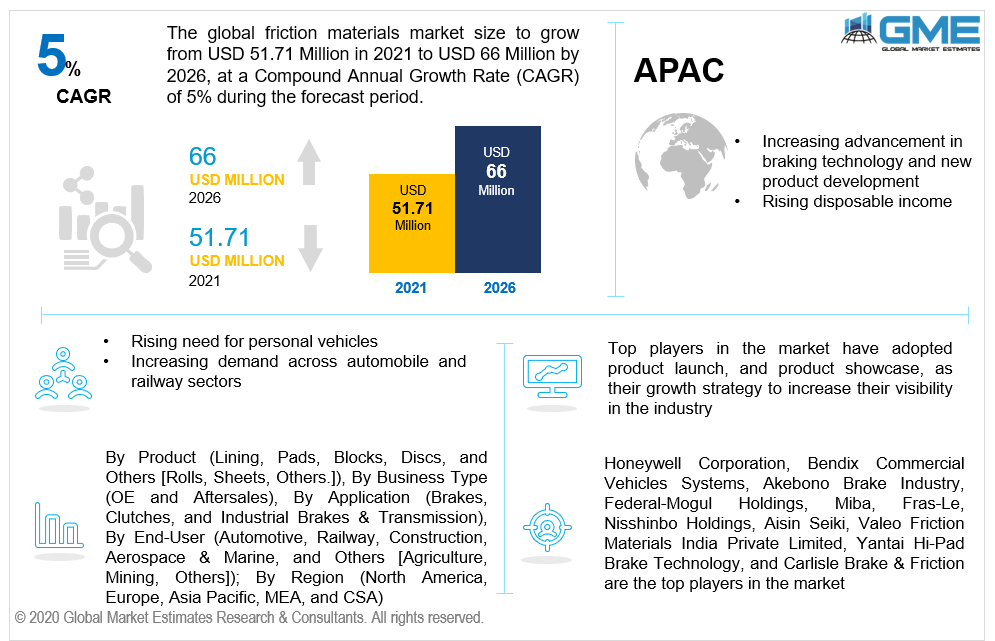

Global Friction Materials Market Size, Trends & Analysis - Forecasts to 2026 By Product (Lining, Pads, Blocks, Discs, and Others [Rolls, Sheets, Others]), By Business Type (OE and Aftersales), By Application (Brakes, Clutches, and Industrial Brakes & Transmission), By End-User (Automotive, Railway, Construction, Aerospace & Marine, and Others [Agriculture, Mining, Others]); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The friction materials market is estimated to be valued at USD 51.71 million in 2021 and is projected to reach USD 66 million by 2026 at a CAGR of 5%. The major market drivers that will enhance growth are technological advancements in braking systems and the rising demand for personal vehicles. Due to the rising population, the demand for commercial & passenger vehicles will increase, which gives a boost to the market. The other key market drivers are expanding the quality of such materials & products and as a result of sophisticated advances in braking systems; there will be a rise in the market growth over the forecast period. Moreover, manufacturers are maximizing their earnings in this market while still adhering to regulations. An influx of new competitors is envisaged throughout the forecast period as a result of the introduction of upgraded technology.

The escalating requirement for the purchase of passenger & commercial vehicles is the foremost prominent accelerator in the global market. This has resulted in increasing manufacturing, fueling demand for such materials used in automotive components. New product development by manufacturers to grab a larger footprint will also foster growth and will act as a driver for the frictional materials market. Increasing disposable income in developing economies will foster demand across different end-user industries and will also contribute to market growth. Moreover, the development across different verticals, such as the aerospace industry, agriculture, mining, and construction, is anticipated to drive the market for frictional materials.

Such materials can resist severe deterioration as well as high temperatures, which is a critical element driving market expansion. Further, a considerable increment in demand for electric vehicles, a rapidly expanding services industry in many regions, and a growing absence of stronger inter-city community transportation facilities in many nations are triggering a considerable spike in private automobile ownership and skyrocketing demand in the automotive industry owing to population growth, which is one of the key aspects of propelling the market. Furthermore, escalating demand for lightweight friction products in the automotive end-use sector, as well as expanding technical advances and modernization in such materials, will offer new possibilities for the market during the forecast period.

Nevertheless, the soaring pervasiveness of counterfeit brake components is a critical determinant that acts as a substantial attribute, amongst others, posing constraints, while breakthroughs in braking technologies to eliminate the utilization of such materials will further assert the development of the market during the forecast period. Such materials have to comply with regulatory bodies such as the Friction Materials Standards Institute (FMSI), SAE International and meet the Restriction of Hazardous Substances (RoHS) standards. Thus, leading to skyrocketing demand for such materials.

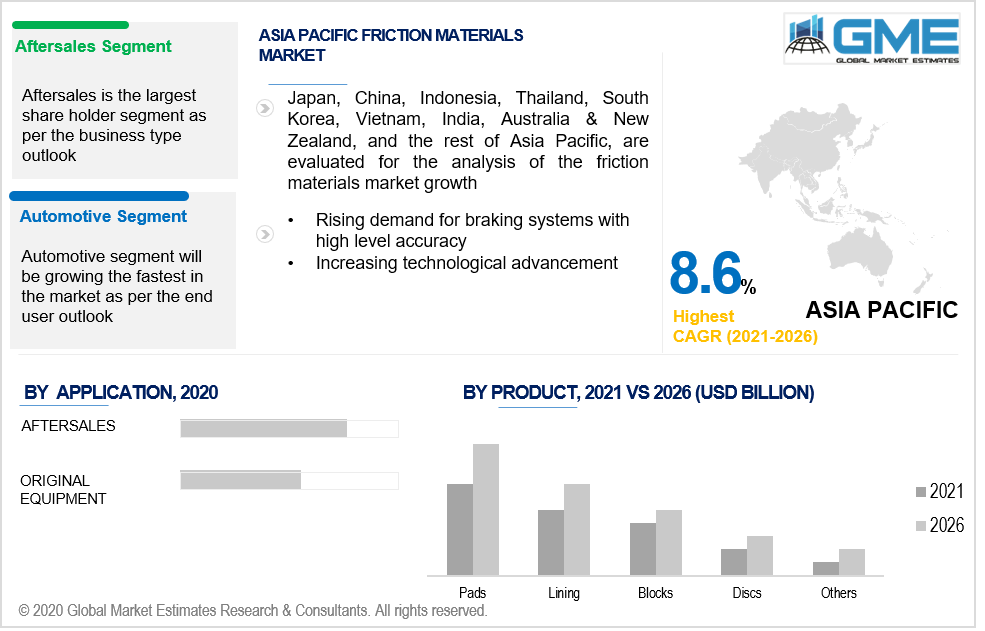

Based on products, the market is segmented into lining, pads, blocks, discs, and others. The other segment comprises rolls, sheets, and many more. Pad segments hold the largest market share due to their increasing application in industrial brakes & automobile braking systems and new developments in the automobile industry. These brake pads are commonly utilized in light cars and some types of machinery. These pads are deployed in braking systems when there is a lot of friction, which causes the system to wear down. As a result, these goods are processed to emit less pollution and to be less susceptible to deterioration at elevated temperatures.

Based on business type, the market is segmented into original equipment (OE) and aftersales. The aftersales market segment is likely to report the largest market share. This is due to the perishability of frictional products as they are consumable products and these products have higher requirements in the end-user industry. And also, due to new technological advancements, new frictional products have been introduced into the market and these products are in higher demand. As they do not come with the original equipment, these products are available in the aftersales market. So, this will foster the growth of the aftersales market segment during the forecast period.

Based on application, the market is segmented into brakes, clutches, and industrial brakes and transmissions. Due to their rising demand and increasing consumption, brakes hold the largest market share in this segment. The other factors that contribute towards are increasing demand for personal vehicles which will positively affect the demand for frictional materials in the braking system in the automobile sector.

Based on the end-user analysis, the market is segmented into the automotive, railway, construction, aerospace and marine, and others. Others include agriculture, mining, and many others. The automotive sector is foreseen to hold the maximum share of the market. The demand in this segment is rising due to the increasing requirement for braking and transmission systems. Also, the technological advancement in the gear and clutch system will foster the growth of the market. Such materials are becoming more popular in both light and heavy-duty automobiles, which leads to automotive segment's supremacy.

The APAC region dominates the frictional material market and holds the largest market share. This domination is due to the increasing disposable income of developing economies and the higher demand for private vehicles in this region. Moreover, the increase in spending by manufacturers on technological advancement and the increasing development across industries such as railways, automobiles, agriculture, and construction in countries like India and China will enhance the APAC region to grow at a faster rate.

Because of the area's expanding car industry, North America is a key location for the frictional materials market. Furthermore, technological advancements occurring throughout the area are fueling the expansion of this market. In North America, many producers and suppliers are working on novel technical breakthroughs to assist the development of the market.

Throughout the forecast period, Europe is expected to expand significantly. The European Union has enacted an integrated Pollution Prevention and Control Directive in order to reduce the use of hazardous chemicals, which has had a significant impact on the aggregate growth of the market in this area. To circumvent these regulations, EBC created ceramic brakes, which are presently driving the market.

Honeywell Corporation, Bendix Commercial Vehicles Systems, Akebono Brake Industry, Federal-Mogul Holdings, Miba, Fras-Le, Nisshinbo Holdings, Aisin Seiki, Valeo Friction Materials India Private Limited, Yantai Hi-Pad Brake Technology, and Carlisle Brake & Friction are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Battery Testing Equipment Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Business Type Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Battery Testing Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Technological Advancements And Modernization In The Friction Materials

3.3.1.2 Increasing Demand For Lightweight Friction Products In Automotive

3.3.2 Industry Challenges

3.3.2.1 Rising Prevalence Of Fake Brake Materials

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Business Type Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Battery Testing Equipment Market, By Product

4.1 Product Outlook

4.2 Lining

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Pads

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Blocks

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Discs

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Others

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.6.2 Rolls, Market Size, By Region, 2016-2026 (USD Million)

4.6.3 Sheets, Market Size, By Region, 2016-2026 (USD Million)

4.6.4 Others, Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Battery Testing Equipment Market, By Application

5.1 Application Outlook

5.2 Brakes

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Clutches

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Industrial Brakes & Transmission

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Battery Testing Equipment Market, By Business Type

6.1 Business Type Outlook

6.2 OE

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Aftersales

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Battery Testing Equipment Market, By End-User

7.1 End-User Outlook

7.2 Automotive

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Railway

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

7.5 Construction

7.5.1 Market Size, By Region, 2016-2026 (USD Million)

7.6 Aerospace & Marine

7.6.1 Market Size, By Region, 2016-2026 (USD Million)

7.7 Others

7.7.1 Market Size, By Region, 2016-2026 (USD Million)

7.7.2 Agriculture, Market Size, By Region, 2016-2026 (USD Million)

7.7.3 Mining, Market Size, By Region, 2016-2026 (USD Million)

7.7.4 Others, Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Battery Testing Equipment Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2016-2026 (USD Million)

8.2.2 Market Size, By Product, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By Business Type, 2016-2026 (USD Million)

8.2.5 Market Size, By End-User, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.2.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2016-2026 (USD Million)

8.3.2 Market Size, By Product, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.5 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2016-2026 (USD Million)

8.4.2 Market Size, By Product, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By Business Type, 2016-2026 (USD Million)

8.4.5 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market size, By Business Type, 2016-2026 (USD Million)

8.4.9.4 Market size, By End-User, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2016-2026 (USD Million)

8.5.2 Market Size, By Product, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By Business Type, 2016-2026 (USD Million)

8.5.5 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2016-2026 (USD Million)

8.6.2 Market Size, By Product, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By Business Type, 2016-2026 (USD Million)

8.6.5 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Business Type, 2016-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Honeywell Corporation

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Bendix Commercial Vehicles Systems

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Akebono Brake Industry

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Federal-Mogul Holdings

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Miba

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Fras-Le

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Nisshinbo Holdings

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Aisin Seiki

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Valeo Friction Materials India Private Limited

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Yantai Hi-Pad Brake Technology

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Carlisle Brake & Friction

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Other Companies

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

The Global Friction Materials Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Friction Materials Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS