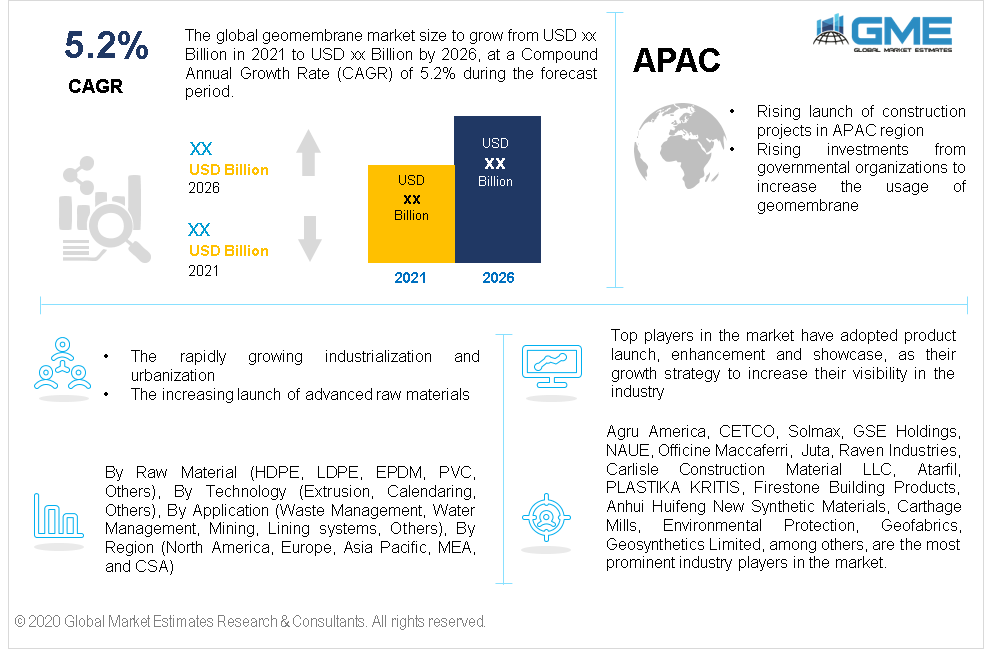

Global Geomembrane Market Size, Trends, and Analysis- Forecasts to 2026 By Raw Material (HDPE, LDPE, EPDM, PVC, Others), By Technology (Extrusion, Calendaring, Others), By Application (Waste Management, Water Management, Mining, Lining Systems, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

A Geomembrane is a layer with an extremely low permeable nature that prevents fluids from passing out or controlling the fluid migration in man made systems, infrastructures, or projects. The geomembrane is manufactured using a thin sheet of polymer, which is extensively used across various verticals. Rising urbanization, increasing number of building projects and other infrastructural constructions in developing regions, increasing awareness about wastewater treatments, and rising investments from governmental organizations are increasing the usage of geomembrane in the global market.

The geomembrane is widely used in various industrial projects, structures, and systems, owing to its favorable properties like its thickness, smooth textured sheet, with high density, and vapor transmission. American Society of Testing and Materials, International Organisations of Standardisation, and Geosynthetic Research Institute have developed many tests to study the materialist properties of geomembrane sheets. These tests have tried to determine the strength of the sheet, their quality, and durability. The geomembrane has mechanical properties like resistance to wear and tear, any pressure impact, or puncture, and it has extensive width to the material and high elongation. Geomembrane also facilitates ease in operation and molding used during the built of any project or structure. Studies have proved its sustainability and durability to various environmental conditions. The specific type of geomembrane also exhibits the property of UV shield.

Manufacturers of geomembrane give significant importance to the selection of polymer resin base, which is the crucial part that determines the quality of the geomembrane. Next, the essential and appropriate combination of additives such as carbon black and antioxidants is added along with stabilizers to the geomembrane's manufacturing process to guarantee durability and sustained lifespan of the sheet in any condition.

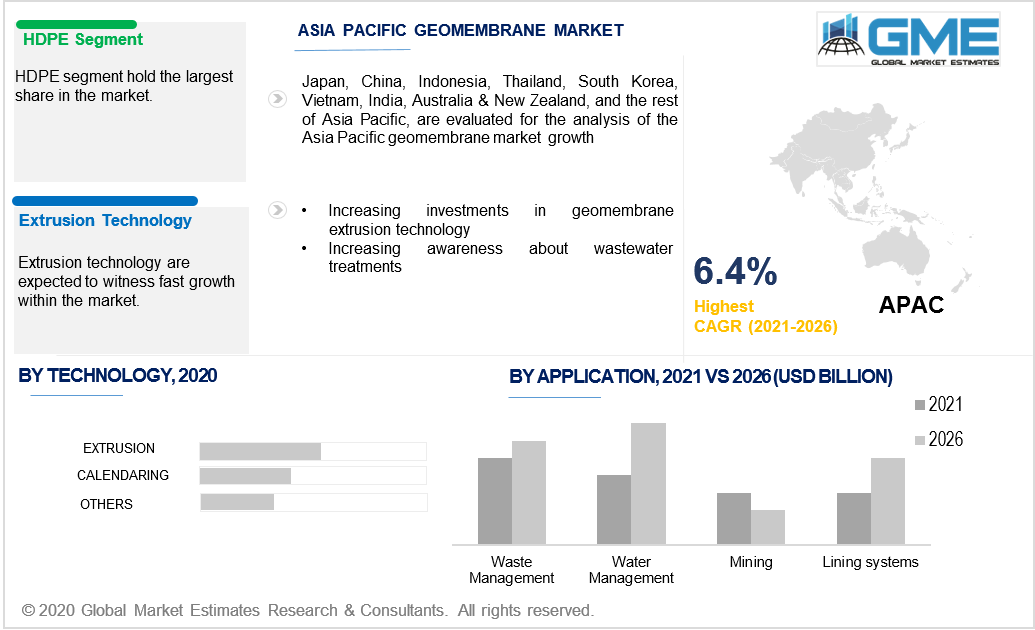

Various types of raw materials are used in the manufacturing process of geomembrane. However, HDPE is the most commonly and majorly used raw material. Compared to the rest of the liner raw materials, HDPE is preferred due to its extensively operational and economical advantages. The manufacturing process of HDPE geomembrane is reasonably less complex than the rest of the raw material types, which makes it a more demanded and positively driven supply, and thus, it is considered superior to the rest of the raw material types.

The HDPE manufacturing process incorporates the formulation of mostly 95% to 98% os resins which is the highest level compared to the rest, which increases its durability and control power to prevent fluid migration. HDPE also consists of 2 to 3 per cent of black carbon and 0.25 to 1 per cent of additives that increase lifespan and resistivity. The physical properties exhibited by HDPE make it the more favorable raw material. The tests carried out by the American Society of Testing and Materials and by the International Organisation of Standardization have certainly found very minimal differences between the properties facilitated by HDPE and PVC raw material. However, HDPE outperforms the properties showcased by PVC, especially in terms of resistance to wear and tear and resistance to drastic environmental changes and conditions. The materials used in HDPE make it a long term product and the most preferred choice in waterproofing, land filing, and other applications.

Extrusion technology is high adapted in the geomembrane market and hence bags the top position in the market in terms of revenue share. Extrusion technology displays high adaptability to different circumstances, which makes it easy for the manufacturers to facilitate the specific requirements of the end-users and their applicational purposes. This extrusion technology also enables the manufacturers to satisfy the product characteristics required or demanded by specific end users. The technology enables to provide various shapes, textures, sizes, and appearances, which best suit the infrastructural procedures and the requirements of the end users pertaining to their projects. This specific quality of customizing the product characteristics is not provided by any other technology available in the market other than the extrusion technology.

Since the technology utilizes higher temperatures and heating processes, the manufacturers are able to produce geomembranes of higher quality and consistency. The extrusion technology also enables the industry players to lower their processing or production costs, as well as helps save the raw material and excess usage. It assists the producers in saving their costs on labor and other capital investments. This technological advancement allows the producers of geomembranes to increase their productivity and sustain continuous production processes. The extrusion technology also prevents waste generation or emission of effluents. The above mentioned features make this technology most used and preferred over the rest of the technologies.

Based on application, the market is split into waste management, water management, mining, lining systems, others. Geomembrane sheets are majorly used in the mining industry and hence the mining application segment will be the largest segment in the market from 2021 to 2026. The geomembranes are applied in bottom liners, canal liners, and pond liners. The light weight of the geomembrane sheets and its easy installation and application procedures at the mining sites make it more favorable in this industry.

The Asia Pacific region has its dominance in the geomembrane market. The countries in the Asia Pacific region are the biggest manufacturers of the geomembrane sheets and are also the most prominent end users of them. The increasing mining, waste treatment, and water treatments have been drastically boosting the demand for geomembranes in the market. The APAC region has the majority of the developing countries, becomes a hub and an opportunistic space for new manufacturers to emerge and earn profitable revenues. Also, the increasing government investments in developing and bringing technological advancements enable the manufacturers in the south Asian region to increase the manufacturing process and raise their productivity. The North American region will be the second largest region in the market.

Agru America, CETCO, Solmax, GSE Holdings, NAUE, Officine Maccaferri, Juta, Raven Industries, Carlisle Construction Material LLC, Atarfil, PLASTIKA KRITIS, Firestone Building Products, Anhui Huifeng New Synthetic Materials, Carthage Mills, Environmental Protection, Geofabrics, Geosynthetics Limited, Ginegar Plastic Products, Global Synthetics, Layfield Group, Nilex, SOTRAFA, SOPREMA, Texel Industries Limited, Titan Environmental Containment, and US Fabrics (US) are some of the significant industry players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Geomembrane Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Raw Material Overview

2.1.3 Technology Overview

2.1.4 Application Overview

2.1.6 Regional Overview

Chapter 3 Geomembrane Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising urbanization and commercialization

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated construction systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Raw Material Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Geomembrane Market, By Raw Material

4.1 Raw Material Outlook

4.2 HDPE

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 LDPE

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 EPDM

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 PVC

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Geomembrane Market, By Application

5.1 Application Outlook

5.2 Waste Management

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Water Management

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Mining

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Lining System

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Geomembrane Market, By Technology

6.1 Extrusion

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Calendaring

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Geomembrane Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Raw Material, 2020-2026 (USD Million)

7.2.3 Market Size, By Technology, 2020-2026 (USD Million)

7.2.4 Market Size, By Application, 2020-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.2.4.2 Market Size, By Technology, 2020-2026 (USD Million)

7.2.4.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.2.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.3 Market Size, By Technology, 2020-2026 (USD Million)

7.3.4 Market Size, By Application, 2020-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.9.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.10.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.3.11.2 Market Size, By Technology, 2020-2026 (USD Million)

7.3.11.3 Market Size, By Application, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.3 Market Size, By Technology, 2020-2026 (USD Million)

7.4.4 Market Size, By Application, 2020-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Technology, 2020-2026 (USD Million)

7.4.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.9.2 Market size, By Technology, 2020-2026 (USD Million)

7.4.9.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.4.10.2 Market Size, By Technology, 2020-2026 (USD Million)

7.4.10.3 Market Size, By Application, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Raw Material, 2020-2026 (USD Million)

7.5.3 Market Size, By Technology, 2020-2026 (USD Million)

7.5.4 Market Size, By Application, 2020-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Technology, 2020-2026 (USD Million)

7.5.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Raw Material, 2020-2026 (USD Million)

7.6.3 Market Size, By Technology, 2020-2026 (USD Million)

7.6.4 Market Size, By Application, 2020-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Technology, 2020-2026 (USD Million)

7.6.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Raw Material, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Technology, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Application, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Agru America

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 CETCO

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Solmax

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 GSE Holdings

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 NAUE

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Officine Maccaferri,

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Juta

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Raven Industries

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Carlisle Construction Material LLC

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Geomembrane Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Geomembrane Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS