Iron Ore Pellets Market: Insights

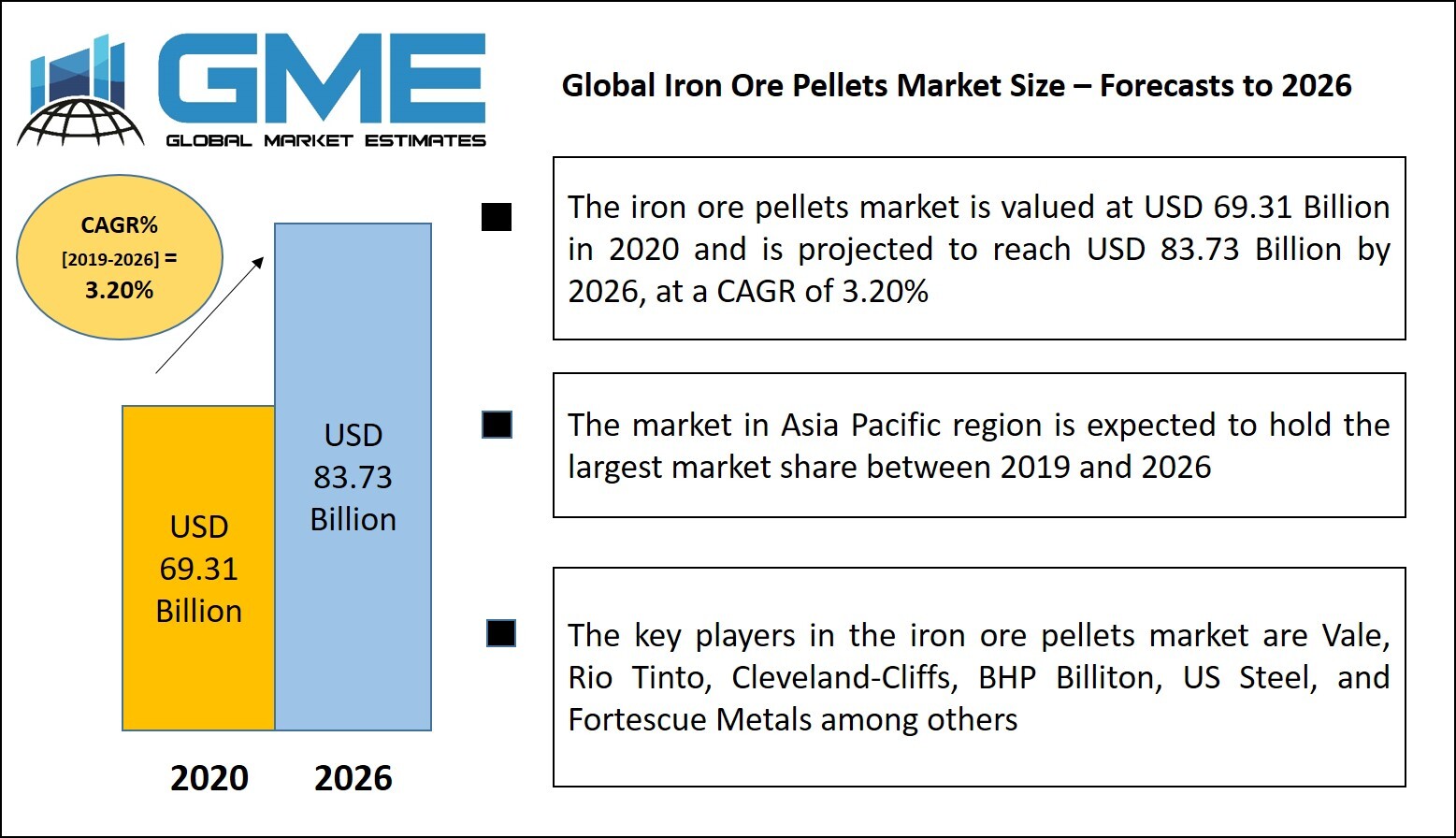

The global iron ore pellets market is expected to generate revenue amounting to USD 69.31 billion in 2020, and is projected to reach to USD 83.73 billion by 2026, growing at a CAGR of 3.20% over the forecast period. Expanding steel production in developing economies of Asia Pacific, such as India, China, and Vietnam, is one of the major factor expected to fuel the market growth during the forecast period. Rising adoption of carbon free steel making technologies are driving the iron ore pellets demand.

Iron ore pellets are spherical balls of iron ore that are used in steel manufacturing. Rise in building and construction industry and rapid industrialization is expected to propel the market growth for steel during the forecast period. The growing automotive industry and manufacturing sector across various regions including North America, Europe, Asia Pacific, and Central & South America is further projected to propel the market growth. However, volatile iron ore prices, and availability of substitutes are likely to hamper the market growth over the coming years.

Iron ore pellets are small and hardened iron balls with a diameter of 10-20 mm and are used as raw material for iron/steel manufacturing. The pelletizing process was commercially introduced in the world market in 1955. Palletization is a process designed to transform iron ore fines into agglomerates to feed Blast Furnace (BF) and Direct Reduced Iron (DRI) producing units.

Iron Ore Pellets Market Size: By Segmentation

The global Iron Ore Pellets market is segmented on the basis of grade into BF grade and DRI grade. The BF grade segment is expected to hold the largest market share in the global iron ore pellets market during the forecast period. Primary Iron Ore Pellets is a pre-formed, tear-resistant woven or non-woven polypropylene fabric into which yarn is tufted or stitched in order to make carpets. BF grade is a lower grade product when compared to iron pellets used in Direct Reduced (DR) method, and therefore has a lower cost compared to its counterpart. Blast furnace grade is usually found in integrated steel plants. The Lower cost of BF iron ore pellets, and abundance of integrated steel plants found in developed economies are some of the major factors expected to propel the market growth during the forecast period. The DRI grade segment is expected to grow at a high CAGR during the forecast period. The rising demand in emerging economies of Asia Pacific is driving the market growth. The operating costs and initial capital investments for direct reduction plants are lower than integrated steel plants, and therefore these plants are becoming more popular in developing economies. These are some of the major factors expected to grow during the forecast period.

On the basis of balling technology, the market is segmented into balling disc and balling drum. The balling disc segment is expected to hold the largest share in the global iron ore pellets market during the forecast period. The growing demand for producing high-quality iron ore pellets is driving the market growth for balling discs. The discs can be inclined at multiple angles based on requirements for producing desired shape, size & quality of iron ore pellets.

On the basis of product source, the global iron ore pellets market is segmented into hematite and magnetite among others. The magnetite segment is expected to hold the largest market share during the forecast period. The higher iron content in magnetite is driving the market growth. The increasing adoption of magnetite in steel conversion and blast furnace is also driving the market growth for the segment. The products produced from magnetite ores exhibit superior quality as compared to hematite ores.

Iron Ore Pellets Market Size: By Region

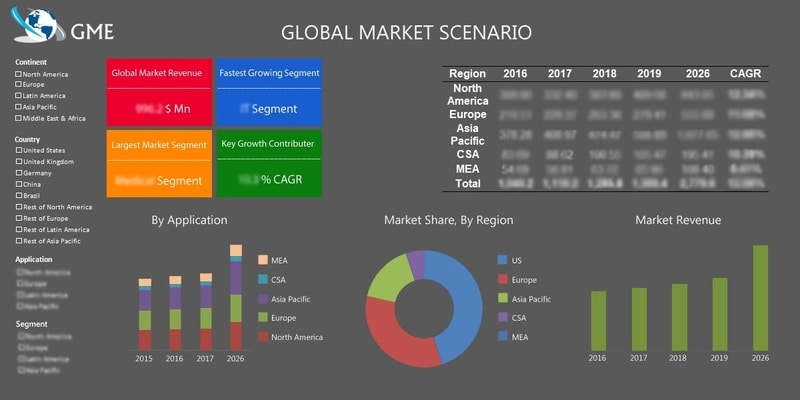

On the basis of region, the market of iron ore pellets is segmented into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. The Asia Pacific region is expected to dominate the market and is also estimated to expand at a rapid pace during the forecast period. The presence of large steel manufacturing base in the region is driving the market growth for iron ore pellets. According to the data published by World Steel Association, China alone produced approximately 53.3% of the global crude steel in 2019. The expanding manufacturing, automotive and construction sectors in the region are driving the market growth.

Iron Ore Pellets Market Share & Competitor Analysis

Some of the key players operating in the iron ore pellets market include: Bahrain Steel, BHP Billiton, Cleveland-Cliffs Inc., Samarco, Ternium, US Steel, LKAB, Metinvest, Jindal SAW Ltd, Anglo American, Arya Group, Rexon Strips Ltd, Metalloinvest, Rio Tinto, Evraz, FERREXPO, Vale, SIMEC Group, and Xindia Steels Ltd., among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2020, United States Steel Corporation announced a four-year agreement to sell substantial volumes of quality iron ore pellets to Ontario in Canada based Algoma Steel Inc.

Check the Press Release on Global Iron Ore Pellets Market Report

Iron Ore Pellets Market: By Grade

- Introduction

- Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- Blast furnace (BF) Grade

- Blast furnace (BF) Grade: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Direct reduction (DR) Grade

- Direct reduction (DR) Grade: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Balling Technology

- Introduction

- Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- Balling disc

- Balling disc: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Balling drum

- Balling drum: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Application

- Introduction

- Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- Steel production

- Steel production: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Iron-based chemicals

- Iron-based chemicals: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Product Source

- Introduction

- Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- Hematite

- Hematite: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Magnetite

- Magnetite: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Others

- Others: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Steelmaking Technology

- Introduction

- Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- Electric arc furnace

- Electric arc furnace: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Oxygen based/blast furnace

- Oxygen based/blast furnace: Iron Ore Pellets Market, 2018-2026 (USD Million)

- Electric induction furnace

- Electric induction furnace: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Pelletizing Process

- Introduction

- Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Travelling grate (TG)

- Travelling grate (TG): Iron Ore Pellets Market, 2018-2026 (USD Million)

- Grate kiln (GK)

- Grate kiln (GK): Iron Ore Pellets Market, 2018-2026 (USD Million)

- Others

- Others: Iron Ore Pellets Market, 2018-2026 (USD Million)

Iron Ore Pellets Market: By Region

- Introduction

- Global Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- North America

- North America Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- By Grade

- North America Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- North America Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- North America Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- North America Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- North America Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- North America Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- By Country

- U.S

- By Grade

- U.S Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- U.S Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- U.S Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- U.S Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- U.S Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- U.S Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Canada.

- By Grade

- Canada Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Canada Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Canada Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Canada Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Canada Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Canada Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Mexico

- By Grade

- Mexico Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Mexico Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Mexico Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Mexico Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Mexico Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Mexico Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Europe

- Europe Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- By Grade

- Europe Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Europe Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Europe Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Europe Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Europe Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Europe Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- By Country

- Germany

- By Grade

- Germany Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Germany Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Germany Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Germany Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Germany Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Germany Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- UK

- By Grade

- UK Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- UK Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- UK Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- UK Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- UK Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- UK Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- France

- By Grade

- France Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- France Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- France Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- France Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- France Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- France Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Italy

- By Grade

- Italy Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Italy Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Italy Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Italy Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Italy Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Italy Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Rest Of Europe

- By Grade

- Rest Of Europe Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Rest Of Europe Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Rest Of Europe Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Rest Of Europe Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Rest Of Europe Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Rest Of Europe Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Asia Pacific

- Asia Pacific Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- By Grade

- Asia Pacific Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Asia Pacific Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Asia Pacific Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Europe Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Asia Pacific Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Asia Pacific Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- By Country

- China

- By Grade

- China Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- China Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- China Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- China Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- China Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- China Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Japan

- By Grade

- Japan Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Japan Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Japan Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Japan Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Japan Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Japan Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- India

- By Grade

- India Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- India Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- India Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- India Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- India Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- India Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Central & South America

- Central & South America Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- By Grade

- Central & South America Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Central & South America Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Central & South America Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Central & South America Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Central & South America Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Central & South America Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- By Country

- Brazil

- By Grade

- Brazil Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Brazil Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Brazil Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Brazil Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Brazil Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Brazil Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- Middle East & Africa

- Middle East & Africa Iron Ore Pellets Market, Regional Analysis, 2018-2026 (USD Million)

- By Grade

- Middle East & Africa Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Middle East & Africa Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Middle East & Africa Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Middle East & Africa Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Middle East & Africa Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Middle East & Africa Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- By Country

- Saudi Arabia

- By Grade

- Saudi Arabia Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- Saudi Arabia Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- Saudi Arabia Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- Saudi Arabia Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- Saudi Arabia Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- Saudi Arabia Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

- UAE

- By Grade

- UAE Iron Ore Pellets Market, By Grade, 2018-2026 (USD Million)

- By Balling Technology

- UAE Iron Ore Pellets Market, By Balling Technology, 2018-2026 (USD Million)

- By Application

- UAE Iron Ore Pellets Market, By Application, 2018-2026 (USD Million)

- By Product Source

- UAE Iron Ore Pellets Market, By Product Source, 2018-2026 (USD Million)

- By Steelmaking Technology

- UAE Iron Ore Pellets Market, By Steelmaking Technology, 2018-2026 (USD Million)

- By Pelletizing Process

- UAE Iron Ore Pellets Market, By Pelletizing Process, 2018-2026 (USD Million)

The global Iron Ore Pellets Market has been studied from the year 2017 till 2026. However, the CAGR provided in the report is from the year 2018 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Iron Ore Pellets Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.