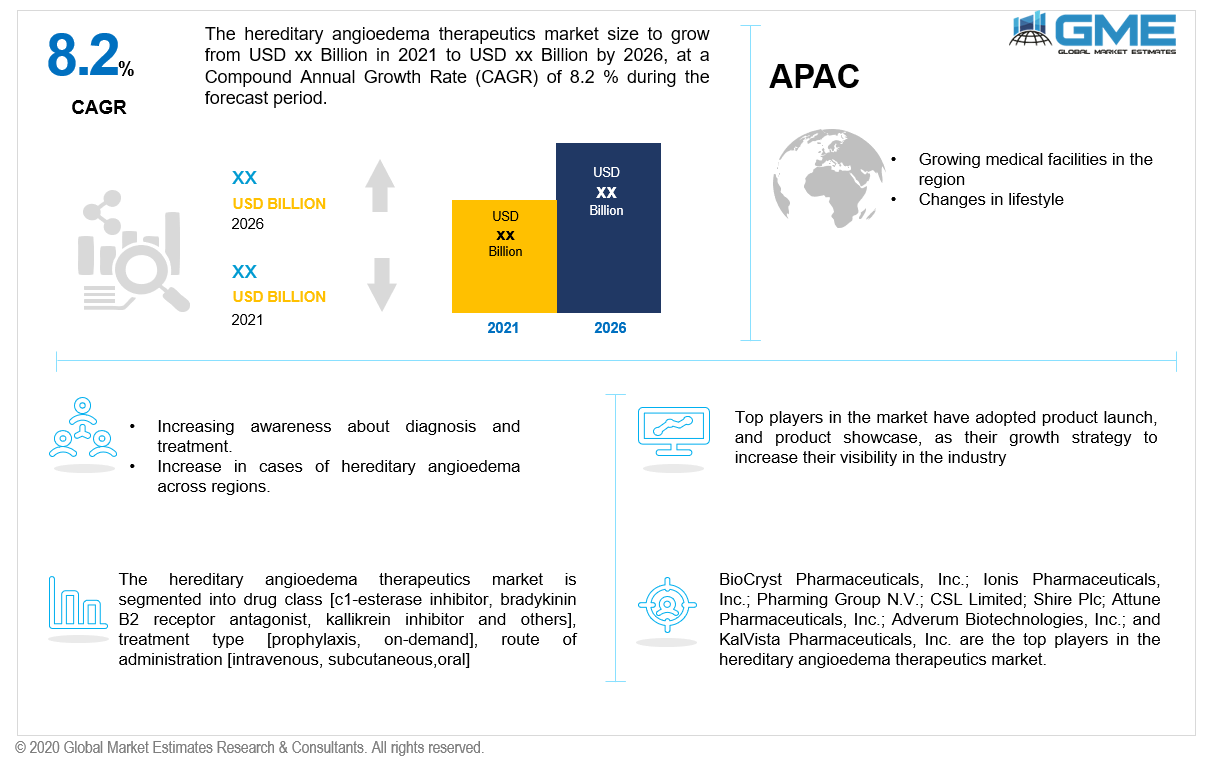

Global Hereditary Angioedema Therapeutics Market Size, Trends & Analysis - Forecasts to 2026 By Drug Class [C1-esterase Inhibitor, Bradykinin B2 Receptor Antagonist, Kallikrein Inhibitor, Others], By Treatment Type [Prophylaxis, On-demand], By Route of Administration [Intravenous, Subcutaneous, Oral], By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User, Landscape, Company Market Share Analysis, and Competitor Analysis

Hereditary angioedema is a relatively uncommon genetic disorder. Rare diseases have become more common in recent years as global monitoring of their occurrence has increased over the last few decades. This is especially important for genetic disorders, since systematic scans and testing are scarce, making it difficult to estimate how many patients are affected. HAE, or hereditary angioedema, has been in the news recently as governments and non-governmental organizations around the world seek to raise global consciousness to boost diagnosis and care.

The Hereditary Angioedema Association is predicted to play an important role in spreading new therapies around the world. They have also attempted to raise awareness of products and enhance the benefits that HAE patients need, which is expected to lead to a positive change in the Hereditary Angioedema industry. Population growth, as well as lifestyle changes, improved insurance programs, and increased efforts by pharmaceutical and biotechnology companies to develop new products and solutions for the industry, are expected to fuel market revenue for Hereditary Angioedema in the years ahead. Nonetheless, high drug prices and delayed detection of illnesses are some of the variables limiting the growth of the Hereditary Angioedema market during the forecast period.

The swelling of tissues in the feet, head, digestive tract, airway, or face is caused by lymphatic or blood pressure, which is the continuous concentration of liquids outside of the veins. Hereditary angioedema may be inherited or acquired; it is most frequent in children and teenagers. Key players in this segment are pursuing a proactive approach to improving popular products while also increasing their future earnings, resulting in a rise in the global hereditary angioedema market over the years. The components that drive the hereditary angioedema industry, which is expected to have flickering growth in the future, are increased awareness, strengthened management, and better performance.

An assault may also be triggered by stress or minor trauma. Swelling in the airway will make it difficult to breathe and lead to life-threatening airway obstruction. At the time of a strike, about 35% of people with this disease develop a non-itchy rash named erythema marginatum. Any birth, regardless of the sex of the resulting foetus, has a 50-52% chance of transmitting the defective gene to offspring from the infected parent.

Also, the industry is projected to expand due to an increase in cases of hereditary angioedema in different regions around the world.

Due to the extreme current pandemic situation and the ongoing need to develop a drug and vaccine, pharmaceutical companies have devoted all of their R&D assets to the creation of the COVID-19 vaccine. For the time being, R&D attempts for rare diseases like hereditary angioedema have been identified in R&D laboratories. Some companies, on the other hand, are focusing their R&D efforts on recognizing the effects of COVID-19 in patients with rare diseases and performing Esoteric Testing to evaluate novel COVID-19 therapies.

Based on the drug class, the Hereditary Angioedema Therapeutics market can be segmented as C1-esterase inhibitor, Bradykinin B2 receptor antagonist, Kallikrein inhibitor, and others. During the forecast timeline, the C1-esterase inhibitor segment would be the largest. The use of the drugs of both on-demand and prophylactic management of HAE accounts for the majority of the segment's revenue.

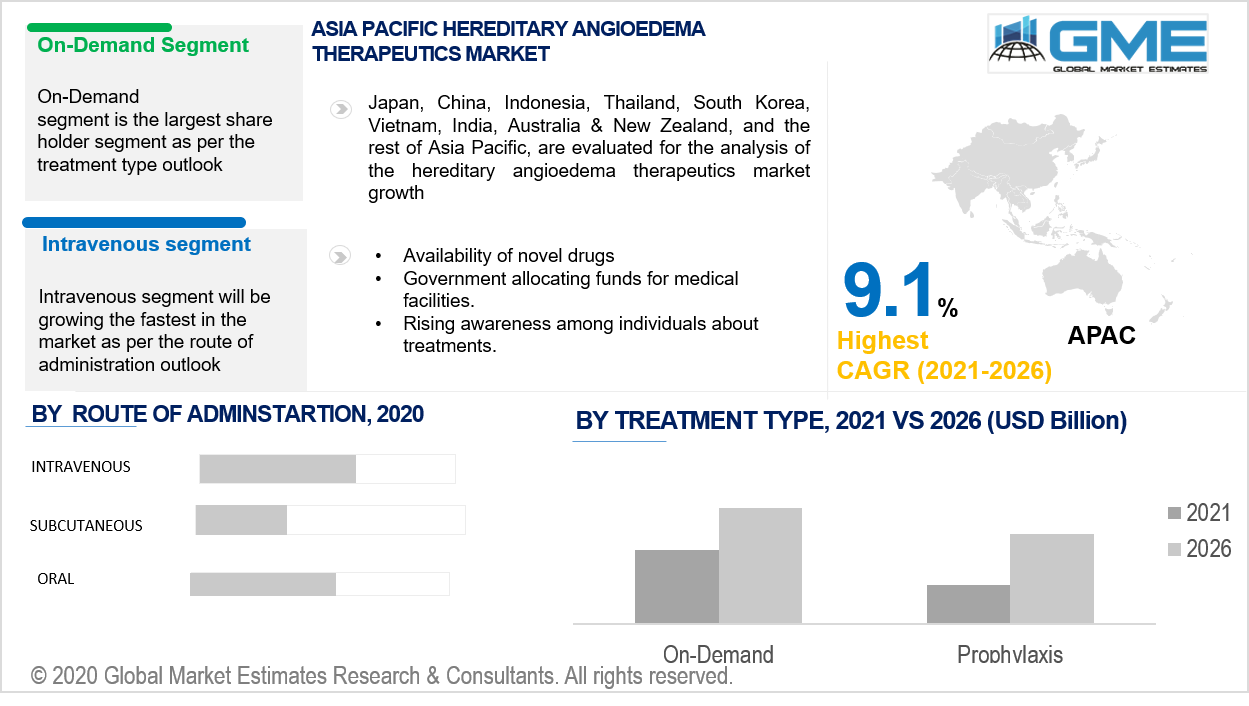

Based on treatment type, the hereditary angioedema therapeutics market is divided into prophylaxis and on-demand. In the years ahead, on-demand treatment would have the highest market share. A higher intensity rendering engine for the hereditary angioedema therapeutics industry is the continued use of on-demand drugs for the treatment of acute hereditary angioedema attacks. Furthermore, corporations' regional expansion into newer markets is likely to aid segment growth.

Based on the route of administration, the hereditary angioedema therapeutics market is classified as intravenous, subcutaneous, and oral. During the forecast years, the intravenous therapies category would dominate the market in terms of sales. The majority of current HAE treatments are given intravenously, which has contributed to the disease's rapid development. For medications used to cure pathological angioedema, intravenous injection has become the preferred mode of administration. This is because standard prophylactic medications have historically been given intravenously, and this approach has accounted for a large portion of the worldwide inherited angioedema care demand in recent years.

Due to the benefits like easy dosing and superior effectiveness relative to intravenously administered treatments, subcutaneously administered treatments are predicted to develop at the fastest pace over the projected period. Insulin, diacetylmorphine, goserelin, and morphine, are all very powerful drugs that can be given subcutaneously. Subcutaneous injections as a mode of drug administration are expected to see a rise in demand due to an increase in demand for easy-to-use patients.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. Because of new product releases by global companies, improved payment scenarios, and well-developed healthcare facilities, North America will account for a large proportion of the industry in terms of sales in the coming years.

During the projected timeline, the APAC region is projected to rise at the fastest pace. The demand in the area is expected to be driven by rising patient awareness and the introduction of innovative therapies for the treatment of hereditary angioedema. Moreover, the elevation of the hereditary angioedema therapeutics sector is shown by changes in lifestyle and ongoing efforts in the management of healthcare services.

BioCryst Pharmaceuticals, Inc.; Ionis Pharmaceuticals, Inc.; Pharming Group N.V.; CSL Limited; Shire Plc; Attune Pharmaceuticals, Inc.; Adverum Biotechnologies, Inc.; Arrowhead KalVista Pharmaceuticals, Inc.; and KalVista Pharmaceuticals, Inc. are the top players in the hereditary angioedema therapeutics market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2021, BioCryst’s product ORLADEYOTM (berotralstat), the first oral, once-daily therapy to prevent attacks in patients with hereditary angioedema, has been approved by the European Commission.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Hereditary Angioedema Therapeutic Industry Overview, 2019-2026

2.1.1 Drug Class Overview

2.1.2 Treatment Type Overview

2.1.3 Route of Administration Overview

2.1.4 Region Overview

Chapter 3 Global Hereditary Angioedema Therapeutic Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing awareness

3.3.1.2 Advanced technology in treatment

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Drug Class Growth Scenario

3.4.2 Treatment Type Growth Scenario

3.4.3 Route of Administration Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.7 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Hereditary Angioedema Therapeutic Market, By Drug Class

4.1 Connectivity Type Outlook

4.2 Bradykinin B2 receptor antagonist

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 C1-esterase inhibitor

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Kallikrein

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Hereditary Angioedema Therapeutic Market, By Treatment Type

5.1 Treatment Type Outlook

5.2 Prophylaxis

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 On-Demand

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Hereditary Angioedema Therapeutic Market, By Route of Administration

6.1 Route of Administration Type Outlook

6.2 Intravenous

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Subcutaneous

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Oral

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Hereditary Angioedema Therapeutic Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.3 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.2.4 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.2.7 U.S.

7.2.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.7.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.2.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.2.8 Canada

7.2.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.2.8.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.2.8.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.3 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.4 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3.7 Germany

7.3.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3.8 UK

7.3.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3.9 France

7.3.9.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3.10 Italy

7.3.10.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.3.11 Rest of Europe

7.3.11.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.3.11.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.3.11.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.3 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.4.4 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4.4 China

7.4.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.4.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.4.4.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4.5 India

7.4.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.7.2 Market size, By Treatment Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.4.8.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.3 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.5.4 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.5.4 Brazil

7.5.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.4.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.5.4.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.5.5 Mexico

7.5.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.7 MEA

7.7.1 Market Size, By Country 2019-2026 (USD Billion)

7.7.2 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.7.3 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.7.4 Saudi Arabia

7.7.4.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.7.4.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.7.4.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.7.5 UAE

7.7.5.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.7.5.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.7.5.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

7.7.7 South Africa

7.7.7.1 Market Size, By Drug Class, 2019-2026 (USD Billion)

7.7.7.2 Market Size, By Treatment Type, 2019-2026 (USD Billion)

7.7.7.3 Market Size, By Route of Administration, 2019-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Shire Plc

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 BioCryst Pharmaceuticals, Inc

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Ionis Pharmaceuticals, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Pharming Group N.V.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.7 CSL Limited

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.7 Attune Pharmaceuticals, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Adverum Biotechnologies, Inc.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 KalVista Pharmaceuticals Ltd.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Arrowhead Pharmaceuticals Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Other Companies

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

The Global Hereditary Angioedema Therapeutics Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Hereditary Angioedema Therapeutics Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS