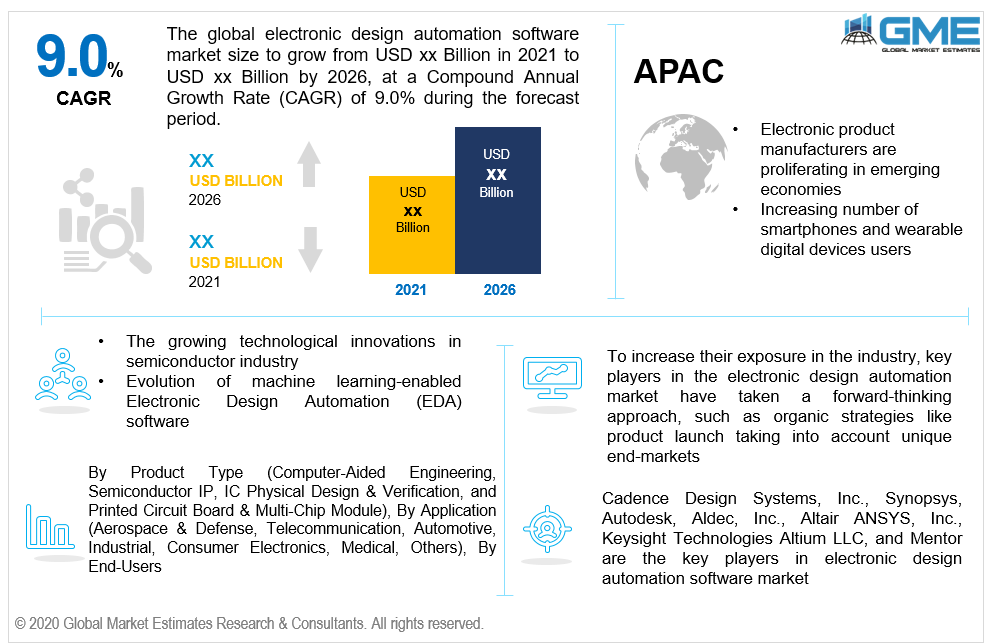

Global Electronic Design Automation Software Market Size, Trends & Analysis - Forecasts to 2026 By Product Type (Computer-Aided Engineering (CAE), Semiconductor IP (SIP), IC Physical Design & Verification, and Printed Circuit Board (PCB) & Multi-Chip Module (MCM)), By Application (Aerospace & Defense, Telecommunication, Automotive, Industrial, Consumer Electronics, Medical, Others), By End-Users (Microprocessors & Controllers, Memory Management Units (MMU), and Others), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Electronic Design Automation (EDA) Software is a collection of software algorithms that allow the development and designing of complex electronic systems such as printed circuit boards (PCBs), integrated circuits (ICs), and other devices. Before putting a design into practice, the designer evaluates, tracks and simulates them using EDA software. All of the tools in EDA work together to design and analyze entire semiconductor chips according to a design flow determined by chip designers. Over the next few years, the industry's growth will be supported by the transition to smaller, and more powerful semiconductors. Furthermore, the adoption of these tools will be driving the market growth as it will be reducing errors and design time, and overall cost or expense.

The growth of the electronic design automation (EDA) market is being fuelled by the rise in demand for Internet of Things (IoT) based devices, smartphones, gaming consoles, and networking devices. This requires advanced System on Chip (SoC) architecture that can be effectively designed by using EDA software and tools. Newer design methodologies are the key features of EDA which address limitations such as slower simulation rates, synthesis problems, restricted validation support, and limited architecture modeling capabilities. Also, as the demand for modeling activities grows, consulting firms and market vendors are ought to adopt EDA-based design methodologies during the forecast period.

The consumer electronics industry is booming due to the introduction of innovative and creative products. These products are more lightweight and energy-efficient since advanced electronic design and automation technologies of EDA software are used. This software is capable to design modern processors using FinFET architecture. Furthermore, the electronic design automation software market is witnessing the emergence of technologies like IoT, AI, and VR, which will propel the demand for EDA.

The semiconductor industry has always witnessed skyrocketed demand for innovative and compact electronic components. This has led the IC manufacturers to design compact systems for consumer electronics, automotive, and healthcare products. As a result, IC manufacturers are using EDA software to design smart electronic products with high precision and well-structured microelectronic circuits. The augment of the COVID-19 pandemic is anticipated to further drive the electronic design automation software market's dynamics. Multiple factors such as a decrease in semiconductor industry sales in 2020, a downturn in demand, a shortage of raw material supply, spending on the electronic design automation industry are expected to slow down the market growth. However, both the manufacturer and the government are working to sustain operations to stabilize the demand-supply chain which can pose as an opportunity for market growth.

Leading electronic device manufacturers use EDA, which is a high-tech licensed tool. Open-source EDA software tools, on the other hand, are widely available, particularly among small businesses. This increasing preference for open-source EDA software is suppressing demand for licensed tools, limiting market expansion. In particular, over the forecast period, the market's growth is estimated to be hampered by the complex VLSI structure in the semiconductor and telecommunication industry.

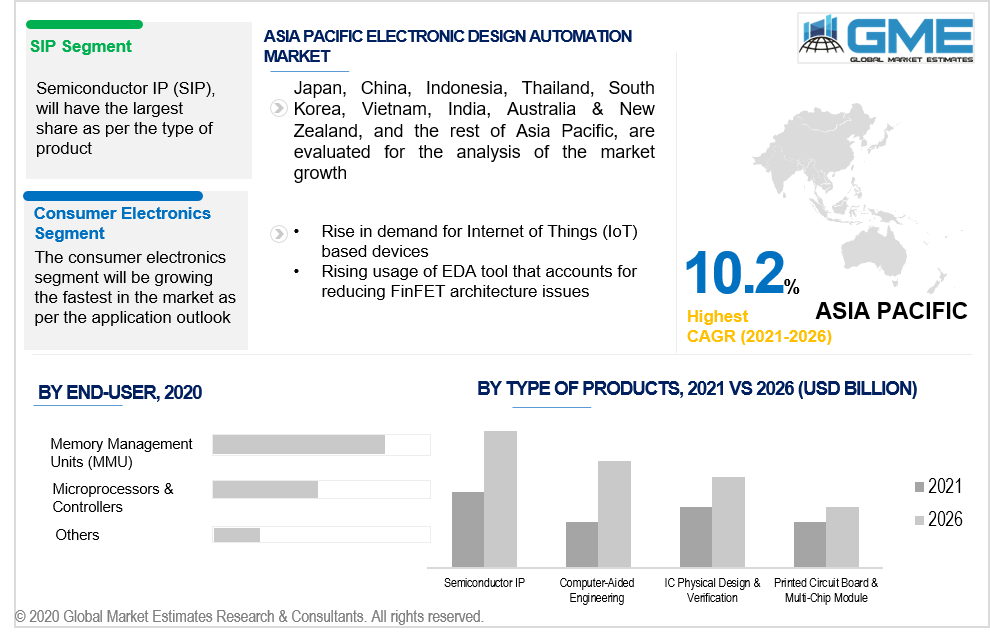

Based on the product type, the market is segmented into computer-aided engineering (CAE), semiconductor intellectual property (SIP), IC physical design & verification, and printed circuit board (PCB) & multi-chip module (MCM). The semiconductor intellectual property holds the largest market segment. The end-user segment demands lightweight structural designs for modern electronic devices; thus, consumer electronics manufacturers are constantly using EDA tools. This consideration of compact high-tech devices will contribute to the market's expansion during the forecast period.

Based on application, the market is segregated into aerospace & defense, telecommunication, automotive, industrial, consumer electronics, medical, others. Consumer electronics will be the largest segment as per the application outlook. EDA software's ability to provide pre-verified and modular IP modules, schematic design competence, seamlessly integrated circuit evaluation, and IP development and testing kits are driving the segment's growth.

Based on the end-user, the market is divided into microprocessors & controllers, memory management units (MMU), and others. The microprocessor & controller segment accounts for the majority of the market’s share. Given the widespread use of microprocessors and controllers in a wide range of consumer electronics products, this segment is anticipated to expand significantly over the forecast period. Also, the rising need for microcontrollers in authentication systems, automated controls, optoelectronic devices, and other smart devices, as well as changing processor dimensions in terms of size and processing power, are expected to propel the segment forward during the forecast phase.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). The North American region captured the highest market share in 2020. North American region has the most aggressive level of penetration of products and services based on advanced technology, namely the Internet of things, blockchain, AI, etc. in the market. The majority of electronics manufacturers are adopting machine learning-enabled Electronic Design Automation (EDA) software thereby propelling the market growth in all the countries of North America. During the forecast period, the Asia-Pacific market would have the highest CAGR value. This is due to the increasing popularity of wearable technology-based devices, smartphones, and perhaps even the proliferation of electronic manufacturers in developing economies of this region.

The electronic design automation software market is dominated by companies such as Cadence Design Systems, Inc., Synopsys, Autodesk, Aldec, Inc., Altair ANSYS, Inc., Keysight Technologie,s Altium LLC, and Mentor.

Please note: This is not an exhaustive list of companies profiled in the report.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Electronic Design Automation Software Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electronic Design Automation Software Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS