Global Food Certification Market Size, Trends & Analysis - Forecasts to 2026 By Type (BRC, ISO22000, IFS, SQF, HALAL, KOSHER, Free-from certifications [allergen-free, gluten-free, vegan, GMO-free, and USDA Organic], Other types [FSSC22000, ISTA, and other GFSI certifications]); By Application (Dairy products, Infant food products, meat, poultry, and seafood products, Beverages, Free-from foods, Bakery & confectionery and Other applications [Functional food, crops, and convenience food]); By Risk Category (High-risk, and Low-risk); By Supply Chain (Manufacturers, Growers, Retailers, and Other supply chains [logistics, storage, and import-export agencies); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis & Competitor Analysis

Food certification is a type of assurance regarding food safety, food quality, storage material, and distribution of a food product. The certification depicts the consumption behavior of the food product and provides the surety that the product does not contain any harmful ingredients. Food safety hazards are comprised of biological, physical, or chemical agent in the food with the potential to severely affect the human health system. The food certification helps various food serving agencies such as restaurants, the food & beverage industry, cafeteria, and other small catering business to obey the guidelines of good hygiene.

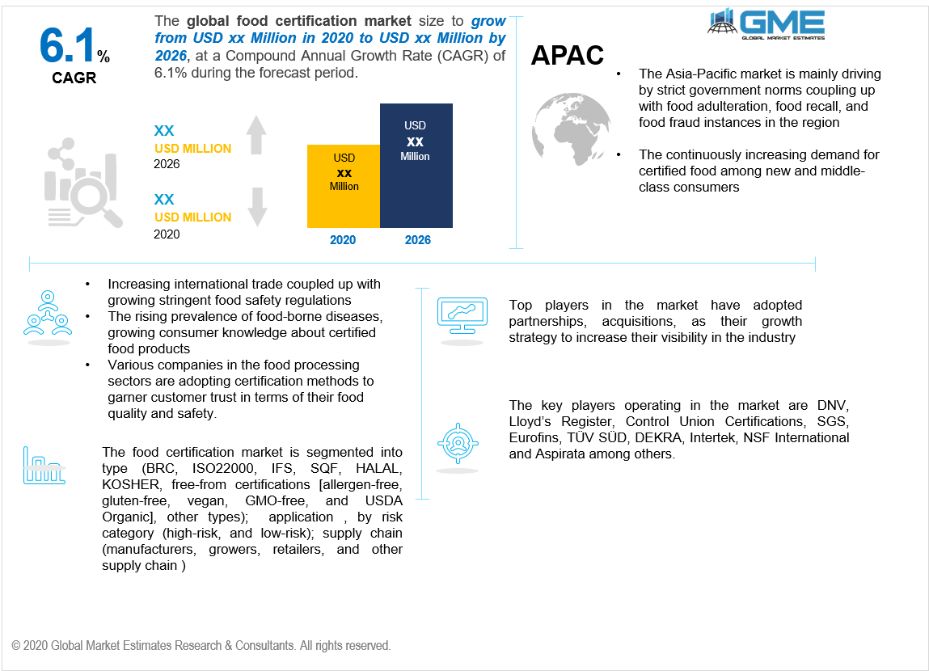

As per the research report published by GME, the food certification market is projected to grow at a CAGR of 6.1% during the 2020-2026 timespan. Increasing international trade coupled up with established strict food hygiene and safety rules have been propelling the demand for food certification. Various companies in the food processing sectors are adopting certification methods to garner customer trust in terms of their food quality and safety.

However, not enough knowledge among small-scale suppliers and the growing incidence of inaccurate labels are some of the key factors hindering the growth of the market.

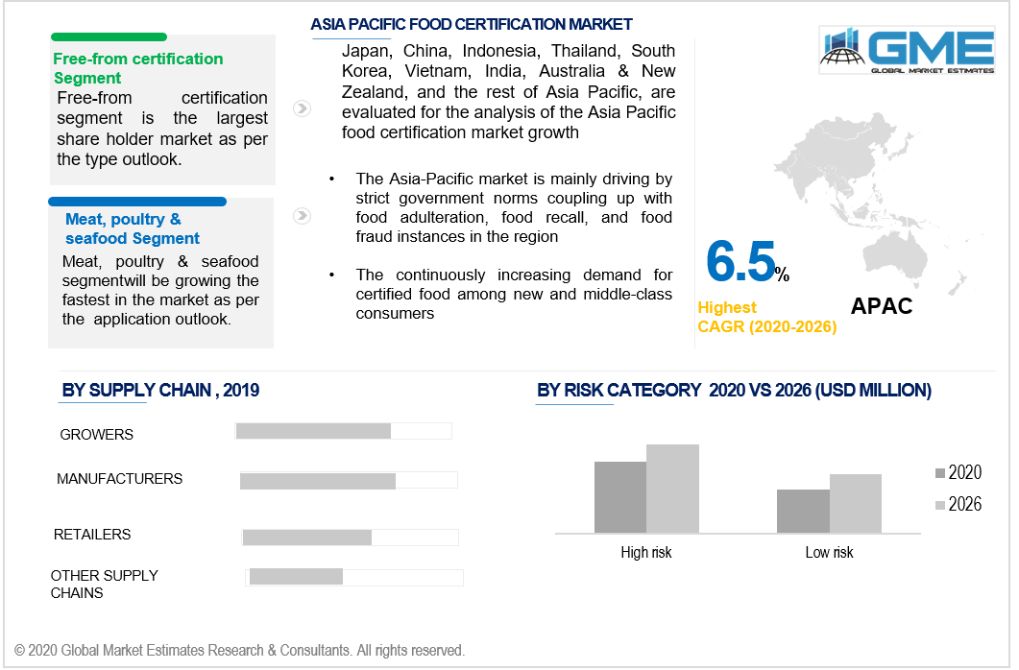

IFS, SQF, Free-from certifications, and KOSHER, and other types are the bifurcations of the food certification market based on type. Free-from certifications are estimated to grow at the fastest rate during the aforementioned period due to increasing customer interest in natural and organic products. Also increasing pressure from various regulatory bodies across the world to bring any product into the market after proper labeling on their product such as if the product is gluten or allergen-free. This has brought a huge change in the awareness of food allergies in the market which is directly expected uplifted the free-from certification segment market in coming years

Dairy products, meat, free-from foods, infant food products, poultry, beverages, bakery & confectionery, and other applications are the application segmentation of the food certification market. The meat, poultry, and seafood products segment is examined as the largest shareholding segment among all segments, as the necessary certification for meat and associated products are needed for the whole value chain from imports to exporters, and distributors. The consumer, manufacturers, and retailers of poultry and seafood products are continuously demanding information and assurance about the quality, safety, and sustainability of the products they are consuming.

Low and high are the two risk categories of the food certification market. The high-risk category is expected to maintain the segment's dominance in the coming years as high-risk food products are more vulnerable to catch bacterial contamination as they contain more moisture and protein content. Therefore strict quality standards are followed while manufacturing, storing, and transporting the product to its destination. As the products under high risk are more perishable, therefore suppliers and manufacturers are pushed to obtain the certifications for these products, thus driving the segment's market.

The supply chain of the food certification market is as follows-manufacturers, growers, retailers, and other supply chains. Growers are the dominant segment of the food certification market followed by manufacturers and other supply chains. The going global food trading and expansion of different manufacturing units around the globe for processed products has forced growers to ensure the safety and quality of their food products.

The Asia Pacific is expected to dominate the food certification market between 2020-2026 period. The Asia-Pacific market is mainly driving by strict government norms coupling up with food adulteration, food recall, and food fraud instances in the region. Also, the continuously increasing demand for certified food among new and middle-class consumers in the regions is adding value to the overall business of the food certification market.

The key players operating in the market include: DNV, Lloyd’s Register, Control Union Certifications, SGS, Eurofins, TÜV SÜD, DEKRA, Intertek, NSF International, and Aspirata among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In September 2020, Intertek and Roquette announced a new shared audit program focused on the food industry. The audit program allows different companies to compare the same suppliers simultaneously through a 3rd party audit while maintaining the same standard of safety and quality.

In November 2019, Bureau Veritas announced its purchase of a new Italy based company, Q Certificazioni S.r.l. The certification is the independent body specialized in organic food certification. The agent of the acquisition is to bring the company into the organic food certification market of Italy.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Food Certification Market has been studied from the year 2017 till 2026. However, the CAGR provided in the report is from the year 2018 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Food Certification Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS