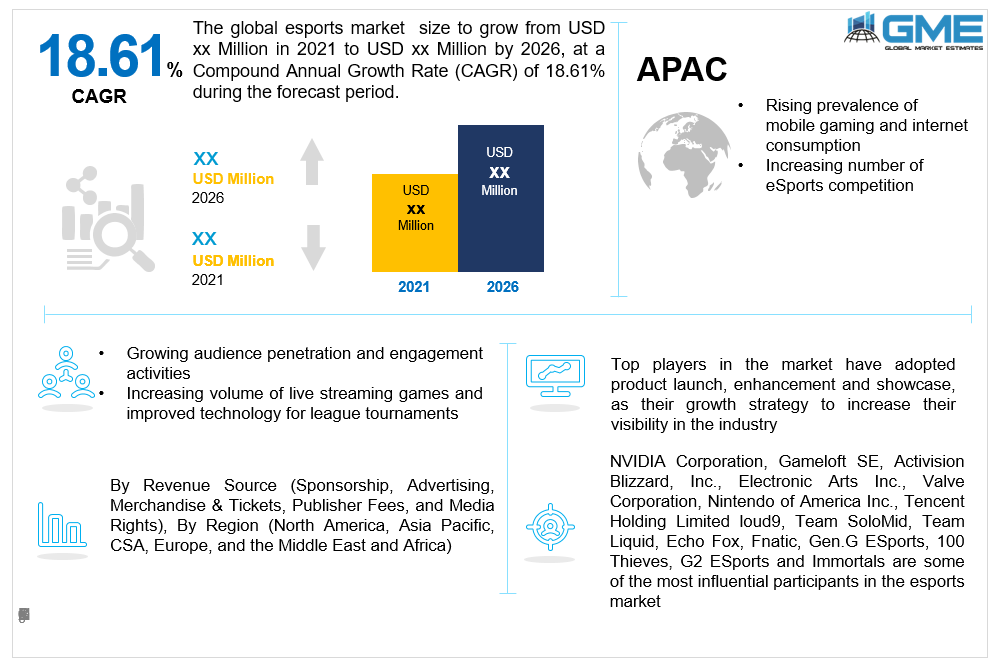

Global Esports Market Size, Trends, and Analysis - Forecasts To 2026 By Revenue Source (Sponsorship, Advertising, Merchandise & Tickets, Publisher Fees, and Media Rights), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The millennial generation and younger people are more dependent on the internet and gadgets. This has cleared the path for online hobbies and gaming. Currently, youngsters choose video games over sports and outdoor activities. The global esports market has benefited as a result of this. Furthermore, increased esports knowledge and peer-to-peer sharing have boosted the global esports market. An increase in the volume of tournaments with high reward pools is the latest craze in the overall market that is propelling the global esports market much further.

The market is growing due to increased audience penetration and engagement activities, significant investments, increased live streaming of games and improved technology for league tournaments. Game creators, influencers, players, and event planners have all benefitted from the industry's commercialization. Because of the growing success of gaming tournaments, streaming profits, one-to-one sponsorship deals, and incredible multinational prize pools, youngsters are preferring esports as a professional occupation.

Furthermore, colleges and universities are introducing dedicated esports curricula in order to train skilled professionals. Academic institutions, in addition to offering sports programs, are now providing scholarships to players to help them develop their gaming skills. Moreover, as new gaming technologies become more widely adopted, mobile penetration rises, and internet access improves, the number of gamers rises, propelling the eSports market growth. The eSports market is projected to expand rapidly across the globe as games like Fortnite, PUBG, League of Legends, Counterstrike, and others gain in popularity.

The market has been fueled even further by the changing gaming world. From a casual sport to a professional career prospect, the video gaming market is quickly evolving leading to growth in the Esport market. Similar to traditional sports, major esports tournaments engross millions of audiences in a state of obsession. As a consequence, these tournaments are drawing investments and sponsors from major brands to celebrities, which is eventually leading to overcrowding in-game live streams. Moreover, increased spending over the last two years has opened up new growth opportunities. The environment provides varied investment options across a variety of subsectors, so investments in this market have made considerable progress in recent years. Traditional venture capital funds are the primary drivers of funding, led by strategic investors and private equity. With more franchise-style tournaments, rising viewers, and increasing esports momentum, investments are expected to rise. The increasing degree of interest from different investors suggests that the demand for eSport will continue to expand steadily over the forthcoming years leading to growth in the eSport market.

Since eSports is still a comparative niche market, it still has some growth pitfalls. For example, many participants and players argue that certain tournaments lack credibility, making it difficult to determine which tournaments are legitimate and which are fraudulent. The market is being hindered by budget restraints and a shortage of qualified professionals in esports. Furthermore, since the publisher's goals vary from that of the organizer, the operator does not have total ownership over the leagues and tournaments.

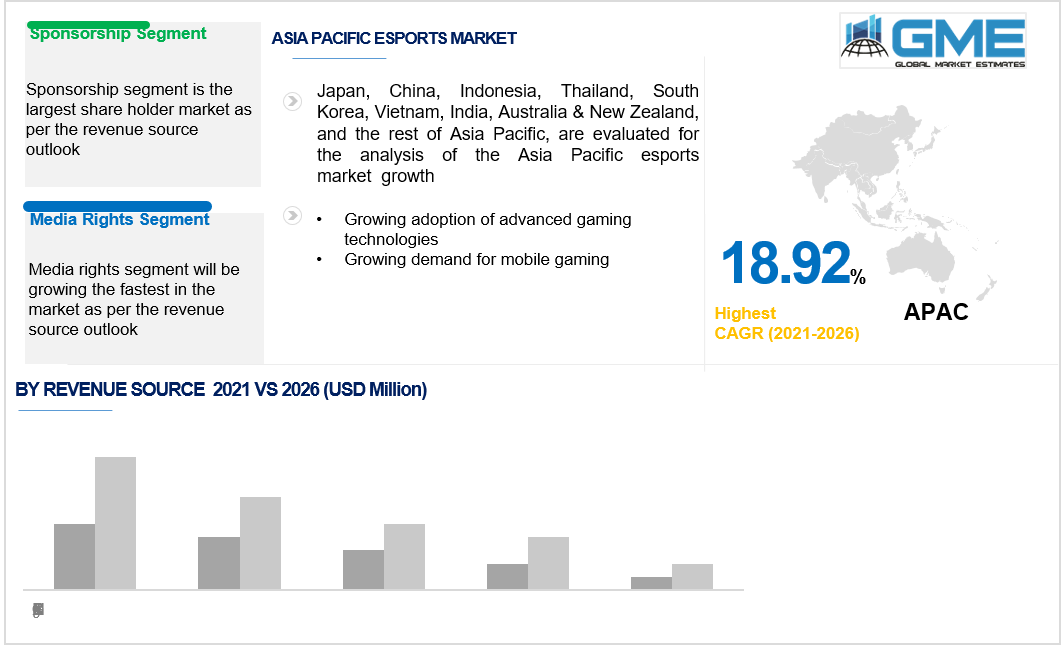

Depending on the source the market is categorized as sponsorship, advertising, merchandise & tickets, publisher fees, and media rights. The sponsorship segment is foreseen to lead the global esports market. Sponsorship provides a significant opportunity for marketers to reach out directly to their target audiences through online and offline media outlets. Booths, giveaways, digital ads, video displays, banners, and a variety of other innovative approaches help the company reach millions of followers. Many iconic brands, such as Nvidia and Intel, have already formed sponsorship agreements with esports leagues and teams. These transactions have demonstrated to be excellent investments since they allow them to enhance their market share and brand awareness by marketing gaming-related commodities.

North America is presumed to hold the highest market share, with the United States leading the way. For years, the region has led the industry, with PC gaming catering to a more specialized audience. Investment and development in this domain are anticipated to continue in the near future, owing to the franchised Overwatch League and North American League of Legends Championship Series (NA LCS). In the United States, esports is a billion-dollar industry including game developers, television networks, tournaments, players, and streaming platforms. The North American Scholastic Esports Federation (NASEF) is working on developing the community by organizing student competitions, assisting high schools in forming esports clubs, and providing coaching and mentoring. In 2019, NASEF and the Japan High School esports Federation (JHSEF) developed a strategic alliance to collaborate on the growth and promotion of esports as an educational platform in the United States and Japan.

Asia Pacific is predicted to lead the market in terms of CAGR. Asia-Pacific will prevail due to the increasing adoption of smartphones and internet consumption, which will boost the market's growth. Furthermore, as the volume of eSports competitions grows, it has become a viable industry for large investments. Also, China has designated eSports as a national business, allowing them to generate specialized employment in the nation. South Korea is also a well-known esports destination, supplying gamers with traditional facilities such as gaming houses, coaching, chefs, and analysts. In 2019, SK Telecom Co., Ltd., a South Korean telecom provider, joined Comcast Corporation to create an esports venture. Over the forthcoming years, such kinds of advances and programs are supposed to augment the APAC market forward.

NVIDIA Corporation, Gameloft SE, Activision Blizzard, Inc., Electronic Arts Inc., Valve Corporation, Nintendo of America Inc., Tencent Holding Limited, Team SoloMid, Team Liquid, Echo Fox, Fnatic, Gen.G ESports, 100 Thieves, G2 ESports and Immortals are some of the most influential participants in the esports market.

Please note: This is not an exhaustive list of companies profiled in the report.

Electronic Arts Inc. collaborated with FIFA to begin an esports tournament series for the Electronic Arts FIFA video game franchise in November 2017.

Tencent Holding Limited is gaining a strategic edge in the esports business through investing in Riot Games, Inc., Epic Games, Inc., Supercell Oy, and Kakao Corp.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Esports Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Revenue Source Overview

2.1.3 Regional Overview

Chapter 3 Global Esports Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Popularity of Video Games

3.3.1.2 Increasing Infrastructure for the League Tournaments

3.3.2 Industry Challenges

3.3.2.1 Lack of Standardization

3.4 Prospective Growth Scenario

3.4.1 Revenue Source Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Esports Market, By Revenue Source

4.1 Revenue Source Outlook

4.2 Sponsorship

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Advertising

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Merchandise & Tickets

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Publisher Fees

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

4.6 Media Rights

4.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Esports Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2019-2026 (USD Million)

5.2.2 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.2.4 U.S.

5.2.4.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.2.5 Canada

5.2.5.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2019-2026 (USD Million)

5.3.2 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.4 Germany

5.2.4.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.5 UK

5.3.5.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.6 France

5.3.6.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.7 Italy

5.3.7.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.8 Spain

5.3.8.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.3.9 Russia

5.3.9.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2019-2026 (USD Million)

5.4.2 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4.4 China

5.4.4.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4.5 India

5.4.5.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4.6 Japan

5.4.6.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4.7 Australia

5.4.7.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.4.8 South Korea

5.4.8.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2019-2026 (USD Million)

5.5.2 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.5.4 Brazil

5.5.4.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.5.5 Mexico

5.5.5.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.5.6 Argentina

5.5.6.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.6 MEA

5.6.1 Market Size, By Country 2019-2026 (USD Million)

5.6.2 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.6.4 Saudi Arabia

5.6.4.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.6.5 UAE

5.6.5.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

5.6.6 South Africa

5.6.6.1 Market Size, By Revenue Source, 2019-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 NVIDIA Corporation

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Gameloft SE

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Activision Blizzard, Inc.

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Electronic Arts Inc.

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Valve Corporation

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 Nintendo of America Inc.

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Tencent Holding Limited

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Team SoloMid

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Team Liquid

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.11 Echo Fox

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info Graphic Analysis

6.12 Fnatic

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info Graphic Analysis

6.13 Gen.G ESports

6.13.1 Company Overview

6.13.2 Financial Analysis

6.13.3 Strategic Positioning

6.13.4 Info Graphic Analysis

6.14 100 Thieves

6.14.1 Company Overview

6.14.2 Financial Analysis

6.14.3 Strategic Positioning

6.14.4 Info Graphic Analysis

6.15 G2 ESports

6.15.1 Company Overview

6.15.2 Financial Analysis

6.15.3 Strategic Positioning

6.15.4 Info Graphic Analysis

6.16 Other Companies

6.16.1 Company Overview

6.16.2 Financial Analysis

6.16.3 Strategic Positioning

6.16.4 Info Graphic Analysis

The Global Esports Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Esports Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS