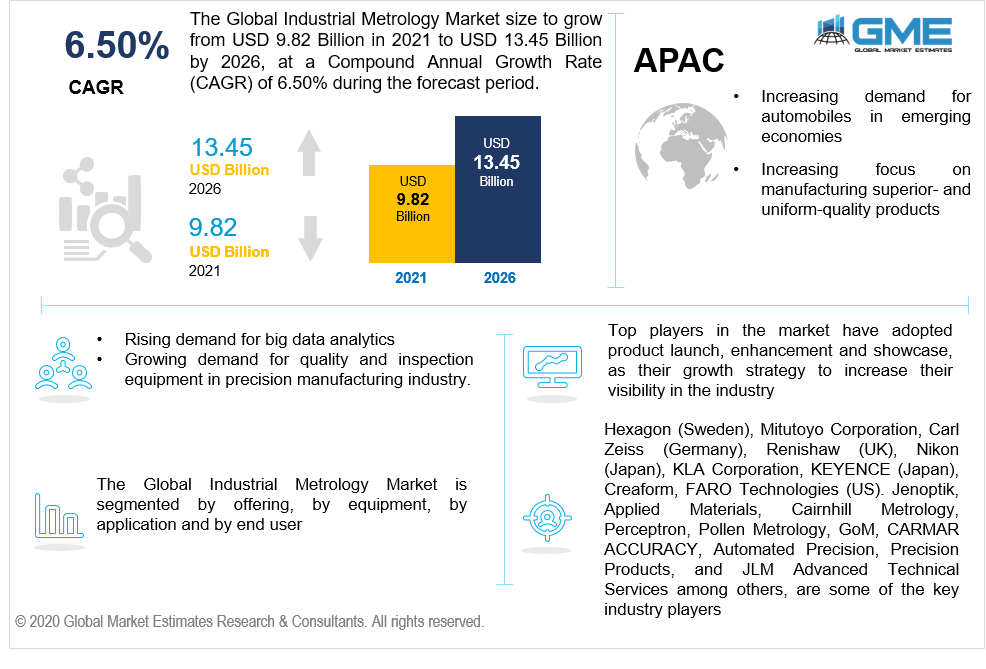

Global Industrial Metrology Market Size, Trends, and Analysis - Forecasts to 2026 By Offering (Hardware, Software, Services), By Equipment (Coordinate Measuring Machine (CMM), Optical Digitizer and Scanner (ODS), Measuring Instruments, X-Ray and Computed Tomography, Automated Optical Inspection, Form Measurement Equipment, and 2D Equipment), By Application (Quality Control & Inspection, Reverse Engineering, Mapping and Modeling, Others), By End-Use Industry (Aerospace & Defense, Automotive, Semiconductor, Manufacturing, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis & Competitor Analysis

Industrial metrology is a scientific measurement process in manufacturing industries, for developing high quality and accurate components. Industrial metrology technology includes a quality control process. The growing adoption and demand for big data analytics, along with the increasing demand for automobiles in developing economies are driving the market growth for industrial metrology. Growing usage of cloud services to incorporate metrological data and growing demand for industry 4.0 is supporting the market growth between 2021-2026. Rapid growth in quality control activities in various industries, along with the growing production of automobiles in emerging economies are also propelling the market growth. Industrial metrology finds its application in different industries such as aerospace, manufacturing, and semiconductors among others.

Metrology helps manufacturers to produce spare products and components more accurately, with higher standards. Metrology is the process of developing quality products with modern-day manufacturing techniques. They are used to produce thousands of identical pieces of sophisticated equipment. Industries across various sectors rely heavily on Industrial Metrology to manufacture and develop high-quality parts.

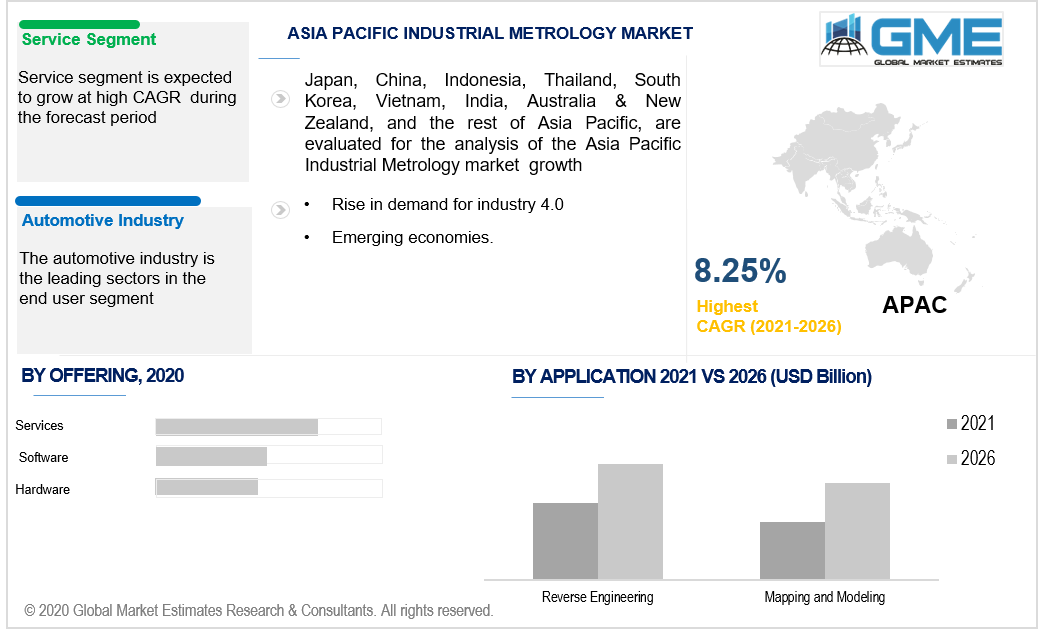

Based on the offering the services segment holds the maximum share and will propel at a high CAGR between 2021-2026. Industry metrology requires high investments to install and the lack of experts responsible for segmentation growth. Major manufacturers companies are outsourcing industry metrology to reduce costs. The software segment will register a significant share in the global market between 2021-2026. The growing adoption of cloud-based services among manufacturing industries also boosting the software segment.

Based on the equipment type, the market is explained into CMM, 2D Equipment, Optical Digitizer and Scanner (ODS), Form Measurement Equipment, Measuring Instruments, Automated Optical Inspection, X-Ray and Computed Tomography among others. The CMM equipment is the widely used equipment among end-users. The segment is also expected to hold the maximum share in the global market. CMM machine is a contact model and non-contact model that includes touch probes, and spherical objects for measurements. The machines are used to measure the target and record the measured data in the manufacturing industries. The machines are used for measuring the physical-geometrical characteristics of an object. The growing need for precision dimensional analysis and validation of geometric accuracy in various industries such as manufacturing, aerospace, and automotive, are boosting the segment growth.

Based on the application, the market is categorized and explained into quality control & inspection, mapping & modeling, and reverse engineering among others. The quality control & inspection segment will be the prominent segment and will generate huge revenue between 2021-2026. The growing competition among end-users and the growing need for safety products across different industries resulted in implementing quality control systems. Industry metrology improves the quality of products and metrology is one of the best options for the production of industry-standard products. Increasing government regulations towards industry parts and equipment are also boosting the segment growth. The growing focus on quality control among automotive and aerospace industries is supporting the market demand.

Based on the end-user analysis, the market is explained into automotive, manufacturing, aerospace, and semiconductors among others. The automotive industry will be the dominating sector among end-users. The growing adoption of in-line techniques in manufacturing facilities is driving the automotive sector. The growing production of lightweight passenger vehicles along with advancements in quality control techniques are supporting the market growth. The growing usage and demand for electric vehicles in developed regions along with growing demand for superior and high-quality products are positively impacting the market.

Based on the regional analysis, the North American region market is estimated to be the leading region and holds the maximum share in the global market. The presence of leading automotive and aerospace players such as Ford, Chevrolet, Siemens Aerospace, Lockheed Martin, General Dynamics Corporation, Tesla, and Chrysler among others is positively impacting the regional growth. High demand for metrology products from these industries is boosting regional growth. The U.S. holds the largest share in the automotive market globally. According to the USA automotive sales data, approximately 17.2 million units’ light vehicles are sold in 2018. The U.S automakers exported 1.8 light vehicles in 2018. The Asia Pacific region will exhibit a peak growth rate between the forecast period, due to The rapid industrialization and growing investments in the automotive and aerospace sectors.

Hexagon (Sweden), Mitutoyo Corporation, Carl Zeiss (Germany), Renishaw (UK), Nikon (Japan), KLA Corporation, KEYENCE (Japan), Creaform, FARO Technologies (US). Jenoptik, Applied Materials, Cairnhill Metrology, Perceptron, Pollen Metrology, GoM, CARMAR ACCURACY, Automated Precision, Precision Products, and JLM Advanced Technical Services among others, are some of the key industry players

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2020, Hexagon acquired MECADAT AG. The company is a distributor of CAD & CAM software and other complementary solutions for mold making.

In November 2020, Nikon launched ‘NEXIV VMZ S3020’ video monitoring system for measuring electrical and electronic components.

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Global Industrial Metrology Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Metrology Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS