Global Fracking Chemicals Market Size, Trends & Analysis - Forecasts to 2029 By Fluid Type (Water-based Fluid, Foam-based Fluid, and Other Fluid Types), By Well Type (Vertical and Horizontal or Directional), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

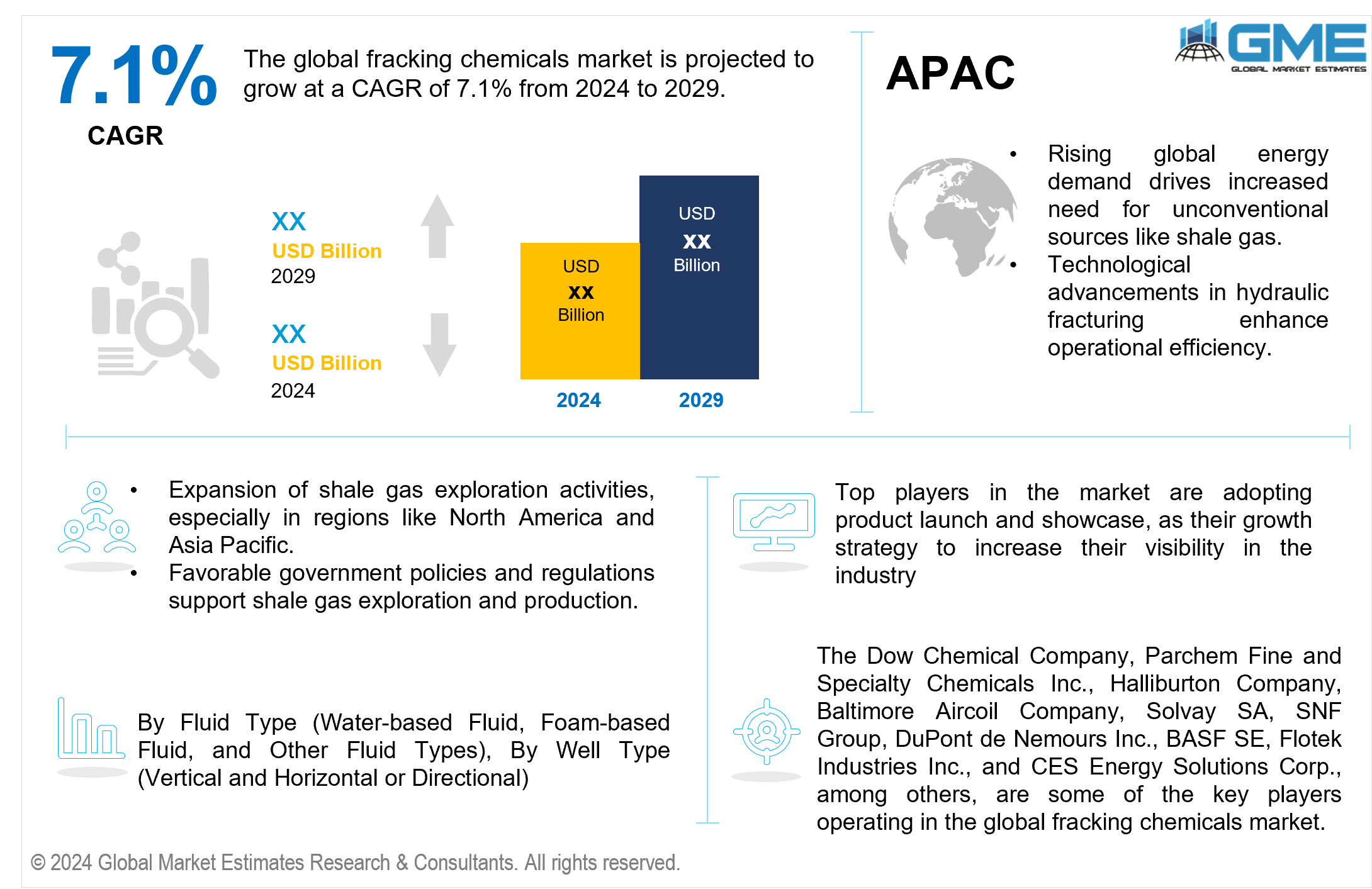

The global fracking chemicals market is projected to grow at a CAGR of 7.1% from 2024 to 2029.

Advances in hydraulic fracturing technology and the growing demand for shale gas extraction are two of the factors propelling the market for fracking chemicals. Fracking fluid additives improves the effectiveness and performance of hydraulic fracturing operations and are crucial to the extraction process. Proppants and other chemical additions are critical elements that keep the cracks open and enhance the extraction process. Fracking chemicals suppliers are focusing towards fracking technology advancements to address the unique needs of various shale formations, which improves production rates and lowers costs.

Fracking chemicals market trendspoint to a transition toward non-toxic fracking chemicals and sustainable fracking practices, owing to rigorous environmental legislation and increased public awareness of fracking's environmental impact. Chemical optimization in fracking is a primary emphasis, with businesses exploring new formulations that reduce environmental impact while retaining high efficiency. This quest for sustainability is aided by advances in fracking fluid systems, which aim to reduce the use of hazardous compounds.

Furthermore, the fracking industry's growth is driven by the overall growth of the oilfield chemicals business and the expansion of the fracking sector. Technological developments in fracking operations, such as enhanced fracking fluid composition and new fracking fluid performance enhancers, help to drive market expansion.

One major restraint for the fracking chemicals market is the increasing regulatory scrutiny and stringent environmental Fracking chemical regulations aimed at minimizing the environmental impact of fracking. These regulations can limit the use of certain chemicals, increase compliance costs, and potentially slow down the fracking industry growth.

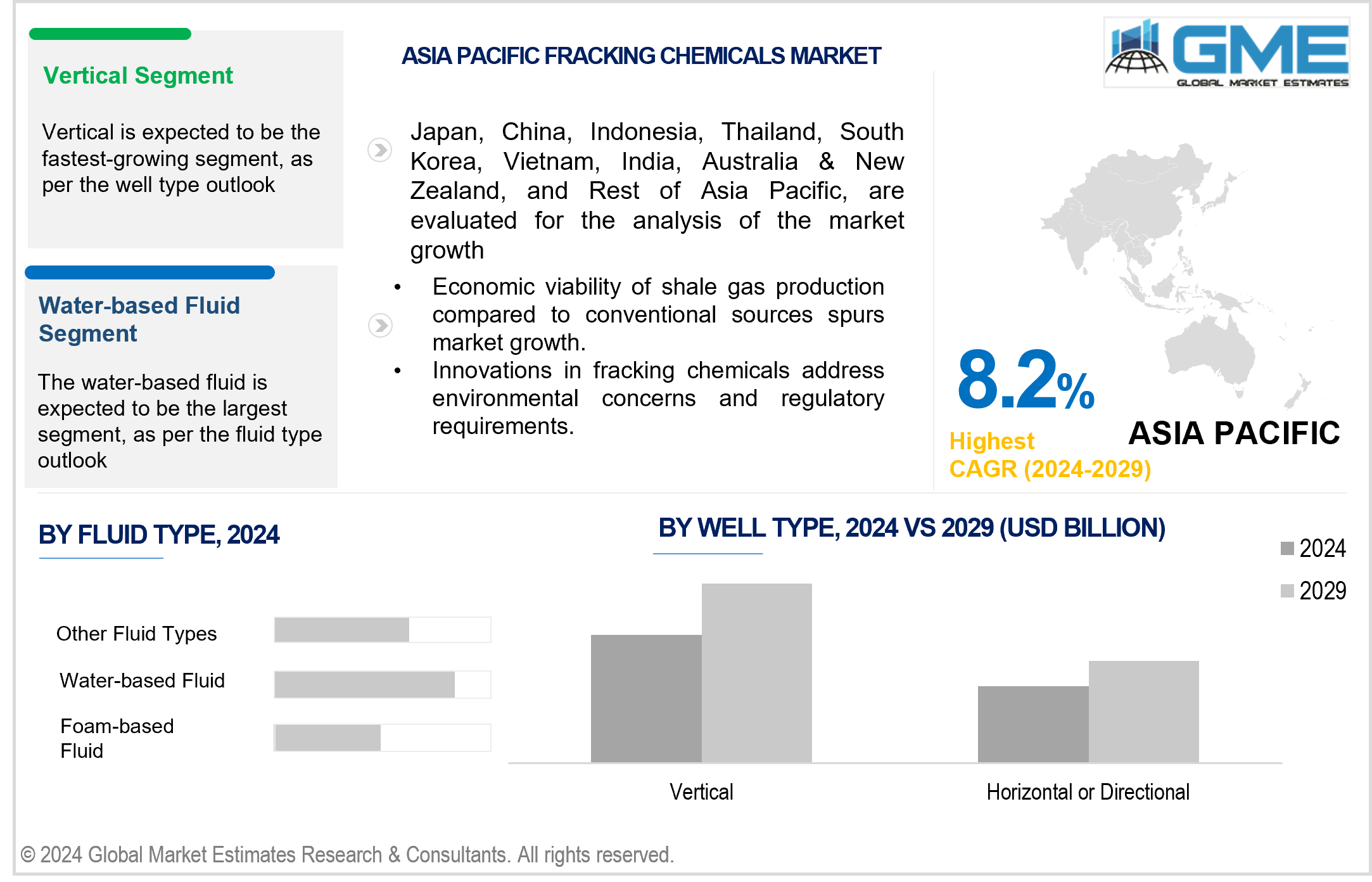

The water-based fluid segment is expected to hold the largest share of the market. The growth of water-based fracking fluids is due to their lower environmental impact compared to oil-based fluids. Water-based fracking fluids are popular because of their low cost, convenience of use, and compatibility with various chemical additions. Furthermore, rising regulatory restrictions and public concern about environmental sustainability push the use of these less destructive, more eco-friendly fluids in hydraulic fracturing operations.

The foam-based fluid segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is attributed to its superior efficiency in water-scarce regions and ability to reduce water usage in fracking operations. Foam-based fluids promote proppant movement and fracture propagation, resulting in increased extraction rates. Their decreased environmental impact, combined with advances in foam fluid technology and increasing regulatory requirements to reduce water use, make them an appealing alternative for sustainable hydraulic fracturing, resulting in substantial industry growth.

The vertical segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Vertical wells are gaining popularity due to their low cost and efficiency in tapping shallower shale seams. Vertical wells are gaining popularity due to their low cost and efficiency in tapping shallower shale seams. Furthermore, technological developments and improved extraction processes are increasing the productivity of vertical wells, making them more appealing and practical options for operators, resulting in significant market expansion.

The horizontal or directional segment is expected to hold the largest share of the market. The growth is due to its ability to access larger volumes of shale gas and oil by extending laterally through the reservoir. This approach maximizes production rates and improves the efficiency of fracking operations. The increasing desire for increased output, combined with technological developments in horizontal drilling, has made this segment the preferred option for many operators.

North America is expected to be the largest region in the global market. The primary reasons boosting the market growth in this region include abundant shale gas reserves and extensive hydraulic fracturing activities, particularly in the United States and Canada. The region's well-established oil and gas industry, advanced extraction technology, and supportive regulatory environment contribute to market growth. Furthermore, significant investments in exploration and production have increased North America's dominance in the worldwide fracking chemicals market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increasing shale gas exploration activities, particularly in countries like China and Australia. Rising energy demand, combined with technological advances in hydraulic fracturing techniques, is driving market growth in the region.

The Dow Chemical Company, Parchem Fine and Specialty Chemicals Inc., Halliburton Company, Baltimore Aircoil Company, Solvay SA, SNF Group, DuPont de Nemours Inc., BASF SE, Flotek Industries Inc., and CES Energy Solutions Corp., among others, are some of the key players operating in the global fracking chemicals market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2024, DuPont outlined a strategic plan to divide itself into three separate, publicly traded companies: New DuPont, Electronics, and Water. This move aims to unlock shareholder value by allowing each entity to focus more intensely on its respective markets and growth opportunities.

In September 2023, Baltimore Aircoil Company (BAC) announced the acquisition of Coil Design LLC, a manufacturer of cooling and heating coils based in Dayton, Tennessee. This acquisition is aimed at bolstering BAC's leadership in the cooling solutions market, particularly in enhancing their capabilities in evaporative hybrid and adiabatic technologies. Coil Design, previously a joint venture partner with BAC, has demonstrated substantial growth and innovation in cooling technologies, aligning well with BAC's commitment to sustainability and customer-centric solutions.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL FRACKING CHEMICALS MARKET, BY FLUID TYPE

4.1 Introduction

4.2 Fracking Chemicals Market: Fluid Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Water-based Fluid

4.4.1 Water-based Fluid Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Foam-based Fluid

4.5.1 Foam-based Fluid Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Other Fluid Types

4.6.1 Other Fluid Types Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL FRACKING CHEMICALS MARKET, BY WELL TYPE

5.1 Introduction

5.2 Fracking Chemicals Market: Well Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Vertical

5.4.1 Vertical Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Horizontal or Directional

5.5.1 Horizontal or Directional Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL FRACKING CHEMICALS MARKET, BY REGION

6.1 Introduction

6.2 North America Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Fluid Type

6.2.2 By Well Type

6.2.3 By Country

6.2.3.1 U.S. Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Fluid Type

6.2.3.1.2 By Well Type

6.2.3.2 Canada Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Fluid Type

6.2.3.2.2 By Well Type

6.2.3.3 Mexico Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Fluid Type

6.2.3.3.2 By Well Type

6.3 Europe Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Fluid Type

6.3.2 By Well Type

6.3.3 By Country

6.3.3.1 Germany Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Fluid Type

6.3.3.1.2 By Well Type

6.3.3.2 U.K. Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Fluid Type

6.3.3.2.2 By Well Type

6.3.3.3 France Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Fluid Type

6.3.3.3.2 By Well Type

6.3.3.4 Italy Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Fluid Type

6.3.3.4.2 By Well Type

6.3.3.5 Spain Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Fluid Type

6.3.3.5.2 By Well Type

6.3.3.6 Netherlands Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Fluid Type

6.3.3.6.2 By Well Type

6.3.3.7 Rest of Europe Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Fluid Type

6.3.3.6.2 By Well Type

6.4 Asia Pacific Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Fluid Type

6.4.2 By Well Type

6.4.3 By Country

6.4.3.1 China Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Fluid Type

6.4.3.1.2 By Well Type

6.4.3.2 Japan Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Fluid Type

6.4.3.2.2 By Well Type

6.4.3.3 India Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Fluid Type

6.4.3.3.2 By Well Type

6.4.3.4 South Korea Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Fluid Type

6.4.3.4.2 By Well Type

6.4.3.5 Singapore Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Fluid Type

6.4.3.5.2 By Well Type

6.4.3.6 Malaysia Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Fluid Type

6.4.3.6.2 By Well Type

6.4.3.7 Thailand Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Fluid Type

6.4.3.6.2 By Well Type

6.4.3.8 Indonesia Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Fluid Type

6.4.3.7.2 By Well Type

6.4.3.9 Vietnam Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Fluid Type

6.4.3.8.2 By Well Type

6.4.3.10 Taiwan Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Fluid Type

6.4.3.10.2 By Well Type

6.4.3.11 Rest of Asia Pacific Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Fluid Type

6.4.3.11.2 By Well Type

6.5 Middle East and Africa Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Fluid Type

6.5.2 By Well Type

6.5.3 By Country

6.5.3.1 Saudi Arabia Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Fluid Type

6.5.3.1.2 By Well Type

6.5.3.2 U.A.E. Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Fluid Type

6.5.3.2.2 By Well Type

6.5.3.3 Israel Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Fluid Type

6.5.3.3.2 By Well Type

6.5.3.4 South Africa Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Fluid Type

6.5.3.4.2 By Well Type

6.5.3.5 Rest of Middle East and Africa Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Fluid Type

6.5.3.5.2 By Well Type

6.6 Central and South America Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Fluid Type

6.6.2 By Well Type

6.6.3 By Country

6.6.3.1 Brazil Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Fluid Type

6.6.3.1.2 By Well Type

6.6.3.2 Argentina Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Fluid Type

6.6.3.2.2 By Well Type

6.6.3.3 Chile Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Fluid Type

6.6.3.3.2 By Well Type

6.6.3.3 Rest of Central and South America Fracking Chemicals Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Fluid Type

6.6.3.3.2 By Well Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 The Dow Chemical Company

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Parchem Fine and Specialty Chemicals Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Halliburton Company

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Baltimore Aircoil Company

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Solvay SA

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 BASF SE

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 SNF Group

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 DuPont de Nemours Inc.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Flotek Industries Inc.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 CES Energy Solutions Corp.

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

2 Water-based Fluid Market, By Region, 2021-2029 (USD Million)

3 Other Fluid Types Market, By Region, 2021-2029 (USD Million)

4 Global Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

5 Vertical Market, By Region, 2021-2029 (USD Million)

6 Horizontal or Directional Market, By Region, 2021-2029 (USD Million)

7 Regional Analysis, 2021-2029 (USD Million)

8 North America Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

9 North America Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

10 North America Fracking Chemicals Market, By COUNTRY, 2021-2029 (USD Million)

11 U.S. Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

12 U.S. Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

13 Canada Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

14 Canada Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

15 Mexico Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

16 Mexico Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

17 Europe Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

18 Europe Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

19 Europe Fracking Chemicals Market, By Country, 2021-2029 (USD Million)

20 Germany Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

21 Germany Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

22 U.K. Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

23 U.K. Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

24 France Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

25 France Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

26 Italy Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

27 Italy Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

28 Spain Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

29 Spain Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

30 Netherlands Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

31 Netherlands Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

32 Rest Of Europe Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

33 Rest Of Europe Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

34 Asia Pacific Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

35 Asia Pacific Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

36 Asia Pacific Fracking Chemicals Market, By Country, 2021-2029 (USD Million)

37 China Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

38 China Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

39 Japan Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

40 Japan Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

41 India Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

42 India Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

43 South Korea Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

44 South Korea Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

45 Singapore Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

46 Singapore Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

47 Thailand Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

48 Thailand Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

49 Malaysia Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

50 Malaysia Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

51 Indonesia Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

52 Indonesia Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

53 Vietnam Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

54 Vietnam Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

55 Taiwan Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

56 Taiwan Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

57 Rest of APAC Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

58 Rest of APAC Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

59 Middle East and Africa Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

60 Middle East and Africa Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

61 Middle East and Africa Fracking Chemicals Market, By Country, 2021-2029 (USD Million)

62 Saudi Arabia Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

63 Saudi Arabia Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

64 UAE Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

65 UAE Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

66 Israel Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

67 Israel Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

68 South Africa Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

69 South Africa Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

70 Rest Of Middle East and Africa Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

71 Rest Of Middle East and Africa Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

72 Central and South America Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

73 Central and South America Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

74 Central and South America Fracking Chemicals Market, By Country, 2021-2029 (USD Million)

75 Brazil Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

76 Brazil Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

77 Chile Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

78 Chile Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

79 Argentina Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

80 Argentina Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

81 Rest Of Central and South America Fracking Chemicals Market, By Fluid Type, 2021-2029 (USD Million)

82 Rest Of Central and South America Fracking Chemicals Market, By Well Type, 2021-2029 (USD Million)

83 The Dow Chemical Company: Products & Services Offering

84 Parchem Fine and Specialty Chemicals Inc.: Products & Services Offering

85 Halliburton Company: Products & Services Offering

86 Baltimore Aircoil Company: Products & Services Offering

87 Solvay SA: Products & Services Offering

88 BASF SE: Products & Services Offering

89 SNF Group : Products & Services Offering

90 DuPont de Nemours Inc.: Products & Services Offering

91 Flotek Industries Inc., Inc: Products & Services Offering

92 CES Energy Solutions Corp.: Products & Services Offering

93 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Fracking Chemicals Market Overview

2 Global Fracking Chemicals Market Value From 2021-2029 (USD Million)

3 Global Fracking Chemicals Market Share, By Fluid Type (2023)

4 Global Fracking Chemicals Market Share, By Well Type (2023)

5 Global Fracking Chemicals Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Fracking Chemicals Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Fracking Chemicals Market

10 Impact Of Challenges On The Global Fracking Chemicals Market

11 Porter’s Five Forces Analysis

12 Global Fracking Chemicals Market: By Fluid Type Scope Key Takeaways

13 Global Fracking Chemicals Market, By Fluid Type Segment: Revenue Growth Analysis

14 Water-based Fluid Market, By Region, 2021-2029 (USD Million)

15 Foam-based Fluid Market, By Region, 2021-2029 (USD Million)

16 Other Fluid Types Market, By Region, 2021-2029 (USD Million)

17 Global Fracking Chemicals Market: By Well Type Scope Key Takeaways

18 Global Fracking Chemicals Market, By Well Type Segment: Revenue Growth Analysis

19 Vertical Market, By Region, 2021-2029 (USD Million)

20 Horizontal or Directional Market, By Region, 2021-2029 (USD Million)

21 Regional Segment: Revenue Growth Analysis

22 Global Fracking Chemicals Market: Regional Analysis

23 North America Fracking Chemicals Market Overview

24 North America Fracking Chemicals Market, By Fluid Type

25 North America Fracking Chemicals Market, By Well Type

26 North America Fracking Chemicals Market, By Country

27 U.S. Fracking Chemicals Market, By Fluid Type

28 U.S. Fracking Chemicals Market, By Well Type

29 Canada Fracking Chemicals Market, By Fluid Type

30 Canada Fracking Chemicals Market, By Well Type

31 Mexico Fracking Chemicals Market, By Fluid Type

32 Mexico Fracking Chemicals Market, By Well Type

33 Four Quadrant Positioning Matrix

34 Company Market Share Analysis

35 The Dow Chemical Company: Company Snapshot

36 The Dow Chemical Company: SWOT Analysis

37 The Dow Chemical Company: Geographic Presence

38 Parchem Fine and Specialty Chemicals Inc.: Company Snapshot

39 Parchem Fine and Specialty Chemicals Inc.: SWOT Analysis

40 Parchem Fine and Specialty Chemicals Inc.: Geographic Presence

41 Halliburton Company: Company Snapshot

42 Halliburton Company: SWOT Analysis

43 Halliburton Company: Geographic Presence

44 Baltimore Aircoil Company: Company Snapshot

45 Baltimore Aircoil Company: Swot Analysis

46 Baltimore Aircoil Company: Geographic Presence

47 Solvay SA: Company Snapshot

48 Solvay SA: SWOT Analysis

49 Solvay SA: Geographic Presence

50 BASF SE: Company Snapshot

51 BASF SE: SWOT Analysis

52 BASF SE: Geographic Presence

53 SNF Group : Company Snapshot

54 SNF Group : SWOT Analysis

55 SNF Group : Geographic Presence

56 DuPont de Nemours Inc.: Company Snapshot

57 DuPont de Nemours Inc.: SWOT Analysis

58 DuPont de Nemours Inc.: Geographic Presence

59 Flotek Industries Inc., Inc.: Company Snapshot

60 Flotek Industries Inc., Inc.: SWOT Analysis

61 Flotek Industries Inc., Inc.: Geographic Presence

62 CES Energy Solutions Corp.: Company Snapshot

63 CES Energy Solutions Corp.: SWOT Analysis

64 CES Energy Solutions Corp.: Geographic Presence

65 Other Companies: Company Snapshot

66 Other Companies: SWOT Analysis

67 Other Companies: Geographic Presence

The Global Fracking Chemicals Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Fracking Chemicals Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS