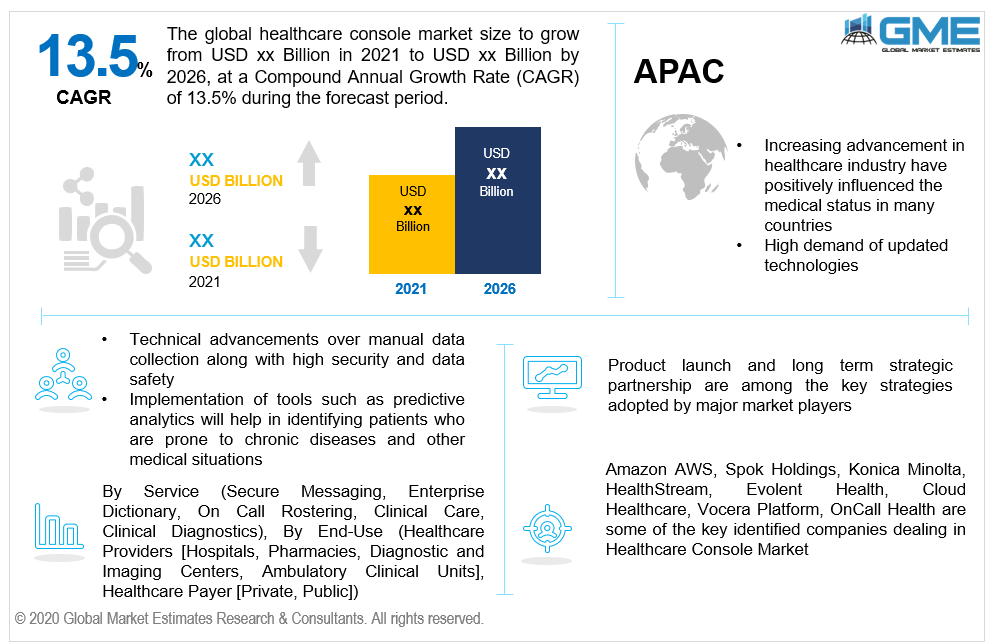

Global Healthcare Console Market Size, Trends & Analysis - Forecasts to 2026 By Service (Secure Messaging, Enterprise Dictionary, On Call Rostering, Clinical Care, Clinical Diagnostics), By End-Use (Healthcare Providers [Hospitals, Pharmacies, Diagnostic and Imaging Centers, Ambulatory Clinical Units], Healthcare Payer [Private, Public]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Also known as the medical electric console, the software provides a single unified communication source across the medical industry platform. It elevates the hustle free communication which helps in offering easy connectivity with the clinical teams, which results in providing the information where it matters the most. High security and data safety is another positive cause associated with its high acceptance in the healthcare IT industry. Easy finding people, resources, and data are some key features offered by the healthcare console market.

The adoption of information technology in the healthcare industry provides an opportunity to smartly use data analytics for further solutions. Implementation of tools such as predictive analytics will help in identifying patients who are prone to chronic diseases and other medical situations. All of these can be achieved by keeping a track of patient’s medical information along with overall health trends in a particular region. These techniques permit healthcare systems to recognize target populations who are at risk which helps systems to meet cost efficiency by providing advanced care & intervention.

The overall healthcare IT market size will be more than USD 350 Billion by 2026. Information technologies adoption in healthcare allows to meet their cost-cutting budget, focus more on patients, and thereby increasing revenue. However, in few cases, implementing these tools can increase their cost in the short run due to initial setup expenses. Also, there is not enough concrete data available to support that an electronic system in healthcare will result in a cost-saving strategy.

It is stated that more than 50% of physicians experienced an improvement in their documentation process while using the IT tools & software. Some institutions also witnessed the reduction in patients they could interact with, which results in raising the workflow efficiency.

In conclusion, the healthcare console helps in getting the right information of the patient's which can be accurately used by practitioners to enhance the whole medical process which results in reducing avoidable tests and procedures. It also permits patients to access their health records which makes them more sound while communicating with their healthcare providers.

Secure messaging, enterprise dictionary, on-call rostering are some of the highlighted services offered by healthcare console market. It accurately manages the hospital staff rosters by providing transparency in showing busy clinicians and forecasting schedule based on the practitioner activity. Elevating the hospital’s contact centers by connecting doctors, nurses, and staff swiftly with the help of smart call handling helps in saving time across the institution.

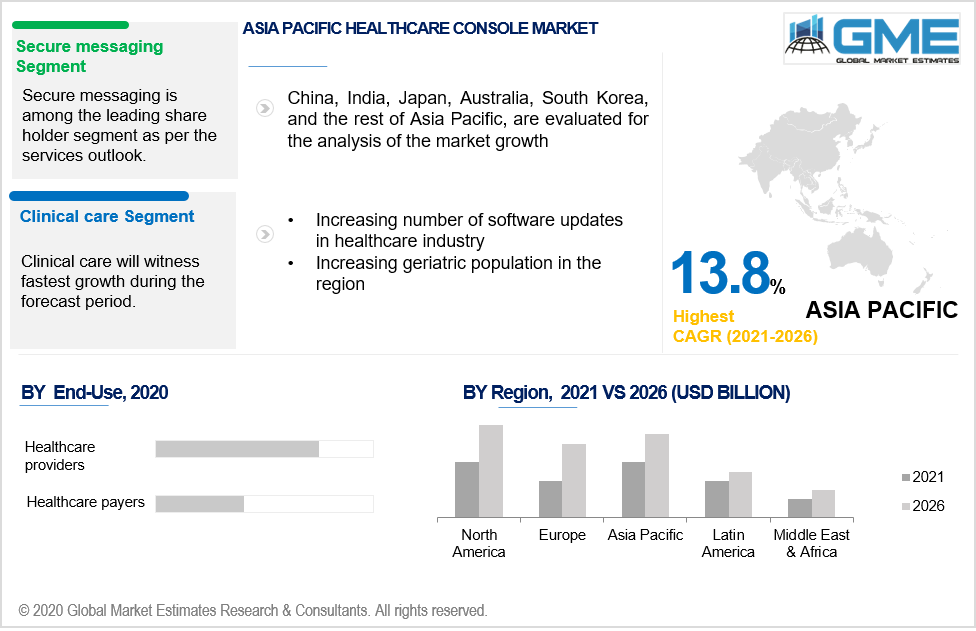

Hospitals, pharmacies, diagnostic centers, and ambulatory clinical units are the major end-users in the provider category. In the payer segment, public and private are the two sub-segments in this category.

Effective communication helps in boosting doctors' performance in patient care. Secure messaging helps in collaborating two-way conversation which provides an updated report to the doctors and nurses.

Increasing advancements in healthcare industry have positively influenced the medical status in many countries. The high demand for updated technologies to meet the current need for time-saving requirements during the Covid-19 pandemic has positively influenced the Asia Pacific healthcare console market.

Positive factors such as innovation in medical sciences and increased healthcare budgeting will drive the European healthcare console market. Change in political agenda due to the increasing number of covid-19 cases in the UK will support the IT advancement in the country.

MEA healthcare console market will witness high growth in the upcoming years. Acceptance towards advanced technology and collaboration with international hospitals to ease foreign patients will enhance the regional growth.

Amazon AWS, Spok, Konica Minolta, HealthStream, Evolent Health, Cloud Healthcare API, Cerulean Studios (Software- Trillian), Paubox Email Suite, Tiger Connect, Vocera Platform, Well, Simple Practice, Imprivata Cortext, Revenue Well, Redox, Luma Health, Weave, Klara, Relatient, Updox, Qliq Secure Texting, OnCall Health, Lua, VSee, Cerner Corporation, McKesson Corporation (U.S.), IBM Watson Health, GE Healthcare (U.S.), Allscripts Healthcare Solutions, Koninklijke Philips N.V. (Netherlands), Cognizant Technology Solutions Corporation (U.S.), Athenahelath, Inc. (U.S.), UnitedHealth Group Incorporated (U.S.) are some of the key identified companies dealing in Healthcare Console Market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March, 2018, Spok, a subsidiary of Spok Holdings, also a leader in healthcare communications has confirmed its long-term strategic partnership with Spectralink Corporation. Spectralink Corporation is among the major player in enterprise mobility solutions. The company’s clinical communication platform i.e. Spok Care Connect integrates with Spectralink’s medical-grade mobile device which includes PIVOT smartphone to meet important information and news from staff.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Healthcare console industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 Services overview

2.1.3 End-Use overview

2.1.4 Regional overview

Chapter 3 Healthcare Console Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.1.1 Growing adoption of software products & services by healthcare professionals

3.3.1.2 Rising knowledge regarding upgraded technology availability in healthcare industry

3.3.1.3 Updated legal development pertaining to healthcare advancement

3.3.2 Industry challenges

3.3.2.1 Safety concerns associated with the personal data sharing

3.4 Prospective growth scenario

3.4.1 Services growth scenario

3.4.2 End-Use growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Healthcare supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Healthcare console technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Healthcare Console Market, By Services

4.1 Services Outlook

4.2 Secure Messaging

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Enterprise Dictionary

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 On call Rostering

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Clinical care

4.5.1 Market size, by region, 2016-2026 (USD Million)

4.6 Clinical diagnostics

4.6.1 Market size, by region, 2016-2026 (USD Million)

4.7 Others

4.7.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Healthcare Console Market, By End-Use

5.1 End-use Outlook

5.2 Healthcare providers

5.2.1 Market size, by region, 2016-2026 (USD Million)

5.2.1 Hospitals

5.2.1.1 Market size, by region, 2016-2026 (USD Million)

5.2.2 Pharmacies

5.2.2.1 Market size, by region, 2016-2026 (USD Million)

5.2.3 Diagnostic and imaging centers

5.2.3.1 Market size, by region, 2016-2026 (USD Million)

5.2.4 Ambulatory clinical units

5.2.4.1 Market size, by region, 2016-2026 (USD Million)

5.3 Healthcare payer

5.3.1 Market size, by region, 2016-2026 (USD Million)

5.3.1 Private

5.3.1.1 Market size, by region, 2016-2026 (USD Million)

5.3.2 Public

5.3.2.1 Market size, by region, 2016-2026 (USD Million)

Chapter 8 Healthcare Console Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market size, by country 2016-2026 (USD Million)

8.2.2 Market size, by services, 2016-2026 (USD Million)

8.2.3 Market size, by end-use, 2016-2026 (USD Million)

8.2.4 U.S.

8.2.4.1 Market size, by services, 2016-2026 (USD Million)

8.2.4.2 Market size, by end-use, 2016-2026 (USD Million)

8.2.5 Canada

8.2.5.1 Market size, by services, 2016-2026 (USD Million)

8.2.5.4 Market size, by end-use, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market size, by country 2016-2026 (USD Million)

8.3.2 Market size, by services, 2016-2026 (USD Million)

8.3.3 Market size, by end-use, 2016-2026 (USD Million)

8.3.4 Germany

8.3.4.1 Market size, by services, 2016-2026 (USD Million)

8.3.4.2 Market size, by end-use, 2016-2026 (USD Million)

8.3.5 UK

8.3.5.1 Market size, by services, 2016-2026 (USD Million)

8.3.5.2 Market size, by end-use, 2016-2026 (USD Million)

8.3.6 France

8.3.6.1 Market size, by services, 2016-2026 (USD Million)

8.3.6.2 Market size, by end-use, 2016-2026 (USD Million)

8.3.7 Italy

8.3.7.1 Market size, by services, 2016-2026 (USD Million)

8.3.7.2 Market size, by end-use, 2016-2026 (USD Million)

8.3.8 Spain

8.3.8.1 Market size, by services, 2016-2026 (USD Million)

8.3.8.2 Market size, by end-use, 2016-2026 (USD Million)

8.3.9 Russia

8.3.9.1 Market size, by services, 2016-2026 (USD Million)

8.3.9.2 Market size, by end-use, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market size, by country 2016-2026 (USD Million)

8.4.2 Market size, by services, 2016-2026 (USD Million)

8.4.3 Market size, by end-use, 2016-2026 (USD Million)

8.4.4 China

8.4.4.1 Market size, by services, 2016-2026 (USD Million)

8.4.4.2 Market size, by end-use, 2016-2026 (USD Million)

8.4.5 India

8.4.5.1 Market size, by services, 2016-2026 (USD Million)

8.4.5.2 Market size, by end-use, 2016-2026 (USD Million)

8.4.6 Japan

8.4.6.1 Market size, by services, 2016-2026 (USD Million)

8.4.6.2 Market size, by end-use, 2016-2026 (USD Million)

8.4.7 Australia

8.4.7.1 Market size, by services, 2016-2026 (USD Million)

8.4.7.2 Market size, by end-use, 2016-2026 (USD Million)

8.4.8 South Korea

8.4.8.1 Market size, by services, 2016-2026 (USD Million)

8.4.8.2 Market size, by end-use, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market size, by country 2016-2026 (USD Million)

8.5.2 Market size, by services, 2016-2026 (USD Million)

8.5.3 Market size, by end-use, 2016-2026 (USD Million)

8.5.4 Brazil

8.5.4.1 Market size, by services, 2016-2026 (USD Million)

8.5.4.2 Market size, by end-use, 2016-2026 (USD Million)

8.5.6 Mexico

8.5.6.1 Market size, by services, 2016-2026 (USD Million)

8.5.6.2 Market size, by end-use, 2016-2026 (USD Million)

8.5.7 Argentina

8.5.7.1 Market size, by services, 2016-2026 (USD Million)

8.5.7.2 Market size, by end-use, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market size, by country 2016-2026 (USD Million)

8.6.2 Market size, by services, 2016-2026 (USD Million)

8.6.3 Market size, by end-use, 2016-2026 (USD Million)

8.6.4 Saudi Arabia

8.6.4.1 Market size, by services, 2016-2026 (USD Million)

8.6.4.2 Market size, by end-use, 2016-2026 (USD Million)

8.6.5 UAE

8.6.5.1 Market size, by services, 2016-2026 (USD Million)

8.6.5.2 Market size, by end-use, 2016-2026 (USD Million)

8.6.6 South Africa

8.6.4.1 Market size, by services, 2016-2026 (USD Million)

8.6.4.2 Market size, by end-use, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2 Amazon AWS

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3 SPOK Holdings

9.3.1 Company overview

9.3.2 Financial analysis

9.3.3 Strategic positioning

9.3.4 Info graphic analysis

9.4 Konica Minolta

9.4.1 Company overview

9.4.2 Financial analysis

9.4.3 Strategic positioning

9.4.4 Info graphic analysis

9.5 HealthStream

9.5.1 Company overview

9.5.2 Financial analysis

9.5.3 Strategic positioning

9.5.4 Info graphic analysis

9.6 Evolent Health

9.6.1 Company overview

9.6.2 Financial analysis

9.6.3 Strategic positioning

9.6.4 Info graphic analysis

9.7 Cloud Healthcare API

9.7.1 Company overview

9.7.2 Financial analysis

9.7.3 Strategic positioning

9.7.4 Info graphic analysis

9.8 Cerulean Studios

9.8.1 Company overview

9.8.2 Financial analysis

9.8.3 Strategic positioning

9.8.4 Info graphic analysis

9.9 Paubox Email Suite

9.9.1 Company overview

9.9.2 Financial analysis

9.9.3 Strategic positioning

9.9.4 Info graphic analysis

9.10 Tiger Connect

9.10.1 Company overview

9.10.2 Financial analysis

9.10.3 Strategic positioning

9.10.4 Info graphic analysis

9.11 Vocera Platform

9.11.1 Company overview

9.11.2 Financial analysis

9.11.3 Strategic positioning

9.11.4 Info graphic analysis

9.12 Well

9.12.1 Company overview

9.12.2 Financial analysis

9.12.3 Strategic positioning

9.12.4 Info graphic analysis

9.13 Simple Practice

9.13.1 Company overview

9.13.2 Financial analysis

9.13.3 Strategic positioning

9.13.4 Info graphic analysis

9.14 Imprivata Cortext

9.14.1 Company overview

9.14.2 Financial analysis

9.14.3 Strategic positioning

9.14.4 Info graphic analysis

9.15 Revenue Well

9.15.1 Company overview

9.15.2 Financial analysis

9.15.3 Strategic positioning

9.15.4 Info graphic analysis

9.16 Redox

9.16.1 Company overview

9.16.2 Financial analysis

9.16.3 Strategic positioning

9.16.4 Info graphic analysis

9.17 Luma Health

9.17.1 Company overview

9.17.2 Financial analysis

9.17.3 Strategic positioning

9.17.4 Info graphic analysis

9.18 Weave

9.18.1 Company overview

9.18.2 Financial analysis

9.18.3 Strategic positioning

9.18.4 Info graphic analysis

9.19 Klara

9.19.1 Company overview

9.19.2 Financial analysis

9.19.3 Strategic positioning

9.19.4 Info graphic analysis

9.20 Relatient

9.20.1 Company overview

9.20.2 Financial analysis

9.20.3 Strategic positioning

9.20.4 Info graphic analysis

9.21 Updox

9.21.1 Company overview

9.21.2 Financial analysis

9.21.3 Strategic positioning

9.21.4 Info graphic analysis

9.22 Qliq Secure Texting

9.22.1 Company overview

9.22.2 Financial analysis

9.22.3 Strategic positioning

9.22.4 Info graphic analysis

9.23 OnCall Health

9.23.1 Company overview

9.23.2 Financial analysis

9.23.3 Strategic positioning

9.23.4 Info graphic analysis

9.24 Lua

9.24.1 Company overview

9.24.2 Financial analysis

9.24.3 Strategic positioning

9.24.4 Info graphic analysis

9.25 VSee

9.25.1 Company overview

9.25.2 Financial analysis

9.25.3 Strategic positioning

9.25.4 Info graphic analysis

9.26 Cerner Corporation

9.26.1 Company overview

9.26.2 Financial analysis

9.26.3 Strategic positioning

9.26.4 Info graphic analysis

9.27 McKesson Corporation

9.27.1 Company overview

9.27.2 Financial analysis

9.27.3 Strategic positioning

9.27.4 Info graphic analysis

9.28 IBM Watson Health

9.28.1 Company overview

9.28.2 Financial analysis

9.28.3 Strategic positioning

9.28.4 Info graphic analysis

9.29 GE Healthcare (U.S.)

9.29.1 Company overview

9.29.2 Financial analysis

9.29.3 Strategic positioning

9.29.4 Info graphic analysis

9.30 Allscripts Healthcare Solutions

9.30.1 Company overview

9.30.2 Financial analysis

9.30.3 Strategic positioning

9.30.4 Info graphic analysis

9.31 Koninklijke Philips N.V.

9.31.1 Company overview

9.31.2 Financial analysis

9.31.3 Strategic positioning

9.31.4 Info graphic analysis

9.32 Cognizant Technology Solutions Corporation

9.32.1 Company overview

9.32.2 Financial analysis

9.32.3 Strategic positioning

9.32.4 Info graphic analysis

9.33 Athenahelath, Inc.

9.33.1 Company overview

9.33.2 Financial analysis

9.33.3 Strategic positioning

9.33.4 Info graphic analysis

9.34 UnitedHealth Group Incorporated

9.34.1 Company overview

9.34.2 Financial analysis

9.34.3 Strategic positioning

9.34.4 Info graphic analysis

The Global Healthcare Console Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Healthcare Console Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS