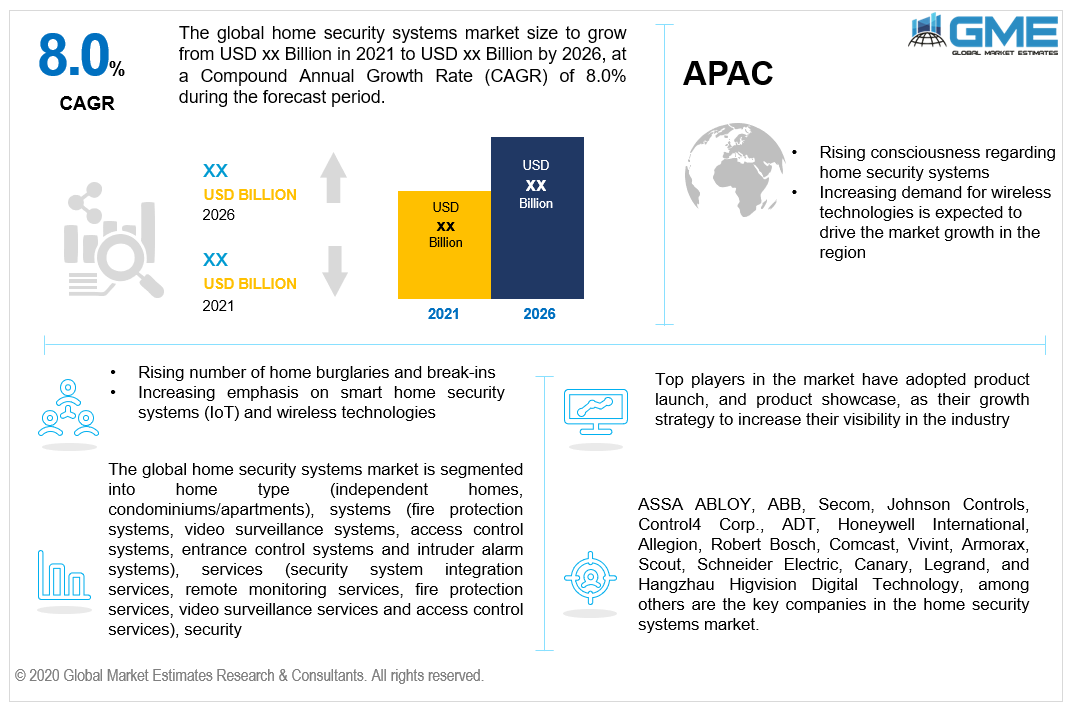

Global Home Security Systems Market Size, Trends & Analysis - Forecasts to 2026 By Home Type (Independent Homes, Condominiums/Apartments), By Systems (Fire Protection Systems, Video Surveillance Systems, Access Control Systems, Entrance Control Systems, and Intruder Alarm Systems), By Services (Security System Integration Services, Remote Monitoring Services, Fire Protection Services, Engineering Services, Installation and Design, Maintenance Services, Managed Services, Video Surveillance Services, Installation & Integration, Access Control- As-A-Service, Access Control Services), By Security (Professionally Installed & Monitored Systems, Self-Installed and Professionally Monitored Systems, and Do-It-Yourself (DIY)), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The home security systems are employed to safeguard personal property and to ensure the safety of the personnel against the potential outside threat of theft, burglaries, life threat and to secure the point of the entrance like doors, windows, and other points. The home security system comprises motion sensors, door and window sensors, cameras, controllers and control panels, sirens, or alarms. These systems help to inform and alert the owner in case of a security breach. In the case of a modern security system, the components are integrated with a single centralized control system. The home security systems provide constant surveillance and home monitoring throughout the year and it helps to provide peace of mind to the owner as it ensures proper security of the home as well as personnel living on that property and therefore there is a growing demand for home security systems across the globe.

There is a growing burglary rate across the world. As per the statistics provided, New Zealand faces the maximum number of burglaries per 100,000 population and its burglary rate stands at 1353 burglaries per 100,000 population. The U.S is also facing a large number of burglaries and break-ins. As per the statistics provided by the Federal Bureau of Investigation (FBI) in the U.S., around 3000 burglaries happen every day and people face an average loss of $3000 due to these burglaries and it is also found out that only 25% of U.S homes have home security systems for their protection. Therefore, there is huge potential for the home security systems market across the world. Apart from burglary, home security systems are also used for fire protection by employing smoke and fire alarms, remote monitoring services for both indoor and outdoor monitoring, gas detection, and electricity management. Therefore, there is a growing awareness among people regarding the home security system and its vivid applications.

There are growing advancements in technology and growing integration Internet of Things (IoT) and Artificial intelligence to develop smart home security systems. These smart home security systems are wireless and are connected through a wireless internet network and provide information and alerts regarding burglary or other issues such as fire or gas leakage. The development of smart sensing devices and communication mediums such as Wifi and Bluetooth technologies has supported the use of IoT in home security systems. The IoT-based home security systems promote portable, easier, and real-time home monitoring over smartphones, laptops, and other smart devices and are a leading factor for the development of smart homes. Therefore, there are increasing opportunities for manufacturers to develop smart home security systems.

The major market drivers for the home security systems are the growing number of home burglaries and break-ins, increasing consciousness regarding home security systems, growing demand for constant home surveillance, increasing emphasis on smart home security systems (IoT) and wireless technologies, growing home security technological advancement and rising demand for fire and gas leakage security systems. These contributors will help the home security market to grow during the period from 2021 to 2026. The higher cost of installation, operation, and maintenance of these systems will hinder home security system market growth.

Based on the home type, the market is categorized into independent homes, and condominiums/apartments. The independent homes segment will hold the largest share in the market. This is due to increasing theft in independent homes and growing awareness for home security systems.

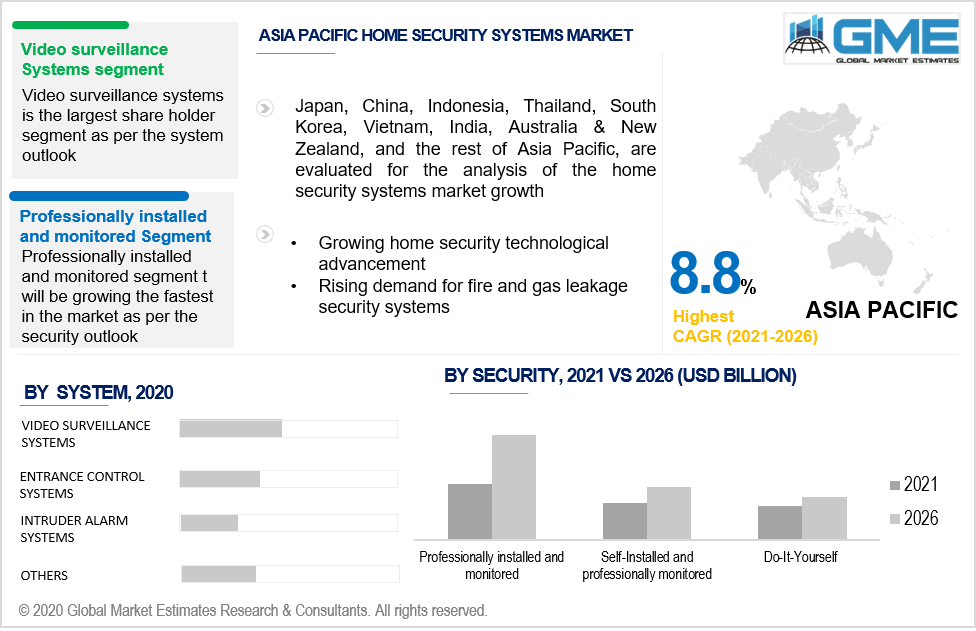

Based on the system, the market is segmented into fire protection systems, video surveillance systems, access control systems, entrance control systems, and intruder alarm systems. The video surveillance systems segment will be dominating the market during the tenure from 2021 to 2026. Video surveillance systems provide real-time video data of the event of activities and also provides evidence post the theft or other problematic event. Video surveillance provides real video output of the property to remote devices and therefore is largely used.

Based on the services, the market is categorized into security system integration services, remote monitoring services, fire protection services, engineering services, installation and design, maintenance services, managed services, video surveillance services, installation & integration, access control- as-a-service, and access control services. Due to the increasing trend of digitization and growing internet penetration and growing demand for third-party security service providers for better security and cost-effectiveness, the demand for security system integration services will be high and will dominate the services market segment.

Based on security, the market is divided into professionally installed & monitored systems, self-installed and professionally monitored systems, and do-it-yourself (DIY)). The professionally installed and monitored segment will dominate the market segment during the forecast timeline due to the increasing dependence on third-party security services and growing integration of IoT and smart devices for home security.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). The North American region will be holding the largest share in the home security systems market during the forecast period. This is due to growing awareness for home security systems and the presence of key market players in this region. The rising trend for smart home and security systems, growing disposable income of households will help the APAC region grow at a faster rate from 2021 to 2026. Japan's industry is one of the fastest-growing markets for IP camera surveillance systems. Nursing homes, small factories, supermarket chain stores, homeowners, and warehouses are all using these solutions.

ASSA ABLOY, ABB, Secom, Johnson Controls, Control4 Corp., ADT, Honeywell International, Allegion, Robert Bosch, Comcast, Vivint, Armorax, Scout, Schneider Electric, Canary, Legrand, and Hangzhau Higvision Digital Technology, among others are the key companies in the home security systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2019, The DS-KV8X13/DS-KV61X3 series of IP Villa Door Stations from Hangzhou Hikvision Digital Technology provide streamlined video intercom solution for homes and commercial buildings, as well as improved convenience and security at the front door.

In August 2018, Honeywell introduced its new Smart Home Security Systems in the U.S. This is an all-in-one Home Type and can be customized and connected with other Home Types and accessories and is equipped with an HD camera with a 1080p Wide angle lens. This has helped Honeywell company to penetrate the new market and gain market visibility.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Home Security Systems Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Home Type Overview

2.1.3 System Overview

2.1.4 Services Overview

2.1.5 Security Overview

2.1.6 Regional Overview

Chapter 3 Home Security Systems Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing number of home burglaries and break-ins

3.3.1.2 Increasing consciousness regarding home security systems

3.3.1.3 Increasing emphasis on smart home security systems (IoT) and wireless technologies and technological advancement

3.3.2 Industry Challenges

3.3.2.1 Higher cost of installation, operation and maintenance of these systems

3.4 Prospective Growth Scenario

3.4.1 Home Type Growth Scenario

3.4.2 System Growth Scenario

3.4.3 Services Growth Scenario

3.4.4 Security Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Home Security Systems Market, By Home Type

4.1 Home Type Outlook

4.2 Independent Homes

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Condominiums/Apartments

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Global Home Security Systems Market, By Systems

5.1 System Outlook

5.2 Fire Protection Systems

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Video Surveillance Systems

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Access Control Systems

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Entrance Control Systems

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Intruder Alarm Systems

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Global Home Security Systems Market, By Services

6.1 Services Outlook

6.2 Security System Integration Services

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Remote Monitoring Services

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Transportation & Logistics

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Fire Protection Services

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

6.6 Video Surveillance Services

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

6.7 Access Control Services

6.7.1 Market Size, By Region, 2019-2026 (USD Billion)

6.8 Access Control-As-A- Services

6.8.1 Market Size, By Region, 2019-2026 (USD Billion)

6.9 Maintenance Services

6.9.1 Market Size, By Region, 2019-2026 (USD Billion)

6.10 Installation & Integration

6.10.1 Market Size, By Region, 2019-2026 (USD Billion)

6.11 Managed Services

6.11.1 Market Size, By Region, 2019-2026 (USD Billion)

6.12 Engineering Services

6.12.1 Market Size, By Region, 2019-2026 (USD Billion)

6.13 Installation and Design

6.13.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Home Security Systems Market, By Services

7.1 Services Outlook

7.2 Professionally Installed & Monitored

7.2.1 Market Size, By Region, 2019-2026 (USD Billion)

7.3 Self-Installed and Professionally Monitored

7.3.1 Market Size, By Region, 2019-2026 (USD Billion)

7.4 Do-It-Yourself (DIY)

7.4.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Home Security Systems Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2019-2026 (USD Billion)

8.2.2 Market Size, By Home Type, 2019-2026 (USD Billion)

8.2.3 Market Size, By Systems, 2019-2026 (USD Billion)

8.2.4 Market Size, By Services, 2019-2026 (USD Billion)

8.2.5 Market Size, By Security, 2019-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.2.6.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.2.6.3 Market Size, By Services, 2019-2026 (USD Billion)

8.2.6.4 Market Size, By Security, 2019-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.2.7.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.2.7.3 Market Size, By Services, 2019-2026 (USD Billion)

8.2.7.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2019-2026 (USD Billion)

8.3.2 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.3 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.4 Market Size, By Services, 2019-2026 (USD Billion)

8.3.5 Market Size, By Security, 2019-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.6.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.6.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.6.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.7.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.7.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.7.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.8.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.8.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.8.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.9.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.9.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.9.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.10.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.10.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.10.4 Market Size, By Security, 2019-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.3.11.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.3.11.3 Market Size, By Services, 2019-2026 (USD Billion)

8.3.11.4 Market Size, By Security, 2019-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2019-2026 (USD Billion)

8.4.2 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.3 Market Size, By Systems, 2019-2026 (USD Billion)

8.4.4 Market Size, By Services, 2019-2026 (USD Billion)

8.4.5 Market Size, By Security, 2019-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.6.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.4.6.3 Market Size, By Services, 2019-2026 (USD Billion)

8.4.6.4 Market Size, By Security, 2019-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.7.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.4.7.3 Market Size, By Services, 2019-2026 (USD Billion)

8.4.7.4 Market Size, By Security, 2019-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.8.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.4.8.3 Market Size, By Services, 2019-2026 (USD Billion)

8.4.8.4 Market Size, By Security, 2019-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.9.2 Market size, By Systems, 2019-2026 (USD Billion)

8.4.9.3 Market Size, By Services, 2019-2026 (USD Billion)

8.4.9.4 Market Size, By Security, 2019-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.4.10.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.4.10.3 Market Size, By Services, 2019-2026 (USD Billion)

8.4.10.4 Market Size, By Security, 2019-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2019-2026 (USD Billion)

8.5.2 Market Size, By Home Type, 2019-2026 (USD Billion)

8.5.3 Market Size, By Systems, 2019-2026 (USD Billion)

8.5.4 Market Size, By Services, 2019-2026 (USD Billion)

8.5.5 Market Size, By Security, 2019-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.5.6.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.5.6.3 Market Size, By Services, 2019-2026 (USD Billion)

8.5.6.4 Market Size, By Security, 2019-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.5.7.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.5.7.3 Market Size, By Services, 2019-2026 (USD Billion)

8.5.7.4 Market Size, By Security, 2019-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.5.8.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.5.8.3 Market Size, By Services, 2019-2026 (USD Billion)

8.5.8.4 Market Size, By Security, 2019-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2019-2026 (USD Billion)

8.6.2 Market Size, By Home Type, 2019-2026 (USD Billion)

8.6.3 Market Size, By Systems, 2019-2026 (USD Billion)

8.6.4 Market Size, By Services, 2019-2026 (USD Billion)

8.6.5 Market Size, By Security, 2019-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.6.6.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.6.6.3 Market Size, By Services, 2019-2026 (USD Billion)

8.6.6.4 Market Size, By Security, 2019-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.6.7.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.6.7.3 Market Size, By Services, 2019-2026 (USD Billion)

8.6.7.4 Market Size, By Security, 2019-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Home Type, 2019-2026 (USD Billion)

8.6.8.2 Market Size, By Systems, 2019-2026 (USD Billion)

8.6.8.3 Market Size, By Services, 2019-2026 (USD Billion)

8.6.8.4 Market Size, By Security, 2019-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 ADT

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Honeywell

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Vivint

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 HANGZHOU HIKVISION DIGITAL TECHNOLOGY

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 SECOM

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Johnson Controls

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 ASSA ABLOY

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Johnson Controls

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Schneider Electric

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Home Security Systems Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Home Security Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS