Global Inspection Machines Market Size, Trends, and Analysis - Forecasts To 2026 By Product (Vision Inspection Systems, Leak Detection Systems, X-ray Inspection Systems, Combination Systems, Checkweighers, Metal Detectors, Software, and Others) By Type (Fully-automated Inspection Machines, Semi-automated Inspection Machines, and Manual Inspection Machines), By Application (Ampoules & Vials, Syringes, Blister Packaging, Bottles, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Medical Device Manufacturers, Food Processing & Packaging Companies, and Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

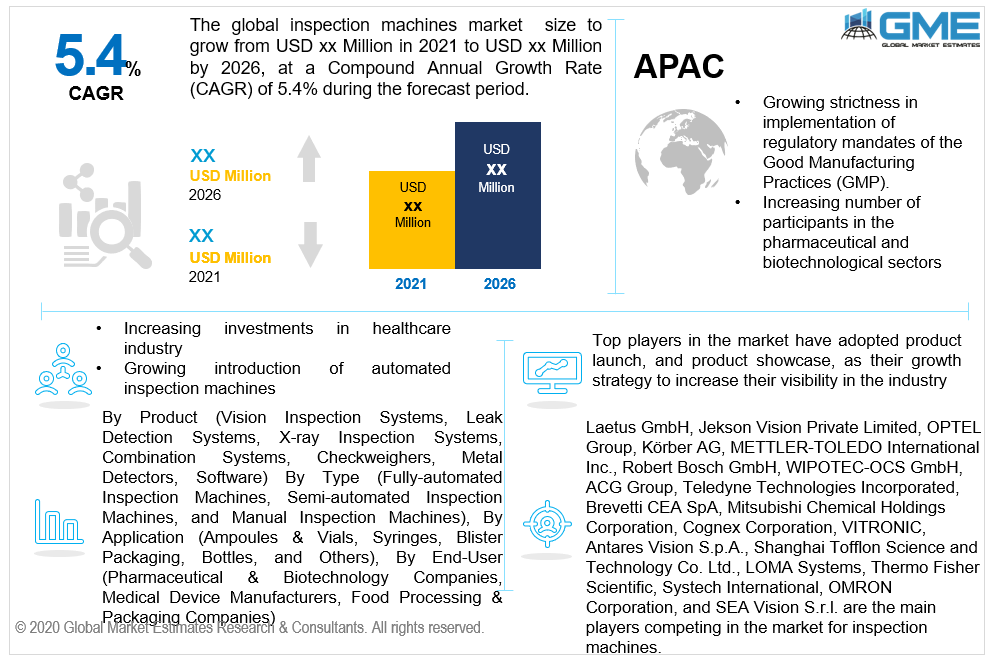

As a consequence of severe regulatory compliance in the healthcare sector imposed by various governments across the world, the global inspection machines market is foreseen to develop significantly throughout the forecast period. Additional variables affecting the growth of the global inspection machines market include different government initiatives to encourage good manufacturing practices or GMP.

Furthermore, the increasing number of automated inspection systems in industries such as healthcare, manufacturing, and food and beverages is boosting the expansion of the global inspection machines market during the forecast period. In particular, with a rising proportion of product recalls due to poor quality and significant technology breakthroughs to address these quality concerns, the global inspection machines market is anticipated to expand rapidly.

Technical advances towards the development of advanced inspection systems that can conduct a wide variety of inspection activities, including their ability to identify non-ferrous metals, is a factor that is anticipated during the forecast period to generate attractive business opportunities for top producers in the global market. In addition, the COVID-19 cases are rising day by day and it is especially important to take care of quality to prevent COVID-19, which is pushing the demand for inspection machines to strengthen. The developments in these technologies are also encouraging nations to spend more on them, particularly in the healthcare industry, in order to develop infrastructure.

The complicated architecture of integrating inspection machines, which necessitates professional maintenance, and increased demand for reconditioned system goods are projected to stymie the inspection machine market's growth. Nonetheless, the increasing expansion of the aging population, the expanding pharmaceutical industry, the quick rise in chronic and infectious illness cases, the speedy growth of the food and beverage industry, and different technology breakthroughs throughout the world are driving development. Furthermore, the advent of new application areas opens up new potential for the different stakeholders in the global inspection machines market.

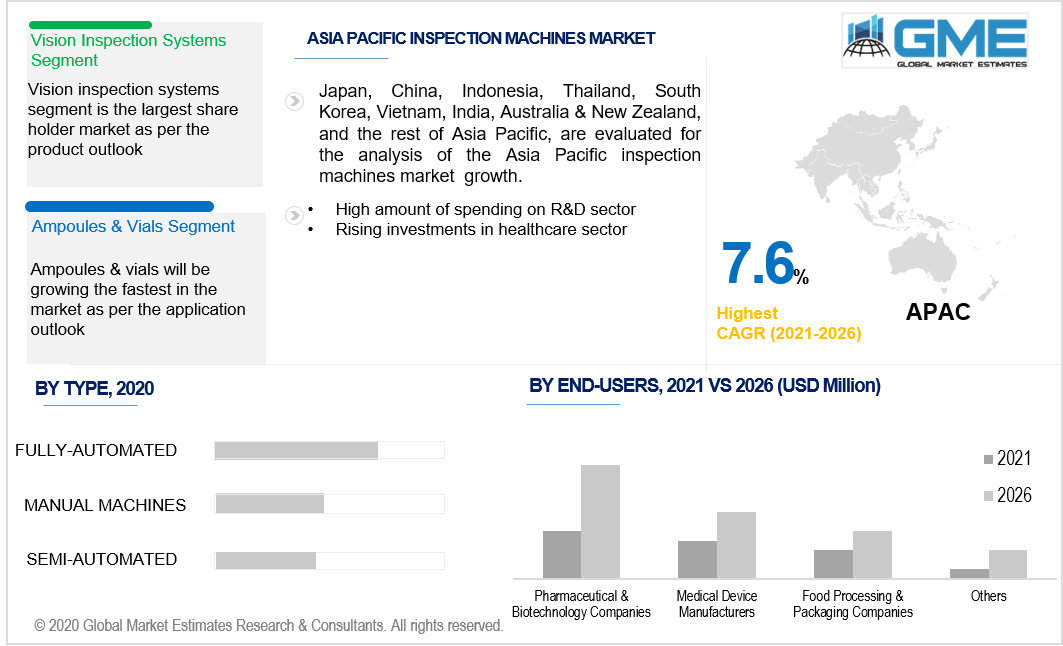

Based on product, the inspection machines market has been categorized into software, leak detection systems, combination systems, check weighers, X-ray inspection systems, metal detectors, vision inspection systems, and others. The largest market share is foreseen to be accounted for by the vision inspection systems segment. Due to their quick adaptability, ease of use, and great performance, the high usage of vision inspection systems is extensively seen in medical devices, biotechnology, pharmaceutical, cosmetic, and food industries which contribute to the demand for consumables. These inspection systems also provide consumers with advanced features, such as the integration of smart cameras, high operating power (which can operate 24 hours a day), inspection accuracy, and compatibility with various types of applications, thus further encouraging their adoption.

Based on type, the inspection machines market has been categorized into fully-automated inspection machines, semi-automated inspection machines, and manual inspection machines. The fully automated machines category is foreseen to lead the market, trailed by semi-automated and manual machines. When contrasted to several other systems, the substantial proportion of the fully automated machines segment may be due to the perks of these systems, including excellent throughput frequency, optimum inspection precision, elevated detection level, and adherence to high standard guidelines. The potential of these systems to detect real-time defects allows it an option to prevent reinspection and is hence implemented across different industries. As part of the zero-error strategy, the increasing need for quality specifications, the growing need to eliminate particles and cosmetic errors, and technical advances in this category will continue to fuel market growth.

Based on the application, the inspection machines market has been categorized into packaging, blister bottles, syringes, ampoules & vials, and others. The ampoules & vials category is likely to contribute to the majority of the market. This is due to the increased use of biopharmaceutical and vaccine delivery methods in the pharmaceutical business, which results in an expansion in the use of inspection systems.

Based on end-users, the inspection machines market has been classified into food processing & packaging companies, medical device manufacturers, pharmaceutical & biotechnology companies, and others. The pharmaceutical & biotechnology companies’ sector is anticipated to hold the largest market share. Inspection machines are commonly used for quality management and quality assurance in the pharmaceutical & biotechnology industries, which is a key factor in fuelling market growth. In addition, due to reasons such as increasing compliance with GMP guidelines and the rising number of inspection control points in the manufacturing & packaging lines, strict regulatory legislation, the growing necessity to counteract spurious pharmaceutical items, product recalls, and the avoidance of firm earnings being lost as a result of the implementation of inspection equipment are all leading to rising number of pharmaceutical & biotechnology firms to use inspection machines.

North America is presumed to hold the largest share of the market for inspection machines, trailed by Europe. The supremacy is attributable to the presence of a large number of biotechnology and pharmaceutical firms & manufacturers of medical devices in the region, tight regulatory criteria for healthcare manufacturers, a growing number of manufacturing plant inspection checkpoints, and tightly regulated levels of inspection & mandatory enforcement in the region. In addition, many big global players are located in the US, which is why the US is a center of competition in the market for inspection machines.

The Asia Pacific region is also expected to register the highest CAGR. The region's growth is mainly attributed to the growing strictness in implementation of regulatory mandates of the Good Manufacturing Practices (GMP), and the increasing number of participants in the pharmaceutical and biotechnological sectors is also another factor affecting the development of the Asia Pacific regions in the market for inspection machines. Due to the advancement of emerging technology and innovation in the inspection and weighing industry, Japan will lead the region with the fastest growth rate.

Laetus GmbH, Jekson Vision Private Limited, OPTEL Group, Körber AG, METTLER-TOLEDO International Inc., Robert Bosch GmbH, WIPOTEC-OCS GmbH, ACG Group, Teledyne Technologies Incorporated, Brevetti CEA SpA, Mitsubishi Chemical Holdings Corporation, Cognex Corporation, VITRONIC, Antares Vision S.p.A., Shanghai Tofflon Science and Technology Co. Ltd., LOMA Systems, Thermo Fisher Scientific, Systech International, OMRON Corporation, and SEA Vision S.r.l. are the main players competing in the market for inspection machines.

Please note: This is not an exhaustive list of companies profiled in the report.

Antares collaborated with IMA in 2020, a corporation devoted to the design and manufacturing of process automation machines and the packaging of pharmaceutical and cosmetic goods.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Inspection Machines Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 End-User Type Overview

2.1.5 Type Overview

2.1.6 Regional Overview

Chapter 3 Global Inspection Machines Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Number of Regulatory Criteria to Maintain GMP Compliance in the Healthcare Sector

3.3.1.2 Increasing Investments in Research and Development Activities

3.3.2 Industry Challenges

3.3.2.1 Complex Nature of Integrating Inspection Machine

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 End-User Type Growth Scenario

3.4.4 Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Inspection Machines Market, By Product

4.1 Product Outlook

4.2 Vision Inspection Systems

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Leak Detection Systems

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

4.4 X-ray Inspection Systems

4.4.1 Market Size, By Region, 2016-2026 (USD Million)

4.5 Combination Systems

4.5.1 Market Size, By Region, 2016-2026 (USD Million)

4.6 Checkweighers

4.6.1 Market Size, By Region, 2016-2026 (USD Million)

4.7 Metal Detectors

4.7.1 Market Size, By Region, 2016-2026 (USD Million)

4.8 Software

4.8.1 Market Size, By Region, 2016-2026 (USD Million)

4.9 Others

4.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Inspection Machines Market, By Application

5.1 Application Outlook

5.2 Ampoules & Vials

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Syringes

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Blister Packaging

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Bottles

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Inspection Machines Market, By End-User Type

6.1 End-User Type Outlook

6.2 Pharmaceutical & Biotechnology Companies

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Food Processing & Packaging Companies

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

6.4 Others

6.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Inspection Machines Market, By Type

7.1 Type Outlook

7.2 Fully-automated Inspection Machines

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.4 Semi-automated Inspection Machines

7.4.1 Market Size, By Region, 2016-2026 (USD Million)

7.5 Manual Inspection Machines

7.5.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Global Inspection Machines Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2016-2026 (USD Million)

8.2.2 Market Size, By Product, 2016-2026 (USD Million)

8.2.3 Market Size, By Application, 2016-2026 (USD Million)

8.2.4 Market Size, By End-User Type, 2016-2026 (USD Million)

8.2.5 Market Size, By Type, 2016-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.6.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.2.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.2.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.2.7.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.2.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2016-2026 (USD Million)

8.3.2 Market Size, By Product, 2016-2026 (USD Million)

8.3.3 Market Size, By Application, 2016-2026 (USD Million)

8.3.4 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.5 Market Size, By Type, 2016-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.6.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.7.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.8.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.9.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.9.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.9.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.10.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.10.4 Market Size, By Type, 2016-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2016-2026 (USD Million)

8.3.11.2 Market Size, By Application, 2016-2026 (USD Million)

8.3.11.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.3.11.4 Market Size, By Type, 2016-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2016-2026 (USD Million)

8.4.2 Market Size, By Product, 2016-2026 (USD Million)

8.4.3 Market Size, By Application, 2016-2026 (USD Million)

8.4.4 Market Size, By End-User Type, 2016-2026 (USD Million)

8.4.5 Market Size, By Type, 2016-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.6.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.4.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.7.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.4.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.8.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.4.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.9.2 Market size, By Application, 2016-2026 (USD Million)

8.4.9.3 Market size, By End-User Type, 2016-2026 (USD Million)

8.4.9.4 Market size, By Type, 2016-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2016-2026 (USD Million)

8.4.10.2 Market Size, By Application, 2016-2026 (USD Million)

8.4.10.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.4.10.4 Market Size, By Type, 2016-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2016-2026 (USD Million)

8.5.2 Market Size, By Product, 2016-2026 (USD Million)

8.5.3 Market Size, By Application, 2016-2026 (USD Million)

8.5.4 Market Size, By End-User Type, 2016-2026 (USD Million)

8.5.5 Market Size, By Type, 2016-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.6.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.5.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.7.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.5.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.5.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.5.8.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.5.8.4 Market Size, By Type, 2016-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2016-2026 (USD Million)

8.6.2 Market Size, By Product, 2016-2026 (USD Million)

8.6.3 Market Size, By Application, 2016-2026 (USD Million)

8.6.4 Market Size, By End-User Type, 2016-2026 (USD Million)

8.6.5 Market Size, By Type, 2016-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.6.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.6.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.6.6.4 Market Size, By Type, 2016-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.7.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.7.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.6.7.4 Market Size, By Type, 2016-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2016-2026 (USD Million)

8.6.8.2 Market Size, By Application, 2016-2026 (USD Million)

8.6.8.3 Market Size, By End-User Type, 2016-2026 (USD Million)

8.6.8.4 Market Size, By Type, 2016-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Laetus GmbH

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Jekson Vision Private Limited

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 OPTEL Group

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Körber AG

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 METTLER-TOLEDO International Inc.

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Robert Bosch GmbH

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 WIPOTEC-OCS GmbH

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 ACG Group

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Teledyne Technologies Incorporated

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Brevetti CEA SpA

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Mitsubishi Chemical Holdings Corporation

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Cognex Corporation

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 VITRONIC

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Antares Vision S.p.A.

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Shanghai Tofflon Science and Technology Co. Ltd.

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

9.17 LOMA Systems

9.17.1 Company Overview

9.17.2 Financial Analysis

9.17.3 Strategic Positioning

9.17.4 Info Graphic Analysis

9.18 Thermo Fisher Scientific

9.18.1 Company Overview

9.18.2 Financial Analysis

9.18.3 Strategic Positioning

9.18.4 Info Graphic Analysis

9.19 Systech International

9.19.1 Company Overview

9.19.2 Financial Analysis

9.19.3 Strategic Positioning

9.19.4 Info Graphic Analysis

9.20 OMRON Corporation

9.20.1 Company Overview

9.20.2 Financial Analysis

9.20.3 Strategic Positioning

9.20.4 Info Graphic Analysis

9.21 SEA Vision S.r.l.

9.21.1 Company Overview

9.21.2 Financial Analysis

9.21.3 Strategic Positioning

9.21.4 Info Graphic Analysis

9.22 Other Companies

9.22.1 Company Overview

9.22.2 Financial Analysis

9.22.3 Strategic Positioning

9.22.4 Info Graphic Analysis

The Global Inspection Machines Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Inspection Machines Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS