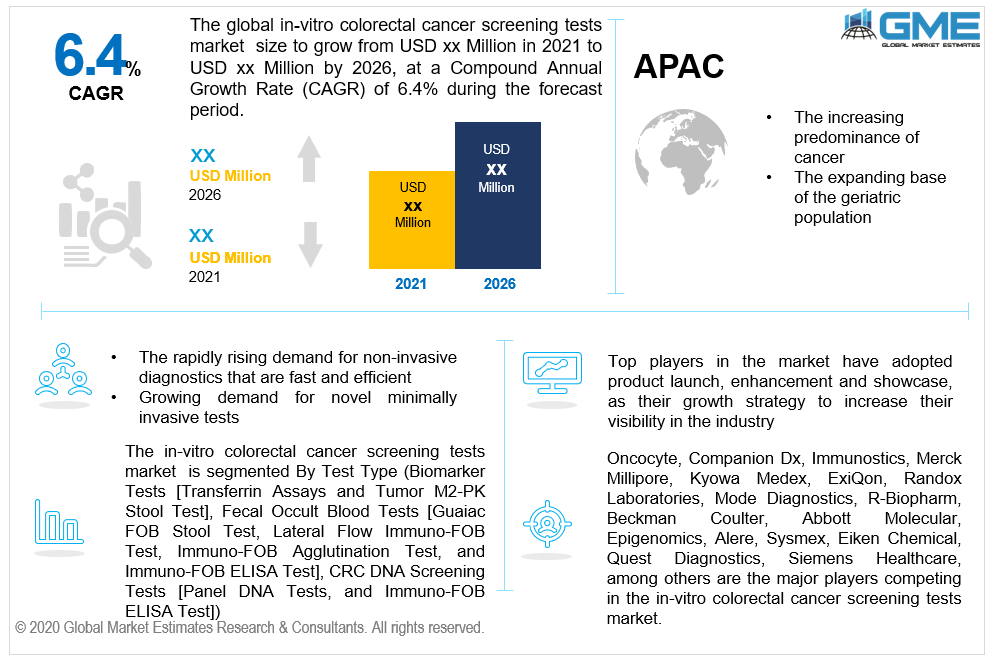

Global In-Vitro Colorectal Cancer Screening Tests Market Size, Trends & Analysis - Forecasts to 2026 By Test Type (Biomarker Tests [Transferrin Assays and Tumor M2-PK Stool Test], Fecal Occult Blood Tests [Guaiac FOB Stool Test, Lateral Flow Immuno-FOB Test, Immuno-FOB Agglutination Test, and Immuno-FOB ELISA Test], CRC DNA Screening Tests [Panel DNA Tests, and Immuno-FOB ELISA Test]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Colorectal cancer originates in the rectum or the colon. This type of cancer can also be termed rectal cancer or colon cancer, depending on their place of origin. The majority of colorectal cancers begin as a formation on the rectum or colon's inner layer. Polyps are the name given to these cysts. Some kinds of polyps can develop into cancer over time, like few years, but all polyps do not turn into cancer.

In a polyp, if cancer forms, it can grow into the rectum or the colon wall over time. The rectum or colon wall is composed of numerous layers. Essentially, colorectal cancer begins in the innermost layer or the mucosa and can spread outward through a few or all of the different layers. When cancerous cells are in the wall, they can next grow into lymph vessels that are the tiny channels carrying away fluid and waste, or blood vessels.

In current years, there have been numerous cases of people suffering from rectal cancer or colon cancer. It has emerged to be an essential determining factor for the cumulative growth of the worldwide market for in-vitro colorectal cancer screening tests. Moreover, the influx of new screening tests that apply genetic testing has also assisted in fuelling the development of the global market. Furthermore, the initiation of governmental and regulatory mandates to make cancer screening tests necessary has also aided in the development of the market for in-vitro colorectal cancer screening tests

The global healthcare sector is observing enormous innovations and growth which has led to technological progress in the screening tests for colorectal cancer has also added to the market development. The new tests involve the application of DNA and genetic biomarkers and have higher accuracy and efficiency. Patients are generally more likely to undertake these in-vitro colorectal cancer screening tests, and as a result, their global market adoption is growing.

Diagnostic tools have encountered a tremendous change in current decades due to the rapidly rising demand for non-invasive diagnostics that are fast and efficient. Compliance with such needs ensures that the tools offer relatively greater ease of operation and encourage better patient agreement and test outcomes. They are also much easier to utilize for medical professionals and put no restrictions on a patient to any dietary necessities. As a result, the growing availability of non-invasive testing and surgical instruments is a tremendous boost to the worldwide demand for in-vitro colorectal cancer screening tests.

The market is growing due to the expanded demand for innovative minimally invasive tests that screen for colorectal cancer utilizing genetic biomarkers and DNA. Regulatory legislation intended at mandating the use of cancer diagnostic tests, and the elevated incidence of colorectal cancer are a few of the key drivers. Technological improvements such as high-speed DNA sequencing and inexpensive genetic analysis would further fuel market development. The research & development for specialized Genomics approaches such as crossbreeding, RNAP sequencing, and microfluidic sequencing would open up novel prospects for the in-vitro colorectal cancer screening tests market.

Lack of qualified clinicians in developed countries, as well as a lack of standardized cancer screening protocols, would serve as a restraint on the progress of the in-vitro colorectal cancer screening tests market throughout the forecast period. Nevertheless, one major determinant that encourages this market’s growth is the increasing predominance of syndromes and inherited diseases. An increase in their count directly indicates a rising demand for testing procedures for conditions such as cancer. However, the in-vitro colorectal cancer screening testing businesses have to undergo an extremely rigorous set of regulations to ensure that their products and tests are ready for use.

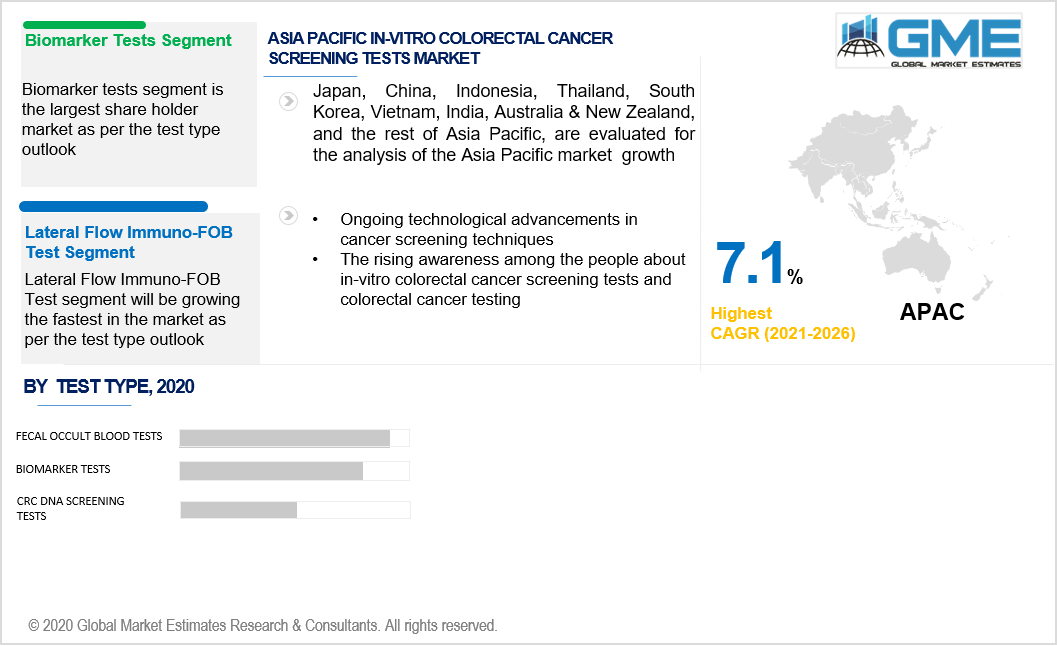

There are three categories of testing: biomarker tests, faecal occult blood tests, and CRC DNA screening tests. Transferrin assays and tumor M2-PK stool test are two sub-segments of the biomarker tests segment. There are some sub-segments within the faecal occult blood tests segment, including the guaiac FOB stool test, the lateral flow immuno-FOB test, the immuno-FOB agglutination test, and the immuno-FOB ELISA tests. Panel DNA testing and immuno-FOB ELISA tests are sub-segments of the CRC DNA screening tests category.

The fecal occult blood tests segment will dominate the global market. The increasing adoption of fecal occult blood tests due to their cost-effectiveness will drive the segment's growth. The immuno-FOB agglutination test and immuno-FOB ELISA test are high revenue-generating business segments of fecal occult blood tests.

The lateral flow immuno-FOB test market is expected to observe a considerable amount of growth throughout the forecast period due to its enhanced sensitivity and specificity. It can be employed in a comprehensive range of settings. Moreover, the lateral flow immuno-FOB test's ease of use and low sample volume requirement will propel the segment's growth.

The increasing research activities about the development of novel biomarker assays and the rising awareness about early diagnosis of the disease permitting the use of diagnostic biomarkers will propel the growth of the biomarker test segment throughout the forecast period. Enzyme biomarker M2-PK has been recognized as an essential enzyme in colorectal cancer, and polyps thus stimulating the tumor M2-PK stool test segment.

As per the geographical analysis, the market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central South America (Brazil, Argentina, and Rest of Central and South America). North America will be the leader in the in-vitro colorectal cancer screening tests market. The region's market share has been influenced by factors such as the presence of a significant geriatric community and the high incidence of colorectal cancer. Moreover, due to better healthcare facilities and elevated incidence levels, the United States is the most profitable nation for the in-vitro colorectal cancer screening tests market.

Asia-Pacific is anticipated to record a substantial CAGR due to the increasing predominance of cancer in this region. Cancer is a rising concern due to the expanding base of the geriatric population and modifications in lifestyle in Asian countries. In-vitro colorectal cancer happens to be the third most deadly disorder in both women and men. The mortality rates of patients with colorectal cancer have been rising in this region over the last decade.

Beckman Coulter, Abbott Molecular, Epigenomics, Alere, Sysmex, Eiken Chemical, Quest Diagnostics, Siemens Healthcare, Oncocyte, Companion Dx, Immunostics, Merck Millipore, Kyowa Medex, ExiQon, Randox Laboratories, Mode Diagnostics, and R-Biopharm, are some of the prominent market players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 In-Vitro Colorectal Cancer Screening Tests Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Test Type Overview

2.1.3 Regional Overview

Chapter 3 In-Vitro Colorectal Cancer Screening Tests Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Improving healthcare infrastructure

3.3.1.2 The rapidly rising demand for non-invasive diagnostics

3.3.2 Industry Challenges

3.3.2.1 Limited Study and Industry Participants

3.4 Prospective Growth Scenario

3.4.1 Test Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 In-Vitro Colorectal Cancer Screening Tests Market, By Test Type

4.1 Test Type Outlook

4.2 Biomarker Tests

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.2.2 Market Size, By Transferrin Assays, 2019-2026 (USD Million)

4.2.3 Market Size, By Tumor M2-PK Stool Test, 2019-2026 (USD Million)

4.3 Fecal Occult Blood Tests

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.3.2 Market Size, By Guaiac FOB Stool Test, 2019-2026 (USD Million)

4.3.3 Market Size, By Lateral Flow Immuno-FOB Test, 2019-2026 (USD Mill3n)

4.3.4 Market Size, By Immuno-FOB Agglutination Test, 2019-2026 (USD Million)

4.3.5 Market Size, By Immuno-FOB ELISA Test, 2019-2026 (USD Million)

4.4 CRC DNA Screening Tests

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.4.2 Market Size, By Panel DNA Tests, 2019-2026 (USD Million)

4.4.3 Market Size, By Immuno-FOB ELISA Test, 2019-2026 (USD Million)

Chapter 5 In-Vitro Colorectal Cancer Screening Tests Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2019-2026 (USD Million)

5.2.2 Market Size, By Test Type, 2019-2026 (USD Million)

5.2.3 U.S.

5.2.3.1 Market Size, By Test Type, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2019-2026 (USD Million)

5.3.2 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.3 Germany

5.2.3.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.4 UK

5.3.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.5 France

5.3.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.6 Italy

5.3.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.7 Spain

5.3.7.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.3.8 Russia

5.3.8.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2019-2026 (USD Million)

5.4.2 Market Size, By Test Type, 2019-2026 (USD Million)

5.4.3 China

5.4.3.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.4.4 India

5.4.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.4.5 Japan

5.4.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.4.6 Australia

5.4.6.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.4.7 South Korea

5.4.7.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2019-2026 (USD Million)

5.5.2 Market Size, By Test Type, 2019-2026 (USD Million)

5.5.3 Brazil

5.5.3.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.5.4 Mexico

5.5.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.5.5 Argentina

5.5.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.6 MEA

5.6.1 Market Size, By Country 2019-2026 (USD Million)

5.6.2 Market Size, By Test Type, 2019-2026 (USD Million)

5.6.3 Saudi Arabia

5.6.3.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.6.4 UAE

5.6.4.1 Market Size, By Test Type, 2019-2026 (USD Million)

5.6.5 South Africa

5.6.5.1 Market Size, By Test Type, 2019-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 Beckman Coulter

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Abbott Molecular

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Epigenomics

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Alere

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Sysmex

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 Eiken Chemical

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Quest Diagnostics

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Siemens Healthcare

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Oncocyte

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.10 Oncocyte

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.11 Companion Dx

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info Graphic Analysis

6.12 Immunostics

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info Graphic Analysis

6.13 Merck Millipore

6.13.1 Company Overview

6.13.2 Financial Analysis

6.13.3 Strategic Positioning

6.13.4 Info Graphic Analysis

6.14 Kyowa Medex

6.14.1 Company Overview

6.14.2 Financial Analysis

6.14.3 Strategic Positioning

6.14.4 Info Graphic Analysis

6.15 ExiQon

6.15.1 Company Overview

6.15.2 Financial Analysis

6.15.3 Strategic Positioning

6.15.4 Info Graphic Analysis

6.16 Randox Laboratories

6.16.1 Company Overview

6.16.2 Financial Analysis

6.16.3 Strategic Positioning

6.16.4 Info Graphic Analysis

6.17 Mode Diagnostics

6.17.1 Company Overview

6.17.2 Financial Analysis

6.17.3 Strategic Positioning

6.17.4 Info Graphic Analysis

6.18 R-Biopharm

6.18.1 Company Overview

6.18.2 Financial Analysis

6.18.3 Strategic Positioning

6.18.4 Info Graphic Analysis

The Global In-Vitro Colorectal Cancer Screening Tests Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the In-Vitro Colorectal Cancer Screening Tests Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS