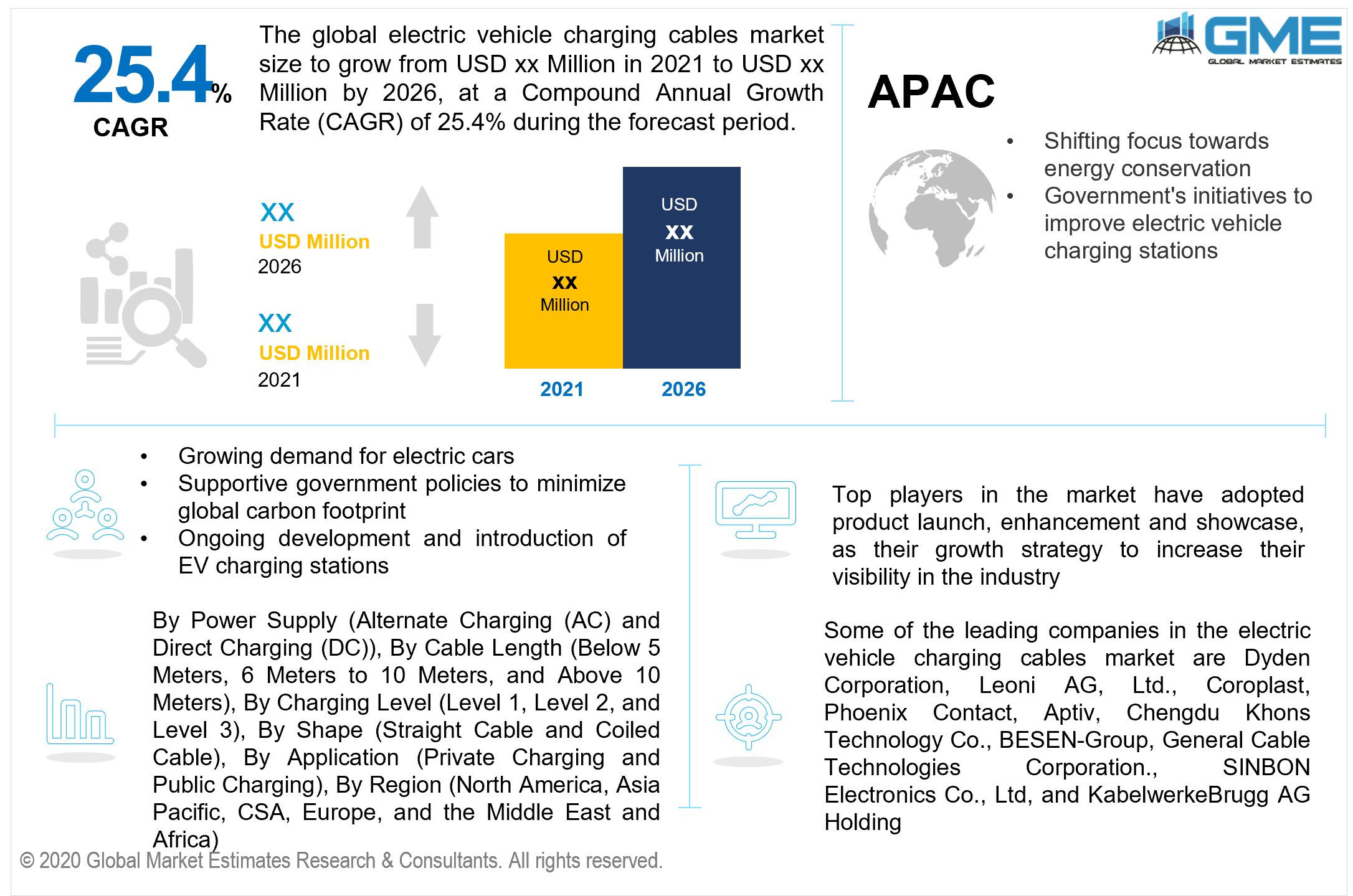

Global Electric Vehicle Charging Cables Market Size, Trends, and Analysis - Forecasts To 2026 By Power Supply (Alternate Charging (AC) and Direct Charging (DC)), By Cable Length (Below 5 Meters, 6 Meters to 10 Meters, and Above 10 Meters), By Charging Level (Level 1, Level 2, and Level 3), By Shape (Straight Cable and Coiled Cable), By Application (Private Charging and Public Charging), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The growing demand for electric cars, as well as supportive government policies to minimize global carbon footprint and encouraging the introduction of electric cars, are moving the global EV charging cables market ahead. Furthermore, the development and introduction of EV charging stations around the world are projected to augment demand for electric cars, resulting in a spike in the use of EV charging cables.

The rise of the electric car charging cables market may be attributable to a variety of energy management considerations. One of the primary elements driving demand for electric car charging cables is increasing awareness about escalating greenhouse gas emissions and power saving. Global energy utilization is predominantly driven by non - renewable energy sources, resulting in increased pollution and greenhouse gas emissions.

Furthermore, rising customer convenience, such as home charging solutions for electric cars, combined with the increasing shift towards transportation services adopting emission-free vehicles and the emerging electric bus market, would drive the market for electric vehicle charging cables over the forecast period.

Furthermore, the industry is expected to be driven by increasing demand for fast charging cables and rapid advancements in the production of EV charger machinery. Different charging modes are supported by electric vehicle charging cables in diverse locations which leads to overall demand expansion. The EV charging cable market is likely to mature quickly in order to sustain rising sales of battery electric cars and plug-in electric cars. However, the increased cost of DC charging cords, and the advent of wireless electric car charging technologies are anticipated to inhibit the global EV charging cables market’s expansion.

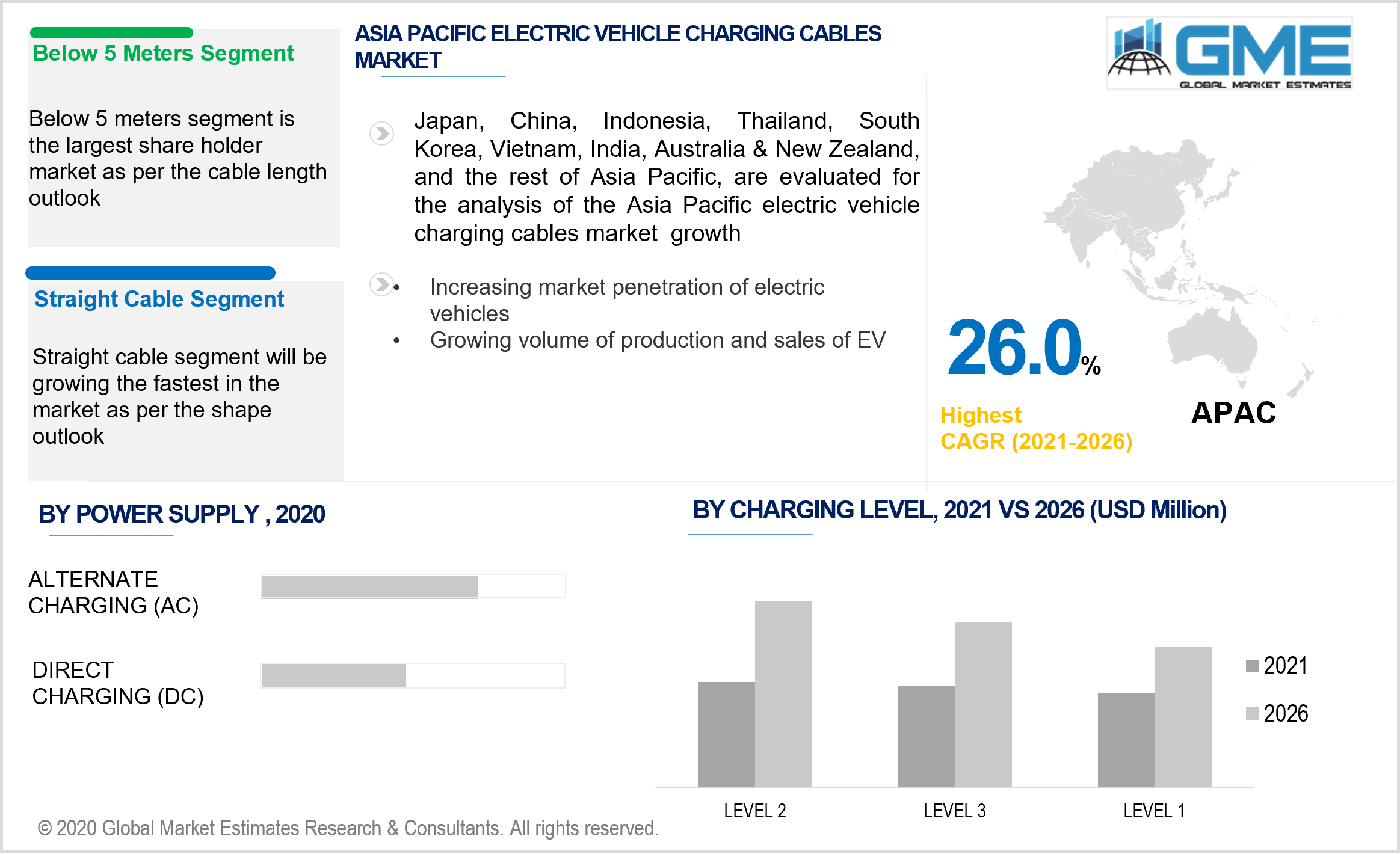

The market is split into two types of power supply: direct charging (DC) and alternate charging (AC). The AC segment is foreseen to lead in the market. Based on the automobile and charging infrastructure requirements, alternative charging is extensively employed as the power source for private charging points. Globally, AC power is mainly found in residential and semi-commercial stations. This kind of power distribution charging station has lower installation costs and lower output power. Furthermore, alternate charging-based wall-mounted electric car chargers are preferable to floor-mounted chargers because they reduce the expense of underground electrification. Furthermore, residential stations are better served by wall-mounted chargers.

Due to significant developments in public stations, the DC segment is projected to rise at the fastest pace during the forecast period. DC fast chargers transfer energy quickly, allowing for greater flexibility in the use of electric vehicles. Furthermore, the segment's growth is expected to be fuelled by growing demands for faster results in less time.

The market is divided into three categories based on cable length: less than 5 meters, 6 meters to 10 meters, and more than 10 meters. The segment with cable lengths of less than 5 meters is foreseen to lead in the market. This is attributable to the augmented use of private electric car charging stations around the globe. Furthermore, cables shorter than 5 meters are more effective in residential applications and are easier to store and use.

Furthermore, the segment with cable lengths of 6 to 10 meters is expected to rise at the fastest rate. The charging stations with a cable length of at least 18 to 20 feet are ideal for meeting customer demands and growing the adoption of electric cars.

The market has been categorized into three categories based on charging levels: level 1, level 2, and level 3. The level 2 segment is foreseen to lead in the market since they are increasingly being used in semi-commercial and residential applications, like private residences, condominiums, houses, parking lots, restaurants, and retail facilities.

Moreover, the level 3 segment group is reported to witness the highest CAGR. A Level 3 system has CHAdeMO technology, that charges from a 480V source. In less than 15 minutes, a level 3 charger will charge a completely depleted electric car battery to 80% capacity. The capacity to charge in less than 30 minutes at maximum voltage is the main factor driving the segment’s development.

The market has been split into coiled and straight cable segments depending on charging cable shape. Straight cable is foreseen to lead in the market because they have low maintenance standards, inexpensive, and easy installation. These cables have been embraced by the majority of public charging stations globally due to these advanced features.

The coiled cable segment is foreseen to grow at the fastest pace. They're also known as spiral cables, and they're simple to manage because they don't stretch over the surface, reducing the risk of tripping. As a result, these cables take up less physical space and last longer than straight cables. Furthermore, new technologies are projected to lower the cost of coiled cables, fuelling this segment’s growth.

The market is split into two categories of charging applications: public charging and private charging. The private charging category is foreseen to lead in the market. This supremacy is due to the widespread use of private charging stations for electric cars.

Public charging stations are foreseen to grow at the fastest rate. Hotels, airports, commercial land parking lots, shopping malls, taxi stands, government buildings, and highways all have these stations. These charging points can provide a high-voltage charge to an electric car in less duration. Moreover, the market for public charging stations will rise due to the pervasive acceptance of electric cars and the increasing demand among EV owners to minimize recharge time.

The Asia Pacific is presumed to lead in this market, accounting for the majority of total sales. China, South Korea, and Japan are the key drivers of development in this area. China is the world's biggest market for electric car charging cables. The governments of China and Japan have contributed to the global EV supply equipment industry's growth prospects and have implemented a variety of policies and programs to enable major market participants to develop EV charging facilities in their home countries. The region's massive number of EV charging stations is estimated to spur regional demand growth.

North America is expected to report the highest CAGR, accompanied by Europe. This is because of the automakers' growing emphasis on producing safer, high-performance, and faster electric cars. The regional demand is expected to be driven by the increasing installation of advanced charging networks and the involvement of large EV supply equipment producers in the area.

Some of the leading companies in the electric vehicle charging cables market are Dyden Corporation, Leoni AG, Ltd., Coroplast, Phoenix Contact, Aptiv, Chengdu Khons Technology Co., BESEN-Group, General Cable Technologies Corporation., SINBON Electronics Co., Ltd, and KabelwerkeBrugg AG Holding among others.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Electric Vehicle Charging Cables Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Power Supply Overview

2.1.3 Cable Length Overview

2.1.4 Application Overview

2.1.5 Charging Level Mode Overview

2.1.6 Shape Overview

2.1.7 Regional Overview

Chapter 3 Global Electric Vehicle Charging Cables Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Government Initiatives for Development of Electric Vehicle Charging Infrastructure

3.3.1.2 Increasing Market Penetration of Electric Vehicles

3.3.2 Industry Challenges

3.3.2.1 High Cost of EV Charging Cable

3.4 Prospective Growth Scenario

3.4.1 Power Supply Growth Scenario

3.4.2 Cable Length Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Charging Level Growth Scenario

3.4.5 Shape Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.10.1 Company Positioning Overview, 2020

Chapter 4 Global Electric Vehicle Charging Cables Market, By Power Supply

4.1 Power Supply Outlook

4.2 Alternate Charging (AC)

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Direct Charging (DC)

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Electric Vehicle Charging Cables Market, By Cable Length

5.1 Cable Length Outlook

5.2 Below 5 Meters

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 6 Meters to 10 Meters

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Above 10 Meters

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Electric Vehicle Charging Cables Market, By Application

6.1 Application Outlook

6.2 Private Charging

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Public Charging

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Electric Vehicle Charging Cables Market, By Charging Level Mode

7.1 Charging Level Outlook

7.2 Level 1

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Level 2

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Level 3

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Electric Vehicle Charging Cables Market, By Shape

8.1 Shape Outlook

8.2 Straight Cable

8.2.1 Market Size, By Region, 2019-2026 (USD Million)

8.3 Coiled Cable

8.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 10 Global Electric Vehicle Charging Cables Market, By Region

9.1 Regional outlook

9.2 North America

9.2.1 Market Size, By Country 2019-2026 (USD Million)

9.2.2 Market Size, By Power Supply, 2019-2026 (USD Million)

9.2.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.2.4 Market Size, By Application, 2019-2026 (USD Million)

9.2.5 Market Size, By Charging Level, 2019-2026 (USD Million)

9.2.6 Market Size, By Shape, 2019-2026 (USD Million)

9.2.7 U.S.

9.2.7.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.2.7.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.2.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.2.7.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.2.7.5 Market Size, By Shape, 2019-2026 (USD Million)

9.2.8 Canada

9.2.8.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.2.8.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.2.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.2.8.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.2.8.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3 Europe

9.3.1 Market Size, By Country 2019-2026 (USD Million)

9.3.2 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.4 Market Size, By Application, 2019-2026 (USD Million)

9.3.5 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.6 Market Size, By Shape, 2019-2026 (USD Million)

9.3.7 Germany

9.3.7.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.7.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.7.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.7.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3.8 UK

9.3.8.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

9.3.8.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.8.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.8.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3.9 France

9.3.9.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.9.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.9.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.9.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3.10 Italy

9.3.10.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.10.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.10.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.10.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.10.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3.11 Spain

9.3.10.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.11.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.11.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.11.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.11.5 Market Size, By Shape, 2019-2026 (USD Million)

9.3.12 Russia

9.3.12.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.3.12.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.3.12.3 Market Size, By Application, 2019-2026 (USD Million)

9.3.12.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.3.12.5 Market Size, By Shape, 2019-2026 (USD Million)

9.4 Asia Pacific

9.4.1 Market Size, By Country 2019-2026 (USD Million)

9.4.2 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.4.4 Market Size, By Application, 2019-2026 (USD Million)

9.4.5 Market Size, By Charging Level, 2019-2026 (USD Million)

9.4.6 Market Size, By Shape, 2019-2026 (USD Million)

9.4.7 China

9.4.7.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.7.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.4.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.7.4 Market Size, By Charging Level Mode, 2019-2026 (USD Million)

9.4.7.5 Market Size, By Shape, 2019-2026 (USD Million)

9.4.8 India

9.4.8.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.8.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.4.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.8.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.4.8.5 Market Size, By Shape, 2019-2026 (USD Million)

9.4.9 Japan

9.4.9.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.9.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.4.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.9.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.4.9.5 Market Size, By Shape, 2019-2026 (USD Million)

9.4.10 Australia

9.4.10.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.10.2 Market size, By Cable Length, 2019-2026 (USD Million)

9.4.10.3 Market size, By Application, 2019-2026 (USD Million)

9.4.10.4 Market size, By Charging Level, 2019-2026 (USD Million)

9.4.10.5 Market size, By Shape, 2019-2026 (USD Million)

9.4.11 South Korea

9.4.10.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.4.11.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.4.11.3 Market Size, By Application, 2019-2026 (USD Million)

9.4.11.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.4.11.5 Market Size, By Shape, 2019-2026 (USD Million)

9.5 Latin America

9.5.1 Market Size, By Country 2019-2026 (USD Million)

9.5.2 Market Size, By Power Supply, 2019-2026 (USD Million)

9.5.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.5.4 Market Size, By Application, 2019-2026 (USD Million)

9.5.5 Market Size, By Charging Level, 2019-2026 (USD Million)

9.5.6 Market Size, By Shape, 2019-2026 (USD Million)

9.5.7 Brazil

9.5.7.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.5.7.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.5.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.7.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.5.7.5 Market Size, By Shape, 2019-2026 (USD Million)

9.5.8 Mexico

9.5.8.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.5.8.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.5.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.8.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.5.8.5 Market Size, By Shape, 2019-2026 (USD Million)

9.5.9 Argentina

9.5.9.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.5.9.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.5.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.5.9.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.5.9.5 Market Size, By Shape, 2019-2026 (USD Million)

9.6 MEA

9.6.1 Market Size, By Country 2019-2026 (USD Million)

9.6.2 Market Size, By Power Supply, 2019-2026 (USD Million)

9.6.3 Market Size, By Cable Length, 2019-2026 (USD Million)

9.6.4 Market Size, By Application, 2019-2026 (USD Million)

9.6.5 Market Size, By Charging Level, 2019-2026 (USD Million)

9.6.6 Market Size, By Shape, 2019-2026 (USD Million)

9.6.7 Saudi Arabia

9.6.7.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.6.7.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.6.7.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.7.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.6.7.5 Market Size, By Shape, 2019-2026 (USD Million)

9.6.8 UAE

9.6.8.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.6.8.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.6.8.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.8.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.6.8.5 Market Size, By Shape, 2019-2026 (USD Million)

9.6.9 South Africa

9.6.9.1 Market Size, By Power Supply, 2019-2026 (USD Million)

9.6.9.2 Market Size, By Cable Length, 2019-2026 (USD Million)

9.6.9.3 Market Size, By Application, 2019-2026 (USD Million)

9.6.9.4 Market Size, By Charging Level, 2019-2026 (USD Million)

9.6.9.5 Market Size, By Shape, 2019-2026 (USD Million)

Chapter 10 Company Landscape

10.1 Competitive Analysis, 2020

10.2 Dyden Corporation

10.2.1 Company Overview

10.2.2 Financial Analysis

10.2.3 Strategic Positioning

10.2.4 Info Graphic Analysis

10.3 Leoni AG, Ltd.

10.3.1 Company Overview

10.3.2 Financial Analysis

10.3.3 Strategic Positioning

10.3.4 Info Graphic Analysis

10.4 Coroplast

10.4.1 Company Overview

10.4.2 Financial Analysis

10.4.3 Strategic Positioning

10.4.4 Info Graphic Analysis

10.5 Phoenix Contact

10.5.1 Company Overview

10.5.2 Financial Analysis

10.5.3 Strategic Positioning

10.5.4 Info Graphic Analysis

10.6 Aptiv

10.6.1 Company Overview

10.6.2 Financial Analysis

10.6.3 Strategic Positioning

10.6.4 Info Graphic Analysis

10.7 Chengdu Khons Technology Co.

10.7.1 Company Overview

10.7.2 Financial Analysis

10.7.3 Strategic Positioning

10.7.4 Info Graphic Analysis

10.8 BESEN-Group

10.8.1 Company Overview

10.8.2 Financial Analysis

10.8.3 Strategic Positioning

10.8.4 Info Graphic Analysis

10.9 General Cable Technologies Corporation

10.9.1 Company Overview

10.9.2 Financial Analysis

10.9.3 Strategic Positioning

10.9.4 Info Graphic Analysis

10.10 SINBON Electronics Co., Ltd.

10.10.1 Company Overview

10.10.2 Financial Analysis

10.10.3 Strategic Positioning

10.10.4 Info Graphic Analysis

10.11 KabelwerkeBrugg AG Holding

10.11.1 Company Overview

10.11.2 Financial Analysis

10.11.3 Strategic Positioning

10.11.4 Info Graphic Analysis

10.12 Other Companies

10.12.1 Company Overview

10.12.2 Financial Analysis

10.12.3 Strategic Positioning

10.12.4 Info Graphic Analysis

The Global Electric Vehicle Charging Cables Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electric Vehicle Charging Cables Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS