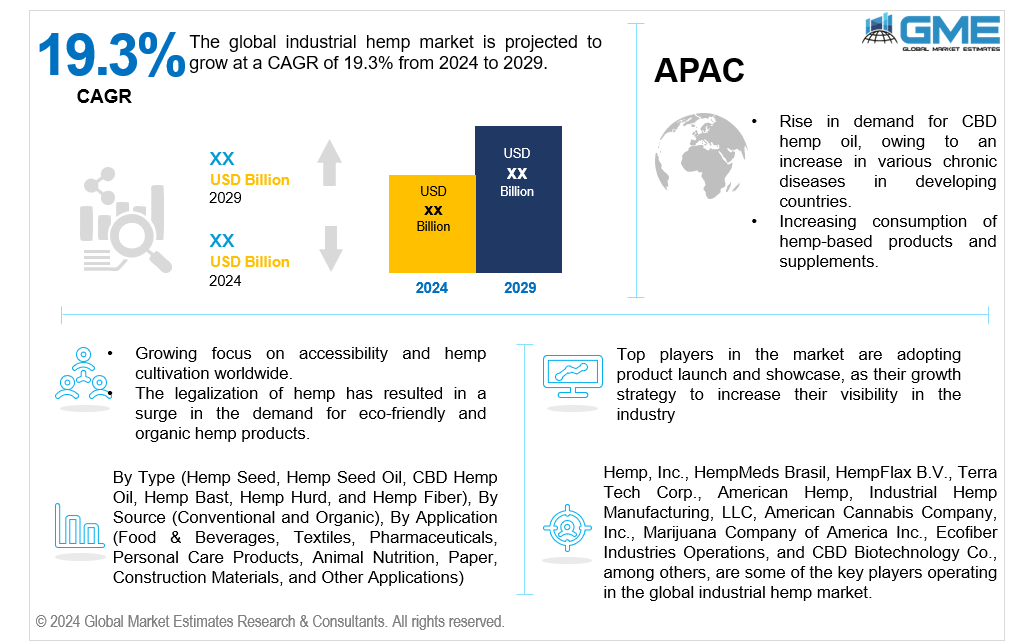

Global Industrial Hemp Market Size, Trends & Analysis - Forecasts to 2029 By Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil, Hemp Bast, Hemp Hurd, and Hemp Fiber), By Source (Conventional and Organic), By Application (Food & Beverages, Textiles, Pharmaceuticals, Personal Care Products, Animal Nutrition, Paper, Construction Materials, and Other Applications), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global industrial hemp market is projected to grow at a CAGR of 19.3% from 2024 to 2029.

The industrial hemp market has witnessed substantial growth in recent years, fuelled by the growing demand for eco-friendly and sustainable products. Industrial hemp is a cannabis sativa plant species that is cultivated specifically for industrial purposes, as opposed to cannabis that is produced for drug production. Industrial hemp production is significantly influenced by its adaptability, which encompasses textiles, construction, food, and personal care products. The cultivation and refining of organic hemp are being facilitated by the revision of hemp industry regulations in countries across the globe, which in turn drives market growth.

Hemp fiber, one of the plant's most essential components, is renowned for its properties. It is widely used in textile manufacturing to produce various materials, including clothing and fibers. Furthermore, hemp refining has made significant strides, facilitating the production of a diverse array of products, such as bioplastics, biofuels, and construction materials like hempcrete.

However, the market has certain constraints. Manufacturers may encounter challenges in adhering to stringent regulatory standards for the cultivation and sale of industrial hemp in various states within the same country, where laws vary for each region for hemp processing. Additionally, the initial costs associated with specialized equipment and infrastructure for hemp manufacturing can be restrictive. Despite these challenges, the hemp market forecast suggests it will continue to expand hemp production and raise awareness of hemp products and their benefits. This trend is set to drive significant growth in the industrial hemp market.

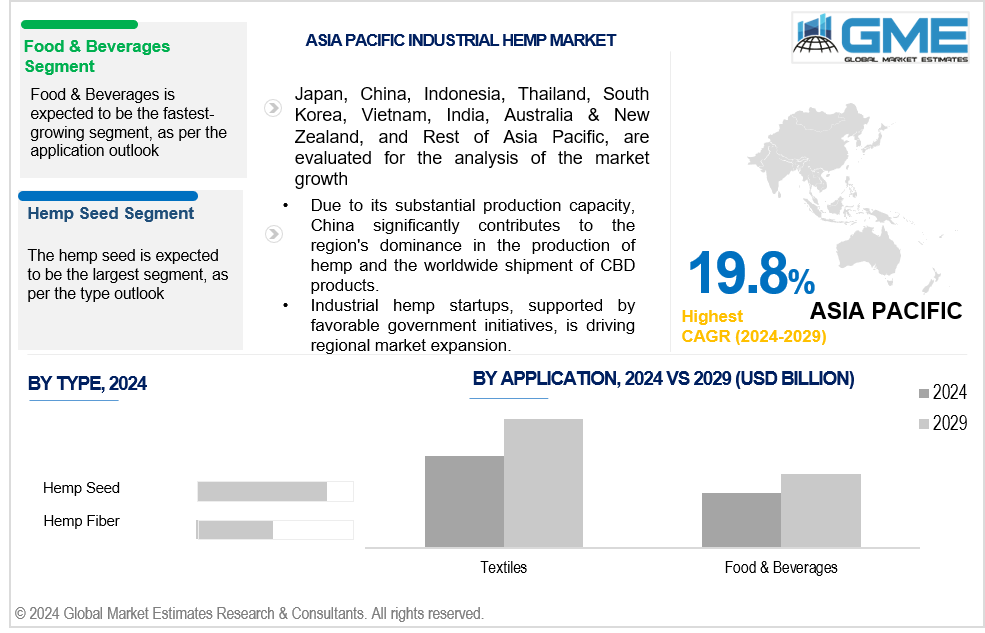

The hemp seed segment is expected to hold the largest share of the market during the forecast period. Hemp oil is derived from hemp seeds and is utilized in different industries like biofuels, pharmaceuticals, and cosmetics. The demand for hemp seeds is further bolstered by the increasing demand for natural hemp products, such as seeds, oil, and food products, which in turn support the overall expansion of the industrial hemp market.

The hemp fiber segment is analyzed to be the fastest-growing segment in the market from 2024 to 2029. The personal hygiene market, natural gas and oil cleaning, and cattle fodder all benefit from the superior absorption of hemp fiber. Paper manufactured from hemp fiber necessitates significantly less chemical processing than paper manufactured from tree pulp. This is further fostering market expansion.

The organic segment is analyzed to hold the largest market share from 2024 to 2029. This expansion is driven by the increasing recognition of the health and biological advantages of organic products in the industrial hemp market. Without the use of pesticides or fertilizers, hemp is grown using organic hemp farming techniques, which is much more in line with sustainable agriculture. This improves the quality of hemp biomass, which has a prolonged lifespan. The organic hemp segment is primarily targeted at health-conscious consumers and industries that prioritize natural and eco-friendly products, such as organic food, natural personal hygiene products, and sustainable textiles. This segment is expected to contribute to the expansion of the market.

The conventional segment is analysed to be the fastest-growing segment in the market from 2024 to 2029. Conventional hemp cultivation utilizes traditional agricultural methods, including the administration of chemical fertilizers and pesticides, to ensure high production and insecticide resistance. From textiles and construction materials to culinary products, cosmetics, and cannabidiol (CBD) production, this segment serves a wide variety of industrial applications. Additionally, the cost-effectiveness and accessibility of conventionally grown hemp render it the preferable option for numerous manufacturers, particularly in regions where organic farming practices are not widely implemented or regulated. Furthermore, the legalization of hemp has increased the potential for conventional hemp cultivation in a variety of industries.

The textiles segment is analyzed to hold the largest market share of the market from 2024 to 2029. Hemp-based textiles are naturally resilient to UV rays, bacteria, and decay while also being nontoxic and durable. This provides an additional advantage over other fabrics in the market. It can be combined with other fabric materials like cotton or linen to enhance the fabric's resilience and stretch, which contributes to the market growth in the textile segment.

The food & beverages segment is analyzed to be the fastest-growing segment in the market from 2024 to 2029. Hemp plastics are becoming increasingly popular as environmentally favorable alternatives to plastic in packaging and containers, thereby reducing plastic waste. The adoption of hemp in a variety of culinary applications is being driven by these innovations, which are designed to appeal to health-conscious consumers who are shifting toward veganism. Additionally, hemp oil is a favored option for the production of food and beverages due to its high nutritional content, which encompasses fats, proteins, and a variety of other constituents.

North America is expected to be the largest region in the global market. Hemp industry trends indicate that the region is increasingly focused on the cultivation of seed oils and cannabidiol (CBD), a non-intoxicating cannabinoid with potential applications in the pharmaceutical and food industries.

Asia Pacific is predicted to witness rapid growth during the forecast period. The industrial hemp market size is growing at a rapid pace in the Asia Pacific region due to advancements in technology and innovation, in conjunction with an increase in global product demand, which are simplifying the process of harvesting for cultivators, thereby altering the landscape of hemp production in the region.

Hemp, Inc., HempMeds Brasil, HempFlax B.V., Terra Tech Corp., American Hemp, Industrial Hemp Manufacturing, LLC, American Cannabis Company, Inc., Marijuana Company of America Inc., Ecofiber Industries Operations, and CBD Biotechnology Co., among others, are some of the key players operating in the global industrial hemp market.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2023, HempMeds Brasil got one of the first-ever permits to import hemp-based cannabidiol (CBD) oil. These new products were created to suit the new requirements of Brazilian doctors who intend to suggest them to their patients.

On February 17, 2023, Hemp, Inc. announced its largest sale of industrial hemp and kenaf products to date. Their semi-trucks transported 120,000 pounds of Hemp, Inc.'s DrillWall, a unique blend of all-natural kenaf and hemp used in the oil and gas well drilling industries.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL INDUSTRIAL HEMP MARKET, BY TYPE

4.1 Introduction

4.2 Industrial Hemp Market : Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Hemp Seed

4.4.1 Hemp Seed Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Hemp Seed Oil

4.5.1 Hemp Seed Oil Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Hemp Bast

4.6.1 Hemp Bast Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 CBD Hemp Oil

4.7.1 CBD Hemp Oil Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Hemp Hurd

4.8.1 Hemp Hurd Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Hemp Fiber

4.9.1 Hemp Fiber Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL INDUSTRIAL HEMP MARKET, BY SOURCE

5.1 Introduction

5.2 Industrial Hemp Market : Source Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Conventional

5.4.1 Conventional Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Organic

5.5.1 Organic Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL INDUSTRIAL HEMP MARKET, BY APPLICATION

6.1 Introduction

6.2 Industrial Hemp Market : Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Food & Beverages

6.4.1 Food & Beverages Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Textiles

6.5.1 Textiles Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Pharmaceuticals

6.5.1 Pharmaceuticals Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Personal Care Products

6.7.1 Personal Care Products Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Animal Nutrition

6.8.1 Animal Nutrition Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 Paper

6.9.1 Paper Market Estimates and Forecast, 2021-2029 (USD Million)

6.10 Construction Materials

6.10.1 Construction Materials Market Estimates and Forecast, 2021-2029 (USD Million)

6.11 Other Applications

6.11.1 Other Applications Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL INDUSTRIAL HEMP MARKET, BY REGION

7.1 Introduction

7.2 North America Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Type

7.2.2 By Source

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Type

7.2.4.1.2 By Source

7.2.4.1.3 By Application

7.2.4.2 Canada Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Type

7.2.4.2.2 By Source

7.2.4.2.3 By Application

7.2.4.3 Mexico Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Type

7.2.4.3.2 By Source

7.2.4.3.3 By Application

7.3 Europe Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Type

7.3.2 By Source

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Type

7.3.4.1.2 By Source

7.3.4.1.3 By Application

7.3.4.2 U.K. Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Type

7.3.4.2.2 By Source

7.3.4.2.3 By Application

7.3.4.3 France Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Type

7.3.4.3.2 By Source

7.3.4.3.3 By Application

7.3.4.4 Italy Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Type

7.3.4.4.2 By Source

7.2.4.4.3 By Application

7.3.4.5 Spain Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Type

7.3.4.5.2 By Source

7.2.4.5.3 By Application

7.3.4.6 Netherlands Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Type

7.3.4.6.2 By Source

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Type

7.3.4.7.2 By Source

7.2.4.7.3 By Application

7.4 Asia Pacific Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Type

7.4.2 By Source

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Type

7.4.4.1.2 By Source

7.4.4.1.3 By Application

7.4.4.2 Japan Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Type

7.4.4.2.2 By Source

7.4.4.2.3 By Application

7.4.4.3 India Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Type

7.4.4.3.2 By Source

7.4.4.3.3 By Application

7.4.4.4 South Korea Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Type

7.4.4.4.2 By Source

7.4.4.4.3 By Application

7.4.4.5 Singapore Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Type

7.4.4.5.2 By Source

7.4.4.5.3 By Application

7.4.4.6 Malaysia Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Type

7.4.4.6.2 By Source

7.4.4.6.3 By Application

7.4.4.7 Thailand Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Type

7.4.4.7.2 By Source

7.4.4.7.3 By Application

7.4.4.8 Indonesia Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Type

7.4.4.8.2 By Source

7.4.4.8.3 By Application

7.4.4.9 Vietnam Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Type

7.4.4.9.2 By Source

7.4.4.9.3 By Application

7.4.4.10 Taiwan Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Type

7.4.4.10.2 By Source

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Type

7.4.4.11.2 By Source

7.4.4.11.3 By Application

7.5 Middle East and Africa Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Type

7.5.2 By Source

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Type

7.5.4.1.2 By Source

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Type

7.5.4.2.2 By Source

7.5.4.2.3 By Application

7.5.4.3 Israel Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Type

7.5.4.3.2 By Source

7.5.4.3.3 By Application

7.5.4.4 South Africa Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Type

7.5.4.4.2 By Source

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Type

7.5.4.5.2 By Source

7.5.4.5.2 By Application

7.6 Central and South America Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Type

7.6.2 By Source

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Type

7.6.4.1.2 By Source

7.6.4.1.3 By Application

7.6.4.2 Argentina Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Type

7.6.4.2.2 By Source

7.6.4.2.3 By Application

7.6.4.3 Chile Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Type

7.6.4.3.2 By Source

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Industrial Hemp Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Type

7.6.4.4.2 By Source

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Hemp, Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 HempMeds Brasil

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 HempFlax B.V.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Terra Tech Corp.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 American Hemp

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Industrial Hemp Manufacturing, LLC

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 American Cannabis Company, Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Marijuana Company of America Inc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Ecofiber Industries Operations

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 CBD Biotechnology Co.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Industrial Hemp Market, By Type, 2021-2029 (USD MILLION)

2 Hemp seed Market, By Region, 2021-2029 (USD MILLION)

3 Hemp seed oil Market, By Region, 2021-2029 (USD MILLION)

4 Hemp bast Market, By Region, 2021-2029 (USD MILLION)

5 CBD hemp oil Market, By Region, 2021-2029 (USD MILLION)

6 Hemp hurd Market, By Region, 2021-2029 (USD MILLION)

7 Hemp fiber Market, By Region, 2021-2029 (USD MILLION)

8 Global Industrial Hemp Market, By Source, 2021-2029 (USD MILLION)

9 Conventional Market, By Region, 2021-2029 (USD MILLION)

10 Organic Market, By Region, 2021-2029 (USD MILLION)

11 Global Industrial Hemp Market, By Application, 2021-2029 (USD MILLION)

12 Food & Beverages Market, By Region, 2021-2029 (USD MILLION)

13 Textiles Market, By Region, 2021-2029 (USD MILLION)

14 Pharmaceuticals Market, By Region, 2021-2029 (USD MILLION)

15 Personal Care Products Market, By Region, 2021-2029 (USD MILLION)

16 Animal Nutrition Market, By Region, 2021-2029 (USD MILLION)

17 Paper Market, By Region, 2021-2029 (USD MILLION)

18 Construction Materials Market, By Region, 2021-2029 (USD MILLION)

19 Other Applications Market, By Region, 2021-2029 (USD MILLION)

20 Regional Analysis, 2021-2029 (USD MILLION)

21 North America Industrial Hemp Market, By Type, 2021-2029 (USD Million)

22 North America Industrial Hemp Market, By Source, 2021-2029 (USD Million)

23 North America Industrial Hemp Market, By Application, 2021-2029 (USD Million)

24 North America Industrial Hemp Market, By Country, 2021-2029 (USD Million)

25 U.S. Industrial Hemp Market, By Type, 2021-2029 (USD Million)

26 U.S. Industrial Hemp Market, By Source, 2021-2029 (USD Million)

27 U.S. Industrial Hemp Market, By Application, 2021-2029 (USD Million)

28 Canada Industrial Hemp Market, By Type, 2021-2029 (USD Million)

29 Canada Industrial Hemp Market, By Source, 2021-2029 (USD Million)

30 Canada Industrial Hemp Market, By Application, 2021-2029 (USD Million)

31 Mexico Industrial Hemp Market, By Type, 2021-2029 (USD Million)

32 Mexico Industrial Hemp Market, By Source, 2021-2029 (USD Million)

33 Mexico Industrial Hemp Market, By Application, 2021-2029 (USD Million)

34 Europe Industrial Hemp Market, By Type, 2021-2029 (USD Million)

35 Europe Industrial Hemp Market, By Source, 2021-2029 (USD Million)

36 Europe Industrial Hemp Market, By Application, 2021-2029 (USD Million)

37 Europe Industrial Hemp Market, By COUNTRY, 2021-2029 (USD Million)

38 Germany Industrial Hemp Market, By Type, 2021-2029 (USD Million)

39 Germany Industrial Hemp Market, By Source, 2021-2029 (USD Million)

40 Germany Industrial Hemp Market, By Application, 2021-2029 (USD Million)

41 U.K. Industrial Hemp Market, By Type, 2021-2029 (USD Million)

42 U.K. Industrial Hemp Market, By Source, 2021-2029 (USD Million)

43 U.K. Industrial Hemp Market, By Application, 2021-2029 (USD Million)

44 France Industrial Hemp Market, By Type, 2021-2029 (USD Million)

45 France Industrial Hemp Market, By Source, 2021-2029 (USD Million)

46 France Industrial Hemp Market, By Application, 2021-2029 (USD Million)

47 Italy Industrial Hemp Market, By Type, 2021-2029 (USD Million)

48 Italy Industrial Hemp Market, By End Use , 2021-2029 (USD Million)

49 Italy Industrial Hemp Market, By Application, 2021-2029 (USD Million)

50 Spain Industrial Hemp Market, By Type, 2021-2029 (USD Million)

51 Spain Industrial Hemp Market, By Source, 2021-2029 (USD Million)

52 Spain Industrial Hemp Market, By Application, 2021-2029 (USD Million)

53 Rest Of Europe Industrial Hemp Market, By Type, 2021-2029 (USD Million)

54 Rest Of Europe Industrial Hemp Market, By Source, 2021-2029 (USD Million)

55 Rest of Europe Industrial Hemp Market, By Application, 2021-2029 (USD Million)

56 Asia Pacific Industrial Hemp Market, By Type, 2021-2029 (USD Million)

57 Asia Pacific Industrial Hemp Market, By Source, 2021-2029 (USD Million)

58 Asia Pacific Industrial Hemp Market, By Application, 2021-2029 (USD Million)

59 Asia Pacific Industrial Hemp Market, By Country, 2021-2029 (USD Million)

60 China Industrial Hemp Market, By Type, 2021-2029 (USD Million)

61 China Industrial Hemp Market, By Source, 2021-2029 (USD Million)

62 China Industrial Hemp Market, By Application, 2021-2029 (USD Million)

63 India Industrial Hemp Market, By Type, 2021-2029 (USD Million)

64 India Industrial Hemp Market, By Source, 2021-2029 (USD Million)

65 India Industrial Hemp Market, By Application, 2021-2029 (USD Million)

66 Japan Industrial Hemp Market, By Type, 2021-2029 (USD Million)

67 Japan Industrial Hemp Market, By Source, 2021-2029 (USD Million)

68 Japan Industrial Hemp Market, By Application, 2021-2029 (USD Million)

69 South Korea Industrial Hemp Market, By Type, 2021-2029 (USD Million)

70 South Korea Industrial Hemp Market, By Source, 2021-2029 (USD Million)

71 South Korea Industrial Hemp Market, By Application, 2021-2029 (USD Million)

72 Singapore Industrial Hemp Market, By Type, 2021-2029 (USD Million)

73 Singapore Industrial Hemp Market, By Source, 2021-2029 (USD Million)

74 Singapore Industrial Hemp Market, By Application, 2021-2029 (USD Million)

75 Malaysia Industrial Hemp Market, By Type, 2021-2029 (USD Million)

76 Malaysia Industrial Hemp Market, By Source, 2021-2029 (USD Million)

77 Malaysia Industrial Hemp Market, By Application, 2021-2029 (USD Million)

78 Thailand Industrial Hemp Market, By Type, 2021-2029 (USD Million)

79 Thailand Industrial Hemp Market, By Source, 2021-2029 (USD Million)

80 Thailand Industrial Hemp Market, By Application, 2021-2029 (USD Million)

81 Indonesia Industrial Hemp Market, By Type, 2021-2029 (USD Million)

82 Indonesia Industrial Hemp Market, By Source, 2021-2029 (USD Million)

83 Indonesia Industrial Hemp Market, By Application, 2021-2029 (USD Million)

84 Vietnam Industrial Hemp Market, By Type, 2021-2029 (USD Million)

85 Vietnam Industrial Hemp Market, By Source, 2021-2029 (USD Million)

86 Vietnam Industrial Hemp Market, By Application, 2021-2029 (USD Million)

87 Taiwan Industrial Hemp Market, By Type, 2021-2029 (USD Million)

88 Taiwan Industrial Hemp Market, By Source, 2021-2029 (USD Million)

89 Taiwan Industrial Hemp Market, By Application, 2021-2029 (USD Million)

90 Rest of Asia Pacific Industrial Hemp Market, By Type, 2021-2029 (USD Million)

91 Rest of Asia Pacific Industrial Hemp Market, By Source, 2021-2029 (USD Million)

92 Rest of Asia Pacific Industrial Hemp Market, By Application, 2021-2029 (USD Million)

93 Middle East and Africa Industrial Hemp Market, By Type, 2021-2029 (USD Million)

94 Middle East and Africa Industrial Hemp Market, By Source, 2021-2029 (USD Million)

95 Middle East and Africa Industrial Hemp Market, By Application, 2021-2029 (USD Million)

96 Middle East and Africa Industrial Hemp Market, By Country, 2021-2029 (USD Million)

97 Saudi Arabia Industrial Hemp Market, By Type, 2021-2029 (USD Million)

98 Saudi Arabia Industrial Hemp Market, By Source, 2021-2029 (USD Million)

99 Saudi Arabia Industrial Hemp Market, By Application, 2021-2029 (USD Million)

100 UAE Industrial Hemp Market, By Type, 2021-2029 (USD Million)

101 UAE Industrial Hemp Market, By Source, 2021-2029 (USD Million)

102 UAE Industrial Hemp Market, By Application, 2021-2029 (USD Million)

103 Israel Industrial Hemp Market, By Type, 2021-2029 (USD Million)

104 Israel Industrial Hemp Market, By Source, 2021-2029 (USD Million)

105 Israel Industrial Hemp Market, By Application, 2021-2029 (USD Million)

106 South Africa Industrial Hemp Market, By Type, 2021-2029 (USD Million)

107 South Africa Industrial Hemp Market, By Source, 2021-2029 (USD Million)

108 South Africa Industrial Hemp Market, By Application, 2021-2029 (USD Million)

109 Rest of Middle East and Africa Industrial Hemp Market, By Type, 2021-2029 (USD Million)

110 Rest of Middle East and Africa Industrial Hemp Market, By Source, 2021-2029 (USD Million)

111 Rest of Middle East and Africa Industrial Hemp Market, By Application, 2021-2029 (USD Million)

112 Central and South America Industrial Hemp Market, By Type, 2021-2029 (USD Million)

113 Central and South America Industrial Hemp Market, By Source, 2021-2029 (USD Million)

114 Central and South America Industrial Hemp Market, By Application, 2021-2029 (USD Million)

115 Central and South America Industrial Hemp Market, By Country, 2021-2029 (USD Million)

116 Brazil Industrial Hemp Market, By Type, 2021-2029 (USD Million)

117 Brazil Industrial Hemp Market, By Source, 2021-2029 (USD Million)

118 Brazil Industrial Hemp Market, By Application, 2021-2029 (USD Million)

119 Argentina Industrial Hemp Market, By Type, 2021-2029 (USD Million)

120 Argentina Industrial Hemp Market, By Source, 2021-2029 (USD Million)

121 Argentina Industrial Hemp Market, By Application, 2021-2029 (USD Million)

122 Chile Industrial Hemp Market, By Type, 2021-2029 (USD Million)

123 Chile Industrial Hemp Market, By Source, 2021-2029 (USD Million)

124 Chile Industrial Hemp Market, By Application, 2021-2029 (USD Million)

125 Rest of Central and South America Industrial Hemp Market, By Type, 2021-2029 (USD Million)

126 Rest of Central and South America Industrial Hemp Market, By Source, 2021-2029 (USD Million)

127 Rest of Central and South America Industrial Hemp Market, By Application, 2021-2029 (USD Million)

128 Hemp, Inc.: Products & Services Offering

129 HempMeds Brasil: Products & Services Offering

130 HempFlax B.V.: Products & Services Offering

131 Terra Tech Corp.: Products & Services Offering

132 American Hemp: Products & Services Offering

133 INDUSTRIAL HEMP MANUFACTURING, LLC: Products & Services Offering

134 American Cannabis Company, Inc.: Products & Services Offering

135 Marijuana Company of America Inc.: Products & Services Offering

136 Ecofiber Industries Operations: Products & Services Offering

137 CBD Biotechnology Co.: Products & Services Offering

138 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Industrial Hemp Market Overview

2 Global Industrial Hemp Market Value From 2021-2029 (USD MILLION)

3 Global Industrial Hemp Market Share, By Type (2023)

4 Global Industrial Hemp Market Share, By Source (2023)

5 Global Industrial Hemp Market Share, By Application (2023)

6 Global Industrial Hemp Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Industrial Hemp Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Industrial Hemp Market

11 Impact Of Challenges On The Global Industrial Hemp Market

12 Porter’s Five Forces Analysis

13 Global Industrial Hemp Market: By Type Scope Key Takeaways

14 Global Industrial Hemp Market, By Type Segment: Revenue Growth Analysis

15 Hemp Seed Market, By Region, 2021-2029 (USD MILLION)

16 Hemp Seed Oil Market, By Region, 2021-2029 (USD MILLION)

17 Hemp Bast Market, By Region, 2021-2029 (USD MILLION)

18 CBD Hemp Oil Market, By Region, 2021-2029 (USD MILLION)

19 Hemp Hurd Market, By Region, 2021-2029 (USD MILLION)

20 Hemp Fiber Market, By Region, 2021-2029 (USD MILLION)

21 Global Industrial Hemp Market: By Source Scope Key Takeaways

22 Global Industrial Hemp Market, By Source Segment: Revenue Growth Analysis

23 Conventional Market, By Region, 2021-2029 (USD MILLION)

24 Organic Market, By Region, 2021-2029 (USD MILLION)

25 Global Industrial Hemp Market: By Application Scope Key Takeaways

26 Global Industrial Hemp Market, By Application Segment: Revenue Growth Analysis

27 Food & Beverages Market, By Region, 2021-2029 (USD MILLION)

28 Textiles Market, By Region, 2021-2029 (USD MILLION)

29 Pharmaceuticals Market, By Region, 2021-2029 (USD MILLION)

30 Personal Care Products Market, By Region, 2021-2029 (USD MILLION)

31 Animal Nutrition Market, By Region, 2021-2029 (USD MILLION)

32 Paper Market, By Region, 2021-2029 (USD MILLION)

33 Construction Materials Market, By Region, 2021-2029 (USD MILLION)

34 Other Applications Market, By Region, 2021-2029 (USD MILLION)

35 Regional Segment: Revenue Growth Analysis

36 Global Industrial Hemp Market: Regional Analysis

37 North America Industrial Hemp Market Overview

38 North America Industrial Hemp Market, By Type

39 North America Industrial Hemp Market, By Source

40 North America Industrial Hemp Market, By Application

41 North America Industrial Hemp Market, By Country

42 U.S. Industrial Hemp Market, By Type

43 U.S. Industrial Hemp Market, By Source

44 U.S. Industrial Hemp Market, By Application

45 Canada Industrial Hemp Market, By Type

46 Canada Industrial Hemp Market, By Source

47 Canada Industrial Hemp Market, By Application

48 Mexico Industrial Hemp Market, By Type

49 Mexico Industrial Hemp Market, By Source

50 Mexico Industrial Hemp Market, By Application

51 Four Quadrant Positioning Matrix

52 Company Market Share Analysis

53 Hemp, Inc.: Company Snapshot

54 Hemp, Inc.: SWOT Analysis

55 Hemp, Inc.: Geographic Presence

56 HempMeds Brasil: Company Snapshot

57 HempMeds Brasil: SWOT Analysis

58 HempMeds Brasil: Geographic Presence

59 HempFlax B.V.: Company Snapshot

60 HempFlax B.V.: SWOT Analysis

61 HempFlax B.V.: Geographic Presence

62 Terra Tech Corp.: Company Snapshot

63 Terra Tech Corp.: Swot Analysis

64 Terra Tech Corp.: Geographic Presence

65 American Hemp: Company Snapshot

66 American Hemp: SWOT Analysis

67 American Hemp: Geographic Presence

68 Industrial Hemp Manufacturing, LLC: Company Snapshot

69 Industrial Hemp Manufacturing, LLC: SWOT Analysis

70 Industrial Hemp Manufacturing, LLC: Geographic Presence

71 American Cannabis Company, Inc.: Company Snapshot

72 American Cannabis Company, Inc.: SWOT Analysis

73 American Cannabis Company, Inc.: Geographic Presence

74 Marijuana Company of America Inc.: Company Snapshot

75 Marijuana Company of America Inc.: SWOT Analysis

76 Marijuana Company of America Inc.: Geographic Presence

77 Ecofiber Industries Operations: Company Snapshot

78 Ecofiber Industries Operations: SWOT Analysis

79 Ecofiber Industries Operations: Geographic Presence

80 CBD Biotechnology Co.: Company Snapshot

81 CBD Biotechnology Co.: SWOT Analysis

82 CBD Biotechnology Co.: Geographic Presence

83 Other Companies: Company Snapshot

84 Other Companies: SWOT Analysis

85 Other Companies: Geographic Presence

The Global Industrial Hemp Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Hemp Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS