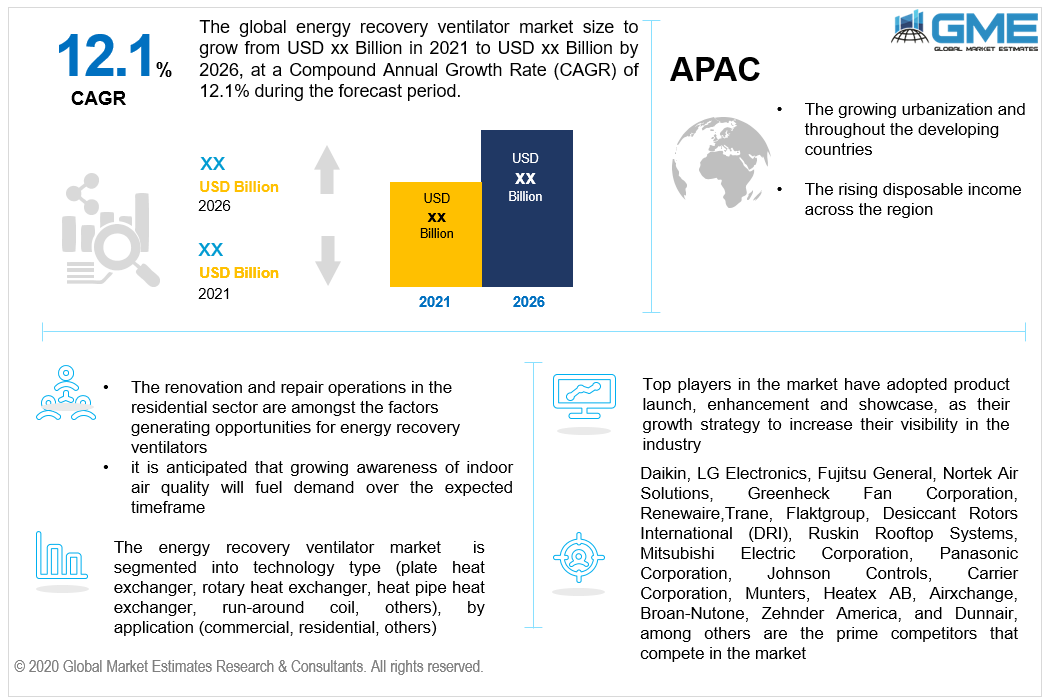

Global Energy Recovery Ventilator Market Size, Trends, and Analysis - Forecasts To 2026 By Technology Type (Plate Heat Exchanger, Rotary Heat Exchanger, Heat Pipe Heat Exchanger, Run-Around Coil, Others), By Application (Commercial, Residential, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Energy recovery ventilation (ERV) is the type of energy recovery for the exchange of energy where the ventilation unit is usually enclosed in drained building/space air and used for the handling or pre-conditioning of the outside ventilation air in commercial and residential HVAC systems. In locations where high concentrations of individuals are present and ample fresh air is required, the energy recovery ventilator (ERV) is installed. This helps to reduce electricity costs and to recover energy in the house. The energy recovery ventilator helps the building to obtain fresh air, reduces CO2 levels, and keeps residents healthy and aware. The advantage of using ventilation for energy recovery is that it satisfies the requirements of the ventilation and energy specifications of the ASHRAE, thus enhancing the quality of indoor air and reducing the overall capacity of HVAC equipment. Also, the ventilator for energy recovery holds cool energy in the summer and hot energy in the winter. LEED certification is being envisaged by builders for the use of energy ventilators in residential and commercial building facilities.

Increasing awareness among individuals about indoor environmental quality is driving the growth of the global market for energy recovery ventilators. The energy recovery ventilator provides advantages such as enhancing the quality of internal air without wasting a lot of energy. The growing urbanization is partly responsible for maintaining the increasing demand for ventilators for energy recovery. Implementation and development of multiple government regulations on the use of energy recovery ventilators to furnish existing structures and the inclusion of green buildings resulting in growing investment in the construction sector are some of the factors that are anticipated to push the demand for the ventilators for energy recovery over the forecast timeframe.

The demand for a ventilator for energy recovery is directly linked to economic growth and improved industrialization of economies. However, rising renovation and repair operations in the residential sector are among the factors generating opportunities for energy recovery ventilators. Similarly, the rising value of protecting sustainable and energy-efficient sources, alongside government measures to build funding for energy recovery ventilators across municipalities, is expected to improve the growth of the market over the forecast timeline, worldwide.

Furthermore, it is anticipated that growing awareness of indoor air quality will fuel demand over the expected timeframe. Air quality is an important concern to be aware of these days. It can save up to USD 200 billion in worker performance and USD 50 billion in lost sick time annually, as per The Lawrence Berkeley National Laboratory. Also, the demand for the energy ventilator is projected to spur market growth, due to its capability to continuously substitute stale indoor air with fresh outdoor air, the ability to remove pollutants including excess moisture and molds, household bacteria and chemicals present in indoor environments, augment energy efficiency and reduce the carbon footprint, among others.

The advent of COVID-19 has brought the world to a halt. It will help to fight this highly infectious disease by growing funding from governments and several companies. There are some struggling industries and some are thriving. Overall, nearly every industry is expected to be affected by the pandemic. The sudden lockdown has also inevitably affected the production of ERV across the production facilities. In the U.S., approximately 45 percent of the HVAC companies lose their seasonal revenues due to the reduced installation of ERV and lack of manpower, referring to several secondary sources. Amid the coronavirus, many industries are hindered and a substantial decline is anticipated by the 2nd half of 2020. HVAC is one of the sectors that is least affected, because of the need for ventilation across different industries. Most residential ventilation systems, however, are not designed for high MERV-rated filters either. Therefore, due to this pandemic, the ERV market is likely to be moderately impacted and is also expected to rebound shortly within the projected timeframe.

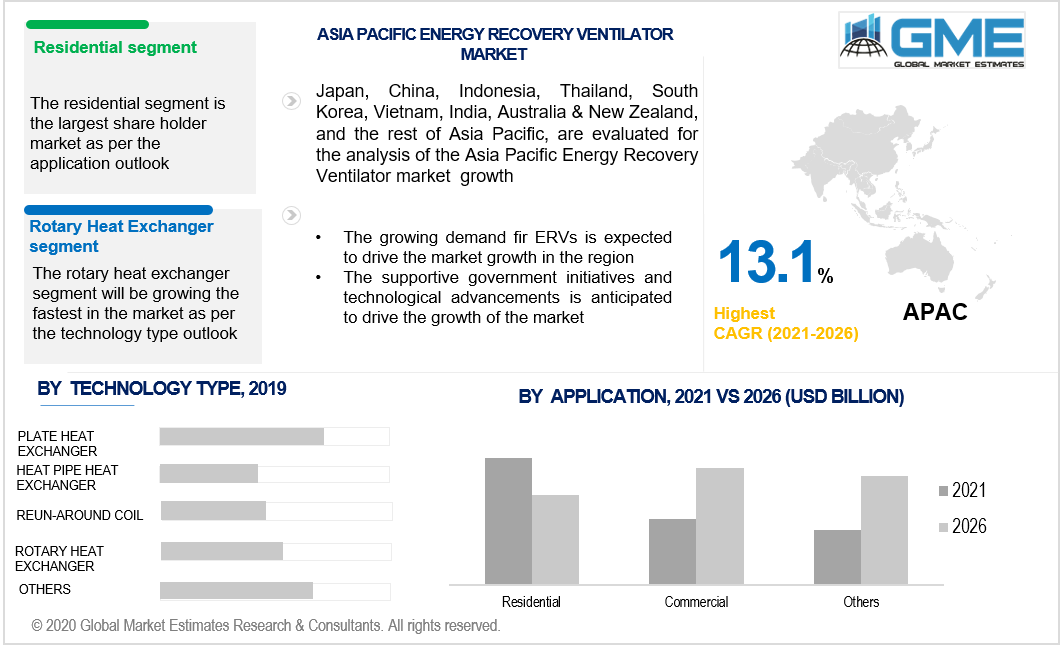

In 2019, the plant heat exchanger technology segment accounted for the largest share of the revenue due to the growing demand for commercial and residential plate heat exchangers to handle, regulate and track energy consumption in buildings, the growth of the plate heat exchanger technology market over the forecast period is expected to drive growth. The plate heat exchanger retains a building's temperature and offers a well-organized heat transfer instrument that further decreases energy consumption and CO2 emissions. Moreover, it is attributable to the ability to improve the efficiency of HVAC systems along with the increasing demand for high-end infrastructural facilities throughout economies is expected to drive the market growth.

Due to the compact structure and high efficiency of rotary heat exchangers, the rotary heat exchanger is expected to grow at CAGR over the projected timeframe. A rotating heat exchanger is a form of heat exchanger for energy recovery that is located within an air handling system's supply and exhaust air streams. Its heat is contained in the matrix and is passed to the fresh air supply coming from the outside in the other half of the rotation.

During the forecast era, the residential sector segment is anticipated to boost at a high CAGR during the forecast time. This is attributed to increasing per capita spending all over the world. In developed countries as well as in developing countries such as India, Nigeria, and China, among others, housing construction is on the spike. The need for wall-mounted and ceiling ERVs to regularise the quality and moisture of the outdoor and indoor air and to offer a safe and secure indoor environment.

From 2021 to 2026, the commercial application segment is anticipated to dominate the market for energy recovery ventilators. The growing use of these ventilators in residential and business applications can be due to the growth of the commercial application segment of the energy recovery ventilator industry. Moreover, an increasing number of green buildings, the formulation and strict enforcement of different government regulations to limit energy consumption in buildings. Also, the global demand for highly efficient energy recovery ventilators is boosting the growth of the commercial application segment market.

The North American region remains the leading market shareholder in the projected timeframe in terms of revenue. It is driven by factors that have led to the market due to the increasing demand for energy recovery ventilators from the commercial and residential sectors of the region is anticipated to propel the growth of the market. Moreover, the growing concerns about greenhouse gas pollution, highly favorable economic development in the United States, and growing government funding to propel the economy through federal tax credit projects

Furthermore, the Asia-Pacific Region will indicate a significant CAGR rate over the forthcoming years. One of the key factors driving the market growth is the growing demand for ERVs, the increasing population, and the rising disposable income. Moreover, the development in the region would further influence the rising living standards of individuals. The modernization of residential and commercial buildings in emerging countries will strengthen the market's robust growth in the region.

Daikin, LG Electronics, Fujitsu General, Nortek Air Solutions, Greenheck Fan Corporation, Renewaire, Loren Cook Company, Paschal Heat, Air & Geothermal, Trane, Flaktgroup, Desiccant Rotors International (DRI), Ruskin Rooftop Systems, Mitsubishi Electric Corporation, Panasonic Corporation, Johnson Controls, Carrier Corporation, Munters, Heatex AB, Airxchange, Broan-Nutone, Ostberg Group, Lennox International, Reznor Manufacturing Company, Zehnder America, and Dunnair, among others are the prime competitors that compete in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2019, Zehnder Group successfully acquired Recair. The company is headquartered in Germany and engaged in offering ventilation products and solutions across Europe.

In February 2019, Cool International Holding GmbH was successfully acquired by Daikin Group to broaden the commercial refrigeration business and capitalize on energy refrigerants and savings regulations.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Energy Recovery Ventilator Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Energy Recovery Ventilator Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS