Global High Precision Tools Market Size, Trends, and Analysis- Forecasts To 2026 By Machine (Lathe Machines, Milling Machines, Drilling Machines, Grinding Machines, Boring Machines, and Gear Cutters), By Technology (Conventional and CNC (Computerized Numerical Control)), By Sales Channel Type (Online and Offline), By Application (Automotive, Aerospace, Metal Foundry, Woodworking, Shipbuilding, Power & Energy, and Other Industries), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

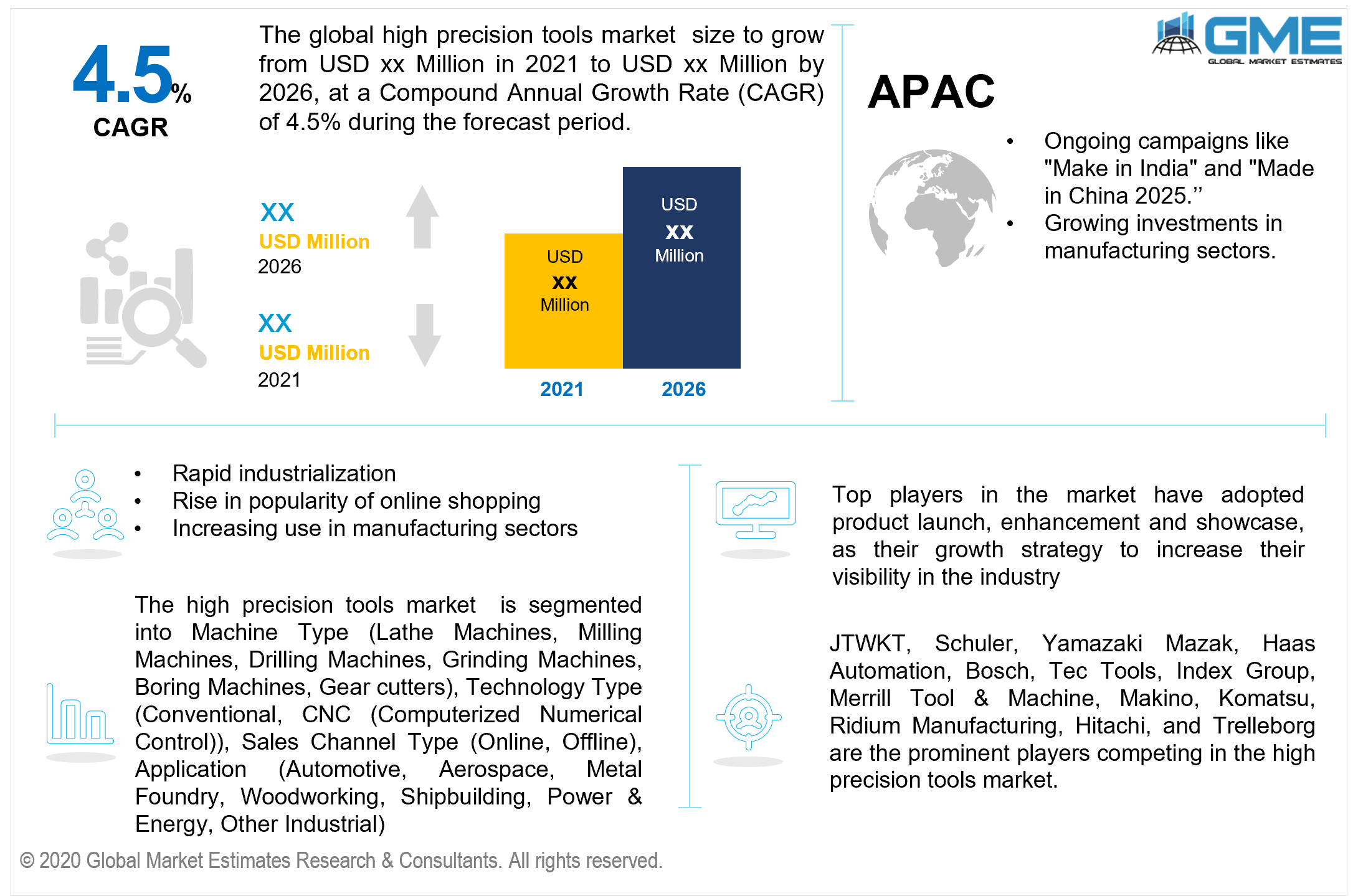

Over the next few years, rapid industrialization around the world is anticipated to push up the demand for high-precision tools. Throughout the forecast period, the global high-precision tools market is predicted to develop at a phenomenal rate due to the global growth of the industrial sector as well as developments in machine tools like Computer Numerical Control (CNC) machines and multiple axial and robotic arms. The global motion control market's expansion has resulted in a significant need for motion control products, notably in the robotics, electronic components assembling, semiconductors, industrial machinery, and renewable energy domains. Because of advancements in the control system, streamlined machine design is now achievable which will lead to a rise in demand for high-precision tools.

The pricing system for producers of high-precision tools is threatened by varying raw material prices. The cost of training the workforce is also factored into the total cost. Recruiting contractors or construction experts contribute to a company's expenses. Both factors raise manufacturing prices, limiting the development of the high precision tools market. The new technologies and advancements in machine tools, which influence major manufacturing sectors such as automobile, metal forming, and aerospace, are considered a crucial sector and foundation of the entire manufacturing industry. As a result, the market for high-precision tools is increasing. The rise in popularity of online shopping, as well as customer preference for them, is opening new growth opportunities for high precision tool manufacturers. As a result, leading industry players are focused on expanding their e-commerce platforms to capture market share.

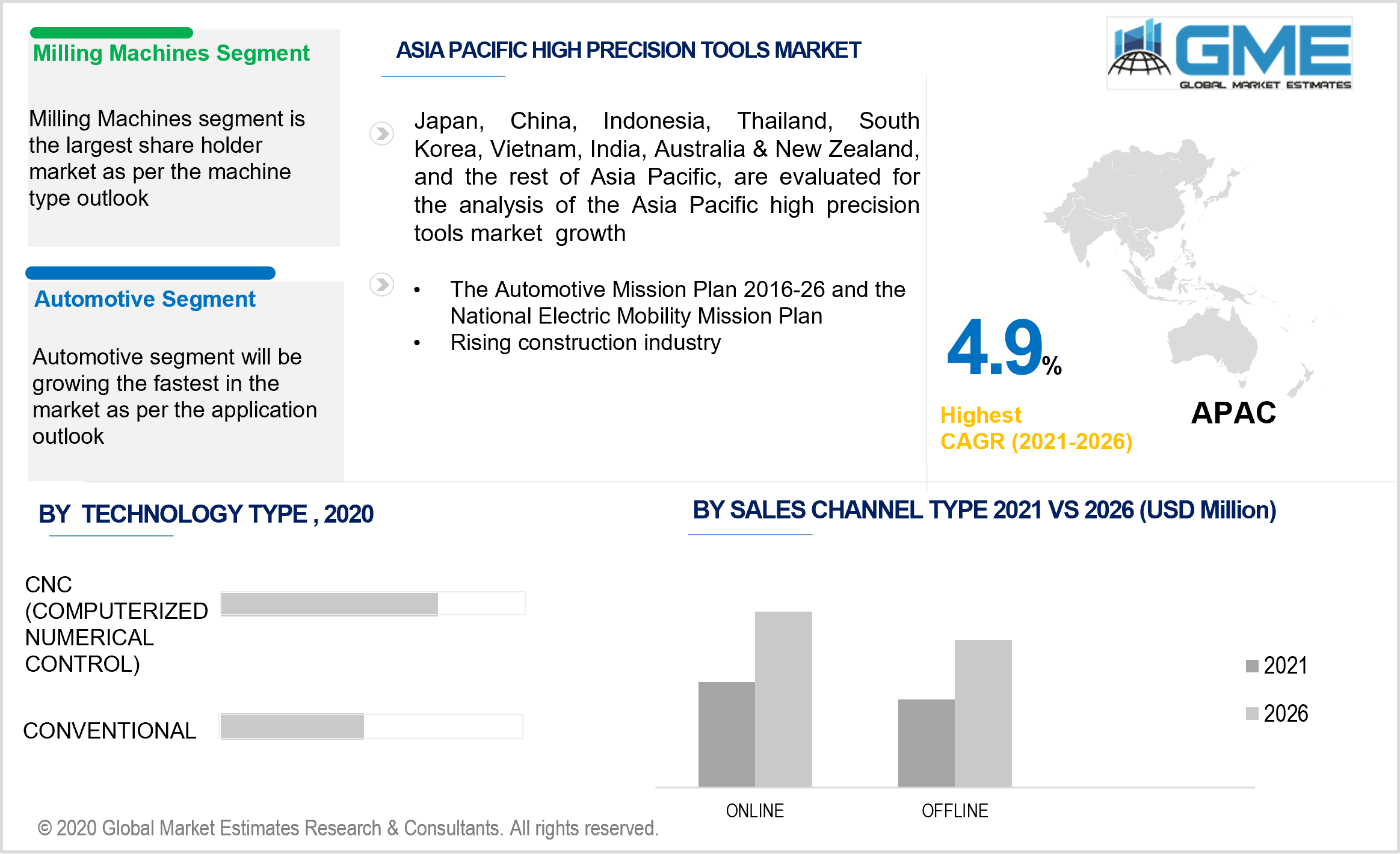

Depending on the machine type, the market is categorized as lathe machines, milling machines, drilling machines, grinding machines, boring machines, and gear cutters. Milling machines are anticipated to pull in the most profits. Milling machines are principally utilized in a range of sectors for metal cutting. Milling machines are in great demand owing to the global development of metalworking processing sectors. Milling machines are exceedingly multifunctional competent in filleting, twisting, chamfering, drilling, gear cutting, and a variety of other operations. Many cuts can be made with multiple cutters with the help of these machines. The milling machines are suitable for the automobile, and defense, aerospace, and railway sectors because of these benefits.

Depending on the technology, the market is categorized as conventional and CNC. Due to increased demand from manufacturing firms for efficiency enhancements and product advancement, the CNC machines segment will retain the majority of the machine tool share of the market and is projected to rise even further in the upcoming years. The rise of the industrial sector has culminated in an increase in need, notably for progressively advanced CNC machines. Machine tool automation contributes to increased efficiency, time savings, and the reduction of human errors. The latest version of CAD/CAM CNC machines are compact, with automated tool changes, and multi-axis operating capabilities, and can perform the full machining process on the same unit.

Depending on the sales channel, the market is categorized as online and offline. The online sales channel is projected to dominate the market. Companies like Georg Fischer, Ltd., and DMG MORI, and others, are focused on the expansion of the online sales channel, which is driving this segment's development. The growing demand for high-precision machine tools from e-commerce websites like Machine Tools Online and Alibaba.com, and others, is also propelling the online segment forward. Manufacturing companies such as DMG MORI and Okuma Corporation, on the other hand, have established online stores to encourage direct sales of their machine tools.

Depending on the application, the market is categorized as automotive, aerospace, metal foundry, woodworking, shipbuilding, power & energy, and other industries. Automotive is foreseen to report the highest market share. This is due to an increase in the use of high-precision tools to fabricate transmission housings, brake drums, gearbox cases, and engine cylinder heads, among several other automotive parts. The segment's growth has also been fuelled by the rising demand for CNC machines from automobile manufacturing companies. Meanwhile, electric vehicle sales and manufacture are expanding at an unprecedented rate, creating a need for high precision tools and other manufacturing-related equipment.

The Asia Pacific is foreseen to lead the market. This is due to campaigns like "Make in India" and "Made in China 2025," which are being undertaken by governments in the country to promote indigenous production. To promote manufacturing expenditure, the Indian government announced in September 2019 that manufacturing firms formed on or after October 1, 2019, will be eligible to pay corporation tax at a rate of 15%. Besides that, nations in the region, such as India, China, and South Korea, are among the world's largest automobile component producers, and the use of high precision tools in the manufacturing of automobile components has been increasing in the region. The rising construction industry in the Asia Pacific is expected to raise the demand for high-precision tools in the region. Also, the Automotive Mission Plan 2016-26 and the National Electric Mobility Mission Plan, all of which encourage the introduction of electric cars, are anticipated to accelerate the market further.

Because of the growing demand for high-precision tools from incumbents in the oil and energy, aerospace and defense, and automobile sectors, among many other industries and industry verticals, the North American regional market is expected to grow at the fastest rate throughout the forecast period. In the country, aircraft manufacturers are actively targeting different industry players for high-precision tool procurement.

JTWKT, Schuler, Yamazaki Mazak, Haas Automation, Bosch, Tec Tools, Index Group, Merrill Tool & Machine, Makino, Komatsu, Ridium Manufacturing, Hitachi, and Trelleborg are the prominent players competing in the high precision tools market.

Please note: This is not an exhaustive list of companies profiled in the report.

May 2020: Mazak Corporation is creating a new sales channel to extend its footprint in the Portuguese market. Mazak's distributor, Normil, will be assisted by the news sales operation, which will be located in Porto.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global High Precision Tools Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Machine Type Overview

2.1.3 Technology Overview

2.1.4 Sales Channel Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Global High Precision Tools Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Emergence of Latest Technology And Innovation In Machine Tools

3.3.1.2 Growing Industrial Sector

3.3.2 Industry Challenges

3.3.2.1 Varying Raw Material Prices

3.4 Prospective Growth Scenario

3.4.1 Machine Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Sales Channel Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global High Precision Tools Market, By Machine Type

4.1 Machine Type Outlook

4.2 Lathe Machines

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Milling Machines

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Drilling Machines

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Grinding Machines

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Boring Machines

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Gear Cutters

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global High Precision Tools Market, By Technology

5.1 Technology Outlook

5.2 Conventional

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 CNC (Computerized Numerical Control)

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global High Precision Tools Market, By Sales Channel

6.1 Sales Channel Outlook

6.2 Online

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Offline

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global High Precision Tools Market, By Application

7.1 Application Outlook

7.2 Automotive

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Metal Foundry

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

7.5 Woodworking

7.5.1 Market Size, By Region, 2016-2026 (USD Million)

7.6 Shipbuilding

7.6.1 Market Size, By Region, 2016-2026 (USD Million)

7.7 Power & Energy

7.7.1 Market Size, By Region, 2016-2026 (USD Million)

7.8 Other Industries

7.8.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Global High Precision Tools Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2016-2026 (USD Million)

8.2.2 Market Size, By Machine Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Technology, 2016-2026 (USD Million)

8.2.4 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.2.5 Market Size, By Application, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Technology, 2016-2026 (USD Million)

8.2.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Application, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Technology, 2016-2026 (USD Million)

8.2.7.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Application, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2016-2026 (USD Million)

8.3.2 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Technology, 2016-2026 (USD Million)

8.3.4 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.5 Market Size, By Application, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Application, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.7.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Application, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.8.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Application, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.9.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Application, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.10.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Application, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Technology, 2016-2026 (USD Million)

8.3.11.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Application, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2016-2026 (USD Million)

8.4.2 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Technology, 2016-2026 (USD Million)

8.4.4 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.4.5 Market Size, By Application, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Technology, 2016-2026 (USD Million)

8.4.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Application, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Technology, 2016-2026 (USD Million)

8.4.7.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Application, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Technology, 2016-2026 (USD Million)

8.4.8.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Application, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Technology, 2016-2026 (USD Million)

8.4.9.3 Market size, By Sales Channel, 2016-2026 (USD Million)

8.4.9.4 Market size, By Application, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Technology, 2016-2026 (USD Million)

8.4.10.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Application, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2016-2026 (USD Million)

8.5.2 Market Size, By Machine Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Technology, 2016-2026 (USD Million)

8.5.4 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.5.5 Market Size, By Application, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Technology, 2016-2026 (USD Million)

8.5.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Application, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Technology, 2016-2026 (USD Million)

8.5.7.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Application, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Technology, 2016-2026 (USD Million)

8.5.8.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Application, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2016-2026 (USD Million)

8.6.2 Market Size, By Machine Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Technology, 2016-2026 (USD Million)

8.6.4 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.6.5 Market Size, By Application, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Technology, 2016-2026 (USD Million)

8.6.6.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Application, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Technology, 2016-2026 (USD Million)

8.6.7.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Application, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Machine Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Technology, 2016-2026 (USD Million)

8.6.8.3 Market Size, By Sales Channel, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Application, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 JTWKT

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Schuler

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Yamazaki Mazak

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Haas Automation

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Bosch

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Tec Tools

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Index Group

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Merrill Tool & Machine

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Makino

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Komatsu

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Ridium Manufacturing

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Hitachi

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Trelleborg

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Other Companies

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

The Global High Precision Tools Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the High Precision Tools Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS