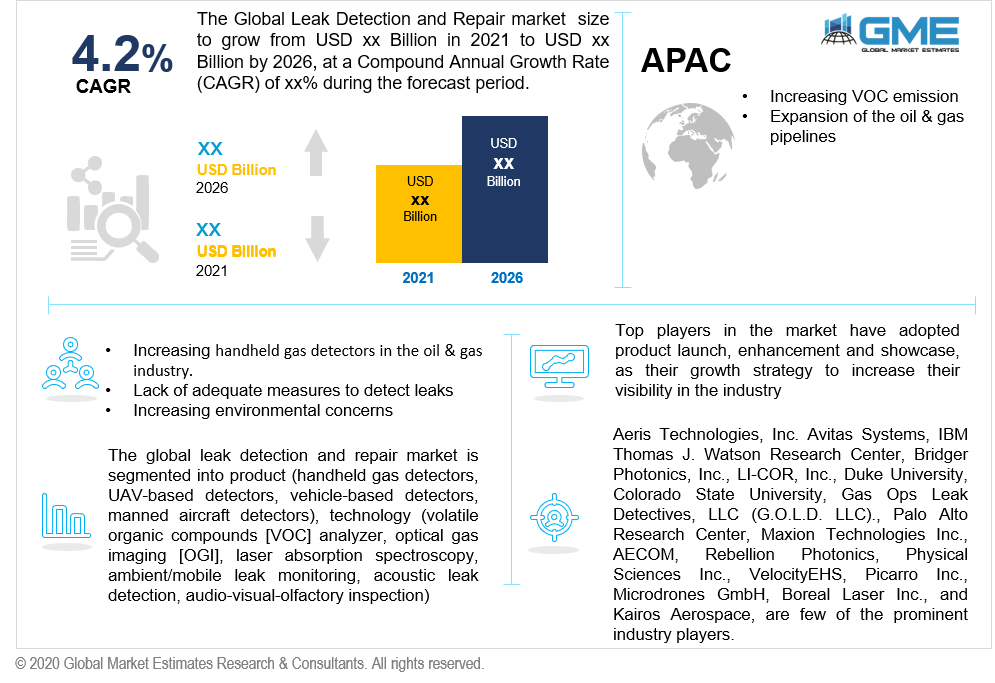

Global Leak Detection and Repair Market Size, Trends, and Analysis- Forecasts to 2026 By Product (Handheld Gas Detectors, UAV-Based Detectors, Vehicle-based Detectors, Manned Aircraft Detectors), By Technology (Volatile Organic Compounds [VOC] Analyzer, Optical Gas Imaging [OGI], Laser Absorption Spectroscopy, Ambient/Mobile Leak Monitoring, Acoustic Leak Detection, Audio-Visual-Olfactory Inspection), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

With the tremendously increasing industrial sectors, many countries have experienced severe accidents and mishaps in regards to hazardous air leaks. The lack of inspection or detection of these leaks has not only affected the industries but has also affected the environment on a larger scale. To bring control over such leaks and prevent any negative impacts, leak detection and repair programs and systems are adopted. In the industrial food processing and HVAC industries, gas leak detection systems are in high demand. People in the vicinity suffer health problems as a result of extended exposure to ammonia, which is used as a refrigerant in food packaging.

The leak detection and repair programs are used to locate, repair, and control the leaks in various sources like pumps, valves, connectors, pipes, and others. According to the Environmental Protection Agency (EPA), the rate of Volatile Organic Compounds emission has been increasing through these unregulated and detected leakages. Moreover, to curb these surging volatile organic compounds (VOC) emission rates, the EPA brought regulations and programs like the Leak Detection and Repair for the industries. Along with these VOC emissions, the rate of hazardous air pollutants (HRP) is also drastically increasing due to increasing leaks through chemical industries.

The Environmental Protection Agency reports showcase that approximately 70367 tons of VOCs and 9357 tons of HRPs are emitted yearly due to equipment leaks and failures. A greater level of VOC is forming ground-level ozone layers scientifically called smog, which create high risk and tremendously adverse effects on the environment. These emissions also have an extreme impact on the health of humans and wildlife. The leak detection and risk programs modify and replace the malfunctioning and leaking components in the industries with leak less components.

Surveys and studies have proven that leak detection and repairs have brought down the VOC levels by 56% and the rest of the air pollutant emissions by 63% across the world. These measures have also shown a tremendous positive impact on the productivity of industries as well as the sale revenues. The citizens of the particular country and especially the workers of industries have experienced betterment in health and lifestyle with these leak detection and repair mechanisms. In the initial phase where countries were facing a drastic increase in emissions, many governments in those nations had come up with temporary measures like charging fees to the industries causing leaks and emitting hazardous pollutants.

However, with adapting leak detecting systems, the industries have witnessed a significant drop in charge of emission fees. Many industries have also faced an extensive number of losses in the past due to leaks and emissions, which have certainly improved by installing leak detection and repair systems.

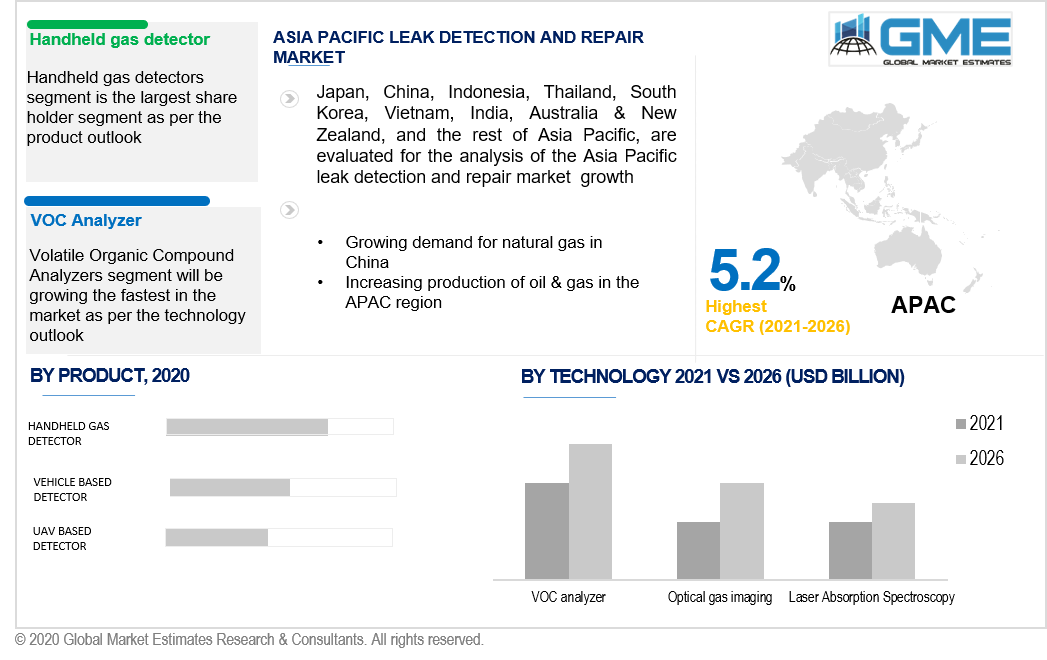

Handheld gas detectors are most prominently used in the leak detection and repair market. These detectors attribute features that are favourable for the end-users. These being handheld certainly increasing the product portability and adaptability. These give highly reliable results and are easy to utilize at any location without requiring any complex measures. They give ease in using as they can even be operated with one hand and are very light in weight, which becomes beneficial for the industries to detect leaks even in urgencies.

In some cases, industrial leaks can be a high risk for the workers’ health and can have adverse effects. However, these handheld gas detectors provide industry operators to quickly and safely detect leaks before even any emission occurs and affects the workers. Besides these factors, these products not only facilitate ample convenience to the staff and the operators but are also very cost-effective and enable industries to save money instead of budgeting as per heavy-duty detectors, eventually giving the same results as the handheld detectors.

Followed by the handheld gas detectors, the vehicle-based gas detectors are gradually expected to gain demand from the end-users due to their increasing beneficial features. With increasing industrial and plant sizes, these detectors enable mobility and flexibility to detect considerably huge areas in a lesser period and provide efficient results.

Volatile Organic Compound Analyzers are the most commonly used technologies in the leak detection and repair market. These analyzers are developed by various industry players certainly to detect the VOC emission that causes adverse effects on the environment and other applications. These technologies are incredibly robust and provide easy portability in deployment methods in any kind of environmental situation. This technology also has excellent efficiency in detecting various levels and types of VOC emissions from the surroundings, and the detection limits of this analyzer can also be extended beyond limits as per operators’ requirements, which give it an upper preference over the rest of the technologies employed under the leak detection systems. This analyzer also has one more efficient feature, which makes it the most chosen because of its fast and continuous ability to detect VOC emissions. It facilitates leak checks every 5 minutes to 15 minutes, thus providing consistency and security to the industries.

The North American region has its dominance over the Leak Detection and Repair market. With North America being heavily industrialized and mass chemical processing and other oil and gas industries, it has had frequent gas leaks and increased VOC emissions. Surveys and reports of 1970 showed that a country like the USA experienced 33742 tonnes of VOC emission. This tremendous emission rate indeed had very extreme adverse effects, which brought out various measures to bring control over the emission rate. The North American region has been the most prominent user and adopter of leak detection and repair systems, which is proved by the figure of countries like the USA, which showed a significant fall to 12035 tonnes of VOC emission in 2020, as compared to the 1970 databases.

Asia Pacific region currently is experiencing a massive amount of leaks and consequent VOC emissions. Countries like India are on the radar list for an extreme VOC emission surge in the last few years. However, the Asia Pacific region is estimated to witness a fast growth rate in the adaptation of leak detection and repair systems. The increasing awareness about environmental conservation and the adverse effect of gas leaks and VOC emissions make industries adapt to these leak detection mechanisms. Also, countries in the APAC region are experiencing growth in industrial setups and new emerging gas, oil, and chemical industries, which is increasing the demand for leak detectors. Also, the increasing emission rates are compelling the governments in APAC countries to mandate adaptation to leak detection and repair programs.

Aeris Technologies, Inc. Avitas Systems, IBM Thomas J. Watson Research Center, Bridger Photonics, Inc., LI-COR, Inc., Duke University, Colorado State University, Gas Ops Leak Detectives, LLC (G.O.L.D. LLC)., Palo Alto Research Center, Maxion Technologies Inc., AECOM, Rebellion Photonics, Physical Sciences Inc., PrecisionHawk, SeekOps, Inc., Advisian, Ball Aerospace & Technologies Corp., Guideware Systems, LLC., Summit Inspections Services, Inc., GHD, Inc., ERM Group, Inc., Guardian Compliance, ABB Ltd., Chicago Bridge & Iron Company N.V., Heath Consultants, ENCOS, Inc., Team Inc., VelocityEHS, Picarro Inc., Microdrones GmbH, Boreal Laser Inc., and Kairos Aerospace, among others, are few of the prominent industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Leak Detection and Repair Market Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Technology Overview

2.1.4 Regional Overview

Chapter 3 Global Leak Detection and Repair Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing production of oil & gas pipelines

3.3.1.2 Increasing demand for leak detection and repair systems

3.3.2 Industry challenges

3.3.2.1 Stringent rules and regulations

3.4 Prospective Growth Scenario

3.4.1 Product Overview

3.4.2 Technology Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Leak Detection and Repair Market, By Technology

4.1 Technology Outlook

4.2 Volatile Organic Compounds (VOC) Analyzer

4.2.1 Market Size, By Region, 2016-2026 (USD Billion)

4.3 Optical Gas Imaging (OGI)

4.3.1 Market Size, By Region, 2016-2026 (USD Billion)

4.4 Laser Absorption Spectroscopy

4.4.1 Market Size, By Region, 2016-2026 (USD Billion)

4.5 Acoustic Leak Detection

4.5.1 Market Size, By Region, 2016-2026 (USD Billion)

4.6 Audio-Visual-Olfactory Inspection

4.6.1 Market Size, By Region, 2016-2026 (USD Billion)

4.7 Ambient/Mobile Leak Monitoring

4.7.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 5 Global Leak Detection and Repair Market, By Product

5.1 Product Outlook

5.2 Handheld Gas Detectors

5.2.1 Market Size, By Region, 2016-2026 (USD Billion)

5.3 UAV-Based Detectors

5.3.1 Market Size, By Region, 2016-2026 (USD Billion)

5.4 Vehicle-based Detectors

5.4.1 Market Size, By Region, 2016-2026 (USD Billion)

5.5 Manned Aircraft Detectors

5.5.1 Market Size, By Region, 2016-2026 (USD Billion)

Chapter 6 Global Leak Detection and Repair Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2016-2026 (USD Billion)

6.2.2 Market Size, By Technology, 2016-2026 (USD Billion)

6.2.3 Market Size, By Product, 2016-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.2.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.2.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2016-2026 (USD Billion)

6.3.2 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.3 Market Size, By Product, 2016-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.7.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.8.2 Market Size, By Product, 2016-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.3.9.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2016-2026 (USD Billion)

6.4.2 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.3 Market Size, By Product, 2016-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.7.2 Market size, By Product, 2016-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.4.8.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2016-2026 (USD Billion)

6.5.2 Market Size, By Technology, 2016-2026 (USD Billion)

6.5.3 Market Size, By Product, 2016-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.5.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.5.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.5.6.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2016-2026 (USD Billion)

6.6.2 Market Size, By Technology, 2016-2026 (USD Billion)

6.6.3 Market Size, By Product, 2016-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.6.4.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.6.5.2 Market Size, By Product, 2016-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Technology, 2016-2026 (USD Billion)

6.6.6.2 Market Size, By Product, 2016-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Aeris Technologies, Inc.

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 IBM Thomas J. Watson Research Center

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Bridger Photonics, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 LI-COR, Inc.

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Duke University

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Colorado State University

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Palo Alto Research Center

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 Maxion Technologies Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Rebellion Photonics

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Avitas Systems

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Leak Detection and Repair Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Leak Detection and Repair Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS