Global Flooring Market Size, Trends & Analysis - Forecasts to 2026 By Product (Soft Coverings, Resilient [LVT, VCT, Vinyl Sheet, Fiberglass, Linoleum], Non-resilient [Ceramic, Stone, Wood, Laminate], Seamless), By Applications (Residential, Industrial, Commercial), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

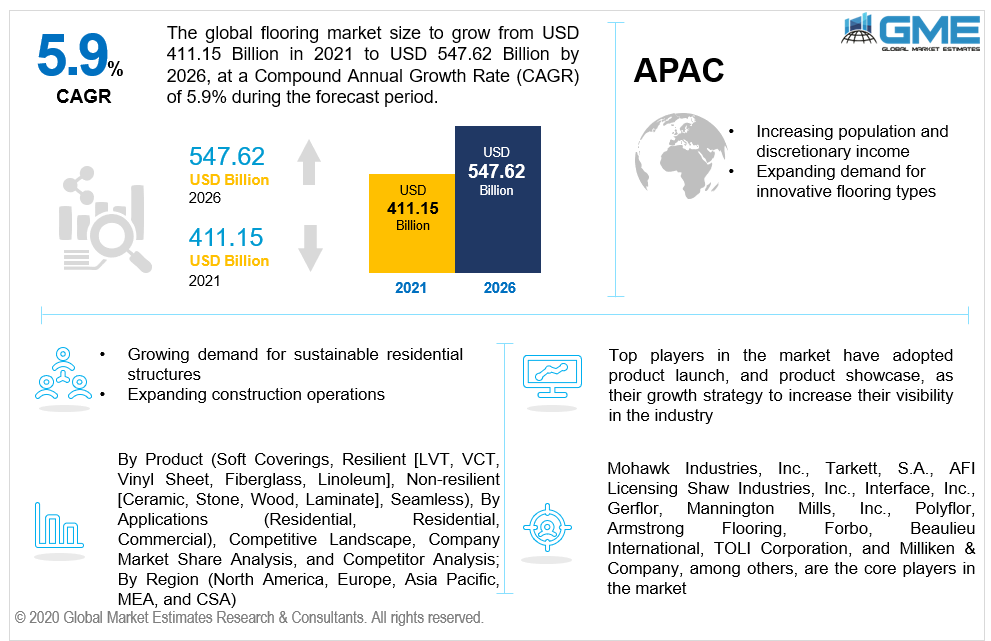

The flooring market is estimated to be valued at USD 411.15 billion in 2021 and is projected to reach USD 547.62 billion by 2026 at a CAGR of 5.9%. Substantial government expenditures on infrastructure construction are likely to boost the demand for flooring. Because of the increased need for leisure and seclusion as a result of livelier settings, the overall market has seen an increase in demand for insulating, as well-insulated flooring offers a better acoustic condition. As a consequence, there is an increasing demand for insulation, which is driving overall market expansion. Customer expectations for aesthetically better layouts, patterns, and colors, as well as low-maintenance and easy-to-install flooring, are foreseen to propel market advancement. The flooring market size has grown significantly as a result of causes including the building and construction sector's expansion. Furthermore, a growing volume of rehabilitation and remodeling projects is driving up demand in the global market.

Do-it-yourself and the employment of ultra-modern procedures to create a genuine impression on LVT flooring are the most significant flooring market trends. In the overall market, continuous construction expansion is also a major driver. In the coming years, rising FDI in Asian infrastructure and businesses will boost the market growth. Moreover, as per the flooring industry analysis, residential construction activity in industrialized countries like Germany, the United States, and the United Kingdom, among others, has led to considerable demand for the product. Throughout the forecast period, substantial industrial and economic expansion, together with population growth, is presumed to boost product demand. Furthermore, the emergence of private sector development businesses in India, China, and the United Arab Emirates is foreseen to boost construction expenditures, bolstering the total market's growth.

According to the flooring industry outlook analysis, overall success is likely to be fueled by the advancement of simple installation methodologies, the provision of novel building solutions, and the increased demand for ecologically sustainable goods. A strict legislative structure for manufacturing, use, deployment, and recycling is also foreseen to boost the market growth. Additionally, substantial expenditures and ongoing research & development in flooring goods have resulted in the development of flooring materials that are more durable and stronger. The Covid 19 impact on the flooring market was quite significant for the global core players because the residential and commercial industries were facing significant economic concerns and difficulties. Moreover, the construction sector also experienced problems, including supply chain disturbances, a scarcity of contractors & resources, and project terminations to save costs, all of which slowed the development of the flooring market over the forecast period. According to the FCNews research, which revealed the flooring industry statistics 2020, flooring sales topped out at USD 22.951 billion and 18.969 billion square feet with the sales trend indicating a slight downfall.

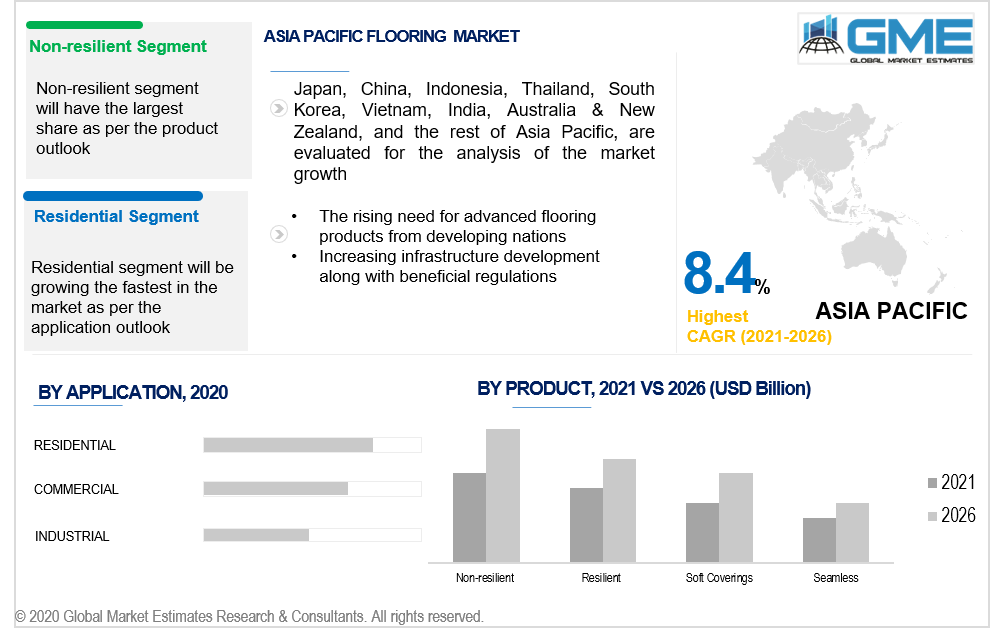

Depending on the product, the market is categorized as soft coverings, resilient, non-resilient, and seamless. Owing to an increase in the volume of residential and commercial construction operations around the world, the non-resilient flooring segment is foreseen to dominate the market. Because of the significant demand for these items attributable to their exceptional water tolerance and endurance, the category will continue to dominate throughout the forecast period. Because of the ongoing rise of LVT and its subclass WPC/rigid core, non-resilient flooring is expected to increase at a reasonable rate. Owing to a decrease in the market for laminate flooring attributable to water and noise constraints, WPC and rigid augmented products have risen in popularity.

Depending on the application, the market is categorized as residential, industrial, and commercial. The residential segment is foreseen to dominate the global market and contribute to more than half of the market share. In developing countries, increasing discretionary income and a spike in the proportion of single-family houses are proposed to be important driving forces. Rapidly growing building initiatives, as well as smart home development activities, are likely to drive up flooring demand. Renovation, rehabilitation, and remodeling of residential areas are also anticipated to augment the market in the coming years.

Patterns and preferences for floor coverings are rapidly shifting. The market has been greatly influenced by urbanization and the demand for environmentally friendly flooring products. Customers are opting for low-maintenance items with flatter flooring. As energy saving in architecture has become a top priority globally, residential settings have demonstrated a preference for greener solutions. These aforementioned factors have led to the supremacy of the residential application segment.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America). The Asia Pacific is presumed to dominate the market. The rising need for flooring from developing nations including China and India are credited with this dominance. The strengthening of the regional market was aided by government policies aimed at developing the construction sector in this region. For instance, the legislature of India's “Housing for All” program is expected to boost product consumption. Furthermore, throughout the forecast period, evolving consumer behavior and the desire for product variety and innovative layouts are foreseen to support regional market development.

Throughout the forecast period, the requirement for flooring in North America is expected to rise. The market is foreseen to continuously grow due to the well-established construction sector in the United States and Canada, as well as escalating demand for single-family homes in the area. Improved living standards and greater prospects entice highly skilled personnel from all over the globe. The proportion of expatriates residing in the area is growing due to increased immigration. As a result, the demand for residential structures, including single-family homes and flats, is increasing. Furthermore, the need will be fueled by expanding construction operations. Due to the prevalence of major producers in the area as well as technical advancements, this area is likely to grow at a substantial rate throughout the forecast period.

Mohawk Industries, Inc., Tarkett, S.A., AFI Licensing Shaw Industries, Inc., Interface, Inc., Gerflor, Mannington Mills, Inc., Polyflor, Armstrong Flooring, Forbo, Beaulieu International, TOLI Corporation, and Milliken & Company, among others, are the core players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Flooring Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Applications Overview

2.1.4 Regional Overview

Chapter 3 Flooring Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing Volume of Rehabilitation and Remodelling Projects

3.3.1.2 Substantial Government Expenditures and Initiatives on Infrastructure Construction

3.3.2 Industry Challenges

3.3.2.1 Increasing Concern About the Environmental Impact and Health Issues

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Applications Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Flooring Market, By Product

4.1 Product Outlook

4.2 Soft Coverings

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Resilient

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.3.2 LVT, Market Size, By Region, 2019-2026 (USD Million)

4.3.3 VCT, Market Size, By Region, 2019-2026 (USD Million)

4.3.4 Vinyl Sheet, Market Size, By Region, 2019-2026 (USD Million)

4.3.5 Fiberglass, Market Size, By Region, 2019-2026 (USD Million)

4.3.6 Linoleum, Market Size, By Region, 2019-2026 (USD Million)

4.4 Non-resilient

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4.2 Ceramic, Market Size, By Region, 2019-2026 (USD Million)

4.4.3 Stone, Market Size, By Region, 2019-2026 (USD Million)

4.4.4 Wood, Market Size, By Region, 2019-2026 (USD Million)

4.4.5 Laminate, Market Size, By Region, 2019-2026 (USD Million)

4.5 Seamless

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Flooring Market, By Applications

5.1 Applications Outlook

5.2 Residential

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Industrial

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Commercial

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Flooring Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Product, 2019-2026 (USD Million)

6.2.3 Market Size, By Applications, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Product, 2019-2026 (USD Million)

6.3.3 Market Size, By Applications, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Applications, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Product, 2019-2026 (USD Million)

6.4.3 Market Size, By Applications, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.7.2 Market size, By Applications, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Product, 2019-2026 (USD Million)

6.5.3 Market Size, By Applications, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Product, 2019-2026 (USD Million)

6.6.3 Market Size, By Applications, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Applications, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Applications, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Mohawk Industries, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Tarkett, S.A.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 AFI Licensing Shaw Industries, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Interface, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Gerflor

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Mannington Mills, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Polyflor

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Armstrong Flooring

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Forbo

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Beaulieu International

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 TOLI Corporation

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Milliken & Company

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Other Companies

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

The Global Flooring Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flooring Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS