest growing electric heat tracing market.

Thermon, nVent, NIBE Industrier AB, Spirax-Sarco Engineering plc, Danfoss, BARTEC, Emerson, Eltherm, Watlow, Heat Trace, Drexma Industries, Drexan Energy Systems, Inc., King Electric, Ebeco, Nexans, Trasor Corp., SST Group, Urecon, WARMUP Plc, are some of the identified market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2020, the nVent RAYCHEM Elexant 9200i wireless communications interface has been introduced by nVent. As an alternative to hard-wired connection, the 9200i offers wireless connections between nVent RAYCHEM electric heat trace controllers and nVent RAYCHEM supervisor software, allowing for remote monitoring and configuration.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Electric Heat Tracing Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Type Overview

2.1.4 Vertical Overview

2.1.5 Regional Overview

Chapter 3 Global Electric Heat Tracing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing demand for energy-efficient electric heat tracing systems

3.3.1.2 Increasing adoption of electric heat tracing systems over conventional steam tracing systems

3.3.2 Industry Challenges

3.3.2.1 Installation of heat tracing systems for tanks and large vessels

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.4.2 Type Growth Scenario

3.4.3 Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Electric Heat Tracing Market, By Application

4.1 Application Outlook

4.2 Freeze Protection & Process Temperature Maintenance

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Roof & Gutter De-Icing

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

4.4 Floor Heating

4.4.1 Market Size, By Region, 2016-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Electric Heat Tracing Market, By Type

5.1 Type Outlook

5.2 Self-Regulating

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 Constant Wattage

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

5.4 Mineral Insulated

5.4.1 Market Size, By Region, 2016-2026 (USD Billion)

5.5 Skin Effect

5.5.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Electric Heat Tracing Market, By Vertical

6.1 Vertical Outlook

6.2 Oil & Gas

6.2.1 Market size, By Region, 2016-2026 (USD Billion)

6.3 Chemicals

6.3.1 Market size, By Region, 2016-2026 (USD Billion)

6.4 Commercial

6.4.1 Market size, By Region, 2016-2026 (USD Billion)

6.5.1 Market size, By Region, 2016-2026 (USD Billion)

6.6 Power & Energy

6.5.1 Market size, By Region, 2016-2026 (USD Billion)

6.7 Food & Beverages

6.5.1 Market size, By Region, 2016-2026 (USD Billion)

6.8 Pharmaceuticals

6.5.1 Market size, By Region, 2016-2026 (USD Billion)

6.9 Water & Wastewater Management

6.9.1 Market size, By Region, 2016-2026 (USD Billion)

6.10 Others

6.10.1 Market size, By Region, 2016-2026 (USD Billion)

Chapter 7 Global Electric Heat Tracing Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Billion)

7.2.2 Market Size, By Application, 2016-2026 (USD Billion)

7.2.3 Market Size, By Type, 2016-2026 (USD Billion)

7.2.4 Market Size, By Vertical, 2016-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Application, 2016-2026 (USD Billion)

7.2.5.2 Market Size, By Type, 2016-2026 (USD Billion)

7.2.5.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Application, 2016-2026 (USD Billion)

7.2.6.2 Market Size, By Type, 2016-2026 (USD Billion)

7.2.6.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Billion)

7.3.2 Market Size, By Application, 2016-2026 (USD Billion)

7.3.3 Market Size, By Type, 2016-2026 (USD Billion)

7.3.4 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market Size, By Application, 2016-2026 (USD Billion)

7.2.5.2 Market Size, By Type, 2016-2026 (USD Billion)

7.2.5.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Application, 2016-2026 (USD Billion)

7.3.6.2 Market Size, By Type, 2016-2026 (USD Billion)

7.3.6.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Application, 2016-2026 (USD Billion)

7.3.7.2 Market Size, By Type, 2016-2026 (USD Billion)

7.3.7.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Application, 2016-2026 (USD Billion)

7.3.8.2 Market Size, By Type, 2016-2026 (USD Billion)

7.3.8.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Application, 2016-2026 (USD Billion)

7.3.9.2 Market Size, By Type, 2016-2026 (USD Billion)

7.3.9.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Application, 2016-2026 (USD Billion)

7.3.10.2 Market Size, By Type, 2016-2026 (USD Billion)

7.3.10.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Billion)

7.4.2 Market Size, By Application, 2016-2026 (USD Billion)

7.4.3 Market Size, By Type, 2016-2026 (USD Billion)

7.4.4 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Application, 2016-2026 (USD Billion)

7.4.5.2 Market Size, By Type, 2016-2026 (USD Billion)

7.4.5.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Application, 2016-2026 (USD Billion)

7.4.6.2 Market Size, By Type, 2016-2026 (USD Billion)

7.4.6.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Application, 2016-2026 (USD Billion)

7.4.7.2 Market Size, By Type, 2016-2026 (USD Billion)

7.4.7.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Application, 2016-2026 (USD Billion)

7.4.8.2 Market size, By Type, 2016-2026 (USD Billion)

7.4.8.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Application, 2016-2026 (USD Billion)

7.4.9.2 Market Size, By Type, 2016-2026 (USD Billion)

7.4.9.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Billion)

7.5.2 Market Size, By Application, 2016-2026 (USD Billion)

7.5.3 Market Size, By Type, 2016-2026 (USD Billion)

7.5.4 Market Size, By Vertical, 2016-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Application, 2016-2026 (USD Billion)

7.5.5.2 Market Size, By Type, 2016-2026 (USD Billion)

7.5.5.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Application, 2016-2026 (USD Billion)

7.5.6.2 Market Size, By Type, 2016-2026 (USD Billion)

7.5.6.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Application, 2016-2026 (USD Billion)

7.5.7.2 Market Size, By Type, 2016-2026 (USD Billion)

7.5.7.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Billion)

7.6.2 Market Size, By Application, 2016-2026 (USD Billion)

7.6.3 Market Size, By Type, 2016-2026 (USD Billion)

7.6.4 Market Size, By Vertical, 2016-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Application, 2016-2026 (USD Billion)

7.6.5.2 Market Size, By Type, 2016-2026 (USD Billion)

7.6.5.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Application, 2016-2026 (USD Billion)

7.6.6.2 Market Size, By Type, 2016-2026 (USD Billion)

7.6.6.3 Market Size, By Vertical, 2016-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Application, 2016-2026 (USD Billion)

7.6.7.2 Market Size, By Type, 2016-2026 (USD Billion)

7.6.7.3 Market Size, By Vertical, 2016-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Drexan Energy Systems, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info-Graphic Analysis

8.3 King Electric

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Ebeco

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Nexans

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 Trasor Corp.

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 SST Group

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 Urecon

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Thermon

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 nVent

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.11 Danfoss

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Electric Heat Tracing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electric Heat Tracing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS