Global Green Hydrogen Market Size, Trends & Analysis - Forecasts to 2029 By Technology Type (Alkaline Electrolysis and PEM Electrolysis), By End-use Industry (Chemicals, Mobility, Power Generation, Grid Injection, Industrial, and Others), By Renewable Source (Wind, Solar, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

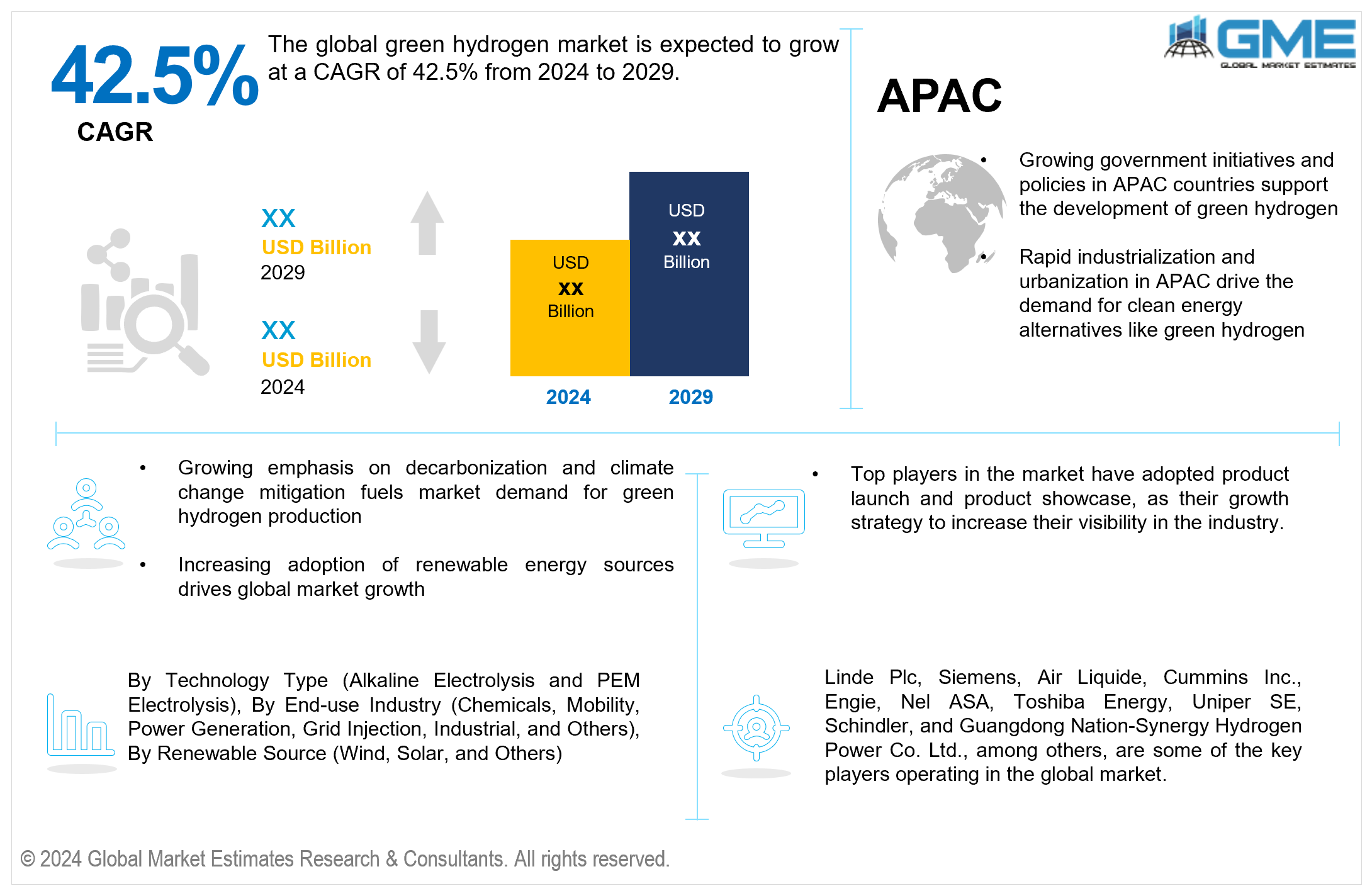

The global green hydrogen market is expected to exhibit a CAGR of 42.5% from 2024 to 2029. Green hydrogen is produced using renewable energy sources like wind or solar power, converting water molecules into hydrogen and oxygen through electrolysis. It is a sustainable and environmentally friendly alternative to traditional methods that emit carbon emissions.

Several market drivers influence the growth of the global green hydrogen market. Climate change concerns have led to a growing focus on reducing carbon emissions, with green hydrogen produced using renewable energy sources, offering a clean alternative to traditional methods that appeal to industries. Renewable energy sources like wind and solar power are expanding, allowing for green hydrogen production. Excess renewable energy can be stored as hydrogen through electrolysis, promoting supply-demand balance and grid stability. Green hydrogen is being researched as a viable replacement to fossil fuels in various industries, including public transit, manufacturing, and energy generation because it can power fuel cell cars, heat processes, and create electricity. Advancements in electrolysis technology, including efficiency and cost reduction, are making green hydrogen production economically viable. Research and development efforts focus on improving electrolyzer performance and exploring new hydrogen storage and transportation methods.

Despite the promising growth prospects, the global green hydrogen market faces certain restraints that hinder its growth. The setup costs for green hydrogen production facilities, including infrastructure for electrolyzers and renewable energy sources, can be substantial. This high initial investment may deter some potential investors or slow down the expansion of the market.

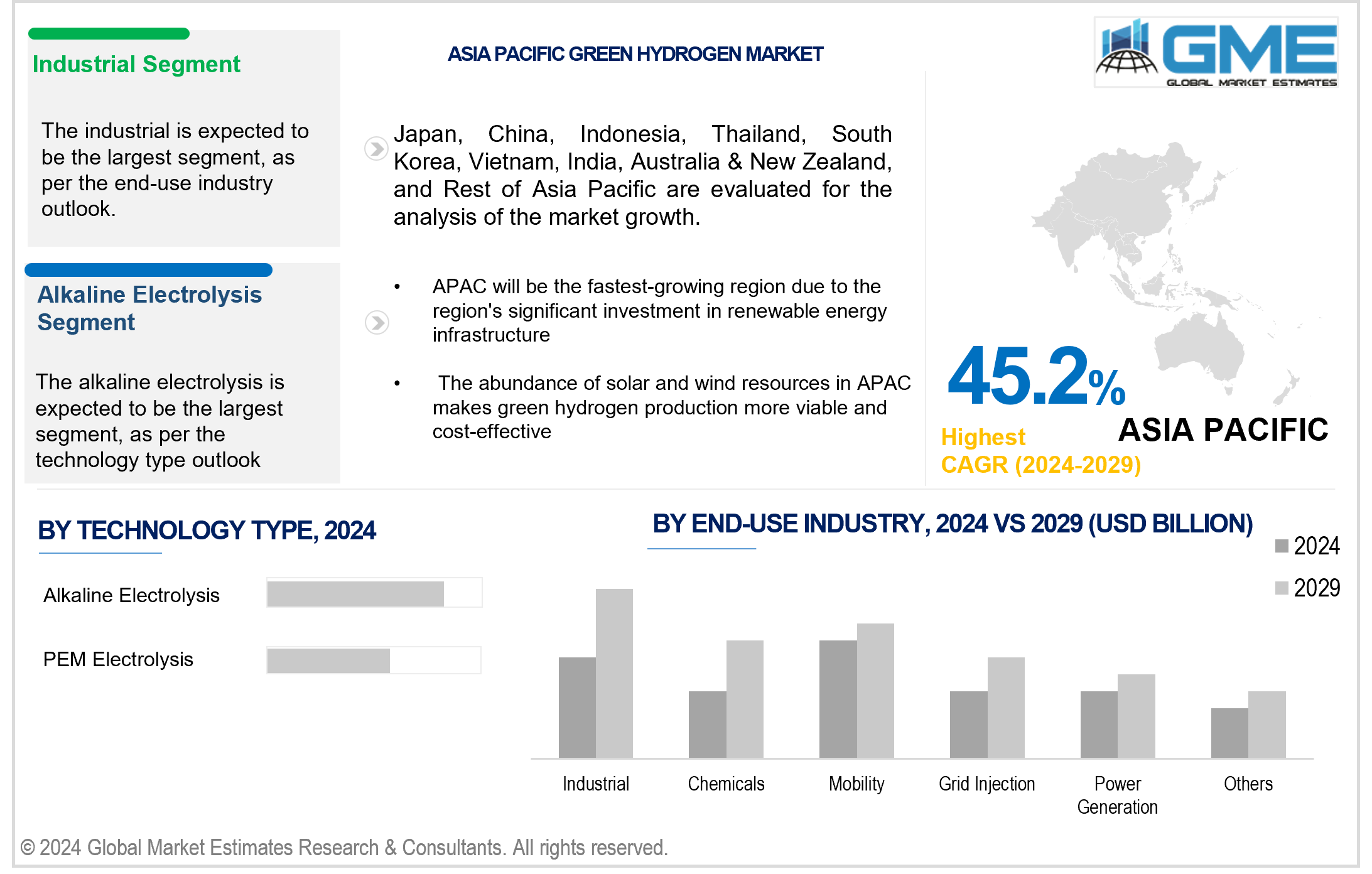

Based on the technology type, the market is segmented into alkaline electrolysis and PEM electrolysis. The alkaline electrolysis segment is expected to be the largest segment during the forecast period. Alkaline electrolysers are preferred for large-scale hydrogen production due to their cost-effectiveness and versatility, making them suitable for various electricity sources, including renewables, contributing to their dominance in the market due to their maturity and cost-effectiveness.

The PEM (Proton Exchange Membrane) electrolysis segment is expected to be the fastest-growing segment in the global green hydrogen market. Unlike traditional alkaline electrolysers, PEM systems operate at higher current densities, making them well-suited for dynamic environments where renewable energy availability fluctuates. Their lower operational temperature and pressure requirements also contribute to their scalability and ease of integration with renewable energy sources, driving their popularity in green hydrogen production.

On the basis of end-use industry, the market is segmented into chemicals, mobility, power generation, grid injection, industrial, and others. The industrial segment is expected to be the largest segment during the forecast period. Green hydrogen is a promising solution for decarbonizing heavy industries like steel, chemicals, and fertilizers, which are traditionally carbon-intensive and difficult to tackle with other renewable energy sources. It offers a viable alternative for high-grade heat processes and serves as a feedstock in chemical reactions, leading to the segment's dominance in the market.

The mobility segment is expected to be the fastest-growing in the global green hydrogen market during the forecast period. The push for decarbonization in transportation, particularly in heavy-duty vehicles, buses, trains, and even maritime and aviation sectors, positions green hydrogen as a key alternative fuel. The mobility sector's growth is spurred by the increasing deployment of fuel cell vehicles and the development of hydrogen refueling infrastructure globally, driven by policy support and the automotive industry's commitment to reduce carbon emissions.

Based on renewable source, the market is segmented into wind, solar, and others. The solar segment is expected to be the largest and fastest-growing segment of the market over the forecast period. Solar energy's global potential, decreasing PV panel costs, and scalability make it the largest segment for green hydrogen production. Its efficiency and widespread adoption, particularly in regions with high solar irradiance, make it a cost-effective solution for various scales of solar farms.

North America is expected to be the region with the largest share of the global green hydrogen market during the forecast period. North America has a thriving renewable energy sector, with substantial expenditures in wind, solar, and hydroelectric power, setting the framework for green hydrogen generation. The region is home to top technology firms and research institutions specializing in energy and environmental technologies, including green hydrogen production, storage, and utilization. This innovation boosts electrolyser efficiency, hydrogen storage solutions, and fuel cell technologies, reducing costs and enhancing commercial viability.

Asia Pacific is expected to be the fastest-growing region in the global green hydrogen market during the forecast period. APAC countries like Japan, South Korea, and China are promoting green hydrogen development to reduce carbon emissions and become global leaders in the hydrogen economy, leveraging their significant renewable energy investments. APAC's diverse renewable energy resources, including solar, wind, hydro, and geothermal, offer a solid foundation for green hydrogen production, with countries like Australia and India showing significant potential for large-scale use. The APAC region, home to major manufacturing and industrial sectors like steel, chemicals, and refining, is promoting decarbonization through the use of green hydrogen as a clean fuel and feedstock.

Linde Plc, Siemens, Air Liquide, Cummins Inc., Engie, Nel ASA, Toshiba Energy, Uniper SE, Schindler, and Guangdong Nation-Synergy Hydrogen Power Co. Ltd., among others, are some of the key players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, Sterling Generators Private Limited (SGPL) announced a memorandum of understanding (MoU) with Tecnicas Reunidas to jointly develop a 1 MW green hydrogen electrolyzer at SGPL's Silvassa plant in India. This collaboration marks SGPL's entry into the hydrogen economy.

In March 2024, Lhyfe, a pioneer in green hydrogen production, received a USD 161.6 million grant from the French government for a 100 MW green hydrogen plant near Le Havre. The project, approved by the European Commission as part of the third wave of IPCEI, has been led by Lhyfe for over two years.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL GREEN HYDROGEN MARKET, BY TECHNOLOGY TYPE

4.1 Introduction

4.2 Green Hydrogen Market: Technology Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Alkaline Electrolysis

4.4.1 Alkaline Electrolysis Market Estimates and Forecast, 2021-2029 (USD Billion)

4.5 PEM Electrolysis

4.5.1 PEM Electrolysis Market Estimates and Forecast, 2021-2029 (USD Billion)

5 GLOBAL GREEN HYDROGEN MARKET, BY RENEWABLE SOURCE

5.1 Introduction

5.2 Green Hydrogen Market: Renewable Source Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Wind

5.4.1 Wind Market Estimates and Forecast, 2021-2029 (USD Billion)

5.5 Solar

5.5.1 Solar Market Estimates and Forecast, 2021-2029 (USD Billion)

5.6 Others

5.6.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

6 GLOBAL GREEN HYDROGEN MARKET, BY END-USE INDUSTRY

6.1 Introduction

6.2 Green Hydrogen Market: End-use Industry Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Chemicals

6.4.1 Chemicals Market Estimates and Forecast, 2021-2029 (USD Billion)

6.5 Mobility

6.5.1 Mobility Market Estimates and Forecast, 2021-2029 (USD Billion)

6.6 Power Generation

6.6.1 Power Generation Market Estimates and Forecast, 2021-2029 (USD Billion)

6.7 Grid Injection

6.7.1 Grid Injection Market Estimates and Forecast, 2021-2029 (USD Billion)

6.8 Industrial

6.8.1 Industrial Market Estimates and Forecast, 2021-2029 (USD Billion)

6.9 Others

6.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Billion)

7 GLOBAL GREEN HYDROGEN MARKET, BY REGION

7.1 Introduction

7.2 North America Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.1 By Technology Type

7.2.2 By Renewable Source

7.2.3 By End-use Industry

7.2.4 By Country

7.2.4.1 U.S. Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.1.1 By Technology Type

7.2.4.1.2 By Renewable Source

7.2.4.1.3 By End-use Industry

7.2.4.2 Canada Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.2.1 By Technology Type

7.2.4.2.2 By Renewable Source

7.2.4.2.3 By End-use Industry

7.2.4.3 Mexico Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.2.4.3.1 By Technology Type

7.2.4.3.2 By Renewable Source

7.2.4.3.3 By End-use Industry

7.3 Europe Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.1 By Technology Type

7.3.2 By Renewable Source

7.3.3 By End-use Industry

7.3.4 By Country

7.3.4.1 Germany Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.1.1 By Technology Type

7.3.4.1.2 By Renewable Source

7.3.4.1.3 By End-use Industry

7.3.4.2 U.K. Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.2.1 By Technology Type

7.3.4.2.2 By Renewable Source

7.3.4.2.3 By End-use Industry

7.3.4.3 France Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.3.1 By Technology Type

7.3.4.3.2 By Renewable Source

7.3.4.3.3 By End-use Industry

7.3.4.4 Italy Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.4.1 By Technology Type

7.3.4.4.2 By Renewable Source

7.2.4.4.3 By End-use Industry

7.3.4.5 Spain Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.5.1 By Technology Type

7.3.4.5.2 By Renewable Source

7.2.4.5.3 By End-use Industry

7.3.4.6 Netherlands Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Technology Type

7.3.4.7.2 By Renewable Source

7.2.4.7.3 By End-use Industry

7.3.4.7 Rest of Europe Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.3.4.7.1 By Technology Type

7.3.4.7.2 By Renewable Source

7.2.4.7.3 By End-use Industry

7.4 Asia Pacific Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.1 By Technology Type

7.4.2 By Renewable Source

7.4.3 By End-use Industry

7.4.4 By Country

7.4.4.1 China Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.1.1 By Technology Type

7.4.4.1.2 By Renewable Source

7.4.4.1.3 By End-use Industry

7.4.4.2 Japan Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.2.1 By Technology Type

7.4.4.2.2 By Renewable Source

7.4.4.2.3 By End-use Industry

7.4.4.3 India Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.3.1 By Technology Type

7.4.4.3.2 By Renewable Source

7.4.4.3.3 By End-use Industry

7.4.4.4 South Korea Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.4.1 By Technology Type

7.4.4.4.2 By Renewable Source

7.4.4.4.3 By End-use Industry

7.4.4.5 Singapore Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.5.1 By Technology Type

7.4.4.5.2 By Renewable Source

7.4.4.5.3 By End-use Industry

7.4.4.6 Malaysia Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Technology Type

7.4.4.7.2 By Renewable Source

7.4.4.7.3 By End-use Industry

7.4.4.7 Thailand Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.7.1 By Technology Type

7.4.4.7.2 By Renewable Source

7.4.4.7.3 By End-use Industry

7.4.4.8 Indonesia Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.8.1 By Technology Type

7.4.4.8.2 By Renewable Source

7.4.4.8.3 By End-use Industry

7.4.4.9 Vietnam Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.9.1 By Technology Type

7.4.4.9.2 By Renewable Source

7.4.4.9.3 By End-use Industry

7.4.4.10 Taiwan Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.10.1 By Technology Type

7.4.4.10.2 By Renewable Source

7.4.4.10.3 By End-use Industry

7.4.4.11 Rest of Asia Pacific Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.4.4.11.1 By Technology Type

7.4.4.11.2 By Renewable Source

7.4.4.11.3 By End-use Industry

7.5 Middle East and Africa Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.1 By Technology Type

7.5.2 By Renewable Source

7.5.3 By End-use Industry

7.5.4 By Country

7.5.4.1 Saudi Arabia Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.1.1 By Technology Type

7.5.4.1.2 By Renewable Source

7.5.4.1.3 By End-use Industry

7.5.4.2 U.A.E. Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.2.1 By Technology Type

7.5.4.2.2 By Renewable Source

7.5.4.2.3 By End-use Industry

7.5.4.3 Israel Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.3.1 By Technology Type

7.5.4.3.2 By Renewable Source

7.5.4.3.3 By End-use Industry

7.5.4.4 South Africa Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.4.1 By Technology Type

7.5.4.4.2 By Renewable Source

7.5.4.4.3 By End-use Industry

7.5.4.5 Rest of Middle East and Africa Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.5.4.5.1 By Technology Type

7.5.4.5.2 By Renewable Source

7.5.4.5.2 By End-use Industry

7.6 Central and South America Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.1 By Technology Type

7.7.2 By Renewable Source

7.7.3 By End-use Industry

7.7.4 By Country

7.7.4.1 Brazil Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.1.1 By Technology Type

7.7.4.1.2 By Renewable Source

7.7.4.1.3 By End-use Industry

7.7.4.2 Argentina Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.2.1 By Technology Type

7.7.4.2.2 By Renewable Source

7.7.4.2.3 By End-use Industry

7.7.4.3 Chile Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.3.1 By Technology Type

7.7.4.3.2 By Renewable Source

7.7.4.3.3 By End-use Industry

7.7.4.4 Rest of Central and South America Green Hydrogen Market Estimates and Forecast, 2021-2029 (USD Billion)

7.7.4.4.1 By Technology Type

7.7.4.4.2 By Renewable Source

7.7.4.4.3 By End-use Industry

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Linde Plc

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Siemens

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Air Liquide

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Guangdong Nation-Synergy Hydrogen Power Co. Ltd.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Engie

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Nel ASA

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Toshiba Energy

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Cummins Inc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Schindler

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Uniper SE

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH OFFERINGOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

2 Alkaline Electrolysis Market, By Region, 2021-2029 (USD Billion)

3 PEM Electrolysis Market, By Region, 2021-2029 (USD Billion)

4 Global Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

5 Wind Market, By Region, 2021-2029 (USD Billion)

6 Solar Market, By Region, 2021-2029 (USD Billion)

7 Others Market, By Region, 2021-2029 (USD Billion)

8 Global Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

9 Chemicals Market, By Region, 2021-2029 (USD Billion)

10 Mobility Market, By Region, 2021-2029 (USD Billion)

11 Power Generation Market, By Region, 2021-2029 (USD Billion)

12 Grid Injection Market, By Region, 2021-2029 (USD Billion)

13 Industrial Market, By Region, 2021-2029 (USD Billion)

14 Others Market, By Region, 2021-2029 (USD Billion)

15 Regional Analysis, 2021-2029 (USD Billion)

16 North America Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

17 North America Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

18 North America Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

19 North America Green Hydrogen Market, By Country, 2021-2029 (USD Billion)

20 U.S. Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

21 U.S. Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

22 U.S. Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

23 Canada Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

24 Canada Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

25 Canada Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

26 Mexico Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

27 Mexico Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

28 Mexico Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

29 Europe Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

30 Europe Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

31 Europe Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

32 EUROPE Green Hydrogen Market, By Country, 2021-2029 (USD Billion)

33 Germany Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

34 Germany Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

35 Germany Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

36 U.K. Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

37 U.K. Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

38 U.K. Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

39 France Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

40 France Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

41 France Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

42 Italy Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

43 Italy Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

44 Italy Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

45 Spain Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

46 Spain Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

47 Spain Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

48 Netherland Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

49 Netherland Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

50 Netherland Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

51 Rest Of Europe Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

52 Rest Of Europe Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

53 Rest of Europe Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

54 Asia Pacific Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

55 Asia Pacific Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

56 Asia Pacific Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

57 Asia Pacific Green Hydrogen Market, By Country, 2021-2029 (USD Billion)

58 China Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

59 China Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

60 China Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

61 India Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

62 India Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

63 India Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

64 Japan Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

65 Japan Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

66 Japan Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

67 South Korea Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

68 South Korea Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

69 South Korea Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

70 Australia Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

71 Australia Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

72 Australia Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

73 Thailand Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

74 Thailand Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

75 Thailand Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

76 Vietnam Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

77 Vietnam Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

78 Vietnam Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

79 indonesia Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

80 indonesia Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

81 indonesia Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

82 Malaysia Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

83 Malaysia Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

84 Malaysia Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

85 Philippines Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

86 Philippines Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

87 Philippines Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

88 Singapore Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

89 Singapore Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

90 Singapore Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

91 Rest of APAC Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

92 Rest of APAC Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

93 Rest of APAC Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

94 Middle East and Africa Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

95 Middle East and Africa Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

96 Middle East and Africa Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

97 Middle East and Africa Green Hydrogen Market, By Country, 2021-2029 (USD Billion)

98 Saudi Arabia Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

99 Saudi Arabia Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

100 Saudi Arabia Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

101 UAE Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

102 UAE Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

103 UAE Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

104 South Africa Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

105 South Africa Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

106 South Africa Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

107 Israel Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

108 Israel Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

109 Israel Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

110 Rest of Middle East and Africa Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

111 Rest of Middle East and Africa Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

112 Rest of Middle East and Africa Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

113 Central and South America Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

114 Central and South America Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

115 Central and South America Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

116 Central and South America Green Hydrogen Market, By Country, 2021-2029 (USD Billion)

117 Brazil Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

118 Brazil Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

119 Brazil Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

120 Argentina Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

121 Argentina Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

122 Argentina Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

123 Chile Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

124 Chile Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

125 Chile Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

126 Rest of Central and South America Green Hydrogen Market, By Technology Type, 2021-2029 (USD Billion)

127 Rest of Central and South America Green Hydrogen Market, By Renewable Source, 2021-2029 (USD Billion)

128 Rest of Central and South America Green Hydrogen Market, By End-use Industry, 2021-2029 (USD Billion)

129 Linde Plc: Products & Services Offering

130 Siemens: Products & Services Offering

131 Air Liquide: Products & Services Offering

132 Guangdong Nation-Synergy Hydrogen Power Co. Ltd.: Products & Services Offering

133 Engie: Products & Services Offering

134 NEL ASA: Products & Services Offering

135 Toshiba Energy : Products & Services Offering

136 Cummins Inc.: Products & Services Offering

137 Schindler: Products & Services Offering

138 Uniper SE: Products & Services Offering

139 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Green Hydrogen Market Overview

2 Global Green Hydrogen Market Value From 2021-2029 (USD Billion)

3 Global Green Hydrogen Market Share, By Technology Type (2023)

4 Global Green Hydrogen Market Share, By Renewable Source (2023)

5 Global Green Hydrogen Market Share, By End-use Industry (2023)

6 Global Green Hydrogen Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Green Hydrogen Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Green Hydrogen Market

11 Impact Of Challenges On The Global Green Hydrogen Market

12 Porter’s Five Forces Analysis

13 Global Green Hydrogen Market: By Technology Type Scope Key Takeaways

14 Global Green Hydrogen Market, By Technology Type Segment: Revenue Growth Analysis

15 Alkaline Electrolysis Market, By Region, 2021-2029 (USD Billion)

16 PEM Electrolysis Market, By Region, 2021-2029 (USD Billion)

17 Global Green Hydrogen Market: By Renewable Source Scope Key Takeaways

18 Global Green Hydrogen Market, By Renewable Source Segment: Revenue Growth Analysis

19 Wind Market, By Region, 2021-2029 (USD Billion)

20 Solar Market, By Region, 2021-2029 (USD Billion)

21 Others Market, By Region, 2021-2029 (USD Billion)

22 Global Green Hydrogen Market: By End-use Industry Scope Key Takeaways

23 Global Green Hydrogen Market, By End-use Industry Segment: Revenue Growth Analysis

24 Chemicals Market, By Region, 2021-2029 (USD Billion)

25 Mobility Market, By Region, 2021-2029 (USD Billion)

26 Power Generation Market, By Region, 2021-2029 (USD Billion)

27 Grid Injection Market, By Region, 2021-2029 (USD Billion)

28 Industrial Market, By Region, 2021-2029 (USD Billion)

29 Others Market, By Region, 2021-2029 (USD Billion)

30 Regional Segment: Revenue Growth Analysis

31 Global Green Hydrogen Market: Regional Analysis

32 North America Green Hydrogen Market Overview

33 North America Green Hydrogen Market, By Technology Type

34 North America Green Hydrogen Market, By Renewable Source

35 North America Green Hydrogen Market, By End-use Industry

36 North America Green Hydrogen Market, By Country

37 U.S. Green Hydrogen Market, By Technology Type

38 U.S. Green Hydrogen Market, By Renewable Source

39 U.S. Green Hydrogen Market, By End-use Industry

40 Canada Green Hydrogen Market, By Technology Type

41 Canada Green Hydrogen Market, By Renewable Source

42 Canada Green Hydrogen Market, By End-use Industry

43 Mexico Green Hydrogen Market, By Technology Type

44 Mexico Green Hydrogen Market, By Renewable Source

45 Mexico Green Hydrogen Market, By End-use Industry

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 Linde Plc: Company Snapshot

49 Linde Plc: SWOT Analysis

50 Linde Plc: Geographic Presence

51 Siemens: Company Snapshot

52 Siemens: SWOT Analysis

53 Siemens: Geographic Presence

54 Air Liquide: Company Snapshot

55 Air Liquide: SWOT Analysis

56 Air Liquide: Geographic Presence

57 Guangdong Nation-Synergy Hydrogen Power Co. Ltd.: Company Snapshot

58 Guangdong Nation-Synergy Hydrogen Power Co. Ltd.: Swot Analysis

59 Guangdong Nation-Synergy Hydrogen Power Co. Ltd.: Geographic Presence

60 Engie: Company Snapshot

61 Engie: SWOT Analysis

62 Engie: Geographic Presence

63 Nel ASA: Company Snapshot

64 Nel ASA: SWOT Analysis

65 Nel ASA: Geographic Presence

66 Toshiba Energy : Company Snapshot

67 Toshiba Energy : SWOT Analysis

68 Toshiba Energy : Geographic Presence

69 Cummins Inc.: Company Snapshot

70 Cummins Inc.: SWOT Analysis

71 Cummins Inc.: Geographic Presence

72 Schindler: Company Snapshot

73 Schindler: SWOT Analysis

74 Schindler: Geographic Presence

75 Uniper SE: Company Snapshot

76 Uniper SE: SWOT Analysis

77 Uniper SE: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Green Hydrogen Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Green Hydrogen Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS