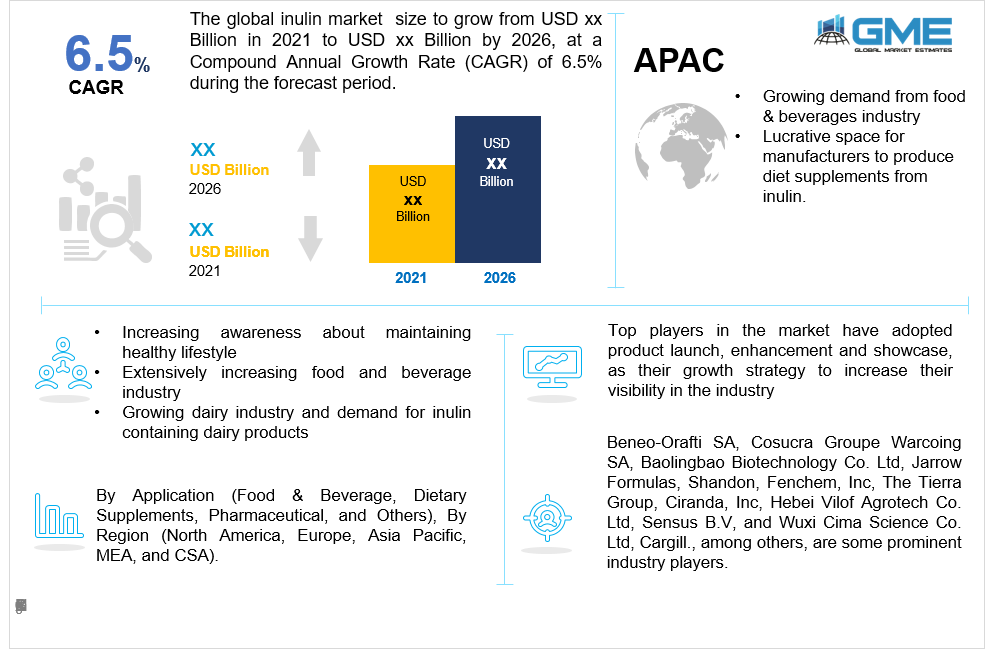

Global Inulin Market Size, Trends, and Analysis - Forecasts to 2026 By Application (Food & Beverage, Dietary Supplements, Pharmaceutical, and Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

The fact that inulin has a plethora of health advantages and serves as a multifunctional food is one of the primary underlying drivers that is raising consumer awareness about its intake. Today, in a fast-growing world, individuals are gradually gaining awareness about the importance of maintaining good physic and a healthy gut. This awareness regarding improving and managing health is accelerating the demand for various sources and supplement forms through which an individual can consume inulin. Besides boosting and maintaining one’s immune system, inulin also acts as one of the most preferred measures to improve digestive health, assists in relieving constipation, helps in weight loss, and controls diabetes. This leads to the surge in demand for inulin in global markets.

According to studies conducted in the United States, surveys have shown that annually approximately 60 million to 70 million people get affected due to various kinds of digestive diseases. Medical research proves that having the right balance of good and bad bacteria in the human digestive system is essential to keep the gut healthy and ensure the prevention of diseases. Thus research and developments (R&Ds) like these promote and encourage people to incorporate the consumption of insulin into their dietary plans.

Also, as of 2016, the survey results of a country like the United States show that approximately 54 percent of the women population and approximately 41.7 percent male population tried losing weight. Many developed and developing countries have witnessed a surge in the fitness industry within the last few years. Inulin fiber facilitates excellent assistance in losing weight. The prebiotics and compounds present in inulin regulate the bowel moments and increases metabolism. These properties assist individuals trying to lose weight to burn the fats quickly without gaining any excess fats. Thus, dietary experts or fitness trainers recommend individuals to consume inulin through various supplement forms like inulin powder, protein bars, or dairy products, thus boosting growth in the inulin market.

Also, inulin consumption is proved to be one of the best measures to control diabetes in individuals. Professionals and doctors globally suggest the consumption of high-performance inulin to control the blood sugar level in individuals with diabetes. The global data shows that, as of 2019, 9.3% of the population has reported having diabetes. This percentage is expected to grow up to 10.2% by 2030, which constitutes approximately 578 million people across the globe. These surging numbers of individuals with diabetes are increasing the growth rate of the inulin market. Though several variables contribute to the increased use of inulin, it has been shown that it can also have a detrimental influence in some circumstances. Prolonged intake of inulin is allergic and causes digestive pain, and this unfavorable characteristic may limit its future growth.

The human studies and animal studies conducted by organizations like Food and Drug Administration (FDA) have evidently and scientifically proved that inulin intake enhances the magnesium and calcium absorption process in the body, which improves bone density, thus, maintaining bone health. Besides these, prebiotic ingredients are gaining tremendous popularity, and people are becoming extremely conscious about their calorie intake and fats consumed. Also, the American Food and Drug Administration (FDA), along with Federal Food, Drug, and Cosmetic Act (FFDCA), has designated inulin as a GRAS product (A substance recognized as safe), with very low phytotoxic effect on the consumers. Thus, leading to skyrocketing demand for inulin in global markets.

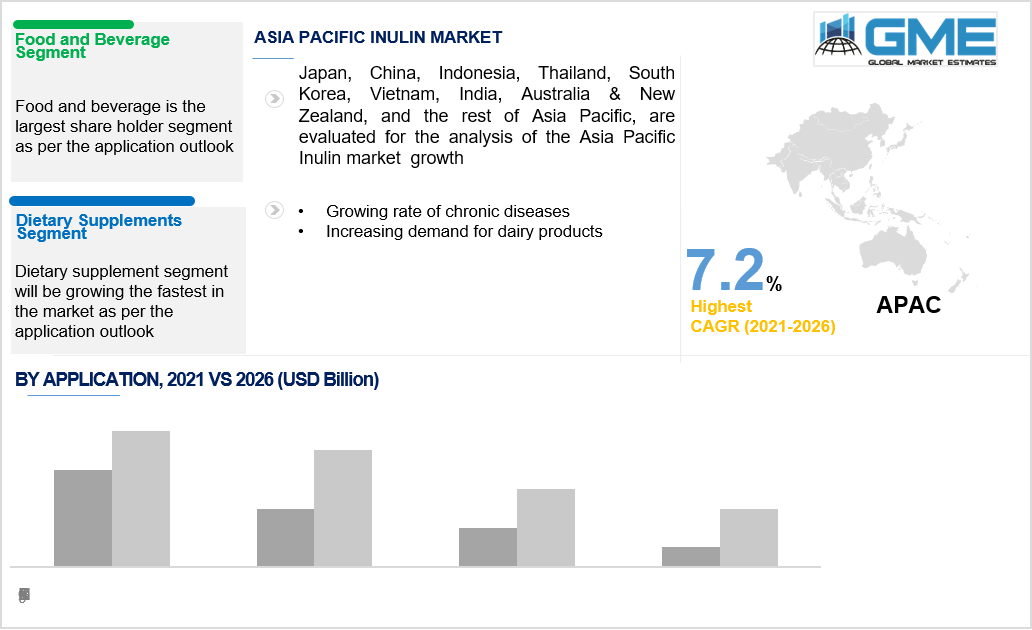

Based on application, the inulin market is segmented into food & beverage, dietary supplements, pharmaceutical, and others. Among these, the food & beverage industry has the largest share in the inulin market compared to the rest of the segment. The food & beverage industry has been the most prominent source for consumers to have inulin intakes. Inulin fiber being found majorly in plants; it is significantly found in vegetables and fruits like banana, wheat, asparagus, onion, and various other herbs. Amidst the food and beverage industry, a whole dairy sector/ industry has been gaining a lot of demand. Dairy products like cheese, milk, yogurt, ice cream, and many others are the most preferred and demanded products for inulin intake.

Besides dairy products, the demand for cereal bars and protein bars has also increased tremendously over the last few decades. These protein bars being another source for inulin intake, are enabling the manufacturers in the food and beverage industry to gain profits and showcase a variety of options and flavors in these protein bars for the consumers. Also, the food and beverage industry in many regions is an excellent source of chicory root, and the extracts from these chicory roots are then used to manufacture chicory inulin. This product is significantly consumed with water and caffeine in the form of beverages.

Followed by the food and beverage industry, the dietary supplement industry is also expected to grow at the fastest rate. With increasing awareness about fitness and weight loss, many experts and professionals recommend having dietary supplements in the form of inulin powder or pills.

Based on geographical division, European Region holds the most prominent position and the largest share in the inulin market. European countries hold approximately 40% share in the inulin market. The food and beverage industry in the European industry has been witnessing tremendous growth in the last few decades. Also, European countries being a massive hub for cheese production, contribute enormously to the growth of the inulin market in the European region. Countries like Germany, France, Italy, United Kingdom are some of the most significant contributors to the inulin market. This region has also witnessed an increase in inulin intake through various dietary supplements. Also, Europe is the world's largest cultivator of chicory roots and producer of chicory inulin.

On the other hand, the Asia Pacific region is expected to witness fast growth within the inulin market during the forecasted period. Having countries with some of the largest populations subsequently makes this region one of the most significant consumers of inulin. Followed by the European region, the Asia Pacific region is the second-largest cultivator of chicory roots and producer of chicory inulin. Countries like Japan, China, and India are few prominent producers of chicory inulin. Being a newly emerging and lucrative space, this region has witnessed tremendous investments from foreign companies that aids in reaching out to greater consumer masses and achieving profitability. Countries in the APAC region and their respective populations are becoming health and fitness conscious, thus contributing effectively to the inulin market. Besides these factors, the APAC region has also reported an increased rate of patients with various chronic diseases like diabetes or digestive issues, thus accelerating growth in the inulin market.

Beneo-Orafti SA, Cosucra Groupe Warcoing SA, Baolingbao Biotechnology Co. Ltd, Jarrow Formulas, Shandon, Fenchem, Inc, The Tierra Group, Ciranda, Inc, Hebei Vilof Agrotech Co. Ltd, Sensus B.V, and Wuxi Cima Science Co. Ltd, Cargill., among others, are some prominent industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Inulin Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Application Overview

2.1.3 Regional Overview

Chapter 3 Global Inulin Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Awareness Among Consumers for Low-Calorie Diet and Fat Reduction

3.3.1.2 Increasing Adoption of Inulin as Dietary Supplements and Nutraceuticals

3.3.2 Industry Challenges

3.3.2.1 Side Effects of Excessive Consumption of Inulin

3.4 Prospective Growth Scenario

3.4.1 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Inulin Market, By Application

4.1 Application Outlook

4.2 Food & Beverage

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Dietary Supplements

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Pharmaceutical

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Others

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Inulin Market, By Region

5.1 Regional outlook

5.2 North America

5.2.1 Market Size, By Country 2019-2026 (USD Million)

5.2.2 Market Size, By Application, 2019-2026 (USD Million)

5.2.4 U.S.

5.2.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.2.5 Canada

5.2.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.3 Europe

5.3.1 Market Size, By Country 2019-2026 (USD Million)

5.3.2 Market Size, By Application, 2019-2026 (USD Million)

5.3.4 Germany

5.2.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.5 UK

5.3.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.6 France

5.3.6.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.7 Italy

5.3.7.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.8 Spain

5.3.8.1 Market Size, By Application, 2019-2026 (USD Million)

5.3.9 Russia

5.3.9.1 Market Size, By Application, 2019-2026 (USD Million)

5.4 Asia Pacific

5.4.1 Market Size, By Country 2019-2026 (USD Million)

5.4.2 Market Size, By Application, 2019-2026 (USD Million)

5.4.4 China

5.4.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.5 India

5.4.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.6 Japan

5.4.6.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.7 Australia

5.4.7.1 Market Size, By Application, 2019-2026 (USD Million)

5.4.8 South Korea

5.4.8.1 Market Size, By Application, 2019-2026 (USD Million)

5.5 Latin America

5.5.1 Market Size, By Country 2019-2026 (USD Million)

5.5.2 Market Size, By Application, 2019-2026 (USD Million)

5.5.4 Brazil

5.5.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.5 Mexico

5.5.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.5.6 Argentina

5.5.6.1 Market Size, By Application, 2019-2026 (USD Million)

5.6 MEA

5.6.1 Market Size, By Country 2019-2026 (USD Million)

5.6.2 Market Size, By Application, 2019-2026 (USD Million)

5.6.4 Saudi Arabia

5.6.4.1 Market Size, By Application, 2019-2026 (USD Million)

5.6.5 UAE

5.6.5.1 Market Size, By Application, 2019-2026 (USD Million)

5.6.6 South Africa

5.6.6.1 Market Size, By Application, 2019-2026 (USD Million)

Chapter 6 Company Landscape

6.1 Competitive Analysis, 2020

6.2 Beneo-Orafti SA

6.2.1 Company Overview

6.2.2 Financial Analysis

6.2.3 Strategic Positioning

6.2.4 Info Graphic Analysis

6.3 Cosucra Groupe Warcoing SA

6.3.1 Company Overview

6.3.2 Financial Analysis

6.3.3 Strategic Positioning

6.3.4 Info Graphic Analysis

6.4 Baolingbao Biotechnology Co. Ltd.

6.4.1 Company Overview

6.4.2 Financial Analysis

6.4.3 Strategic Positioning

6.4.4 Info Graphic Analysis

6.5 Jarrow Formulas

6.5.1 Company Overview

6.5.2 Financial Analysis

6.5.3 Strategic Positioning

6.5.4 Info Graphic Analysis

6.6 Shandon, Fenchem, Inc.

6.6.1 Company Overview

6.6.2 Financial Analysis

6.6.3 Strategic Positioning

6.6.4 Info Graphic Analysis

6.7 The Tierra Grouap, Ciranda Inc.

6.7.1 Company Overview

6.7.2 Financial Analysis

6.7.3 Strategic Positioning

6.7.4 Info Graphic Analysis

6.8 Hebei Vilof Agrotech Co. Ltd.

6.8.1 Company Overview

6.8.2 Financial Analysis

6.8.3 Strategic Positioning

6.8.4 Info Graphic Analysis

6.9 Sensus B.V

6.9.1 Company Overview

6.9.2 Financial Analysis

6.9.3 Strategic Positioning

6.9.4 Info Graphic Analysis

6.10 Wuxi Cima Science Co. Ltd

6.10.1 Company Overview

6.10.2 Financial Analysis

6.10.3 Strategic Positioning

6.10.4 Info Graphic Analysis

6.11 Cargill

6.11.1 Company Overview

6.11.2 Financial Analysis

6.11.3 Strategic Positioning

6.11.4 Info Graphic Analysis

6.12 Other Companies

6.12.1 Company Overview

6.12.2 Financial Analysis

6.12.3 Strategic Positioning

6.12.4 Info Graphic Analysis

The Global Inulin Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Inulin Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS