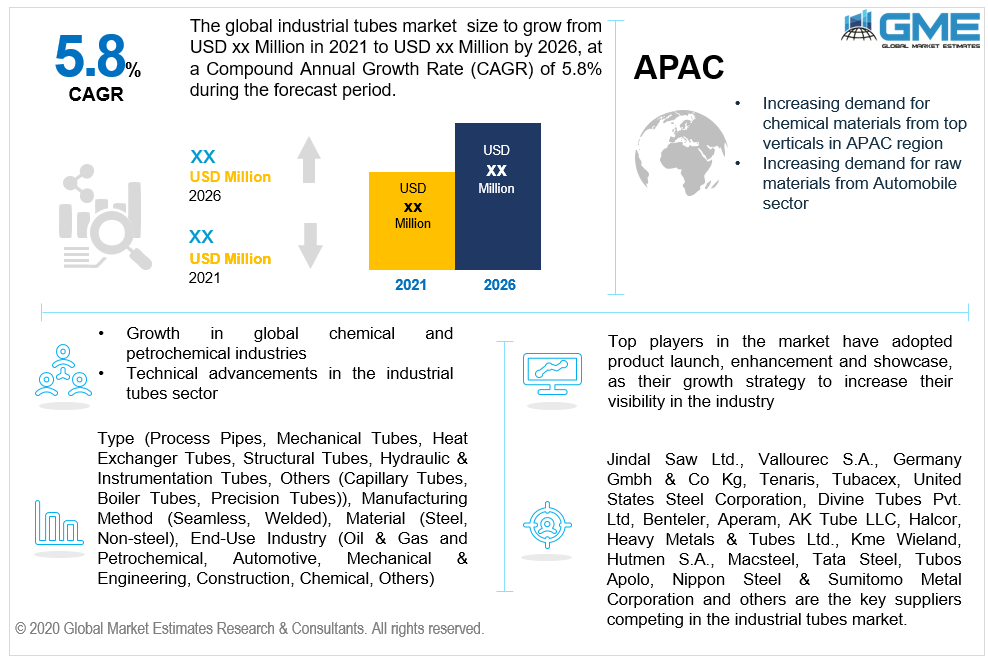

Global Industrial Tubes Market Size, Trends, and Analysis - Forecasts To 2026 By Type (Process Pipes, Mechanical Tubes, Heat Exchanger Tubes, Structural Tubes, Hydraulic & Instrumentation Tubes, Others (Capillary Tubes, Boiler Tubes, Precision Tubes)), By Manufacturing Method (Seamless, Welded), By Material (Steel, Non-steel), By End-Use Industry (Oil & Gas and Petrochemical, Automotive, Mechanical & Engineering, Construction, Chemical, Others (Sanitary Systems, Water Treatment, Medical Tubes, Pharmaceutical, Food & Beverage, Aerospace, and Marine)), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

The terms "pipe" and "tube" are often interchanged when referring to a cylinder used to carry liquid or gas. Hollow cylindrical structures that are made up of copper, steel, nickel, aluminium, and others are industrial tubes. Oil & gas, petrochemicals, automobile, chemicals, energy & power, and manufacturing are only a few of the sectors that use industrial tubing.

The increase in the number of activities in the global chemical and petrochemical industries is one of the main factors driving the industrial tubes industry. In addition, revenues of industrial tubes across the globe are also propelled by the booming energy & power market. Besides that, the product's extensive use in the chemical, construction, oil and gas, automobile, and petrochemical industries can improve global market expansion. This, in fact, in the upcoming years, would broaden the reach of business space. Besides, with its excellent weldability, rust resistance, and chemical property resulted in its huge usage, the high longevity of steel tubes will also boost the size of the industrial tubes industry. Manufacturers are seeking to develop eco-friendly industrial tubes with the rising trend towards the production of eco-friendly goods and as part of corporate social responsibility, thus increasing the reach of the sector over the next decades. Recent technical advances in the commercial dimensions of industrial tubes, such as the AI-based control and monitoring system for heat exchangers, are expected to improve the global demand for industrial tubes.

Certain limitations and obstacles will thwart overall demand growth. Factors such as the shortage of professional staff and the lack of controls and guidelines are affecting the development of the market. Furthermore, market development is hindered by raw material price fluctuations and tight government regulations in numerous nations. Furthermore, demand for industrial tubes is limited in saturated markets. Thus, it serves as a possible constraint to impede the global market's overall growth. Nonetheless, growing offshore investment and new oilfield discoveries are providing promising prospects for the industrial tubes industry.

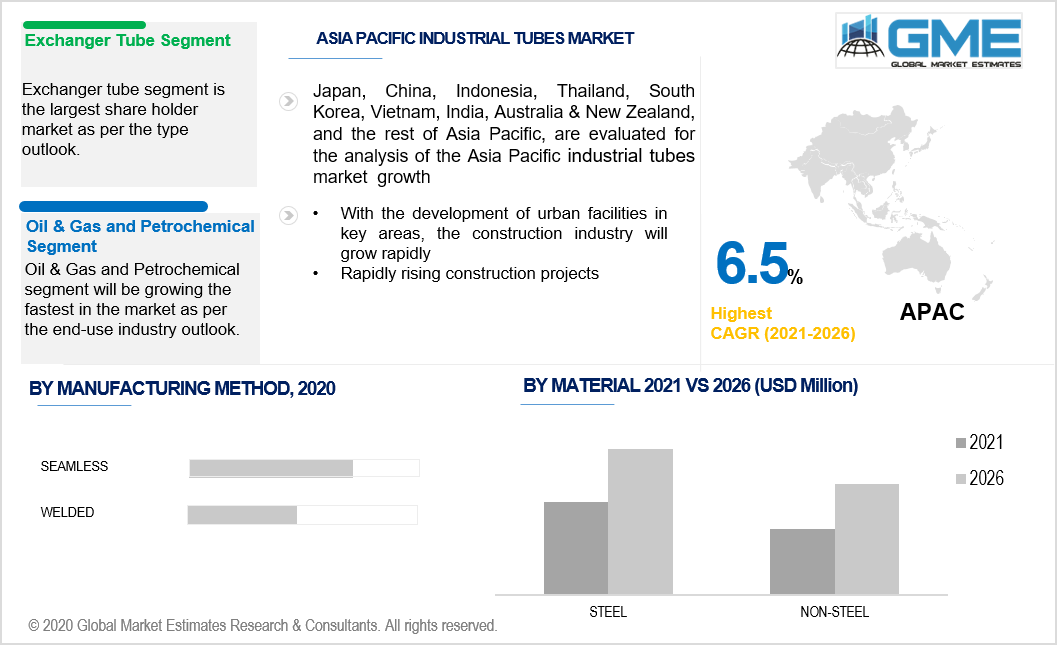

Based on type, the market has been segregated into exchanger tubes, heat structural tubes, hydraulic & instrumentation tubes, mechanical tubes, and process pipes, among others (boiler tubes, capillary tubes, and precision tubes). During to forecast period, the heat exchanger tube segment is projected to experience the highest CAGR. The factors can be traced to the commercialization of AI-based heat exchanger tracking and management systems that concentrated on heat recovery and efficient exploitation of sensible and latent heat from flue gas, resulting in a better outcome for clean coal power, which is propelling demand for this segment.

Welded and seamless are the two types of manufacturing processes. The seamless pipes segment dominates the world industrial pipes segment owing to its superior properties to withstand heat, higher strength under loading, and shape uniformity.

Based on material, the market has been bifurcated into steel and non-steel. The highest market share is held by the steel tubes segment. Formability, high strength, excellent chemical and corrosion tolerance, longevity, and weldability are all factors that lead to its high rate of consumption. Steel tubes are extensively used in the oil & gas, chemical, and petrochemical sectors, leading to enhanced demand for steel tubes.

Based on End-Use, the market has been segregated into chemical, automotive, construction, oil & gas and petrochemical, mechanical & engineering, others (medical tubes, food & beverage, water treatment, aerospace, pharmaceutical, sanitary systems, and marine).

During the forecast period, the oil & gas and petrochemical industry segment is expected to experience the highest CAGR. Since the oil and gas industry is the largest end-user of steel tubes, growth in oil and gas production is the primary driver of the industrial tubes market.

North America will be the largest shareholder of the market while the Asia Pacific region will grow the fastest. The most populated countries such as China and India are in APAC. Because of the increased demand for chemical materials, these countries are quickly expanding their potential in the petrochemical and chemical industries. Furthermore, when the middle-class population's disposable income increases, automobile demand is projected to increase dramatically. Therefore, the demand for industrial pipes is projected to witness a favorable growth pattern in the automotive industry. With the development of urban facilities in key areas, the construction industry is projected to see modest demand for industrial tubes.

As a result of its well-developed oil & gas sector, the Middle East region accounts for a substantial share of the global market for industrial pipes. The oil and gas industry consumes the bulk of industrial tubes, which are used in applications such as riser pipes, topside process pipes, OCTG, instrumentation tubes, or heat exchanger tubes.

Vallourec S.A., Eisenbau Krämer Gmbh, Jindal Saw Ltd., Germany Gmbh & Co Kg, Tubacex, Tenaris, United States Divine Tubes Pvt. Ltd, Ratnamani Metal & Tubes Ltd., Steel Corporation, Benteler, AK Tube LLC, Aperam, Halcor, Kme Wieland, Heavy Metals & Tubes Ltd., Hutmen S.A., Tata Steel, Nippon Steel & Sumitomo Metal Corporation, Tubos Apolo, Acciai Speciali Terni S.P.A., Sandvik AB are the key suppliers competing in the industrial tubes market.

In September 2016, Nippon Steel & Sumitomo Metal Vietnam Company Limited was founded in Vietnam by Nippon Steel & Sumitomo Metal Corporation to fulfill the country's demand for steel tubes.

In July 2018, Vallourec S.A. produced copper tubing for the long-term storage of waste nuclear fuel. In 2006, this initiative was conducted under a contract with customer Posiva Oy (France), an agency for the management of nuclear waste.

In November 2017, Vallourec S.A. obtained a contract from China National Offshore Oil Corporation (CNOOC) to supply 16,000 tonnes of OCTG tubular solution to Shenzhen, Shanghai, Tianjin, and Zhanjiang in China.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Industrial Tubes Industry Overview, 2021-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Manufacturing Method Overview

2.1.4 End-User Overview

2.1.5 Materials Overview

2.1.6 Regional Overview

Chapter 3 Industrial Tubes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Advancements in the industrial tube products

3.3.1.2 Growing construction projects in APAC region

3.3.2 Industry Challenges

3.3.2.1 Lack of adequate infrastructure and automated industrial systems in developing nations

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Manufacturing Method Growth Scenario

3.4.3 End-User Growth Scenario

3.4.4 Materials Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Materials Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Industrial Tubes Market, By Type

4.1 Type Outlook

4.2 Process Pipes

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Mechanical Tubes

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 Heat Exchanger Tubes

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Structural Tubes

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Hydraulic & Instrumentation Tubes

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Others

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Industrial Tubes Market, By End-User

5.1 End-User Outlook

5.2 Oil & Gas and Petrochemical

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Automotive

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Mechanical & Engineering

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Construction

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Chemical

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

5.7 Other

5.7.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Industrial Tubes Market, By Manufacturing Method

6.1 Seamless

6.1.1 Market Size, By Region, 2016-2026 (USD Million)

6.2 Welded

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Industrial Tubes Market, By Materials

7.1 Steel

7.1.1 Market Size, By Region, 2016-2026 (USD Million)

7.2 Non-Steel

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Industrial Tubes Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2016-2026 (USD Million)

8.2.2 Market Size, By Type, 2016-2026 (USD Million)

8.2.3 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.2.4 Market Size, By End-User, 2016-2026 (USD Million)

8.2.5 Market Size, By Materials, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.4.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.2.4.3 Market Size, By End-User, 2016-2026 (USD Million)

Market Size, By Materials, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2016-2026 (USD Million)

8.3.2 Market Size, By Type, 2016-2026 (USD Million)

8.3.3 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.4 Market Size, By End-User, 2016-2026 (USD Million)

8.3.5 Market Size, By Materials, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Materials, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-User, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2016-2026 (USD Million)

8.4.2 Market Size, By Type, 2016-2026 (USD Million)

8.4.3 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.4 Market Size, By End-User, 2016-2026 (USD Million)

8.4.5 Market Size, By Materials, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.9.2 Market size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.9.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.9.4 Market Size, By Materials, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-User, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2016-2026 (USD Million)

8.5.2 Market Size, By Type, 2016-2026 (USD Million)

8.5.3 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.5.4 Market Size, By End-User, 2016-2026 (USD Million)

8.5.5 Market Size, By Materials, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2016-2026 (USD Million)

8.6.2 Market Size, By Type, 2016-2026 (USD Million)

8.6.3 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.6.4 Market Size, By End-User, 2016-2026 (USD Million)

8.6.5 Market Size, By Materials, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Materials, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Manufacturing Method, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-User, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Materials, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Vallourec S.A.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Eisenbau Krämer Gmbh

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Jindal Saw Ltd.

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Germany Gmbh & Co Kg

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Tubacex,

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 United States Divine Tubes Pvt. Ltd

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Tenaris

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Ratnamani Metal & Tubes Ltd.

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Steel Corporation

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Industrial Tubes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Industrial Tubes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS