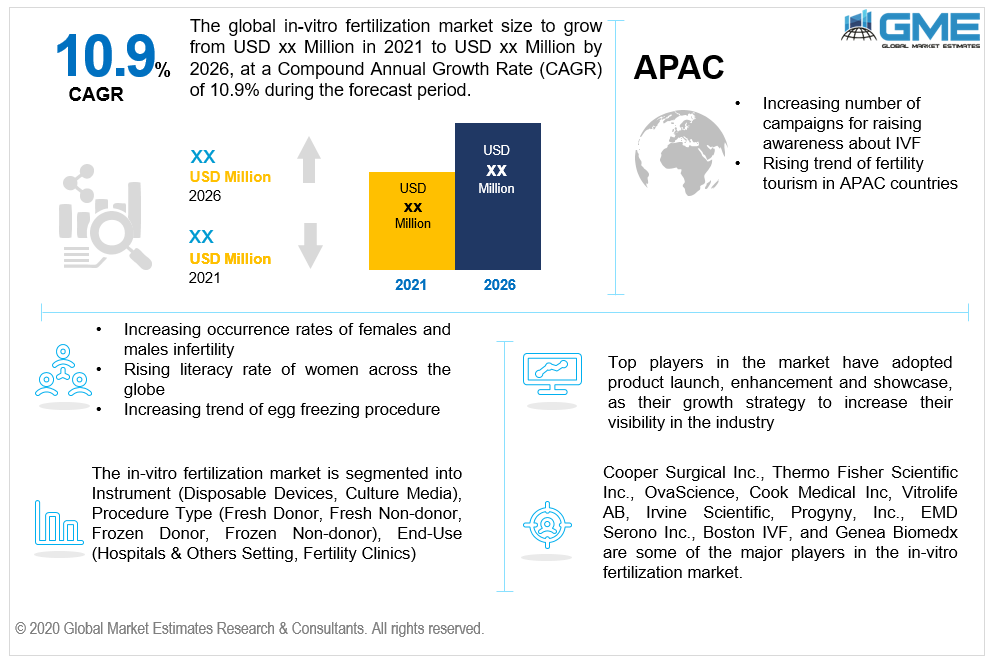

Global In-vitro Fertilization Market Size, Trends, and Analysis - Forecasts To 2026 By Instrument (Disposable Devices, Culture Media), By Procedure Type (Fresh Donor, Fresh Non-Donor, Frozen Donor, Frozen Non-Donor), By End-Use (Hospitals & Others Setting, Fertility Clinics), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

In vitro fertilization (IVF) is a set of procedures that are specifically intended to aid in pregnancy, prevent genetic defects, and facilitate childbirth. Infertility is among the most common issues that a vast number of people are dealing with these days. The matured phase eggs are removed from the ovaries and fertilized with the sperm in the lab and this procedure is popularly known as IVF procedure.

Growing reproductive tourism and the high prevalence rates of male and female infertility are two main factors boosting the market. Infertility is a big health issue that affects people all over the world. Male infertility accounted for 30% of infertility cases and relates to about one-fifth of infertility cases, as per the American Pregnancy Association. Furthermore, as the literacy rate of women rises, females are more likely to delay starting a family due to career commitment, which leaves women more reliant on fertility treatments as fertility declines with age. Other factors that contributed to an increase in the incidence of infertility include a trend toward sedentary lifestyles, obesity, and increasing stress levels among the population at large. As a result, it is projected to boost the global IVF treatment market.

The rising trend and awareness regarding IVF treatments is being attributed to the availability of funding and hence the technology has become one of the priority technology during conceiving process. The Ontario government launched a USD 50 million fertility initiative in December 2016 that will cover IVF care for 5,000 individuals. Moreover, the Singapore government contributes approximately 75 percent of the cost of various ART procedures such as Intracytoplasmic Sperm Injection (ICSI), IVF, and GIFT.

The rising cost and complications associated with IVF and ICSI therapy, on the other hand, are some of the factors limiting the overall growth of the market over the forthcoming years. For example, an unusual syndrome is known as "imprinting disorders" has been linked to IVF treatment, as per research presented by the Reproductive Science Center.

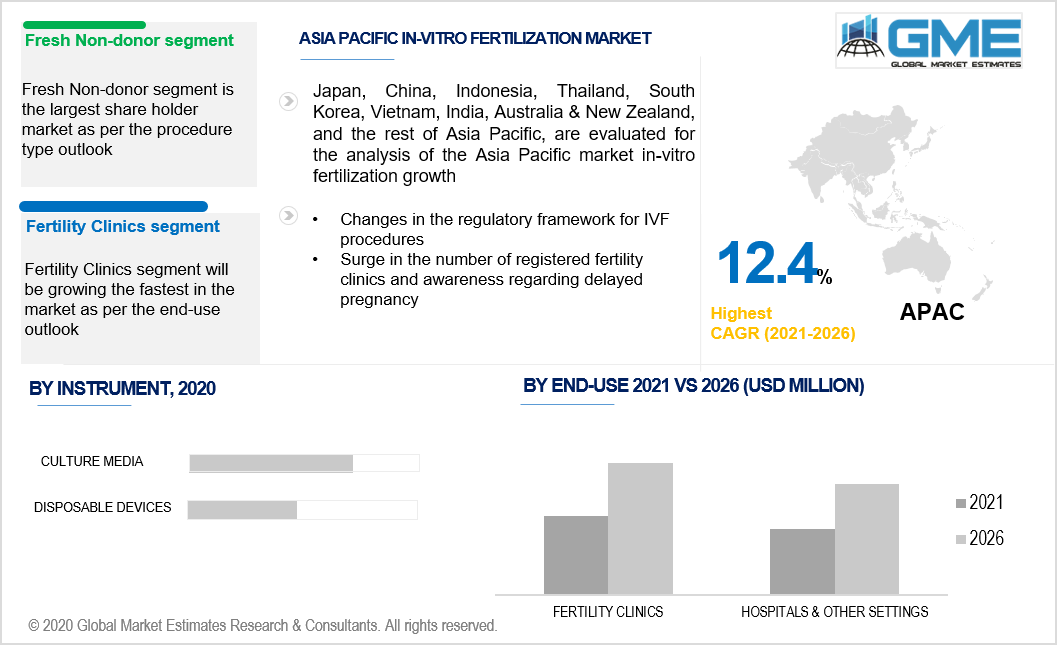

On the basis of the instrument, the market has been categorized intoculture media and disposable devices.Because of variables such as funding availability and an improvement in research activities to develop culture media, the culture media category led to the increased demand for IVF and contributed to the highest profit share during the forecast period.However, the disposable devices category is anticipated to expand at the fastest rate during the estimated timeframe, as market leaders introduce disposable equipment such as chambers, slides, and needles to fulfil sterility and regulatory standards.

During the forecast period, the fresh non-donor category led the IVF market and contributed to the highest overall revenue. The high success rate of the treatment on the first try accounts for this development. Since the technique can be done in even the most difficult situations, it is expected to rise at the highest rate during the forecast period.For example, a patient with Ovarian Hyperstimulation Syndrome (OHSS) may benefit from this form of IVF.However, due to the lower cost than IVF cycles using fresh eggs or embryos, the frozen non-donor category ranked 2nd in the treatment category.Likewise, due to strict federal regulations in several nations regarding sperm and egg donations, the frozen donor and fresh donor categories are anticipated to grow at a slower pace during the coming years.

During the forecast period, the fertility clinics segment led the IVF market, accounting for the highest profit share, and it is expected to continue to do so throughout the forecast period. If the market for ART therapies grows, the number of fertility clinics and ART centers grows as well. Some of the major reasons that can be contributed to the development of fertility clinics include the availability of experts, cost-effectiveness, and low or zero risks of hospital-acquired viruses. Moreover, due to the rising number of registered fertility clinics in advanced and developing nations such as Japan, Brazil, and China, the in vitro fertilization market share from the fertility clinics category is expected to rise at a rapid rate.In 2020, the hospital sector held a relatively smaller share of the overall market. The poor growth of this category can be due to a limited number of patient hospital visits for infertility care, a scarcity of IVF experts in hospital settings, and ineffective regulations in these environments.

Owing to factors such as the growing incidence of infertility coupled with the high probability of success of IVF therapy, medical tourism, and regulatory framework linked to IVF treatments, Europe led the in vitro fertilization market accounting for the highest profit share in 2020. A growing number of Americans are moving to the Czech Republic to receive low-cost IVF treatments.During the forecast period, the rising birth rate from IVF and ICSI treatments in Europe is expected to fuel IVF acceptance in this region.Due to the increasing number of campaigns raising awareness about IVF, changes in the regulatory framework, and fertility tourism, the market for IVF care is anticipated to rise in the Asia Pacific region. Also, the region is seeing a surge in the number of registered fertility clinics, which is projected to lead to a greater acceptance of IVF care over the forthcoming years.Furthermore, due to their emerging healthcare system, Latin America and the Middle East, and Africa are projected to hold significant IVF market dominance, resulting in an increase in medical tourism for infertility therapies in these areas.

Cooper Surgical Inc., Thermo Fisher Scientific Inc., OvaScience, Cook Medical Inc, Vitrolife AB, Irvine Scientific, Progyny, Inc., EMD Serono Inc., Boston IVF, and Genea Biomedx are some of the major players in the in-vitro fertilization market.

Please note: This is not an exhaustive list of companies profiled in the report.

Cooper Surgical Inc. purchased stakes of Wallace Pharmaceuticals (India) in November 2016 to enahnce its current IVF product portfolio.

In January 2017, Genea and Merck launched a Fertility Centre of Excellence in Bangkok.

In 2015, Irvine Scientific and Biotech Inc. formed an alliance (US). Irvine Scientific has exclusive distribution rights for the CRYOLOCK vitrification system as a result of this agreement.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 In-Vitro Fertilization Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Instrument Overview

2.1.3 Procedure Type Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 In-Vitro Fertilization Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 MarketKey Trends

3.3.1 Positive Trends

3.3.1.1 Rising prevalence of female and male infertility rate

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated laboratory systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Instrument Growth Scenario

3.4.2 Procedure Type Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 In-Vitro Fertilization Market, By Instrument

4.1 Instrument Outlook

4.2 Disposable Device

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Culture Media

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 In-Vitro Fertilization Market, By Procedure Type

5.1 Procedure Type Outlook

5.2 Fresh Donor

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Fresh Non-Donor

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Frozen Donor

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Frozen Non-Donor

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 In-Vitro Fertilization Market, By End-User

6.1 Hospitals & Others Setting

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Fertility Clinics

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 In-Vitro Fertilization Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Instrument, 2016-2026 (USD Million)

7.2.3 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.2.4 Market Size, By End-User, 2016-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.2.4.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.2.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.3 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.4 Market Size, By End-User, 2016-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.3.11.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2016-2026 (USD Million)

7.4.2 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.3 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.4.4 Market Size, By End-User, 2016-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.9.2 Market size, By Procedure Type, 2016-2026 (USD Million)

7.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.4.10.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Instrument, 2016-2026 (USD Million)

7.5.3 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.5.4 Market Size, By End-User, 2016-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Instrument, 2016-2026 (USD Million)

7.6.3 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.6.4 Market Size, By End-User, 2016-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Instrument, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Procedure Type, 2016-2026 (USD Million)

7.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Cooper Surgical Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 OvaScience

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Cook Medical Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Vitrolife AB

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Irvine Scientific

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Progyny, Inc.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 EMD Serono Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Boston IVF

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Genea Biomedx

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global In-vitro Fertilization Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the In-vitro Fertilization Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS