Global Hemp Fiber Market Size, Trends & Analysis - Forecasts to 2026 By End-Use (Textile, Construction, Shoes, Paper, Ropes & Cords), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Rising preference for sustainable sources to obtain eco-friendly manufacturing process will influence the hemp fiber market growth. Factors such as antibacterial, durable, and having natural air conditioning systems have promoted product usage in the textile industry. Also, additional benefits such as little water consumption, non-requirement of herbicides, and other synthetic fertilizers have opened new avenues for hemp fibers in other industrial usages.

Changing demographics in the infrastructure sector to promote green building solutions will stimulate product penetration in the construction industry. Mold resistance, light weightiness, and breath-ability are major hemp fiber properties inducing demand in the building material sector. The University of Bath has researched hemp-lime panel usage in the construction industry. The research was funded by the EU to focus on green building solutions in the France, Britain, and Spain markets. Key parameters focused on the study include moisture penetration, change in temperature, humidity level, site assembly, and energy-saving potential.

Studies have shown positive aspects of the Hemp (Cannabis Sativa) which seems promising to change the outlook of many industries. Textile, construction, and paper industry are going to be majorly impacted by the vast commercialization of the Cannabis Sativa. A high production rate with minimal requirement has become the key favorable factor to invest in the recreational usage of these plants.

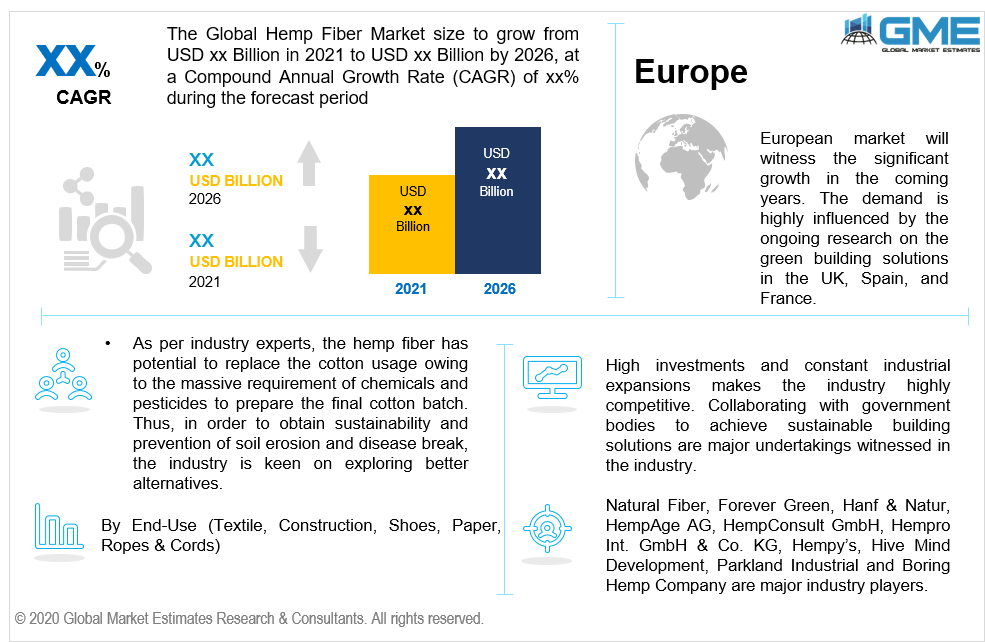

As per industry experts, the plant has the potential to replace cotton usage owing to the massive requirement of chemicals and pesticides to prepare the final cotton batch. Thus, to obtain sustainability and prevention of soil erosion and disease break, the industry is keen on exploring better alternatives.

As compared to conventional material such as cotton, the cannabis sativa is stronger, longer, absorbent, decay-resistant, and insulative in nature. In total, they have over thirty varieties but only a few are used in the commercial sector based on fitness and strength evaluation. Research has also pointed out its effective ultraviolet blocking properties and less prone to fade after vat and sulfur dyes.

Favorable government regulation on the production, exportation, and importation along with pricing standardization will positively drive the Hemp Fiber Market growth during the forecast period.

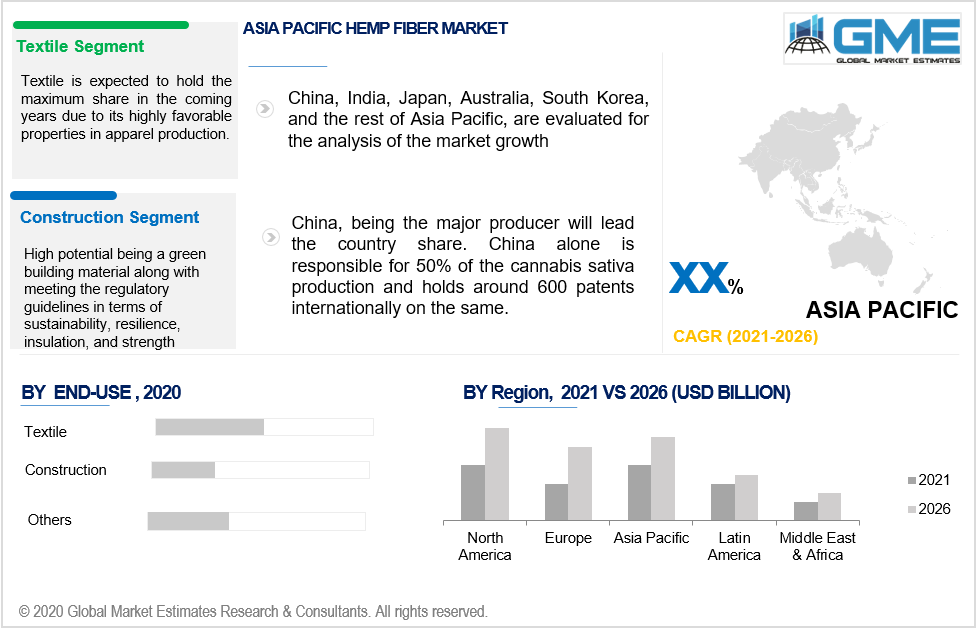

Textile, Construction, Shoemaking, Paper, and Ropes & Cord making are major end-uses in the Hemp Fiber industry. Textile is expected to hold the maximum share in the coming years due to its highly favorable properties in apparel production. Breath-ability, antibacterial, and sustainability are key properties involved in the production of Cannabis Sativa-based clothing. The material has the same texture as linen and is proved to be more resilient and economical than cotton. Also, it is a suitable fabric for people with sensitive skin and does not cause any allergies.

The other major industry utilizing hemp fiber on a large scale is the paper industry. The segment is projected to witness significant gains during the forecast period. Easy cultivation and wide raw material availability without stressing mass deforestation are major reasons to inculcate demand in paper making industry.

Construction is among the most focused and promising sectors in the end-use segment. High potential being a green building material along with meeting the regulatory guidelines in terms of sustainability, resilience, insulation, and strength has resulted in product penetration in the building material sector.

Asia Pacific will dominate the industry share during the forecast period. China, being the major producer will lead the country's share. China alone is responsible for 50% of the cannabis sativa production and holds around 600 patents internationally on the same. Government support to promote industrial cannabis sativa usage along with favorable environmental and farming conditions has promoted the country's contribution to the industry.

The European market will witness significant growth in the coming years. The demand is highly influenced by the ongoing research on green building solutions in the UK, Spain, and France. Other factors such as the increasing number of cannabis sativa producers after the initiation of its industrial usage have prompted the plant's applicability in other industries.

North America is expected to foresee the highest gains up to 2026. Heavy commercialization with massive production will influence the regional industry growth. The U.S. and Canada will witness high penetration in the textile industry due to its availability and production feasibility properties.

Natural Fiber, Forever Green, Hanf & Natur, HempAge AG, HempConsult GmbH, Hempro Int. GmbH & Co. KG, Hempy’s, Hive Mind Development, Parkland Industrial Hemp Growers Cooperative Ltd. (PIHG), CBD Biotechnology Co., Ltd., Botanical Genetics, LLC, Marijuana Company of America Inc., HempMeds Brasil, Terra Tech Corp, American Cannabis Company, Inc., HempFlax B.V., American Hemp, Hemp, Inc., and Boring Hemp Company are major industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

High investments and constant industrial expansions make the industry highly competitive. Collaborating with government bodies to achieve sustainable building solutions are major undertakings witnessed in the industry. Other notable manufacturers include Plains Industrial Hemp Processing Ltd., Ecofiber, Valley Bio Limited, Hempco, Ecofibre, Gencanna, Konoplex Group, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, Canah International, South Hemp Tecno, and Plains Industrial Hemp Processing.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Hemp Fiber Market industry overview, 2016-2026

2.1.1 Industry overview

2.1.2 End-Use overview

2.1.3 Regional overview

Chapter 3 Hemp Fiber Market Trends

3.1 Market segmentation

3.2 Industry background, 2016-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Product innovation

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Hemp Fiber Market, By End-Use

4.1 End-Use Outlook

4.2 Textile

4.2.1 Market size, by region, 2016-2026 (USD Million)

4.3 Construction

4.3.1 Market size, by region, 2016-2026 (USD Million)

4.4 Shoe

4.4.1 Market size, by region, 2016-2026 (USD Million)

4.5 Paper

4.5.1 Market size, by region, 2016-2026 (USD Million)

4.6 Ropes & Cords

4.6.1 Market size, by region, 2016-2026 (USD Million)

Chapter 5 Hemp Fiber Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market size, by country 2016-2026 (USD Million)

5.2.2 Market size, by end-use, 2016-2026 (USD Million)

5.2.3 U.S.

5.2.3.1 Market size, by end-use, 2016-2026 (USD Million)

5.2.4 Canada

5.2.4.1 Market size, by end-use, 2016-2026 (USD Million)

5.3 Europe

5.3.1 Market size, by country 2016-2026 (USD Million)

5.3.2 Market size, by end-use, 2016-2026 (USD Million)

5.3.3 Germany

5.3.3.1 Market size, by end-use, 2016-2026 (USD Million)

5.3.4 UK

5.3.4.1 Market size, by end-use, 2016-2026 (USD Million)

5.3.5 France

5.3.5.1 Market size, by end-use, 2016-2026 (USD Million)

5.3.6 Italy

5.3.6.1 Market size, by end-use, 2016-2026 (USD Million)

5.3.7 Spain

5.3.7.1 Market size, by end-use, 2016-2026 (USD Million)

5.3.8 Russia

5.3.8.1 Market size, by end-use, 2016-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market size, by country 2016-2026 (USD Million)

5.4.2 Market size, by end-use, 2016-2026 (USD Million)

5.4.3 China

5.4.3.1 Market size, by end-use, 2016-2026 (USD Million)

5.4.4 India

5.4.4.1 Market size, by end-use, 2016-2026 (USD Million)

5.4.5 Japan

5.4.5.1 Market size, by end-use, 2016-2026 (USD Million)

5.4.6 Australia

5.4.6.1 Market size, by end-use, 2016-2026 (USD Million)

5.4.7 South Korea

5.4.7.1 Market size, by end-use, 2016-2026 (USD Million)

5.5 Latin America

5.5.1 Market size, by country 2016-2026 (USD Million)

5.5.2 Market size, by end-use, 2016-2026 (USD Million)

5.5.3 Brazil

5.5.3.1 Market size, by end-use, 2016-2026 (USD Million)

5.5.4 Mexico

5.5.4.1 Market size, by end-use, 2016-2026 (USD Million)

5.5.5 Argentina

5.5.5.1 Market size, by end-use, 2016-2026 (USD Million)

5.6 MEA

5.6.1 Market size, by country 2016-2026 (USD Million)

5.6.2 Market size, by end-use, 2016-2026 (USD Million)

5.6.3 Saudi Arabia

5.6.3.1 Market size, by end-use, 2016-2026 (USD Million)

5.6.4 UAE

5.6.4.1 Market size, by end-use, 2016-2026 (USD Million)

5.6.5 South Africa

5.6.5.1 Market size, by end-use, 2016-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive analysis, 2020

6.2 Natural Fiber

6.2.1 Company overview

6.2.2 Financial analysis

6.2.3 Strategic positioning

6.2.4 Info graphic analysis

6.3 Forever Green

6.3.1 Company overview

6.3.2 Financial analysis

6.3.3 Strategic positioning

6.3.4 Info graphic analysis

6.4 Hanf & Natur

6.4.1 Company overview

6.4.2 Financial analysis

6.4.3 Strategic positioning

6.4.4 Info graphic analysis

6.5 HempAge AG

6.5.1 Company overview

6.5.2 Financial analysis

6.5.3 Strategic positioning

6.5.4 Info graphic analysis

6.6 HempConsult GmbH

6.6.1 Company overview

6.6.2 Financial analysis

6.6.3 Strategic positioning

6.6.4 Info graphic analysis

6.7 Hempro Int. GmbH & Co. KG

6.7.1 Company overview

6.7.2 Financial analysis

6.7.3 Strategic positioning

6.7.4 Info graphic analysis

6.8 Hempy’s

6.8.1 Company overview

6.8.2 Financial analysis

6.8.3 Strategic positioning

6.8.4 Info graphic analysis

6.9 Hive Mind Development

6.9.1 Company overview

6.9.2 Financial analysis

6.9.3 Strategic positioning

6.9.4 Info graphic analysis

6.10 Hive Mind Development

6.10.1 Company overview

6.10.2 Financial analysis

6.10.3 Strategic positioning

6.10.4 Info graphic analysis

6.11 CBD Biotechnology Co., Ltd.

6.11.1 Company overview

6.11.2 Financial analysis

6.11.3 Strategic positioning

6.11.4 Info graphic analysis

6.12 Botanical Genetics, LLC

6.12.1 Company overview

6.12.2 Financial analysis

6.12.3 Strategic positioning

6.12.4 Info graphic analysis

6.13 Marijuana Company of America Inc.

6.13.1 Company overview

6.13.2 Financial analysis

6.13.3 Strategic positioning

6.13.4 Info graphic analysis

6.14 HempMeds Brasil

6.14.1 Company overview

6.14.2 Financial analysis

6.14.3 Strategic positioning

6.14.4 Info graphic analysis

6.15 Terra Tech Corp

6.15.1 Company overview

6.15.2 Financial analysis

6.15.3 Strategic positioning

6.15.4 Info graphic analysis

6.16 American Cannabis Company, Inc.

6.16.1 Company overview

6.16.2 Financial analysis

6.16.3 Strategic positioning

6.16.4 Info graphic analysis

6.17 HempFlax B.V.

6.17.1 Company overview

6.17.2 Financial analysis

6.17.3 Strategic positioning

6.17.4 Info graphic analysis

6.18 American Hemp

6.18.1 Company overview

6.18.2 Financial analysis

6.18.3 Strategic positioning

6.18.4 Info graphic analysis

6.19 Hemp, Inc.

6.19.1 Company overview

6.19.2 Financial analysis

6.19.3 Strategic positioning

6.19.4 Info graphic analysis

6.20 Boring Hemp Company

6.20.1 Company overview

6.20.2 Financial analysis

6.20.3 Strategic positioning

6.20.4 Info graphic analysis

6.21 Plains Industrial Hemp Processing Ltd.

6.21.1 Company overview

6.21.2 Financial analysis

6.21.3 Strategic positioning

6.21.4 Info graphic analysis

6.22 Ecofiber

6.22.1 Company overview

6.22.2 Financial analysis

6.22.3 Strategic positioning

6.22.4 Info graphic analysis

6.23 Valley Bio Limited

6.23.1 Company overview

6.23.2 Financial analysis

6.23.3 Strategic positioning

6.23.4 Info graphic analysis

6.24 Hempco

6.24.1 Company overview

6.24.2 Financial analysis

6.24.3 Strategic positioning

6.24.4 Info graphic analysis

6.25 Ecofibre

6.25.1 Company overview

6.25.2 Financial analysis

6.25.3 Strategic positioning

6.25.4 Info graphic analysis

6.26 Gencanna

6.26.1 Company overview

6.26.2 Financial analysis

6.26.3 Strategic positioning

6.26.4 Info graphic analysis

6.27 Konoplex Group

6.27.1 Company overview

6.27.2 Financial analysis

6.27.3 Strategic positioning

6.27.4 Info graphic analysis

6.28 BAFA

6.28.1 Company overview

6.28.2 Financial analysis

6.28.3 Strategic positioning

6.28.4 Info graphic analysis

6.29 Hemp Poland

6.29.1 Company overview

6.29.2 Financial analysis

6.29.3 Strategic positioning

6.29.4 Info graphic analysis

6.30 Dun Agro

6.30.1 Company overview

7.30.2 Financial analysis

7.30.3 Strategic positioning

7.30.4 Info graphic analysis

6.31 Colorado Hemp Works

6.31.1 Company overview

6.31.2 Financial analysis

6.31.3 Strategic positioning

6.31.4 Info graphic analysis

6.32 Canah International

6.32.1 Company overview

6.32.2 Financial analysis

6.32.3 Strategic positioning

6.32.4 Info graphic analysis

6.33 South Hemp Tecno

6.33.1 Company overview

6.33.2 Financial analysis

6.33.3 Strategic positioning

6.33.4 Info graphic analysis

6.34 Plains Industrial Hemp Processing

6.34.1 Company overview

6.34.2 Financial analysis

6.34.3 Strategic positioning

3.34.4 Info graphic analysis

The Global Hemp Fiber Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hemp Fiber Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS