Global High Performance Safety Coatings Market Size, Trends & Analysis - Forecasts to 2026 By Type (Antiviral, Antimicrobial), By Material (Graphene, Silver, Copper, Silicon Dioxide, Titanium Dioxide), By Application (Protective Clothing, Medical & Healthcare, Air & Water Treatment, Packaging, Building & Construction), By Form (Spray, Powder, Liquid), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

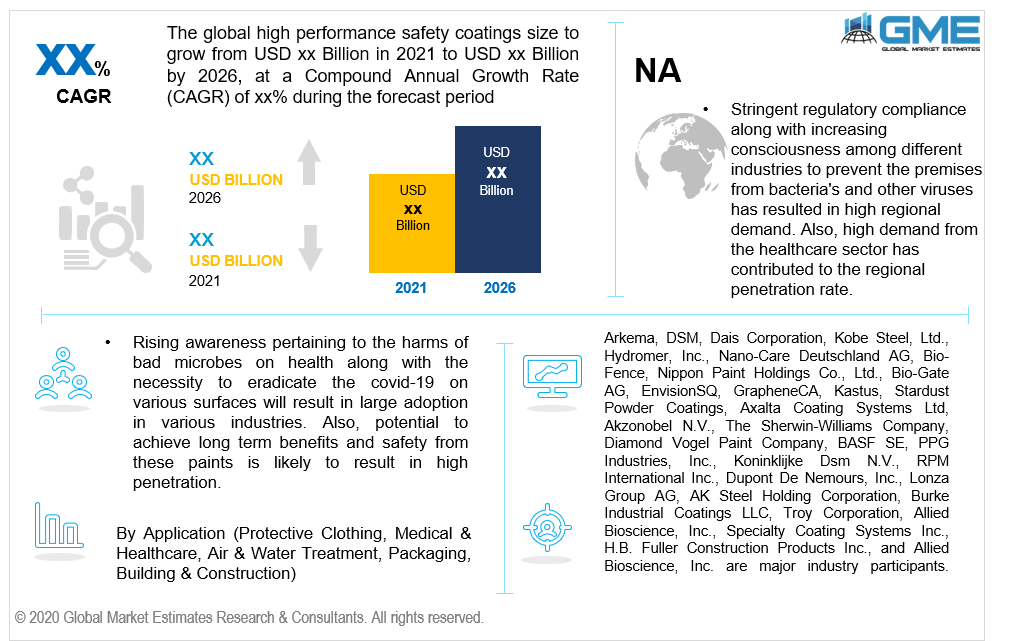

Increasing stress on the industries to maintain the safety of the premises from viruses and bacteria has positively influenced the adoption of high performance safety coatings in the developed and underdeveloped nations. Rising awareness pertaining to the harm of bad microbes on health along with the necessity to eradicate the covid-19 on various surfaces will result in large adoption in various industries. Also, the potential to achieve long-term benefits and safety from these paints is likely to result in high penetration.

Strict regulatory guidelines regarding the raw material and inclusion of harmful materials in the coatings may limit the market growth. However, increasing investment by companies to manufacture more reliable and sustainable solutions will offer lucrative opportunities in the industry.

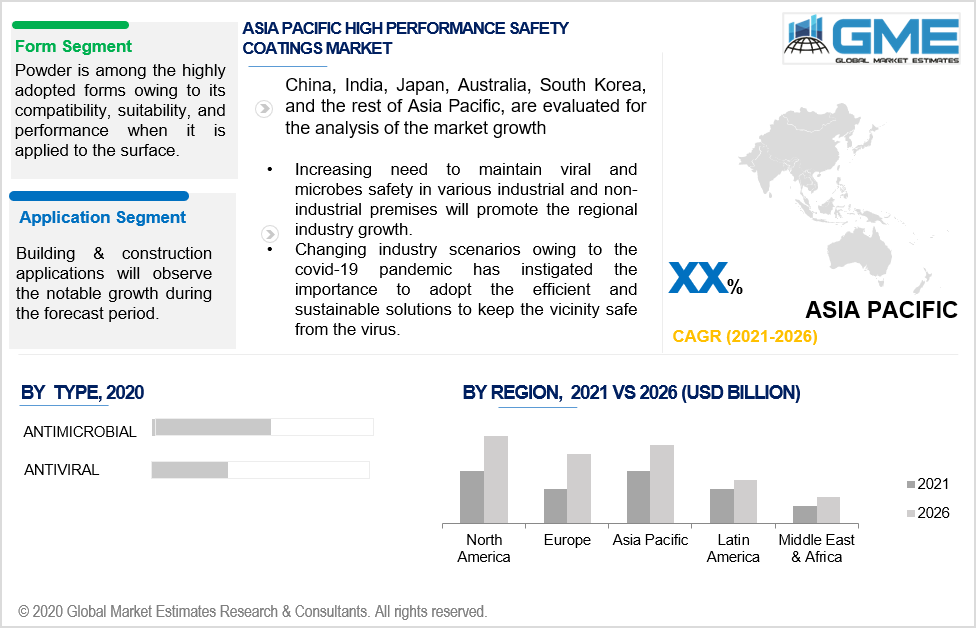

The High Performance Safety Coatings Market by type is divided into antiviral and antimicrobial. Antimicrobial high performance safety coatings dominated the industry and held for the maximum share in 2019. Developed with various anti-microbes and offering high protection from foreign microbes makes the type highly adopted in various industrial and non-industrial premises. Antiviral is expected to witness the highest CAGR due to its high benefits in preventing the surface and property from the covid-19 virus along with increasing adoption of spray based antiviral products.

Graphene, silver, copper, silicon dioxide, and titanium dioxide are majorly adopted materials in the High Performance Safety Coatings industry. Each material holds a different property entirely dependent on the coating purpose. Silver and copper materials are projected to hold a significant share in the coming years. Effective protection from microbes and viruses on the surface along with the minimal impact on the environment will promote growth in this segment.

The applications are segmented into protective clothing, medical & healthcare, air & water treatment, packaging, and building & construction. The medical & healthcare sector is noted to be highly lucrative and promising applications in the coming years. Increased urgency to maintain safety in the hospitals, clinics, and other medical premises to protect the surface from viruses will positively influence the high performance safety coatings demand in medical & healthcare applications.

Building & construction applications will observe notable growth during the forecast period. Changing building codes along with strict guidelines pertaining to health safety will stimulate the demand in this application.

Spray, powder, and liquid are key commercialized forms in the industry. Powder dominated the form segment and held the largest share in 2019. Powder is among the highly adopted forms owing to its compatibility, suitability, and performance when it is applied to the surface. Also, wide product availability for diversified applications has proliferated the demand.

Spray form will observe the fastest growth up to 2026. Rising competitiveness among industry players to enhance the product along with the necessity to create a more effective product has resulted in the introduction of spray-based high performance safety coatings.

Asia Pacific High Performance Safety Coatings Market is projected to observe highest growth up to 2026. The increasing need to maintain viral and microbes safety in various industrial and non-industrial premises will promote the regional industry growth. China, Japan, South Korea, and India are among the key contributing countries. Changing industry scenarios owing to the covid-19 pandemic has instigated the importance to adopt efficient and sustainable solutions to keep the vicinity safe from the virus.

North America will account for a significant share in 2019. Stringent regulatory compliance along with increasing consciousness among different industries to prevent the premises from bacterias and other viruses has resulted in high regional demand. Also, high demand from the healthcare sector has contributed to the regional penetration rate.

The European market is greatly inclined towards the healthcare safety norms which in turn created huge potential for the High Performance Safety Coatings demand in healthcare, protective clothing, and packaging applications.

Global High Performance Safety Coatings Company Market Share is partially consolidated and competitive. The presence of key multi-national companies holding the maximum share makes the market consolidated. However, the wide presence of domestic players having reach in remote areas and local areas makes the market competitive for international companies. Product development and advancement along with innovation in new application areas are prime approaches noticed in the industry.

Arkema, DSM, Dais Corporation, Kobe Steel, Ltd., Hydromer, Inc., Nano-Care Deutschland AG, Bio-Fence, Nippon Paint Holdings Co., Ltd., Bio-Gate AG, EnvisionSQ, GrapheneCA, Kastus, Stardust Powder Coatings, Axalta Coating Systems Ltd, Akzonobel N.V., The Sherwin-Williams Company, Diamond Vogel Paint Company, BASF SE, PPG Industries, Inc., Koninklijke Dsm N.V., RPM International Inc., Dupont De Nemours, Inc., Lonza Group AG, AK Steel Holding Corporation, Burke Industrial Coatings LLC, Troy Corporation, Allied Bioscience, Inc., Specialty Coating Systems Inc., H.B. Fuller Construction Products Inc., and Allied Bioscience, Inc. are major industry participants.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 High performance safety coatings industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 Material overview

2.1.4 Application overview

2.1.5 Form overview

2.1.6 Regional overview

Chapter 3 High Performance Safety Coatings Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.5 COVID-19 influence over industry growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Production overview

3.10.1 Formulation

3.10.2 End-Use

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 High Performance Safety Coatings Market, By Type

4.1 Type Outlook

4.2 Antiviral

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Antimicrobial

4.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 High Performance Safety Coatings Market, By Material

5.1 Material Outlook

5.2 Graphene

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Silver

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Copper

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Silicon dioxide

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Titanium dioxide

5.6.1 Market size, by region, 2019-2026 (USD Million)

5.7 Others

5.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 High Performance Safety Coatings Market, By Application

6.1 Application Outlook

6.2 Protective clothing

6.2.1 Market size, by region, 2019-2026 (USD Million)

6.3 Medical & healthcare

6.3.1 Market size, by region, 2019-2026 (USD Million)

6.4 Air & water treatment

6.4.1 Market size, by region, 2019-2026 (USD Million)

6.5 Packaging

6.5.1 Market size, by region, 2019-2026 (USD Million)

6.6 Building & construction

6.6.1 Market size, by region, 2019-2026 (USD Million)

6.7 Others

6.7.1 Market size, by region, 2019-2026 (USD Million)

Chapter 7 High Performance Safety Coatings Market, By Form

7.1 Form

7.2 Spray

7.2.1 Market size, by region, 2019-2026 (USD Million)

7.3 Powder

7.3.1 Market size, by region, 2019-2026 (USD Million)

7.4 Liquid

7.4.1 Market size, by region, 2019-2026 (USD Million)

7.5 Others

7.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 8 High Performance Safety Coatings Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market size, by country 2019-2026 (USD Million)

8.2.2 Market size, by type, 2019-2026 (USD Million)

8.2.3 Market size, by material, 2019-2026 (USD Million)

8.2.4 Market size, by application, 2019-2026 (USD Million)

8.2.5 Market size, by form, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market size, by type, 2019-2026 (USD Million)

8.2.6.2 Market size, by material, 2019-2026 (USD Million)

8.2.6.3 Market size, by application, 2019-2026 (USD Million)

8.2.6.4 Market size, by form, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market size, by type, 2019-2026 (USD Million)

8.2.7.2 Market size, by material, 2019-2026 (USD Million)

8.2.7.3 Market size, by application, 2019-2026 (USD Million)

8.2.7.4 Market size, by form, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market size, by country 2019-2026 (USD Million)

8.3.2 Market size, by type, 2019-2026 (USD Million)

8.3.3 Market size, by material, 2019-2026 (USD Million)

8.3.4 Market size, by application, 2019-2026 (USD Million)

8.3.5 Market size, by form, 2019-2026 (USD Million)

8.3.6 Germany

8.2.6.1 Market size, by type, 2019-2026 (USD Million)

8.2.6.2 Market size, by material, 2019-2026 (USD Million)

8.2.6.3 Market size, by application, 2019-2026 (USD Million)

8.2.6.4 Market size, by form, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market size, by type, 2019-2026 (USD Million)

8.3.7.2 Market size, by material, 2019-2026 (USD Million)

8.3.7.3 Market size, by application, 2019-2026 (USD Million)

8.3.7.4 Market size, by form, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market size, by type, 2019-2026 (USD Million)

8.3.8.2 Market size, by material, 2019-2026 (USD Million)

8.3.8.3 Market size, by application, 2019-2026 (USD Million)

8.3.8.4 Market size, by form, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market size, by type, 2019-2026 (USD Million)

8.3.9.2 Market size, by material, 2019-2026 (USD Million)

8.3.9.3 Market size, by application, 2019-2026 (USD Million)

8.3.9.4 Market size, by form, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market size, by type, 2019-2026 (USD Million)

8.3.10.2 Market size, by material, 2019-2026 (USD Million)

8.3.10.3 Market size, by application, 2019-2026 (USD Million)

8.3.10.4 Market size, by form, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market size, by country 2019-2026 (USD Million)

8.4.2 Market size, by type, 2019-2026 (USD Million)

8.4.3 Market size, by material, 2019-2026 (USD Million)

8.4.4 Market size, by application, 2019-2026 (USD Million)

8.4.5 Market size, by form, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market size, by type, 2019-2026 (USD Million)

8.4.6.2 Market size, by material, 2019-2026 (USD Million)

8.4.6.3 Market size, by application, 2019-2026 (USD Million)

8.4.6.4 Market size, by form, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market size, by type, 2019-2026 (USD Million)

8.4.7.2 Market size, by material, 2019-2026 (USD Million)

8.4.7.3 Market size, by application, 2019-2026 (USD Million)

8.4.7.4 Market size, by form, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market size, by type, 2019-2026 (USD Million)

8.4.8.2 Market size, by material, 2019-2026 (USD Million)

8.4.8.3 Market size, by application, 2019-2026 (USD Million)

8.4.8.4 Market size, by form, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market size, by type, 2019-2026 (USD Million)

8.4.9.2 Market size, by material, 2019-2026 (USD Million)

8.4.9.3 Market size, by application, 2019-2026 (USD Million)

8.4.9.4 Market size, by form, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market size, by type, 2019-2026 (USD Million)

8.4.10.2 Market size, by material, 2019-2026 (USD Million)

8.4.10.3 Market size, by application, 2019-2026 (USD Million)

8.4.10.4 Market size, by form, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market size, by country 2019-2026 (USD Million)

8.5.2 Market size, by type, 2019-2026 (USD Million)

8.5.3 Market size, by material, 2019-2026 (USD Million)

8.5.4 Market size, by application, 2019-2026 (USD Million)

8.5.5 Market size, by form, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market size, by type, 2019-2026 (USD Million)

8.5.6.2 Market size, by material, 2019-2026 (USD Million)

8.5.6.3 Market size, by application, 2019-2026 (USD Million)

8.5.6.4 Market size, by form, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market size, by type, 2019-2026 (USD Million)

8.5.7.2 Market size, by material, 2019-2026 (USD Million)

8.5.7.3 Market size, by application, 2019-2026 (USD Million)

8.5.7.4 Market size, by form, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market size, by country 2019-2026 (USD Million)

8.6.2 Market size, by type, 2019-2026 (USD Million)

8.6.3 Market size, by material, 2019-2026 (USD Million)

8.6.4 Market size, by application, 2019-2026 (USD Million)

8.6.5 Market size, by form, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market size, by type, 2019-2026 (USD Million)

8.6.6.2 Market size, by material, 2019-2026 (USD Million)

8.6.6.3 Market size, by application, 2019-2026 (USD Million)

8.6.6.4 Market size, by form, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market size, by type, 2019-2026 (USD Million)

8.6.7.2 Market size, by material, 2019-2026 (USD Million)

8.6.7.3 Market size, by application, 2019-2026 (USD Million)

8.6.7.4 Market size, by form, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive analysis, 2020

9.2 Arkema

9.2.1 Company overview

9.2.2 Financial analysis

9.2.3 Strategic positioning

9.2.4 Info graphic analysis

9.3 Dais Corporation

9.3.1 Company overview

9.3.2 Financial analysis

9.3.3 Strategic positioning

9.3.4 Info graphic analysis

9.4 Hydromer, Inc.

9.4.1 Company overview

9.4.2 Financial analysis

9.4.3 Strategic positioning

9.4.4 Info graphic analysis

9.5 Kobe Steel, Ltd.

9.5.1 Company overview

9.5.2 Financial analysis

9.5.3 Strategic positioning

9.5.4 Info graphic analysis

9.6 Nano-Care Deutschland AG

9.6.1 Company overview

9.6.2 Financial analysis

9.6.3 Strategic positioning

9.6.4 Info graphic analysis

9.7 Nippon Paint Holdings Co., Ltd.

9.7.1 Company overview

9.7.2 Financial analysis

9.7.3 Strategic positioning

9.7.4 Info graphic analysis

9.8 Bio-Fence

9.8.1 Company overview

9.8.2 Financial analysis

9.8.3 Strategic positioning

9.8.4 Info graphic analysis

9.9 Bio-Gate AG

9.9.1 Company overview

9.9.2 Financial analysis

9.9.3 Strategic positioning

9.9.4 Info graphic analysis

9.10 GrapheneCA

9.10.1 Company overview

9.10.2 Financial analysis

9.10.3 Strategic positioning

9.10.4 Info graphic analysis

9.11 EnvisionSQ

9.11.1 Company overview

9.11.2 Financial analysis

9.11.3 Strategic positioning

9.11.4 Info graphic analysis

9.12 Kastus

9.12.1 Company overview

9.12.2 Financial analysis

9.12.3 Strategic positioning

9.12.4 Info graphic analysis

9.13 Stardust Powder Coatings

9.13.1 Company overview

9.13.2 Financial analysis

9.13.3 Strategic positioning

9.13.4 Info graphic analysis

9.14 Akzonobel N.V.

9.14.1 Company overview

9.14.2 Financial analysis

9.14.3 Strategic positioning

9.14.4 Info graphic analysis

9.15 Axalta Coating Systems Ltd

9.15.1 Company overview

9.15.2 Financial analysis

9.15.3 Strategic positioning

9.15.4 Info graphic analysis

9.16 The Sherwin-Williams Company

9.16.1 Company overview

9.16.2 Financial analysis

9.16.3 Strategic positioning

9.16.4 Info graphic analysis

9.17 BASF SE

9.17.1 Company overview

9.17.2 Financial analysis

9.17.3 Strategic positioning

9.17.4 Info graphic analysis

9.18 Diamond Vogel Paint Company

9.18.1 Company overview

9.18.2 Financial analysis

9.18.3 Strategic positioning

9.18.4 Info graphic analysis

9.19 PPG Industries, Inc.

9.19.1 Company overview

9.19.2 Financial analysis

9.19.3 Strategic positioning

9.19.4 Info graphic analysis

9.20 RPM International Inc.

9.20.1 Company overview

9.20.2 Financial analysis

9.20.3 Strategic positioning

9.20.4 Info graphic analysis

9.21 Koninklijke Dsm N.V.

9.21.1 Company overview

9.21.2 Financial analysis

9.21.3 Strategic positioning

9.21.4 Info graphic analysis

9.22 Dupont De Nemours, Inc.

9.22.1 Company overview

9.22.2 Financial analysis

9.22.3 Strategic positioning

9.22.4 Info graphic analysis

9.23 Burke Industrial Coatings Llc

9.23.1 Company overview

9.23.2 Financial analysis

9.23.3 Strategic positioning

9.23.4 Info graphic analysis

9.24 Lonza Group Ag

9.24.1 Company overview

9.24.2 Financial analysis

9.24.3 Strategic positioning

9.24.4 Info graphic analysis

9.25 Ak Steel Holding Corporation

9.25.1 Company overview

9.25.2 Financial analysis

9.25.3 Strategic positioning

9.25.4 Info graphic analysis

9.26 Troy Corporation

9.26.1 Company overview

9.26.2 Financial analysis

9.26.3 Strategic positioning

9.26.4 Info graphic analysis

9.27 Specialty Coating Systems Inc.

9.27.1 Company overview

9.27.2 Financial analysis

9.27.3 Strategic positioning

9.27.4 Info graphic analysis

9.28 Allied Bioscience, Inc.

9.28.1 Company overview

9.28.2 Financial analysis

9.28.3 Strategic positioning

9.28.4 Info graphic analysis

9.29 H.B. Fuller Construction Products Inc.

9.29.1 Company overview

9.29.2 Financial analysis

9.29.3 Strategic positioning

9.29.4 Info graphic analysis

The Global High Performance Safety Coatings Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the High Performance Safety Coatings Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS