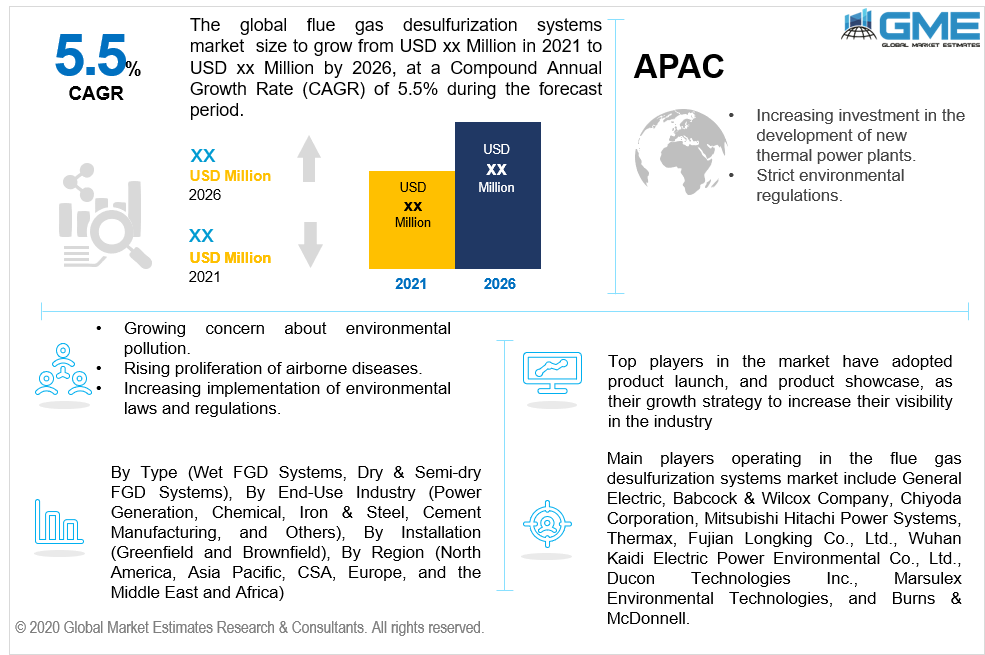

Global Flue Gas Desulfurization Systems Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Wet FGD Systems, Dry & Semi-dry FGD Systems), By End-Use Industry (Power Generation, Chemical, Iron & Steel, Cement Manufacturing, and Others), By Installation (Greenfield and Brownfield), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

Increasing energy demand has expanded the market for desulphurization of flue gas. Augmenting demand by developing nations for this technology will also significantly bolster market value. The rising prominence of flue gas desulfurization systems in the cement and chemical production sectors is likely to drive the overall flue gas desulfurization systems market. Furthermore, as individuals and governments across the world become more conscious of the dangers of air pollution to their wellbeing, the requirement for flue gas desulfurization (FGD) systems rises, contributing to the market's growth. The key players in the flue gas desulfurization systems market are attempting to broaden and enhance their product portfolios in order to efficiently remove flue gases from industrial facilities.

On the contrary, the elevated performing pricing and debut expenditures necessitated by the systems are expected to limit the proliferation of the flue gas desulfurization systems market. Furthermore, the power generation sectors, which are the primary consumers of FGD systems to reduce SO2 emissions, are phasing out the usage of coal. As a result, the global decline in the volume of coal power plants is likely to impede the advancement of the flue gas desulfurization systems market over the forecast period. Consequently, several alternative approaches have been developed that can simultaneously handle sulphur dioxide and even other gases. Market growth is also anticipated to be stimulated by the proliferation of electricity demand, along with major investments in thermal power plants.

Moreover, the existence of strict pollution regulations is expected to raise product demand over the forecast period. It is anticipated that the strong consumer demand for FGD gypsum would enable businesses to install FGD systems in their power plants. In a broad variety of industries, FGD gypsum has applications, including highway construction, gypsum panel products, water treatment, agriculture, cement manufacturing, mining applications, and glassmaking. In varying soil conditions, it is often used as a soil amendment. Furthermore, FGD by-products are also used in the manufacturing of cement, wallboards, and plaster of paris.

Rising energy consumption has resulted in increased demand for the flue gas desulphurization market. In addition, rising demand for this technology in developing economies would assist enhance market value. Globally, the degradation of atmospheric conditions has become a considerable challenge that should be acknowledged. Rapid industrialization is occurring, as is the creation of new significant players in several sectors. This would imply that rigorous controls governing flue gas emissions would be imposed on them. As a result, the expansion in industries is precisely proportionate to the expansion in the flue gas desulphurization market.

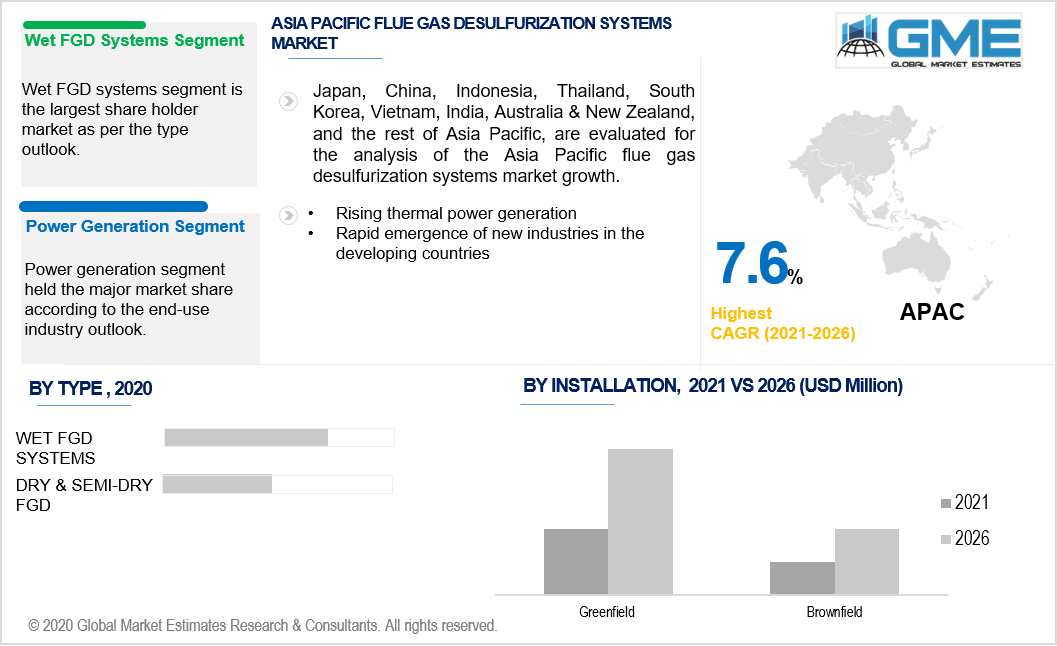

Depending on the type, the flue gas desulfurization systems market has been segmented into wet and dry & semi-dry. The wet FGD product type category is foreseen to lead the market and account for the largest share. The major factors responsible for implementing wet FGD technology are its better removal capacities, an increase in energy demand, high emission requirements set by federal governments, and a rise in the amount of coal-fired power plants in developing nations. The development of the wet FGD systems market is due to its early commercial deployment in 1970 and its high performance in regards to SO2 removal. In addition, gypsum is the derivative of traditional wet FGD systems, this utilizes limestone as a reagent. This is usually sold to suppliers of cement, wallboard, and the fertilizer sector.

Depending on the end-use industry, the flue gas desulfurization systems market has been segmented into power generation, chemical, iron & steel, cement manufacturing, and others. The power generation end-user industry segment is presumed to hold the major market share of the global FGD market. Due to the use of high sulfur content coal in power plants. Coal-fired power plants are the main progenitor of sulfur pollutants. As a result, globally enhanced power generation is the rationale for the segment's supremacy over various end-use industries.

Based on the installation, the flue gas desulphurization (FGD) market is categorized into greenfield and brownfield. Greenfield is likely to predominate. Brownfield technology will upgrade the equipment, leaving it attached to co-exist with the previous equipment, while all-new equipment will be built in Greenfield.

Over the forecast period, Asia Pacific is expected to dominate the market. The Indian, Japanese and Chinese FGD market is predicted to expand owing to increased thermal power generation, which is prophesied to boost the need for FGD systems in the Asia Pacific region. APAC holds its supremacy due to the fast development of new sectors in emerging nations, as well as the government's imposition of rigorous flue gas emission restrictions. Furthermore, the desire to have a clean environment is a motivating factor. The cement and chemical sectors in APAC are seeing great growth, which is projected to drive the need for flue gas desulfurization systems throughout the forecast period.

North America is foreseen to register the highest CAGR. Increased infrastructure development expenditures, along with burgeoning competition understanding of the benefits of pollution control systems, will fuel industry growth. Legislative initiatives targeted at reducing pollution levels in the industrial sector will improve the business landscape even further.

Main players operating in the flue gas desulfurization systems market include General Electric, Babcock & Wilcox Company, Chiyoda Corporation, Mitsubishi Hitachi Power Systems, Thermax, Fujian Longking Co., Ltd., Wuhan Kaidi Electric Power Environmental Co., Ltd., Ducon Technologies Inc., Marsulex Environmental Technologies, and Burns & McDonnell.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Flue Gas Desulfurization Systems Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-Use Industry Overview

2.1.4 Installation Overview

2.1.5 Regional Overview

Chapter 3 Global Flue Gas Desulfurization Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Energy Demand

3.3.1.2 Growing Implementation of Stringent Environmental Restrictions

3.3.2 Industry Challenges

3.3.2.1 Higher Installation Costs and Waste Disposable Expense

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-Use Industry Growth Scenario

3.4.3 Installation Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Flue Gas Desulfurization Systems Market, By Type

4.1 Type Outlook

4.2 Wet FGD Systems

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Dry & Semi-dry FGD Systems

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Flue Gas Desulfurization Systems Market, By End-Use Industry

5.1 End-Use Industry Outlook

5.2 Power Generation

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Chemical

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Iron & Steel

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Cement Manufacturing

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Flue Gas Desulfurization Systems Market, By Installation

6.1 Installation Outlook

6.2 Greenfield

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Brownfield

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Flue Gas Desulfurization Systems Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Million)

7.2.2 Market Size, By Type, 2019-2026 (USD Million)

7.2.3 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.2.4 Market Size, By Installation, 2019-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.2.5.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.2.5.3 Market Size, By Installation, 2019-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.2.6.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.2.6.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Million)

7.3.2 Market Size, By Type, 2019-2026 (USD Million)

7.3.3 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.4 Market Size, By Installation, 2019-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.5.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.5.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.6.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.6.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.7.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.7.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.8.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.8.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.9.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.9.3 Market Size, By Installation, 2019-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Type, 2019-2026 (USD Million)

7.3.10.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.3.10.3 Market Size, By Installation, 2019-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Million)

7.4.2 Market Size, By Type, 2019-2026 (USD Million)

7.4.3 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.4.4 Market Size, By Installation, 2019-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.5.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.4.5.3 Market Size, By Installation, 2019-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.6.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.4.6.3 Market Size, By Installation, 2019-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.7.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.4.7.3 Market Size, By Installation, 2019-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.8.2 Market size, By End-Use Industry, 2019-2026 (USD Million)

7.4.8.3 Market Size, By Installation, 2019-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Type, 2019-2026 (USD Million)

7.4.9.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.4.9.3 Market Size, By Installation, 2019-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Million)

7.5.2 Market Size, By Type, 2019-2026 (USD Million)

7.5.3 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.5.4 Market Size, By Installation, 2019-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.5.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.5.5.3 Market Size, By Installation, 2019-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.6.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.5.6.3 Market Size, By Installation, 2019-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.5.7.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.5.7.3 Market Size, By Installation, 2019-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Million)

7.6.2 Market Size, By Type, 2019-2026 (USD Million)

7.6.3 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.6.4 Market Size, By Installation, 2019-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.5.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.6.5.3 Market Size, By Installation, 2019-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.6.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.6.6.3 Market Size, By Installation, 2019-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Type, 2019-2026 (USD Million)

7.6.7.2 Market Size, By End-Use Industry, 2019-2026 (USD Million)

7.6.7.3 Market Size, By Installation, 2019-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 General Electric

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Babcock & Wilcox Company

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Chiyoda Corporation

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Mitsubishi Hitachi Power Systems

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Thermax

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Fujian Longking Co., Ltd.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Wuhan Kaidi Electric Power Environmental Co., Ltd.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Ducon Technologies Inc.

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Marsulex Environmental Technologies

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Burns & McDonnell

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Flue Gas Desulfurization Systems Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flue Gas Desulfurization Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS