Global Feminine Hygiene Products Market Size, Trends & Analysis - Forecasts to 2026 By Nature (Disposable, and Reusable); By Type (Menstrual Cups, Panty Liners, Tampons, and Sanitary Napkins); By Distribution Channels (Online Retail Stores, Pharmacies, Drug Stores, Supermarkets, and Others); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis & Competitor Analysis

The feminine hygiene products are generally used by women to maintain the hygiene of their bodies. These products are constructed in different layers of quilted cotton fabric with alternative layers of super absorbent plastic and polymers, impermeable to liquids. These products include tampons, sanitary pads, menstrual cups, and napkins/pads which are made up of synthetic as well as natural raw materials. According to GME studies, the feminine hygiene products market is projected to show an impressive trend during the 2020-2026 timespan.

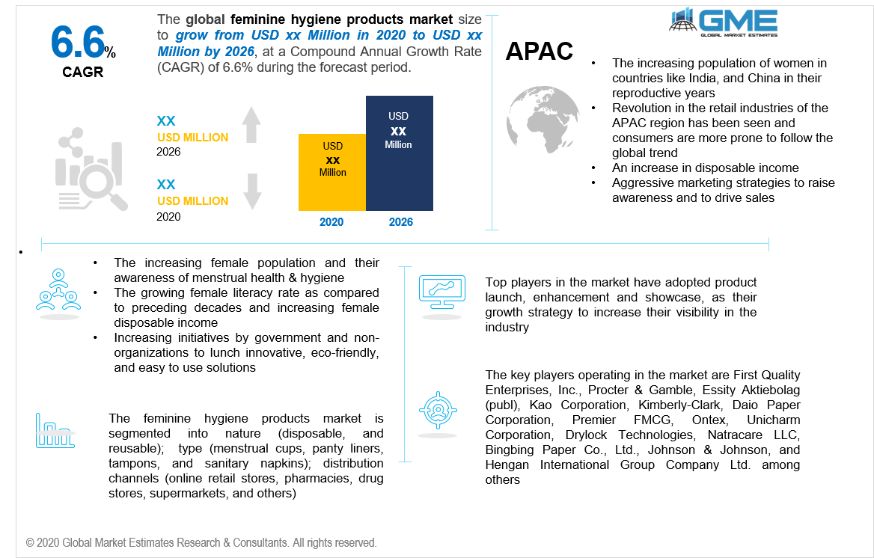

The increasing female population and their awareness of menstrual health & hygiene are prevailing the feminine hygiene products market in present times. The growing female literacy rate as compared to preceding decades and increasing female disposable income is building lucrative opportunities for feminine hygiene products. Increasing initiatives by government and non-organizations to launch innovative, eco-friendly, and easy to use solutions is boosting the demand for various novel products waiting to get launch in the future. However general perception and taboo related to menstruation remained to be the major drawback for the growth of feminine hygiene products.

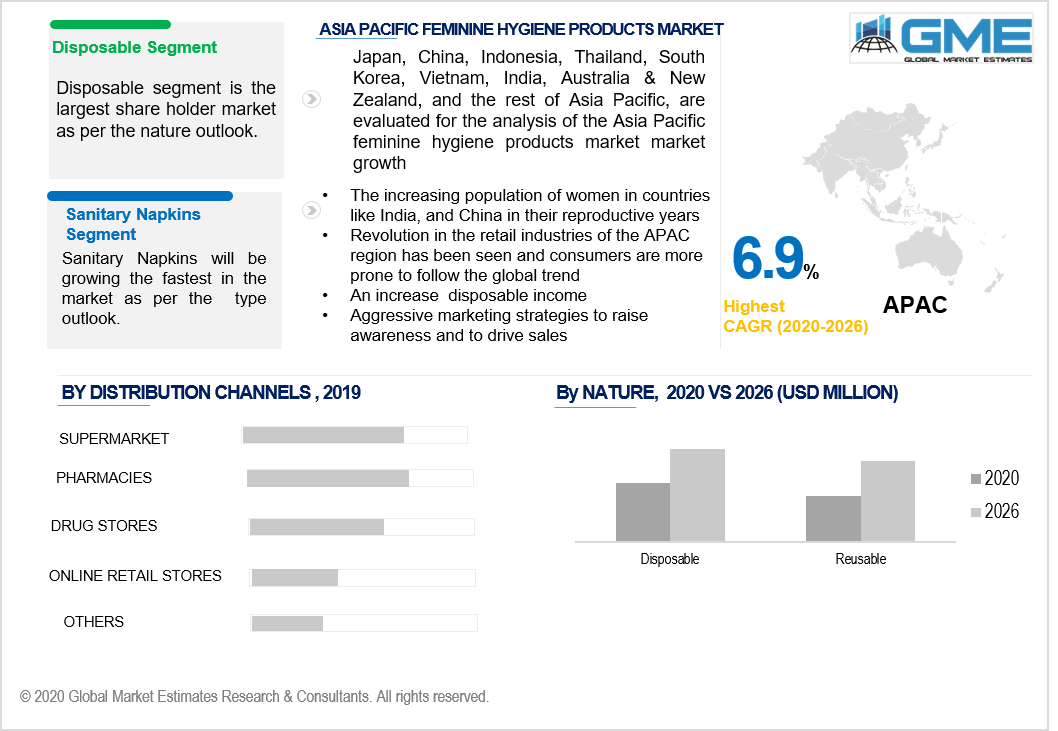

Disposable, and reusable are the two divisions based on nature. The disposable segment is the fastest-growing segment of feminine hygiene products due to growing awareness and excessive use of disposable products such as sanitary pads, tampons, and panty liners as compares to reusable products. These disposable products can be used during menstruation as well as for panty shields, which are used to protect undergarments under light menstrual flow thus targeting a bigger volume of the feminine audience as compared to the reused segment.

The types of feminine hygiene products used by the consumers are menstrual cups, panty liners, tampons, and sanitary napkins. Sanitary napkins hold the highest share of the feminine hygiene products market in recent times as compared to its competitors. The prime reason behind the significant growth of the segment is its ease of availability and awareness among the customers. These pads are worn externally and provide much better comfort than the feminine products which are worn internally.

Online retail stores, pharmacies, drug stores, supermarkets, and others are the market segmentation of feminine hygiene products. Supermarket contributes to the largest revenue of the feminine hygiene products market as the segment provides a wide variety of brands of the products under the single roof of the building along with household items. The convenience offered by the supermarket is one of the sole factor driving the growth of the market.

Asia-Pacific is estimated to grow at the highest market value. The increasing population of women in countries like India, and China in their reproductive years is the primary beneficial factor contributing to the growth of the market in the APAC region. Revolution in the retail industries of the APAC region has been seen and consumers are more prone to follow the global trend. Besides this, an increase in disposable income enables women to choose from a wide range of hygiene and sanitary solutions. Aggressive marketing strategies to raise awareness and to drive sales have contributed to the regional growth of feminine hygiene products.

The key players operating in the market include First Quality Enterprises, Inc., Procter & Gamble, Essity Aktiebolag (publ), Kao Corporation, Kimberly-Clark, Daio Paper Corporation, Premier FMCG, Ontex, Unicharm Corporation, Drylock Technologies, Natracare LLC, Bingbing Paper Co., Ltd., Johnson & Johnson, and Hengan International Group Company Ltd. among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2020, Softex Indonesia was taken over by Kimberly-Clark Corporation. The acquisition aim is to expand and accelerate the company’s business of personal hygiene in Southeast Asia.

In May 2020, Ontex announced to build a new production facility starting in 2021. The personal hygiene plant is planned to set up in Rockingham County, US.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Feminine Hygiene Products Market has been studied from the year 2017 till 2026. However, the CAGR provided in the report is from the year 2018 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Feminine Hygiene Products Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS