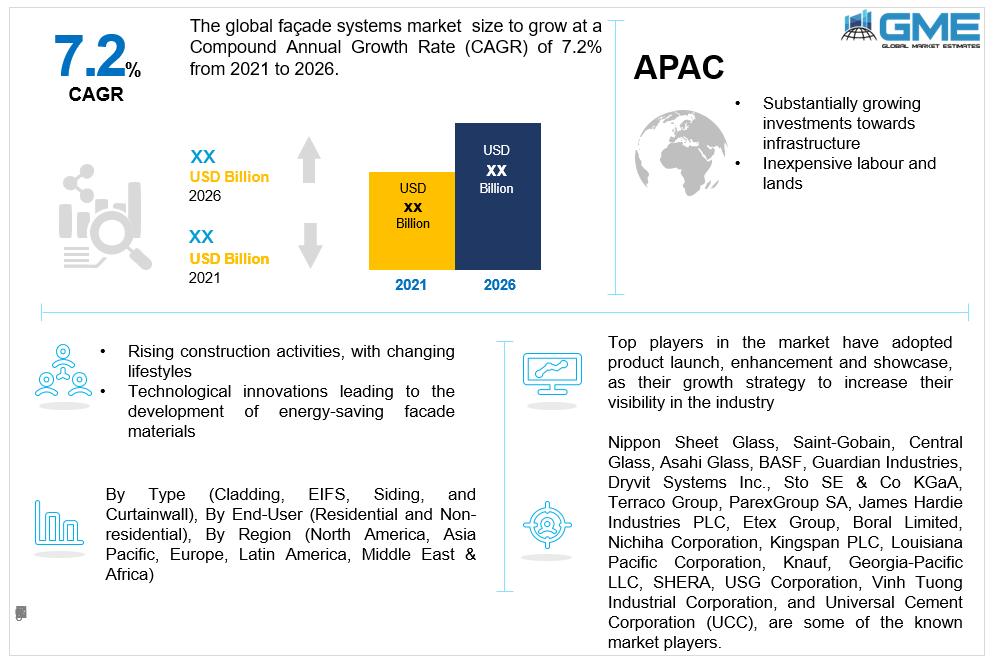

Global Facade Systems Market Size, Trends & Analysis - Forecasts to 2026 By Type (Cladding, EIFS, Siding, and Curtainwall), By End-User (Residential and Non-residential), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Facade systems comprise structural elements that offer vertical and lateral resistance to environmental factors and provide acoustic, thermal, and fire-resisting properties. The facade system categories depend entirely on the scale & type of building and the local planning requirements that affect the appearance of the buildings. A wide variety of facade shapes and treatments can be created by using light steel walls and curved inclined walls, large ribbon windows, and projections like balconies or solar shading.

The facade system provides separation between the inside and the outside environment. Nevertheless, it is required to provide open windows for ventilation, a visual connection with the outside, and acceptable light levels for the users of the building. This system also provides the architect and owner the chance to design the structure representative of the owner’s ideals, outlook, and business. The several benefits of facade systems based on their aesthetic and functional requirements include various colored and surface textures, lightweight facades minimizing the load on the supporting structures, and high pre-fabrication for installation speed.

The rise in construction activities, with changing lifestyles, rapid urbanization, and a growing population worldwide are propelling the market’s growth. The construction sector is a flourishing industry, particularly in developing countries. With the development process and individuals' migration, the demand is growing significantly for facade systems in residential applications. Facade Systems will gain traction from the commercial, residential, and industrial sectors’ construction projects over the coming years. Moreover, the allocation of funds for the construction of robust infrastructures in the emerging and developed economies will transform into massive growth opportunity for the facade systems market.

Classic and eco-friendly designs promote the market for facade systems and will eventually increase the growth scope for numerous composite material manufacturers. The easy availability of essential raw materials like aluminum, glass composites, ceramics, and stainless steel will push the facade system manufacturing industries to develop rapidly. The research & development investments have gained status for novel materials like carbon fiber composites to make constructions that are strong, highly durable, and likely to surge interest for this sector’s new manufacturers.

Demand for facade systems can be ascribed to the massive development of the construction sector across the world. The need for facade systems is stimulated by factors such as rising metropolitan and non-domestic architectural and foundational developments, its sturdiness, and the ability to enhance the aesthetic impression of the dwellings. Additionally, improved distribution methods and the availability of a wide range of options have enabled businesses to expand their consumer base and meet specific needs. However, massive raw material and startup costs are projected to stymie market expansion.

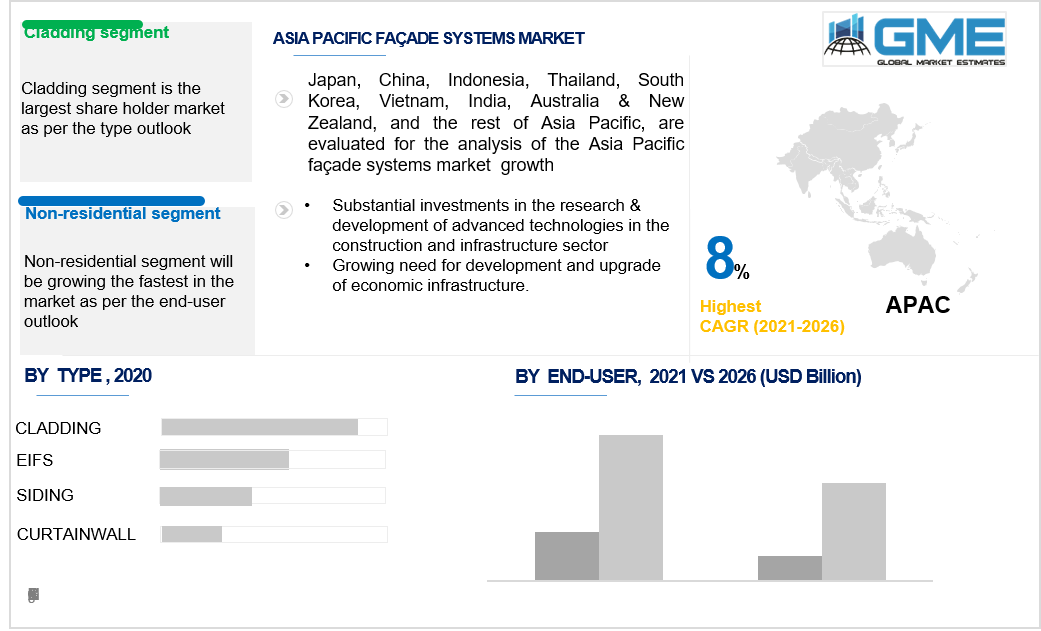

By type, there are four segments, namely, cladding, siding, exterior insulation and finish system (EIFS), and curtain wall. The cladding segment is expected to lead the market. Cladding in construction involves applying several layers of material, providing weather & fire resistance, pollution prevention, and thermal insulation, and improving the durability and appearance of buildings. Currently, the market is characterized by traditional designs, which are expected to be superseded by new eco-friendly designs in the coming years. The availability of raw material supply and high demand in the end-use sector, particularly the commercial and industrial sectors, as a result of the global economy's turnaround, is expected to open up prospects for industry participants throughout the projected period. Major advancements in composite material production are leading to the elimination of numerous restrictions such as excessive heat and soundproofing.

By end-user, there are two segments: residential and non-residential. The non-residential segment will account for the largest market share. Builders and contractors implement facade systems as they enhance the building's appearance while shielding the structure from external environmental forces, thus complying with the homeowners’ demand. Moreover, the growing inclination towards developing green buildings to fight increasing energy costs and global warming will increase global demand. The segment of residential comprises majorly of apartments, dormitories, bungalows, duplexes, and other house designs like units, townhouses, and villas. The use of facade systems in such residential buildings has advanced and is preferable due to the growing inclination towards developing sustainable and smart buildings. The expenditure on residential construction will surge in the emerging South American and Asia Pacific regions. The rapid urbanization, need for aesthetic appeal, and protection and durability from extreme weather conditions, high thermal efficiency, and fire protection will propel the market’s growth.

The facade systems market by region can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. Asia Pacifc region is presumed to be the global market leader. The Asia Pacific is a hotspot for international investment and expanding industrial sectors, attributable to low-cost labor and inexpensive land availability. The rising infrastructural activities in the building sectors are mainly responsible for the growth in demand for facade systems. Because of the significant expansion in the infrastructure sector for architectural attractiveness, the necessity for facade systems is increasing significantly in the area. North America was the second-largest market shareholder, trailed by Europe. Construction activity is increasing significantly in North America and Europe. Growing urbanization in North American nations will improve infrastructure in areas such as transportation and electricity generation. Furthermore, technological advances in the building and construction sectors are altering the essence of infrastructure expenditure as well as its speed and efficiency. These variables will have a favorable effect on the market for facade systems.

Nippon Sheet Glass, Saint-Gobain, Central Glass, Asahi Glass, BASF, Guardian Industries, Dryvit Systems Inc., Sto SE & Co KGaA, Terraco Group, ParexGroup SA, James Hardie Industries PLC, Etex Group, Boral Limited, Nichiha Corporation, Kingspan PLC, Louisiana Pacific Corporation, Knauf, Georgia-Pacific LLC, SHERA, USG Corporation, Vinh Tuong Industrial Corporation, and Universal Cement Corporation (UCC), are some of the known market players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Facade Systems Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-User Overview

2.1.4 Regional Overview

Chapter 3 Global Facade Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Allocation of Funds for the Construction Of Robust Infrastructures

3.3.1.2 Increasing Development of the Construction Sector

3.3.2 Industry Challenges

3.3.2.1 Massive Raw Material and Startup Costs

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Facade Systems Market, By Type

4.1 Type Outlook

4.2 Cladding

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 EIFS

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Siding

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Curtainwall

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Facade Systems Market, By End-User

5.1 End-User Outlook

5.2 Residential

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Non-residential

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Facade Systems Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Million)

6.2.2 Market Size, By Type, 2016-2026 (USD Million)

6.2.3 Market Size, By End-User, 2016-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.2.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Million)

6.3.2 Market Size, By Type, 2016-2026 (USD Million)

6.3.3 Market Size, By End-User, 2016-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.7.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

6.3.9.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Million)

6.4.2 Market Size, By Type, 2016-2026 (USD Million)

6.4.3 Market Size, By End-User, 2016-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.7.2 Market size, By End-User, 2016-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

6.4.8.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Million)

6.5.2 Market Size, By Type, 2016-2026 (USD Million)

6.5.3 Market Size, By End-User, 2016-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.5.6.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Million)

6.6.2 Market Size, By Type, 2016-2026 (USD Million)

6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.4.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.5.2 Market Size, By End-User, 2016-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

6.6.6.2 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Nippon Sheet Glass

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Saint-Gobain

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Central Glass

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Asahi Glass

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 BASF

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Guardian Industries

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Dryvit Systems Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Sto SE & Co KGaA

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Terraco Group

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 ParexGroup SA

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 James Hardie Industries PLC

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Etex Group

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Boral Limited

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Nichiha Corporation, Kingspan PLC

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

7.16 Louisiana Pacific Corporation

7.16.1 Company Overview

7.16.2 Financial Analysis

7.16.3 Strategic Positioning

7.16.4 Info Graphic Analysis

7.17 Knauf

7.17.1 Company Overview

7.17.2 Financial Analysis

7.17.3 Strategic Positioning

7.17.4 Info Graphic Analysis

7.18 Georgia-Pacific LLC

7.18.1 Company Overview

7.18.2 Financial Analysis

7.18.3 Strategic Positioning

7.18.4 Info Graphic Analysis

7.19 SHERA

7.19.1 Company Overview

7.19.2 Financial Analysis

7.19.3 Strategic Positioning

7.19.4 Info Graphic Analysis

7.20 USG Corporation

7.20.1 Company Overview

7.20.2 Financial Analysis

7.20.3 Strategic Positioning

7.20.4 Info Graphic Analysis

7.21 Vinh Tuong Industrial Corporation

7.21.1 Company Overview

7.21.2 Financial Analysis

7.21.3 Strategic Positioning

7.21.4 Info Graphic Analysis

7.22 Universal Cement Corporation (UCC)

7.22.1 Company Overview

7.22.2 Financial Analysis

7.22.3 Strategic Positioning

7.22.4 Info Graphic Analysis

7.23 Other Companies

7.23.1 Company Overview

7.23.2 Financial Analysis

7.23.3 Strategic Positioning

7.23.4 Info Graphic Analysis

The Global Facade Systems Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Facade Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS