Global Industrial Display Market Size, Trends, and Analysis- Forecasts To 2026 By Technology (LCD, LED, and OLED), By Size (Small, Medium, and Large), By Vertical (Marine, Oil & Gas, Transportation, Healthcare, Manufacturing, Power, and Others) By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

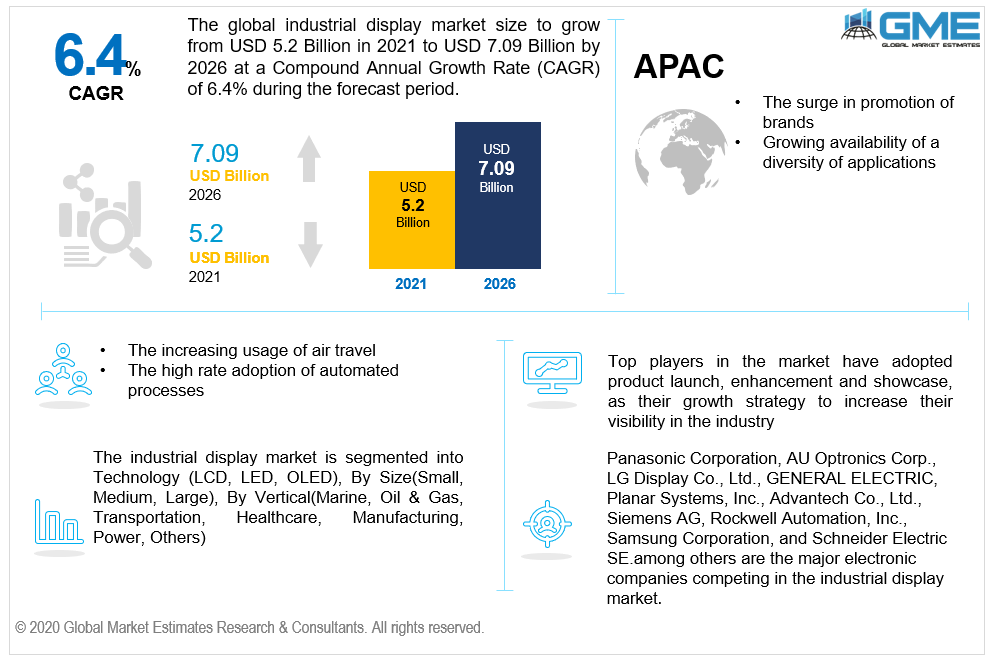

Considerations like the development of high specification devices, improved contrast ratio, technological advancements, increasing disposable income, high growth of LED-backlit, new product developments, growing demand for electronic devices, the availability of a myriad of application domains, and increasing investments in sophisticated product development are boosting the market expansion of industrial displays.

Moreover, rising demand for HMI devices, rising adoption of the internet of things, soaring funding for research, growing need for LED-backlit LCD-based display solutions, improved lifestyle of people, development of HD displays, rapid urbanization, flexible solution of electronic display systems, the surge in promotion of brands, global shift of technology, increasing usage in air travel, increasing acceptance of LED and LCD, and high rate adoption of automated processes are expected to increase demand for the industrial display market.

Nonetheless, some factors restrict or hinder the growth of the market. These include the capital-intensive nature, development of alternative technologies, high investment costs, and fear of exposure to radiation coming out of the display screens. However, the burgeoning need for digital signage technologies in sectors for displaying critical information is opening up new opportunities for the industrial display industry.

Features like wide temperature range, energy efficiency, longer lifespan, low impact on the environment, high durability, lower price & maintenance, improved impact resistance, robust display screen, radiofrequency distribution, and resistance to shock, scratch & dust are responsible for widespread acceptance of industrial displays.

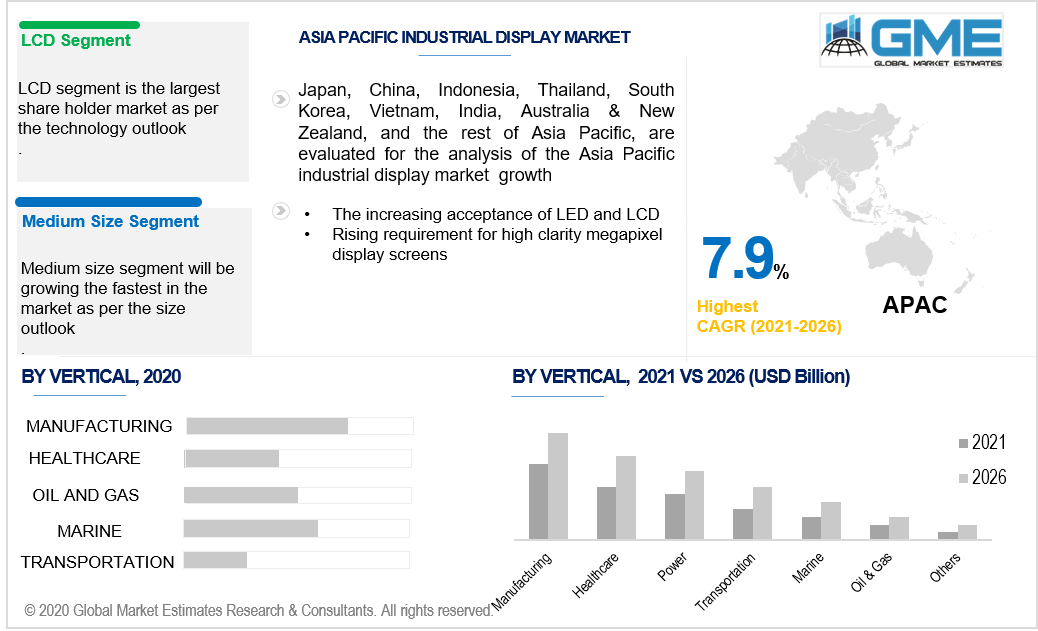

According to the product segment, the three categories include LCD, LED, and OLED. Over the forecast period, the LCD category will be the largest shareholder. This segment has the largest share due to factors like the availability of computational support, presence in a variety of shapes and sizes, a narrow spectrum, improved compatibility in the range of applications, long-lasting, high stability, organizational compliance, wide availability, a high standard of living, and a growing need for convenience among consumers. LCD-based industrial displays are utilized on industrial PCs, tablets, signs, computer screens, and video walls. These displays feature lower procurement expenses, good screen resolution, a long operational life, and may be used in both indoor and outdoor settings.

According to the size analysis, the three segments are small, medium, and large. The medium segment is predicted will acquire the largest market share due to characteristics like the low-priced, enhanced security, development of high specification display services, enhanced productivity, low consumption of power & sustainability, reduced electricity consumption, high durability & wireless connection, and innovative product launches. The displays include contemporary characteristics such as radio frequency identification (RFID), ethernet connectivity, automated touch detectors, and touch screen boards, and elevated temperature tolerance. This is expected to boost the segment's growth.

However, the small size segment fosters the fastest growth in the market due to the benefits like higher brightness and contrast ratio, ease to handle, convenience, a wide variety of utilization domains for miniature electronic display, rising customer needs for comfort and convenience, enhanced customer satisfaction, availability of a variety of choices, low priced coupled with the high preference of small size displays by the end-users.

According to the vertical analysis, the seven segments are marine, oil & gas, transportation, healthcare, manufacturing, power, and others. The manufacturing segment is predicted to be the largest shareholder in terms of revenue growth in the market due to improved display performance, the availability of advanced infrastructure, improved color accuracy, energy-efficiency, longer lifespan, higher reliability, developed cost efficiencies, the rising level of venture funding, the scope of implementation in diverse applications, availability of comprehensive & flexible solutions of display systems, innovative product launches and the rising number of key manufacturers in the market. However, the healthcare segment will grow the fastest in the market due to increasing lifestyle diseases, growing incidences of obesity and hypertension, rising investments in health infrastructure, a developing health sector, increasing awareness regarding health and fitness, newer technological advancements, and the availability of trained and professional staff.

As per the geographical analysis, the market of the industrial display can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America. The market for North America will be dominant due to the presence of a large number of chief market players in the U.S., rising demand for interactive display modules, increasing investments in product innovation, the presence of adequate reimbursement policies, rising adoption of IoT based technology, favorable government initiatives, increasing demand for electronic devices, soaring awareness regarding health and fitness, advancement in display technology, strict regulations for energy efficiency, the presence of skilled professionals, the rising level of research work, higher adoption among end-user industries, rapid adoption of video walls, increased awareness among people regarding the latest monitoring technologies, and the constant launch of advanced semiconductor components.

However, the Asia Pacific region will grow the fastest due to the rising middle-class population, increasing growth opportunities, fast economic growth & urbanization, improved manufacturing efficiencies, high adoption of products from the power generation sector, increased spending on smart electronic products, upcoming technological development projects, increasing investment in display network infrastructure, low labor costs, rising disposable income, soaring need for display screens with excellent quality & megapixels, and adoption of technology like the industrial internet of things (IIOT).

Panasonic Corporation, AU Optronics Corp., LG Display Co., Ltd., GENERAL ELECTRIC, Planar Systems, Inc., Advantech Co., Ltd., Siemens AG, Rockwell Automation, Inc., Samsung Corporation, and Schneider Electric SE. among others, are the major electronic companies competing in the industrial display market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Industrial Display Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Size Overview

2.1.4 Vertical Overview

2.1.5 Regional Overview

Chapter 3 Global Industrial Display Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The development of high specification devices

3.3.1.2 The rising demand for HMI devices

3.3.2 Industry Challenges

3.3.2.1 Capital intensive in nature

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 Size Growth Scenario

3.4.3 Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Industrial Display Market, By Technology

4.1 Technology Outlook

4.2 LCD

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 LED

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 OLED

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Industrial Display Market, By Size

5.1 Size Outlook

5.2 Small

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Medium

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Large

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Industrial Display Market, By Vertical

6.1 Marine

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Oil & Gas

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Transportation

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Healthcare

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

6.5 Manufacturing

6.5.1 Market Size, By Region, 2016-2026 (USD Million)

6.6 Power

6.6.1 Market Size, By Region, 2016-2026 (USD Million)

6.7 Others

6.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Industrial Display Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2016-2026 (USD Million)

7.2.2 Market Size, By Technology, 2016-2026 (USD Million)

7.2.3 Market Size, By Size, 2016-2026 (USD Million)

7.2.4 Market Size, By Vertical, 2016-2026 (USD Million)

7.2.5 U.S.

7.2.5.1 Market Size, By Technology, 2016-2026 (USD Million)

7.2.5.2 Market Size, By Size, 2016-2026 (USD Million)

7.2.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.2.6 Canada

7.2.6.1 Market Size, By Technology, 2016-2026 (USD Million)

7.2.6.2 Market Size, By Size, 2016-2026 (USD Million)

7.2.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2016-2026 (USD Million)

7.3.2 Market Size, By Technology, 2016-2026 (USD Million)

7.3.3 Market Size, By Size, 2016-2026 (USD Million)

7.3.4 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.5 Germany

7.3.5.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.5.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.6 UK

7.3.6.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.6.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.7 France

7.3.7.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.7.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.7.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.8 Italy

7.3.8.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.8.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.8.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.9 Spain

7.3.9.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.9.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.9.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.3.10 Russia

7.3.10.1 Market Size, By Technology, 2016-2026 (USD Million)

7.3.10.2 Market Size, By Size, 2016-2026 (USD Million)

7.3.10.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2016-2026 (USD Million)

7.4.2 Market Size, By Technology, 2016-2026 (USD Million)

7.4.3 Market Size, By Size, 2016-2026 (USD Million)

7.4.4 Market Size, By Vertical, 2016-2026 (USD Million)

7.4.5 China

7.4.5.1 Market Size, By Technology, 2016-2026 (USD Million)

7.4.5.2 Market Size, By Size, 2016-2026 (USD Million)

7.4.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.4.6 India

7.4.6.1 Market Size, By Technology, 2016-2026 (USD Million)

7.4.6.2 Market Size, By Size, 2016-2026 (USD Million)

7.4.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.4.7 Japan

7.4.7.1 Market Size, By Technology, 2016-2026 (USD Million)

7.4.7.2 Market Size, By Size, 2016-2026 (USD Million)

7.4.7.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.4.8 Australia

7.4.8.1 Market Size, By Technology, 2016-2026 (USD Million)

7.4.8.2 Market size, By Size, 2016-2026 (USD Million)

7.4.8.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.4.9 South Korea

7.4.9.1 Market Size, By Technology, 2016-2026 (USD Million)

7.4.9.2 Market Size, By Size, 2016-2026 (USD Million)

7.4.9.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.6.5 Latin America

7.5.1 Market Size, By Country 2016-2026 (USD Million)

7.5.2 Market Size, By Technology, 2016-2026 (USD Million)

7.5.3 Market Size, By Size, 2016-2026 (USD Million)

7.5.4 Market Size, By Vertical, 2016-2026 (USD Million)

7.5.5 Brazil

7.5.5.1 Market Size, By Technology, 2016-2026 (USD Million)

7.5.5.2 Market Size, By Size, 2016-2026 (USD Million)

7.5.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.5.6 Mexico

7.5.6.1 Market Size, By Technology, 2016-2026 (USD Million)

7.5.6.2 Market Size, By Size, 2016-2026 (USD Million)

7.5.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.5.7 Argentina

7.5.7.1 Market Size, By Technology, 2016-2026 (USD Million)

7.5.7.2 Market Size, By Size, 2016-2026 (USD Million)

7.5.7.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2016-2026 (USD Million)

7.6.2 Market Size, By Technology, 2016-2026 (USD Million)

7.6.3 Market Size, By Size, 2016-2026 (USD Million)

7.6.4 Market Size, By Vertical, 2016-2026 (USD Million)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Technology, 2016-2026 (USD Million)

7.6.5.2 Market Size, By Size, 2016-2026 (USD Million)

7.6.5.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.6.6 UAE

7.6.6.1 Market Size, By Technology, 2016-2026 (USD Million)

7.6.6.2 Market Size, By Size, 2016-2026 (USD Million)

7.6.6.3 Market Size, By Vertical, 2016-2026 (USD Million)

7.6.7 South Africa

7.6.7.1 Market Size, By Technology, 2016-2026 (USD Million)

7.6.7.2 Market Size, By Size, 2016-2026 (USD Million)

7.6.7.3 Market Size, By Vertical, 2016-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Samsung Electronics

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 AU Optronics Corp.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 LG Display Co., Ltd.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 GENERAL ELECTRIC

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Rockwell Automation, Inc

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Advantech Co., Ltd

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Siemens AG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Schneider Electric SE

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Panasonic Corporation

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Planar Systems, Inc.

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

The Global Industrial Display Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Display Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS