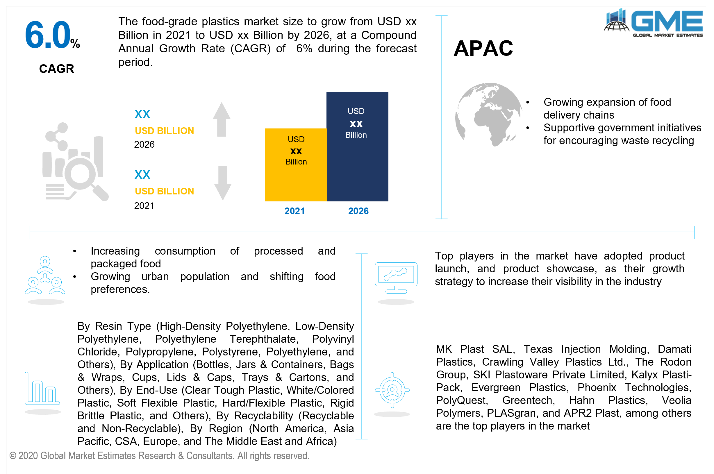

Global Food Grade Plastics Market Size, Trends & Analysis - Forecasts to 2026 By Resin Type (High-Density Polyethylene, Low-Density Polyethylene, Polyethylene Terephthalate, Polyvinyl Chloride, Polypropylene, Polystyrene, Polyethylene, and Others), By Application (Bottles, Jars & Containers, Bags & Wraps, Cups, Lids & Caps, Trays & Cartons, and Others), By End-Use (Clear Tough Plastic, White/Colored Plastic, Soft Flexible Plastic, Hard/Flexible Plastic, Rigid Brittle Plastic, and Others), By Recyclability (Recyclable and Non-Recyclable), By Region (North America, Asia Pacific, CSA, Europe, and The Middle East and Africa); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

Food grade plastics are plastics that have been specifically designed for food processing and storage purposes. Food grade plastics are designed primarily to safeguard and preserve food while also maximizing its shelf life. Food grade plastics, in addition to being lightweight and solid, are also microbial resistant, making them an essential component of the food packaging industry. Over the period, major attempts have been made for the advancement of recyclable plastics, with producers emphasizing the use of recyclable food-grade plastics. Organizations such as the United States Food and Drug Administration (FDA) and Health Canada have developed quality standards for the manufacturing of food-grade plastics. Since there are various varieties of plastics used for food packaging and storage, the resin marking code may be used to distinguish the category of plastic utilized for food packaging.

The augmented growth of the food & beverage industries, along with the expansion of the pharmaceutical industry, is expected to be the primary factor driving the growth in the global food-grade plastics market. Meat packaging is probably one of the most vital considerations of the food and beverage industry. Globally, the market for food packaging is likely to intensify owing to an uptick in meat use by customers. The reliance on healthy packaged food is boosting demand for food-grade plastics that ensure no pollution or pathogenic influence on the food products as well as biodegradability of the packaging upon disposal. As a result, the rising demand for food packaging and processing is supposed to propel up demand for food-grade plastics.

Furthermore, processed food consumption and the global proliferation of retail food distribution channels, particularly in developed economies, are presumed to drive up demand for food-grade plastics. People's growing understanding of environmental waste has resulted in the necessity for the production and acceptance of plastic substitutes in the packaging industry. The production situation is likely to become more intense as government legislation and standards on plastic goods become stricter. The foregoing factors could impede the growth of the food-grade plastics industry.

Depending on the type of resin, the market is classified as high-density polyethylene, low-density polyethylene, polyethylene terephthalate, polyvinyl chloride, polypropylene, polystyrene, polyethylene, and others. The polyethylene terephthalate segment has the highest demand and is predicted to retain its supremacy throughout the forecast period. The Polyethylene Terephthalate segment's market share is due to the simplified accessibility of PET bottles, lightweight, low cost, and convenience of recycling. This aids in its higher popularity amongst manufacturers of this plastic. Aside from being lightweight, Polyethylene Terephthalate is flexible or semi-rigid, rendering it damage resilient and an ideal alternative for packing liquids or food. The significant benefit of this kind of recycled plastic is that it reduces the chance of degradation chemical spill. Because of the above advantages of recycled plastic, it is widely used in food packaging for sports beverages, carbonated beverages, ketchup, and cooking oil, among many other products. The widespread recognition and recognition of PET for food contact by numerous organizations and corresponding bodies, such as the FDA's approval of its application for a food product, also correlates to its augmented acceptance and share of the market held by this segment.

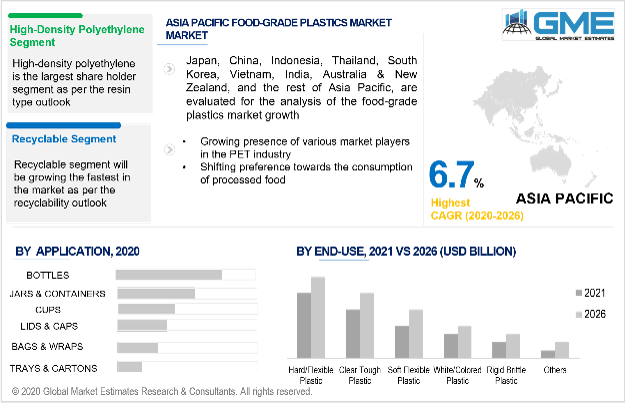

Based on the application of the food-graded plastic, the market can be segregated into bottles, jars & containers, bags & wraps, cups, lids & caps, trays & cartons, and other applications. The bottle segment has the highest market share and is foreseen to hold that position. The convenience of collection, the abundance of bottles, especially PET bottles, and the fact that they can be conveniently categorized all contribute to its increased popularity amongst manufacturers. Current trends explicitly demonstrate manufacturers' growing demand for bottles as a source of recycled plastics is leading to segment supremacy.

Based on consumer analysis or end-use, the market can be segmented into clear tough plastic, white/colored plastic, soft flexible plastic, hard/flexible plastic, rigid brittle plastic, and others. The dominance of the hard/flexible plastic segment is due to the rising need for takeaway in the food and beverage market, as well as the growing market for microwave wares, which lead to the segment's augmented demand as these goods need hard/flexible plastics. Throughout the forecast period, the consistent development of the frozen dessert market leads to the expansion trend shown by the hard/flexible plastic category, since these plastics are strongly favoured for packaging these items.

Depending on the recyclability, the market can be segmented into recyclable and non-recyclable. Recyclable plastic is the market leader. Plastic waste seriously affects the climate, especially oceanic and natural life. Pertaining to the genuine impacts of plastic squanders on the climate, governments across the world have forced severe guidelines towards their utilization. Therefore, notable organizations are joining forces to limit the utilization of plastic and make individuals mindful of its negative impacts. Increasing government policies to manage plastic waste, growing demand for packaged food items, and the increasing popularity of buying food digitally are all driving growth in the recycled plastics market segment.

As per the geographical analysis, the market food-grade plastics can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. The region's continually expanding demographic and rising consumer purchasing power, specifically in economies such as India and China, are expected to drive growth in the food and beverage and pharmaceutical industries. Furthermore, the proliferation of food distribution channels and a change in consumer inclination regarding packaged foods are expected to make the Asia Pacific a significant market for food-grade plastics. Because of their high intake of refined and frozen foods, established markets, including North America and Europe, are expected to be lucrative markets for food-grade plastics. Furthermore, stricter government rules governing food packaging are presumed to have an advantageous influence on the market in these areas. Because of increasing disposable income, metropolitan demographic increase, and changing food tastes, Latin America is a significant growth area for food-grade plastics. Because of growing processed food consumption and rising purchasing power in emerging economies, the Middle East and Africa are expected to be lucrative markets for food-grade plastics.

MK Plast SAL, Texas Injection Molding, Damati Plastics, Crawling Valley Plastics Ltd., The Rodon Group, SKI Plastoware Private Limited, Kalyx Plasti-Pack, Evergreen Plastics, Phoenix Technologies, PolyQuest, Greentech, Hahn Plastics, Veolia Polymers, PLASgran, and APR2 Plast, among others are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Food-Grade Plastics Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Resin Type Overview

2.1.3 Application Overview

2.1.4 End-Use Overview

2.1.5 Recyclability Overview

2.1.6 Regional Overview

Chapter 3 Food-Grade Plastics Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The Escalated Growth of Food & Beverage Industry Coupled with Pharmaceutical Industry

3.3.1.2 Increasing Demand for Food Packaging And Storage

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Resin Type Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-Use Growth Scenario

3.4.4 Recyclability Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Food-Grade Plastics Market, By Resin Type

4.1 Resin Type Outlook

4.2 High-Density Polyethylene

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Low-Density Polyethylene

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Polyethylene Terephthalate

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Polyvinyl Chloride

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Polypropylene

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Polystyrene

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

4.8 Polyethylene

4.8.1 Market Size, By Region, 2016-2026 (USD Million)

4.9 Others

4.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Food-Grade Plastics Market, By Application

5.1 Application Outlook

5.2 Bottles

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Jars & Containers

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Bags & Wraps

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Cups

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Lids & Caps

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Trays & Cartons

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

5.8 Others

5.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Food-Grade Plastics Market, By End-Use

6.1 End-Use Outlook

6.2 Clear Tough Plastic

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 White/Colored Plastic

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Soft Flexible Plastic

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Hard/Flexible Plastic

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Rigid Brittle Plastic

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Others

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Food-Grade Plastics Market, By Recyclability

7.1 Recyclability Outlook

7.2 Recyclable

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Non-Recyclable

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Food-Grade Plastics Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.5 Market Size, By Recyclability, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.5 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.5 Market Size, By Recyclability, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market size, By End-Use, 2016-2026 (USD Million)

8.4.9.4 Market size, By Recyclability, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.5 Market Size, By Recyclability, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.5 Market Size, By Recyclability, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Recyclability, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Resin Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-Use, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Recyclability, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 MK Plast SAL

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Texas Injection Molding

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Damati Plastics

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Crawling Valley Plastics Ltd.

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 The Rodon Group

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 SKI Plastoware Private Limited

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Kalyx Plasti-Pack

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Evergreen Plastics

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Phoenix Technologies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 PolyQuest, Greentech

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Hahn Plastics

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Veolia Polymers

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 PLASgran

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 APR2 Plast

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Other Companies

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

The Global Food Grade Plastics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Food Grade Plastics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS