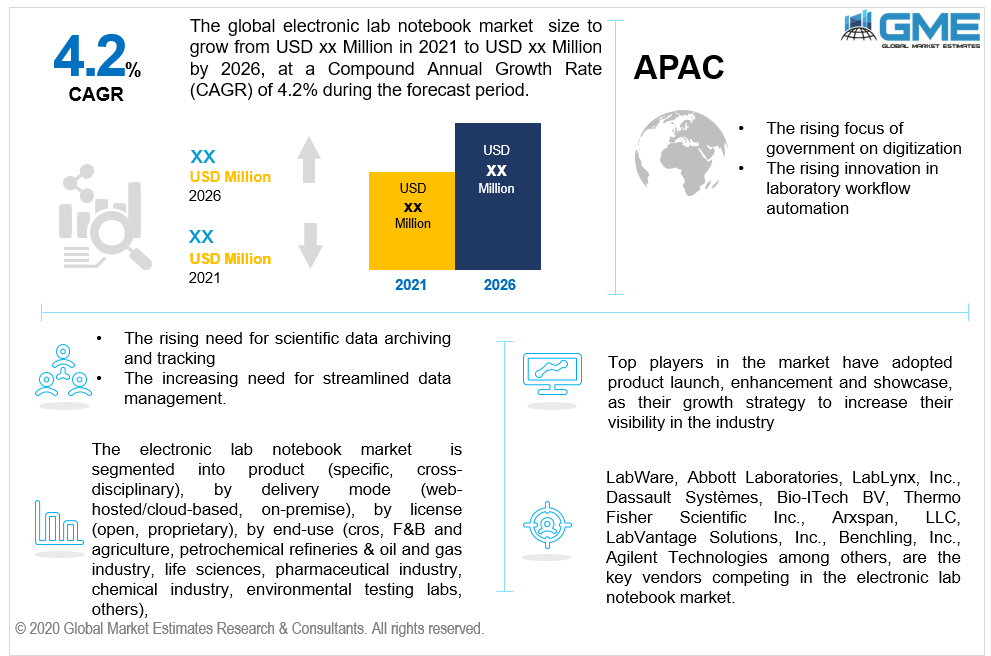

Global Electronic Lab Notebook Market Size, Trends, and Analysis- Forecasts To 2026 By Product (Specific, Cross-Disciplinary), By Delivery Mode (Web-Hosted/Cloud-based, On-Premise), By License (Open, Proprietary), By End-Use (CROs, F&B and Agriculture, Petrochemical Refineries & Oil and Gas Industry, Life Sciences, Pharmaceutical Industry, Chemical Industry, Environmental Testing Labs, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Electronic Lab Notebooks (ELNs) are used in academic groups as well as in industries to make lab work more convenient, efficient, and repeatable. By providing features such as combining the data, team, inventory, and project management with experiment records, they assist the user to manage their work. As it is more effective in handling data, an electronic notebook is replaced with laboratory paper notebooks. Growing R&D operations, increasing laboratory automation, and digitalization of laboratory data are expected to improve the demand during the projected timeframe. The adoption of high-throughput systems has improved the overall efficiency of laboratory operations. Moreover, the increasing need for streamlined data management and the need for scientific data archiving and tracking is further supporting the growth of this segment. Furthermore, a rapid shift across the globe towards cloud-based ELN and growing ELN adoption by developing economies will provide significant opportunities for the market to grow.

Based on the product outlook, the market is divided into two types namely; cross-disciplinary, and specific. The cross-disciplinary segment holds the highest revenue share owing to its high demand and usage. It can be used in specialized disciplines, including IT, management, legal, and research & department.

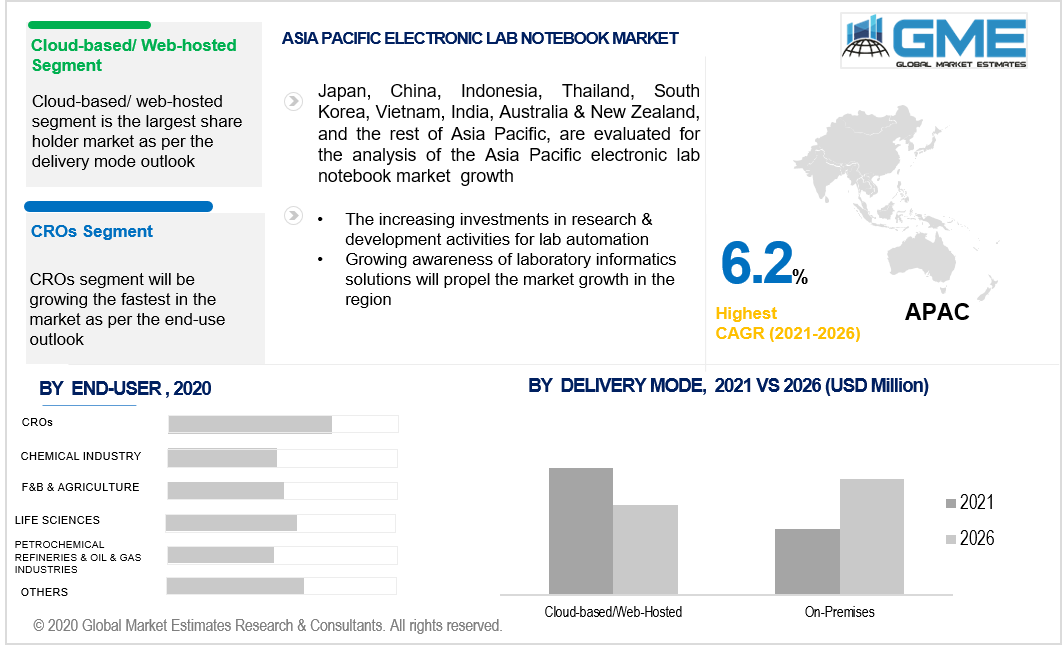

The two segments are on-premise and cloud-based/web-hosted, according to the distribution mode outlook. The largest shareholder in terms of revenue growth was the cloud-based/web hosted segment in 2020. Some of the advantages of cloud-based applications are the growing adoption by CROs of cloud-based ELN systems due to benefits like time-saving, labor cost reduction, and safe access to medical data. These parameters are expected to build the segment's substantial growth opportunities.

Based on the type of license available for electronic lab notebooks, the market can be segmented into open and proprietary. In terms of revenue, proprietary licenses will be the largest segment of the market. The source code is protected by the software owner and contains several key features. It is more robust as compared to open source.

The end-user market can be categorized into six categories namely: CROs, F&B and agriculture, petrochemical refineries & oil & gas industries, life sciences, pharmaceutical industry, chemical industry, and laboratories for environmental testing, among others. Contract research organizations are expected to support the fastest growth in the market in 2020, owing to the growing outsourcing trend. The growing use of ELN by outsourcing organizations to minimize healthcare costs is attributable to the favorable growth of the segments.

In terms of market value, a significant share is held by the North American region. This is attributable to high investment in R&D for technologically advanced infrastructure and the increasing demand for the incorporation of laboratory systems in the healthcare and life-sciences industries. However, due to the rising laboratory automation and increasing availability and awareness of laboratory informatics solutions, the Asia Pacific region will grow fastest. Increasing government focus on digitization, combined with increasing outsourcing practices in the region, is likely to increase market demand for electronic lab notebooks.

LabWare, Abbott Laboratories, LabLynx, Inc., Dassault Systèmes, Bio-ITech BV, Thermo Fisher Scientific Inc., Arxspan, LLC, LabVantage Solutions, Inc., Benchling, Inc., Agilent Technologies among others, are the key vendors competing in the electronic lab notebook market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2018, Abbott launched its new electronic lab notebook templates in the STARLIMS content library which is an addition to new smartphone applications

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Electronic Lab Notebook Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Electronic Lab Notebook Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS