Global Flocculants Market Size, Trends, and Analysis - Forecasts to 2026 By Type (Synthetic, Natural, Mineral), By End-Use Industry (Chemical Processing, Water Treatment, Mineral Extraction, Papers, Food & Beverage, Oil & Gas, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

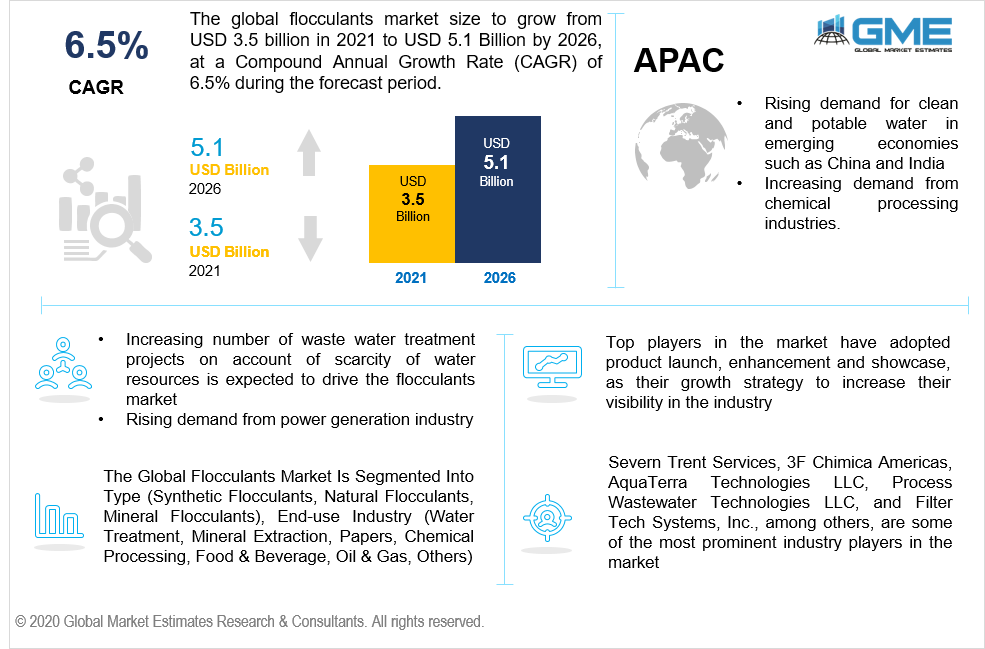

The global flocculants market is valued at USD 3.5 billion in 2021 to reach a value of USD 5.1 billion by 2026, with a compound annual growth rate of 6.5%. Rising government norms and regulatory rules pertaining to waste water treatment from oil & gas industry, chemical industry, food industry, etc., and increasing water pollution levels will help the global flocculants market grow rapidly from 2021 to 2026.

In recent times, many countries have witnessed a surge in the emission of effluent from domestic as well as industrial areas, which contaminate the water bodies and cause environmental issues. To bring these measures in control, various countries around the world are investing in research activities to launch methods and processes that can save the increasing water scarcity issue and reuse the contaminated water by making it potable.

Flocculation is a chemical process where the particles form aggregates. This process combines a massive number of small particles and converts them into fewer large-sized particles. The process of flocculation demands a high molecular weight. It works as an absorbent and bridges the gaps between the newly formed large flocs. They provide increased and higher rates of filtration, which is the most desired feature of it by various end-user industries. Even if the flocculants increase the productivity, they require significantly lower costs of equipment, settlers, small-sized tanks, and other requisites needed in other processes than flocculation. Besides lower installation or utilization costs, they are extremely easy to operate and maintain and facilitates quicker results. Hence low cost efficiency due to flocculants will help the market grow rapidly.

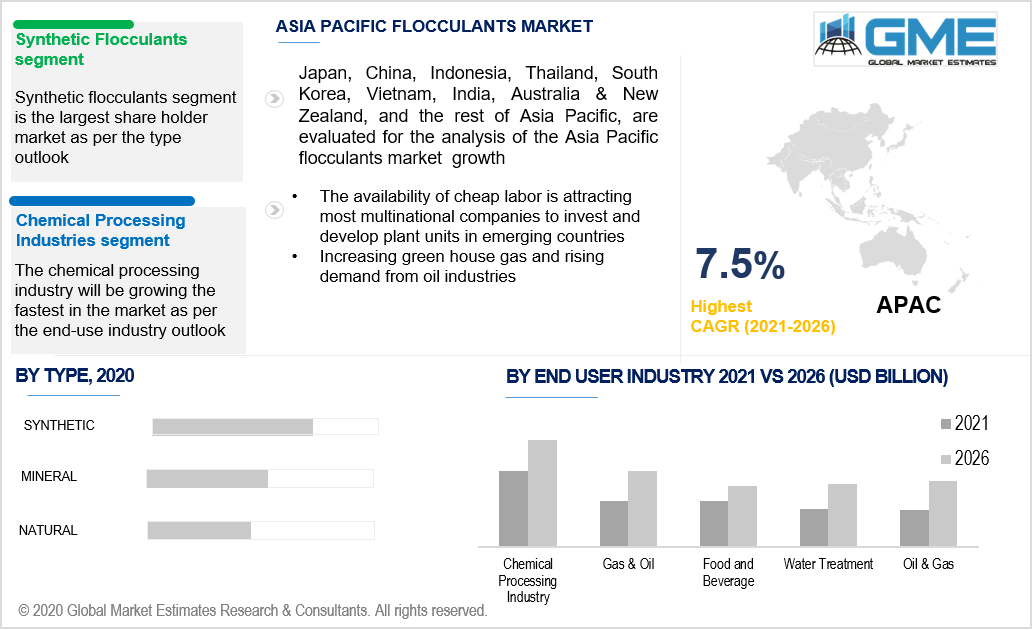

Synthetic, natural, mineral are the three types of flocculants in the market. Synthetic types are extensively used in various end-user industries for their widespread application area and hence hold the largest shares in the market. This type of product has higher efficiency in the flocculation process. The reason that makes these synthetic types more demanded in the market is their effortless and bulk availability and cost-effective nature. These synthetic types also exhibit well-established flocculation mechanisms and utilizing these require no specific or complex operational processes, which makes it favorable for the end-users as the task of the skilled workforce gets eliminated. However, this synthetic type contains chemical or artificial formulations that have negative impacts in the long term.

Most of the industries prefer natural type rather than synthetic or mineral ones. These natural types are extremely harmless and are biodegradable and have no negative impacts on the environment and have no use of any artificial ingredients in their formulation. However, these types have a very short shelf life due to the biodegradable nature of the components present in them. In recent times, they are found to be extensively used in paper and pulp industries, which certainly has a significant demand in the market.

The market by end-user segment is divided into chemical processing, water treatment, mineral extraction, papers, food & beverage, oil & gas, others. The chemical processing industry is the most prominent end-user industry and also the fastest growing in the market. Developing Countries are adapting and installing various chemical processing industries like wastewater treatment plants, filtration, and many others. These chemical processing industries have also become strong platforms for earning profitable revenues. These industries react to numerous chemicals like polymers, petrochemicals, and other basic inorganics to produce a particular output.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific is the fastest growing region in the flocculants market. The countries in the Asia Pacific region like India, Japan, South Korea, and China are expanding their chemical industries tremendously, which is helping the regional market grow rapidly. Besides the chemical industries, these countries also have enormous contributions to greenhouse gas and other oil industries and have a significant food and beverage industry as well. Today with increasing contaminants in water flow and increasing adverse effects on the economy of industries, the awareness about the importance of utilizing flocculants to separate the large solid contaminated flocs from the fluids is increasing. Also, the production of various kinds of flocculants, especially the synthetic type, do not require skilled workers with extensive technical knowledge or a degree, and thus, many international and multinational companies from the flocculant production business invest in countries like India and China to utilize the readily available cheap labor with no specific skill sets or skilled training. Followed by the Asia Pacific, North America is also significantly growing in the flocculants market, owing to the increasing contribution from the chemical, gas, and oil industries.

Severn Trent Services, 3F Chimica Americas, AquaTerra Technologies LLC, Process Wastewater Technologies LLC, AWACS a Division of Filter Tech Systems, ChemTreat, Inc., Tramfloc, Inc., SNF Floerger, General Electric, Coventya, Wyo-Ben, Inc., Chautauqua Chemicals Co., Inc., Mitsubishi Chemical Holdings Group, METALLINE CORPORATION, Florida Chemical Supply, Inc, JRM Chemical, Inc., Industrial Specialty Chemicals, Inc., Sabo Industrial Corporation, Aqua Ben Corporation, Aquatic BioScience, Avista Technologies, and Aquamark Inc., among others, are some of the most prominent industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2020, Mitsubishi Chemical Holdings Group and MT AquaPolymer, Inc. & Hymo Corporation entered into a strategic partnership in order to outsource the manufacturing process of polymer flocculants to Mitsubishi Chemical Corporation.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Flocculants Industry Overview, 2020-2026

2.1.1 Type Overview

2.1.2 End-User Industry Overview

Chapter 3 Global Flocculants Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The increasing demand for power may augment the demand for flocculants over the forecast period

3.3.1.2 The demand for clean and potable water in emerging economies

3.3.2 Industry Challenges

3.3.2.1 Increasing need for eco-friendly products formula may challenge industry growth

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-User Industry Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Flocculants Market, By Type

4.1 Type Outlook

4.2 Synthetic

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Natural

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Mineral

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Flocculants Market, By End-User Industry

5.1 End-User Industry Outlook

5.2 Water Treatment

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Chemical Processing

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Mineral Extraction

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Papers

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Food & Beverage

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Oil & Gas

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Others

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Flocculants Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Type, 2020-2026 (USD Billion)

6.2.3 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Type, 2020-2026 (USD Billion)

6.3.3 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Type, 2020-2026 (USD Billion)

6.4.3 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.7.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Type, 2020-2026 (USD Billion)

6.5.3 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Type, 2020-2026 (USD Billion)

6.6.3 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By End-User Industry, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Severn Trent Services

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 3F Chimica Americas

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 AquaTerra Technologies LLC

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Process Wastewater Technologies LLC

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 AWACS a Division of Filter Tech Systems

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 ChemTreat, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 Mitsubishi Chemical Holdings Group

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 JRM Chemical, Inc

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 Industrial Specialty Chemicals, Inc.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Sabo Industrial Corporation

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Flocculants Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flocculants Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS