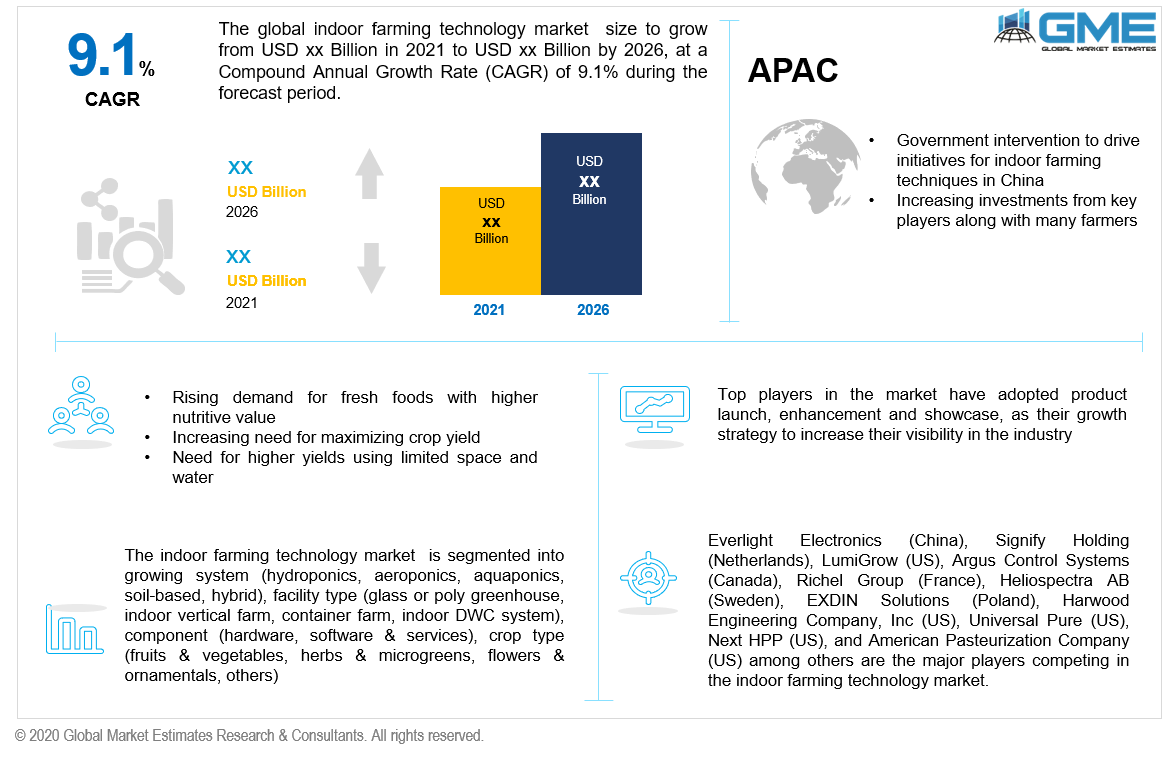

Global Indoor Farming Technology Market Size, Trends & Analysis - Forecasts to 2026 By Growing System (Hydroponics, Aeroponics, Aquaponics, Soil-based, Hybrid), By Facility Type (Glass or Poly Greenhouse, Indoor Vertical Farm, Container Farm, Indoor DWC System), By Component (Hardware, Software & Services), By Crop Type (Fruits & vegetables, Herbs & Microgreens, Flowers & Ornamentals, Others), By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Indoor farming technology is a means of using various technologies to grow foods and plants within the house. This method uses artificial lighting to produce plants with increased nutrients, and it incorporates soil-based, aeroponics, aquaponics, and hybrid technologies. Indoor farming technology can be employed in the home as well as in the business sector on small and large scale. The combination of artificial lighting and hydroponics is used in indoor farming technology to provide the plants with the essential nutrients they would have received had they been grown outdoors. Farmers or cultivators regulate and monitor parameters like moisture levels, nutrient levels, and light amounts in indoor farming technology, and they have a numerous range of options for what to grow. Advanced indoor farming systems can produce high-yield, high-quality crops in small regions.

Due to the agriculture industry's burden of meeting increased demand for grains and food, high-yielding agricultural techniques such as urban farming and precision farming are required. As a result, indoor agriculture could be a viable solution to the growing worry about food security in the coming years.

Due to the rapid increase in both population and urbanization, farming lands are indeed falling short. Never the less, there is a continuous growing demand for food production to satisfy the steeply growing population globally despite these challenges. Hence, the growing government initiatives are also responsible for the boost in this market’s growth. As a result, indoor farming technology overcomes these obstacles, which has been a major driver in increasing demand for indoor farming technologies and resulting in global market growth.

There are several advantages of indoor farming approaches like reducing water usage, declining use of toxic chemicals used as pesticides, protection from climate changes, and increasing crop production yield. These are the driving factors for the growth of the global indoor farming technology market. Moreover, the increasing demand for fresh and organic food will boost the global market growth over the forecast period with a growing health-conscious population.

The increasing adoption of innovative new-fangled techniques like HVAC equipment, automation techniques, LED, and climate control systems in the indoor farming industry is anticipated to generate revenue opportunities for the market players in the global market over the forecast period. Otherwise, harvesting in greenhouses with little technological help has been in presence for quite a while now.

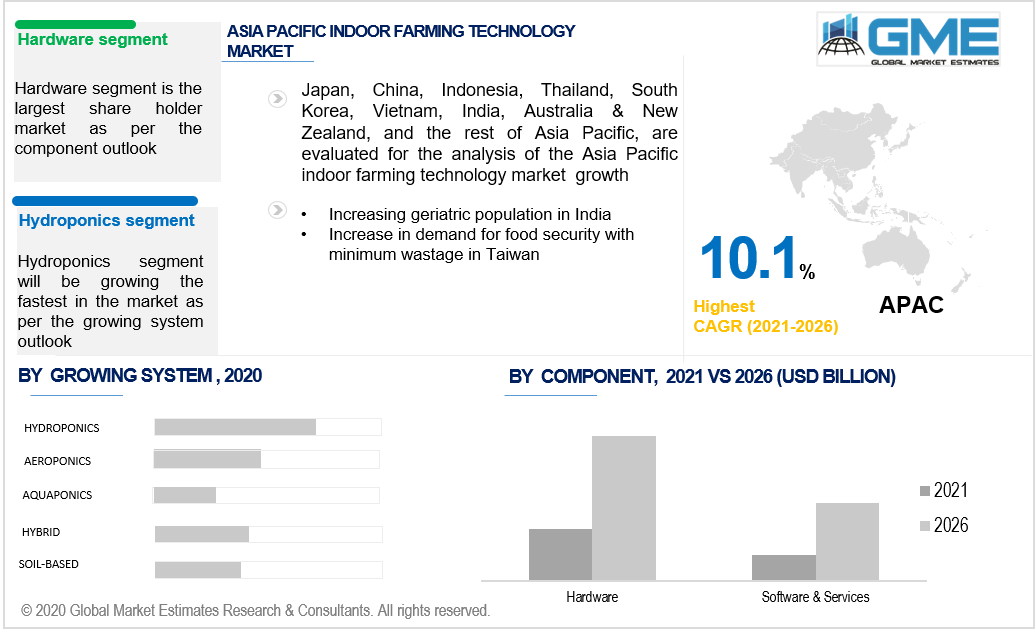

The hydroponics segment will show the fastest growth rate in the market over the estimated time frame. Hydroponics is simply the art of gardening without any soil. In the absence of soil, water provides hydration, oxygen, and nutrients to plant life.

Aeroponics is considered to be a key component of indoor farming's development. It facilitates quicker plant growth, enabling the farming of more plants in lesser time than average conditions. This aeroponics system can be controlled externally through timers or computers to release moist air at even intervals and does not involve the frequent use of weeding, pesticides, and other maintenance procedures compared to conventional farming.

There are four segments by facility system: glass or poly greenhouse, indoor vertical farm, container farm, and indoor DWC system. The indoor vertical farm segment is expected to dominate the market in the estimated period. Indoor vertical farms are entirely opaque and enclosed rooms consisting of vertical growing systems like hydroponics, aeroponics, and aquaponics. Vertical farms are modular and may be sized to fit into any structure. Indoor vertical farming nurtures crops in vertically stacked layers like used warehouses, skyscrapers, or shipping containers. In this method, all the environmental factors can be controlled inside the enclosed structure by ecological control systems, utilizing artificial lights, fertigation systems, and irrigation.

Based on the component, there are two segments, namely hardware and software & services.The hardware segment is expected to dominate the market.

The herbs & microgreens segment is expected to dominate the market in the estimated period. Herbs can be grown indoors perennially or during the winter months to protect tender herbs like basil and rosemary. Herbs provide benefits such as fragrant leaves and a variety of leaf shapes and hues when cultivated inside. All herbs, on the other hand, do not grow well in indoor farmhouses since their root systems require huge containers. Microgreens are small vegetables that are used both as a flavor and visual ingredients in numerous dishes Microgreens are cut above the soil line while harvesting. From seeding to harvesting, the average time essential for microgreens is around 10–14 days.

In 2020, North America had the highest proportion of the worldwide indoor farming sector. Growers in the United States have been able to implement large-scale indoor farming with the use of high-efficiency LED lighting and improved indoor management procedures. Canada has also experienced a favourable growth trend, with hydroponically grown tomatoes accounting for a considerable portion of global exports. The adoption of new and efficient technologies to boost yields is fueling the expansion of hydroponics and aeroponics systems in the region, which is boosting the entire indoor farming industry.

Moreover, the European indoor farming technology market dominates the overall market revenue share, owing to challenges faced in old-style farming methods, particularly weather challenges that hinder crop production.

Furthermore, the Asia Pacific region is expected to develop at the fastest rate, as demand for indoor farming technology has increased in this region as a result of increased international business lines investing in agriculture activities to exclusively fulfil the demands of crop growers for export-quality commodities. Due to increased R&D investments from multiple multinational manufacturers and the use of greenhouse farming for the production of particular crops, China is expected to hold the highest share of the Asia Pacific indoor farming technology market.

Everlight Electronics (China), Signify Holding (Netherlands), LumiGrow (US), Argus Control Systems (Canada), Logiqs (Netherlands), Netafim (Israel), Vertical Farm Systems (Australia), Richel Group (France), Heliospectra AB (Sweden), General Hydroponics (US), EXDIN Solutions (Poland), Harwood Engineering Company, Inc (US), Universal Pure (US), NextHPP (US), and American Pasteurization Company (US) are some of the key identified market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2019, LumiGrow Inc. released a new smart fixture called TopLight Hybrid. The hybrids will allow users to take advantage of the expanded white spectrum, which is wireless and controlled by the company's SmartPAR software.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Indoor Farming Technology Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Growing System Growth Scenario

2.1.3 Facility Type Growth Scenario

2.1.4 Component Growth Scenario

2.1.5Crop Type Growth Scenario

2.1.6 Regional Overview

Chapter 3 Global Indoor Farming Technology Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for fresh foods with higher nutritive value

3.3.1.2 Increasing need for maximizing crop yield

3.3.2 Industry Challenges

3.3.2.1 Shortage in the availability of skilled workforce

3.4 Prospective Growth Scenario

3.4.1 Growing System Growth Scenario

3.4.2 Facility Type Growth Scenario

3.4.3 Component Growth Scenario

3.4.4 Crop Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Indoor Farming Technology Market, By Facility Type

4.1 Facility Type Outlook

4.2 Glass or Poly Greenhouse

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Indoor Vertical Farm

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

4.4 Container Farm

4.4.1 Market Size, By Region, 2016-2026 (USD Billion)

4.5 Indoor DWC System

4.5.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Indoor Farming Technology Market, By Growing System

5.1 Growing System Outlook

5.2 Hydroponics

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 Aeroponics

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

5.4 Aquaponics

5.4.1 Market Size, By Region, 2016-2026 (USD Billion)

5.5 Soil-based

5.5.1 Market Size, By Region, 2016-2026 (USD Billion)

5.6 Hybrid

5.6.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Global Indoor Farming Technology Market, By Component

6.1 Component Outlook

6.2 Hardware

6.2.1 Market Size, By Region, 2016-2026 (USD Billion)

6.3 Software & Services

6.3.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 7 Global Indoor Farming Technology Market, By Crop Type

7.1 Crop Type Outlook

7.2 Fruits & vegetables

7.2.1 Market Size, By Region, 2016-2026 (USD Billion)

7.3 Herbs & Microgreens

7.3.1 Market Size, By Region, 2016-2026 (USD Billion)

7.4 Flowers & Ornamentals

7.4.1 Market Size, By Region, 2016-2026 (USD Billion)

7.5 Others

7.5.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 7 Global Indoor Farming Technology Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Billion)

8.2.2 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.2.3 Market Size, By Growing System, 2016-2026 (USD Billion)

8.2.4 Market Size, By Component, 2016-2026 (USD Billion)

8.2.5 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.2.6.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.2.6.3 Market Size, By Component, 2016-2026 (USD Billion)

8.2.6.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.2.7.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.2.7.3 Market Size, By Component, 2016-2026 (USD Billion)

8.2.7.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Billion)

8.3.2 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.3 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.4 Market Size, By Component, 2016-2026 (USD Billion)

8.3.5 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.6.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.6.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.6.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.7.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.7.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.7.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.8.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.8.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.8.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.9.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.9.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.9.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.10.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.10.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.10.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.3.11.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.3.11.3 Market Size, By Component, 2016-2026 (USD Billion)

8.3.11.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Billion)

8.4.2 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.3 Market Size, By Growing System, 2016-2026 (USD Billion)

8.4.4 Market Size, By Component, 2016-2026 (USD Billion)

8.4.5 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.6.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.4.6.3 Market Size, By Component, 2016-2026 (USD Billion)

8.4.6.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.7.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.4.7.3 Market Size, By Component, 2016-2026 (USD Billion)

8.4.7.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.8.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.4.8.3 Market Size, By Component, 2016-2026 (USD Billion)

8.4.8.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.9.2 Market size, By Growing System, 2016-2026 (USD Billion)

8.4.9.3 Market Size, By Component, 2016-2026 (USD Billion)

8.4.9.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.4.10.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.4.10.3 Market Size, By Component, 2016-2026 (USD Billion)

8.4.10.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Billion)

8.5.2 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.5.3 Market Size, By Growing System, 2016-2026 (USD Billion)

8.5.4 Market Size, By Component, 2016-2026 (USD Billion)

8.5.5 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.5.6.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.5.6.3 Market Size, By Component, 2016-2026 (USD Billion)

8.5.6.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.5.7.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.5.7.3 Market Size, By Component, 2016-2026 (USD Billion)

8.5.7.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.5.8.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.5.8.3 Market Size, By Component, 2016-2026 (USD Billion)

8.5.8.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Billion)

8.6.2 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.6.3 Market Size, By Growing System, 2016-2026 (USD Billion)

8.6.4 Market Size, By Component, 2016-2026 (USD Billion)

8.6.5 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.6.6.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.6.6.3 Market Size, By Component, 2016-2026 (USD Billion)

8.6.6.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.6.7.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.6.7.3 Market Size, By Component, 2016-2026 (USD Billion)

8.6.7.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Facility Type, 2016-2026 (USD Billion)

8.6.8.2 Market Size, By Growing System, 2016-2026 (USD Billion)

8.6.8.3 Market Size, By Component, 2016-2026 (USD Billion)

8.6.8.4 Market Size, By Crop Type, 2016-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Signify Holding

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Everlight Electronics

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Argus Control Systems

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 Lumigrow

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Netafim

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Logiqs

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Illumitex

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 Hydrodynamics International

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 American Hydroponics

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Richel Group

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Indoor Farming Technology Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Indoor Farming Technology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS