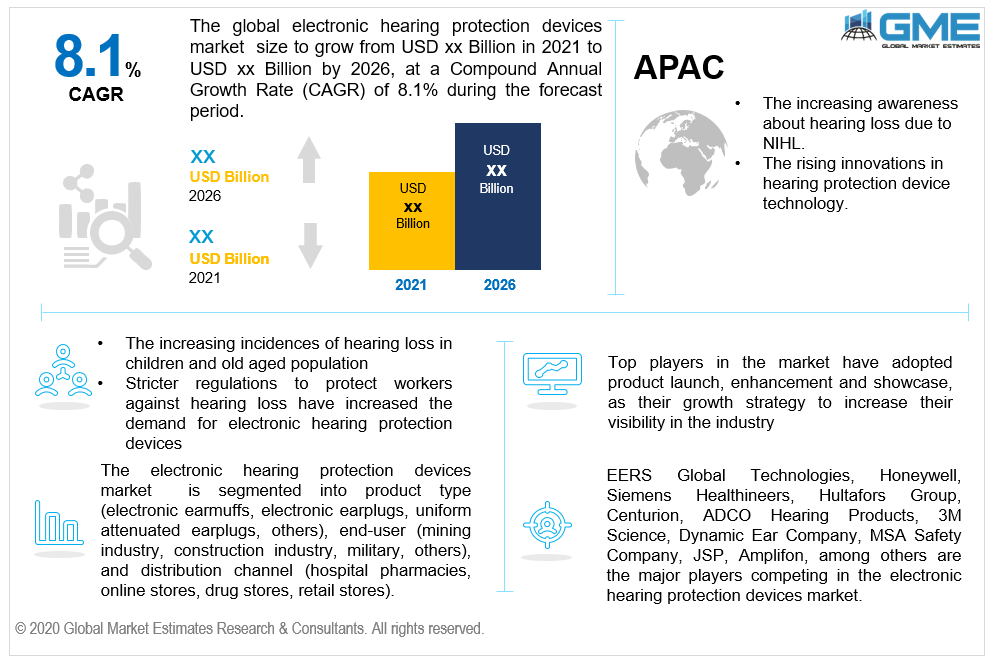

Global Electronic Hearing Protection Devices Market Size, Trends, and Analysis- Forecasts To 2026 By Product Type (Electronic Earmuffs, Electronic Earplugs, Uniform Attenuated Earplugs, Others), By End User (Mining Industry, Construction Industry, Military, Others), By Distribution Channel (Hospital Pharmacies, Online Stores, Drug Stores, Retail Stores), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Electronic hearing protection devices are used to protect patients from high levels of noise which generally exists in any industrial setting. Noise-induced hearing loss (NIHL) is the most common cause of hearing loss in current times. The rising incidences of hearing loss especially in later stages of life stemming from exposure to high decibel noises in the past have increased the demand for electronic hearing protection devices. Industries such as construction and mining and military applications have been implementing widespread usage of hearing protection devices to protect workers from hearing loss. In mining and construction industries, the excavation process involves the usage of explosives and machinery that create extreme levels of noise as it bores into the earth. As workers are exposed to heavy noises day in and day out for a prolonged period, studies have shown that they are at risk of experiencing partial or complete hearing loss in later stages of their life. The military is constantly testing new ordinances like guns and explosives regularly. The testing of explosives creates high levels of sound which can cause hearing loss sometimes even instantly. Along with testing, the military also conducts rigorous and constant training sessions intended to teach their personnel the basics of operating weaponry. These activities are all capable of creating high levels of noise that can cause NIHL. The heavy funding in military and Defense by governments across the globe ensures they have the necessary funds to procure hearing protection devices to protect their personnel. As military personnel are vital to the government and country’s safety and are heavily invested in by governments, protecting their hearing is vital for the military. The rising incidences of NIHL among industry workers have forced governments to create laws that protect them from NIHL, the onus falls on the industry to protect their workers who are The electronic hearing protection devices market is driven by rising incidences of hearing loss, government regulations protecting workers from NIHL, technological advancements, and new products, and the increasing number of hearing protection device vendors. The market is restrained by the prevalent use of low-cost manual protection devices, lack of awareness of NIHL, cost of electronic hearing protection devices, and the small number of vendors in the market.

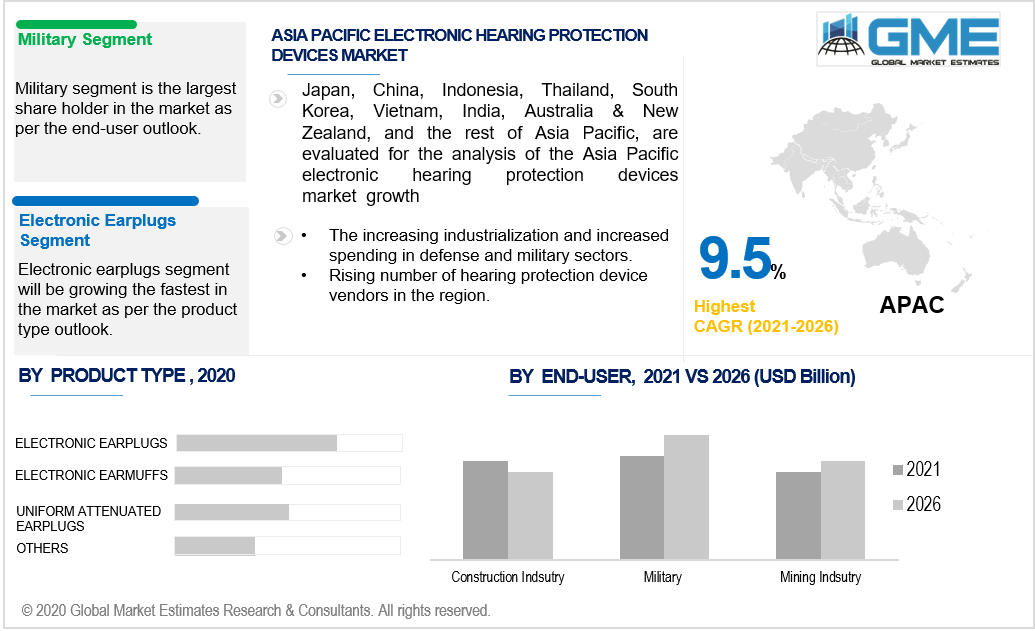

The electronic hearing protection devices market is segmented into electronic earplugs, electronic earmuffs, uniform attenuated earplugs, and others based on the type of product being sold by vendors. The electronic earplugs segment is the dominant product segment from 2021 to 2026. The relative ease of using earplugs, their compactness, and lower costs are major drivers for this segment. Earmuffs cover the entire ear and require more high-quality materials to ensure comfort and protection from noise. Earplugs are smaller and fit into the ear canal, they are not as material intensive to produce and are cheaper than earmuffs. Earmuffs provide a lot more protection than earplugs but most general industrial use does not require the heavy protection provided by them. Earplugs are more widely used as they are cheaper and most industries do not require as much protection provided by earmuffs.

Based on the end-user analysis, the market can be divided into the construction industry, mining industry, military, and others. The military segment holds the lion’s share in the market. The growth of this segment can be attributed to the extreme noise levels produced during artillery testing, explosions, and the operation of guns and tanks. Militaries require hearing protection as operation and testing happen daily and prolonged exposure to such high levels of noise can cause NIHL. Military personnel is required to have as perfect senses as possible so that they can react instantly to any situation. As governments invest heavily in their training, personnel protection is vital to governments.

Based on the distribution channels through which the product is sold, the market can be segmented into online stores, hospital pharmacies, retail, and drug stores. The online store segment is expected to grow at the fastest rate among all other segments. Online stores do not require physical infrastructure and personnel to operate and their relative ease of access to customers in remote regions makes them an attractive option. The ease and convenience of online stores combined with their lower prices are expected to be the major drivers of this segment. Online stores do not require physical infrastructure and personnel to operate and their relative ease of access to customers in remote regions makes them an attractive option.

The North American market was the dominant market region in 2021 while the APAC region is expected to show the fastest growth rate. The North American region is driven by the rising government safety regulations to protect workers from NIHL, the heavy spending on military and Defense sectors, the larger presence of hearing protection device vendors, and the rising incidences of hearing loss in the population. The governments of North American countries have heavy regulations to protect the safety of workers and are strictly enforced which has forced companies to invest more in electronic hearing protection devices. The APAC region has been undergoing heavy industrialization as the number of industries especially those involved in manufacturing, mining, and construction. These industries involve the use of heavy machinery that generates a lot of noise and as workers are becoming more aware of NHIL, they are demanding hearing protection devices from their employers. The APAC region has also seen an increase in the number of hearing protection device vendors in the region. These factors are all expected to contribute heavily to the growth of the market in this region along with increasing worker protection laws in the region.

Honeywell, EERS Global Technologies, Siemens Healthineers, Centurion, Hultafors Group, ADCO Hearing Products, Dynamic Ear Company, 3M Science, MSA Safety Company, Amplifon, and JSP, among others, are the vendors competing in the electronic hearing protection devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2020, Aplifon acquired hearing services and solution company PJC Hearing.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Electronic Hearing Protection Devices Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electronic Hearing Protection Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS