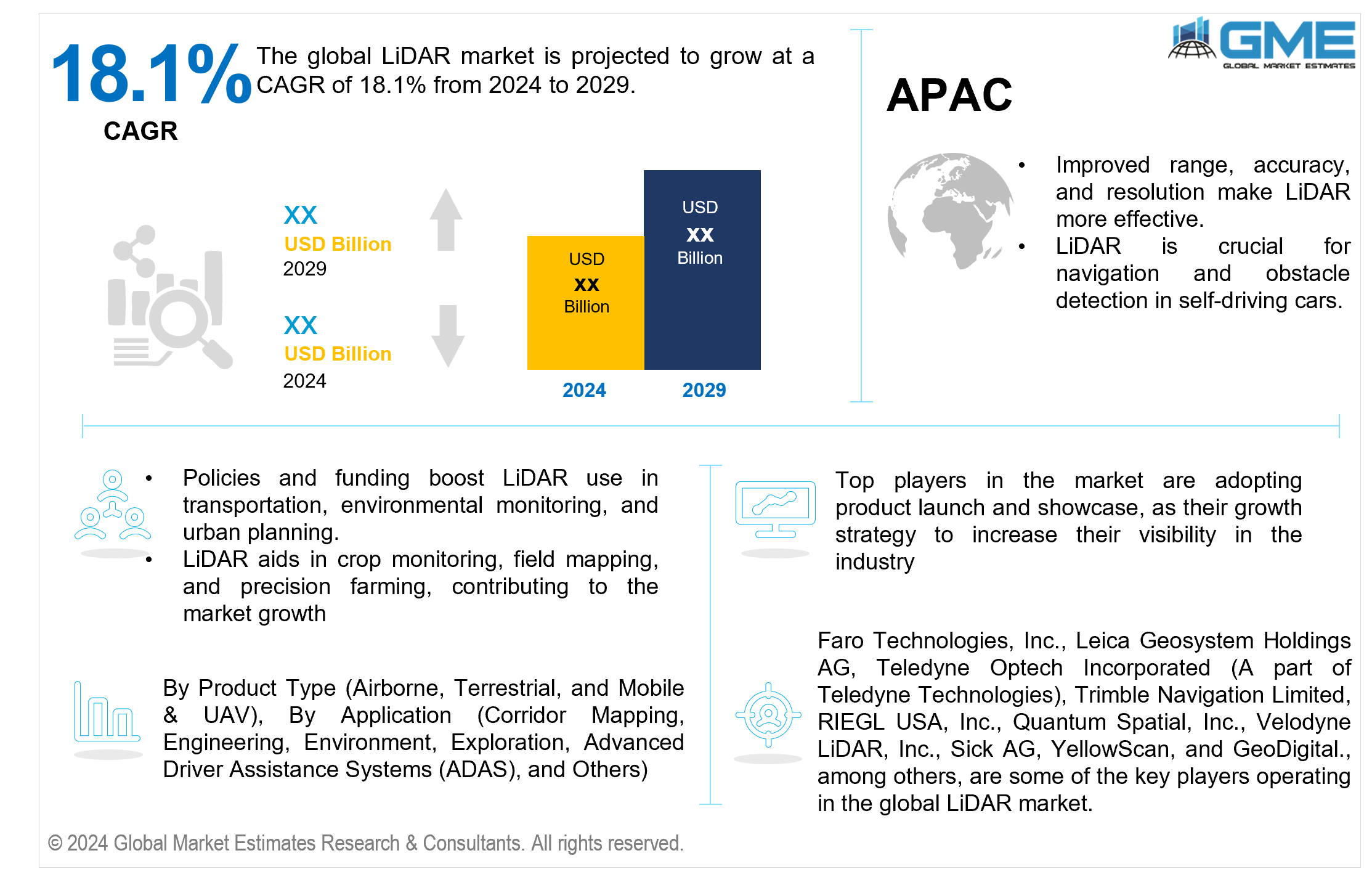

Global LiDAR Market Size, Trends & Analysis - Forecasts to 2029 By Product Type (Airborne, Terrestrial, and Mobile & UAV), By Application (Corridor Mapping, Engineering, Environment, Exploration, Advanced Driver Assistance Systems (ADAS), and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global LiDAR market is projected to grow at a CAGR of 18.1% from 2024 to 2029.

The global LiDAR market has grown significantly due to several major factors, including technological breakthroughs and growing LiDAR applications across various sectors. One key factor is the rapid development and integration of LiDAR technology in self-driving vehicles. Autonomous vehicles LiDAR rely largely on LiDAR sensors for accurate 3D mapping and real-time navigation, which improves self-driving car safety and efficiency. The increasing demand for self-driving vehicles has prompted investments and advancements in high-resolution LiDAR, propelling the industry ahead.

Another contributing reason is the extensive use of LiDAR in surveying and building industries. LiDAR systems offer precise measurements and detailed 3D models, which are essential for planning and monitoring large-scale building projects. The technology's capacity to generate accurate 3D mapping with LiDAR helps with project management and lowers the hazards associated with human surveying methods. Additionally, LiDAR in construction is increasingly being used for smart city programs that require sophisticated urban planning and infrastructure management.

Drones carrying sensors have transformed LiDAR in forestry, such as in environmental monitoring, and surveying. These LiDAR for drone applications enable broad data gathering over large and difficult-to-access areas, resulting in high-resolution topographical data that is invaluable for LiDAR in environmental monitoring. The ability to conduct speedy and detailed assessments, as mentioned above, makes LiDAR a popular technology in various domains, propelling the market growth.

Furthermore, the LiDAR market benefits from ongoing LiDAR innovation and advances in LiDAR performance and LiDAR accuracy. Advances in LiDAR data processing have increased the speed and quality of data interpretation, making LiDAR more accessible and useful for numerous applications. As more sectors discover LiDAR's benefits and potential for LiDAR integration into current systems, the need for diverse and creative LiDAR systems from LiDAR manufacturers grows. These trends point to a strong growth trajectory for the worldwide LiDAR market, fueled by a broader range of applications and technological breakthroughs.

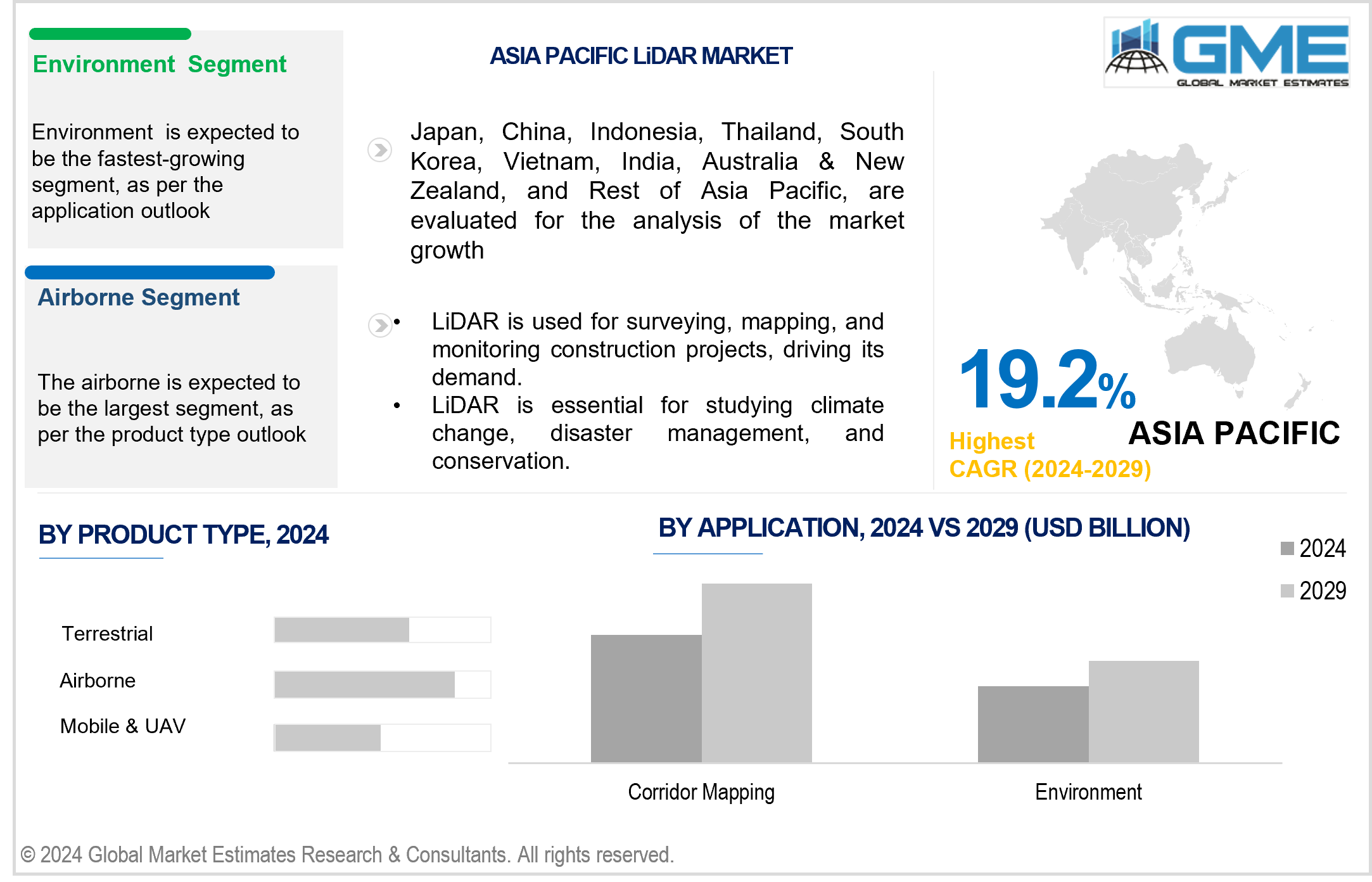

The airborne segment is expected to hold the largest share of the market. This growth is due to its widespread use in large-scale mapping and surveying applications. Airborne LiDAR collects high-resolution, precise data across large and inaccessible areas, making it perfect for topographic surveys, forestry management, and environmental monitoring. The ability to cover long distances quickly and efficiently increases the utility and demand for airborne LiDAR systems.

The terrestrial segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The growth is attributed to its increasing applications in urban planning, building, and LiDAR for smart cities. Terrestrial LiDAR systems provide precise and detailed 3D mapping of ground-level structures, allowing for accurate modeling and monitoring. As smart city efforts and infrastructure projects spread around the world, demand for terrestrial LiDAR solutions is expected to skyrocket, propelling the market forward.

The environment segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. This growth is attributed to a rising global focus on climate change, conservation, and sustainability. LiDAR's capacity to offer precise data for environmental monitoring, such as vegetation analysis, coastal erosion, and flood risk assessment, makes it indispensable in environmental applications.

The corridor mapping segment is expected to hold the largest share of the market. The segment's growth is due to its importance in infrastructure projects such as transportation and utilities. LiDAR's ability to correctly map linear features such as roads, trains, and power lines enables exact planning and maintenance. The growing need for efficient infrastructure development and modernization, particularly in urban and smart city projects, fuels the demand for corridor mapping, ensuring its dominant market position.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include early acceptance of advanced technology, significant investments in autonomous cars, and vast infrastructure development. The existence of top LiDAR manufacturers, as well as strong support for research and innovation, help to fuel market growth. Furthermore, widespread applications in environmental monitoring, smart cities, and surveying help to maintain North America's dominance in the global LiDAR market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increased investments in infrastructure development, smart city initiatives, and autonomous vehicle technology. The region's growing building activity and increased usage of advanced mapping technologies are driving up demand for LiDAR.

Faro Technologies, Inc., Leica Geosystem Holdings AG, Teledyne Optech Incorporated (A part of Teledyne Technologies), Trimble Navigation Limited, RIEGL USA, Inc., Quantum Spatial, Inc., Velodyne LiDAR, Inc., Sick AG, YellowScan, and GeoDigital., among others, are some of the key players operating in the global LiDAR market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2023, SICK, a prominent sensor manufacturer, announced the launch of multiScan100 LiDAR family, featuring the multiScan136 model. This LiDAR utilizes time of flight (TOF) measurement to achieve a 360° all-round view in 3D, capturing up to 690,000 measuring points for precise environmental mapping.

In January 2024, YellowScan, known for its pioneering work in Lidar mapping from drones, made a significant entry into the hydrographic sector with its YellowScan Navigator, a UAV-based bathymetric LiDAR solution. This new product addresses the critical need for surveyors to map underwater topography in various environments like rivers, ponds, and coastal areas.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LIDAR MARKET, BY APPLICATION

4.1 Introduction

4.2 LiDAR Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Corridor Mapping

4.4.1 Corridor Mapping Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Engineering

4.5.1 Engineering Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Environment

4.6.1 Environment Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Exploration

4.7.1 Exploration Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Advanced Driver Assistance Systems (ADAS)

4.8.1 Advanced Driver Assistance Systems (ADAS) Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL LIDAR MARKET, BY PRODUCT TYPE

5.1 Introduction

5.2 LiDAR Market: Product Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Airborne

5.4.1 Airborne Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Terrestrial

5.5.1 Terrestrial Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Mobile & UAV

5.6.1 Mobile & UAV Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL LIDAR MARKET, BY REGION

6.1 Introduction

6.2 North America LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Application

6.2.2 By Product Type

6.2.3 By Country

6.2.3.1 U.S. LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Application

6.2.3.1.2 By Product Type

6.2.3.2 Canada LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Application

6.2.3.2.2 By Product Type

6.2.3.3 Mexico LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Application

6.2.3.3.2 By Product Type

6.3 Europe LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Application

6.3.2 By Product Type

6.3.3 By Country

6.3.3.1 Germany LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Application

6.3.3.1.2 By Product Type

6.3.3.2 U.K. LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Application

6.3.3.2.2 By Product Type

6.3.3.3 France LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Application

6.3.3.3.2 By Product Type

6.3.3.4 Italy LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Application

6.3.3.4.2 By Product Type

6.3.3.5 Spain LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Application

6.3.3.5.2 By Product Type

6.3.3.6 Netherlands LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Product Type

6.3.3.7 Rest of Europe LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Application

6.3.3.6.2 By Product Type

6.4 Asia Pacific LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Application

6.4.2 By Product Type

6.4.3 By Country

6.4.3.1 China LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Application

6.4.3.1.2 By Product Type

6.4.3.2 Japan LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Application

6.4.3.2.2 By Product Type

6.4.3.3 India LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Application

6.4.3.3.2 By Product Type

6.4.3.4 South Korea LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Application

6.4.3.4.2 By Product Type

6.4.3.5 Singapore LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Application

6.4.3.5.2 By Product Type

6.4.3.6 Malaysia LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Product Type

6.4.3.7 Thailand LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Application

6.4.3.6.2 By Product Type

6.4.3.8 Indonesia LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Application

6.4.3.7.2 By Product Type

6.4.3.9 Vietnam LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Application

6.4.3.8.2 By Product Type

6.4.3.10 Taiwan LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Application

6.4.3.10.2 By Product Type

6.4.3.11 Rest of Asia Pacific LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Application

6.4.3.11.2 By Product Type

6.5 Middle East and Africa LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Application

6.5.2 By Product Type

6.5.3 By Country

6.5.3.1 Saudi Arabia LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Application

6.5.3.1.2 By Product Type

6.5.3.2 U.A.E. LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Application

6.5.3.2.2 By Product Type

6.5.3.3 Israel LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Application

6.5.3.3.2 By Product Type

6.5.3.4 South Africa LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Application

6.5.3.4.2 By Product Type

6.5.3.5 Rest of Middle East and Africa LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Application

6.5.3.5.2 By Product Type

6.6 Central and South America LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Application

6.6.2 By Product Type

6.6.3 By Country

6.6.3.1 Brazil LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Application

6.6.3.1.2 By Product Type

6.6.3.2 Argentina LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Application

6.6.3.2.2 By Product Type

6.6.3.3 Chile LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Product Type

6.6.3.3 Rest of Central and South America LiDAR Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Application

6.6.3.3.2 By Product Type

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Faro Technologies, Inc.

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Leica Geosystem Holdings AG

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Teledyne Optech Incorporated (A part of Teledyne Technologies)

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Trimble Navigation Limited

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 RIEGL USA, Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 QUANTUM SPATIAL, INC.

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Velodyne LiDAR, Inc

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Sick AG

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 YellowScan

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 GeoDigital

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global LiDAR Market, By Application, 2021-2029 (USD Mllion)

2 Corridor Mapping Market, By Region, 2021-2029 (USD Mllion)

3 Engineering Market, By Region, 2021-2029 (USD Mllion)

4 Environment Market, By Region, 2021-2029 (USD Mllion)

5 Advanced Driver Assistance Systems (ADAS) Market, By Region, 2021-2029 (USD Mllion)

6 Exploration Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

9 Airborne Market, By Region, 2021-2029 (USD Mllion)

10 Terrestrial Market, By Region, 2021-2029 (USD Mllion)

11 Mobile & UAV Market, By Region, 2021-2029 (USD Mllion)

12 Regional Analysis, 2021-2029 (USD Mllion)

13 North America LiDAR Market, By Application, 2021-2029 (USD Mllion)

14 North America LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

15 North America LiDAR Market, By COUNTRY, 2021-2029 (USD Mllion)

16 U.S. LiDAR Market, By Application, 2021-2029 (USD Mllion)

17 U.S. LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

18 Canada LiDAR Market, By Application, 2021-2029 (USD Mllion)

19 Canada LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

20 Mexico LiDAR Market, By Application, 2021-2029 (USD Mllion)

21 Mexico LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

22 Europe LiDAR Market, By Application, 2021-2029 (USD Mllion)

23 Europe LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

24 Europe LiDAR Market, By Country, 2021-2029 (USD Mllion)

25 Germany LiDAR Market, By Application, 2021-2029 (USD Mllion)

26 Germany LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

27 U.K. LiDAR Market, By Application, 2021-2029 (USD Mllion)

28 U.K. LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

29 France LiDAR Market, By Application, 2021-2029 (USD Mllion)

30 France LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

31 Italy LiDAR Market, By Application, 2021-2029 (USD Mllion)

32 Italy LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

33 Spain LiDAR Market, By Application, 2021-2029 (USD Mllion)

34 Spain LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

35 Netherlands LiDAR Market, By Application, 2021-2029 (USD Mllion)

36 Netherlands LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

37 Rest Of Europe LiDAR Market, By Application, 2021-2029 (USD Mllion)

38 Rest Of Europe LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

39 Asia Pacific LiDAR Market, By Application, 2021-2029 (USD Mllion)

40 Asia Pacific LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

41 Asia Pacific LiDAR Market, By Country, 2021-2029 (USD Mllion)

42 China LiDAR Market, By Application, 2021-2029 (USD Mllion)

43 China LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

44 Japan LiDAR Market, By Application, 2021-2029 (USD Mllion)

45 Japan LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

46 India LiDAR Market, By Application, 2021-2029 (USD Mllion)

47 India LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

48 South Korea LiDAR Market, By Application, 2021-2029 (USD Mllion)

49 South Korea LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

50 Singapore LiDAR Market, By Application, 2021-2029 (USD Mllion)

51 Singapore LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

52 Thailand LiDAR Market, By Application, 2021-2029 (USD Mllion)

53 Thailand LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

54 Malaysia LiDAR Market, By Application, 2021-2029 (USD Mllion)

55 Malaysia LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

56 Indonesia LiDAR Market, By Application, 2021-2029 (USD Mllion)

57 Indonesia LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

58 Vietnam LiDAR Market, By Application, 2021-2029 (USD Mllion)

59 Vietnam LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

60 Taiwan LiDAR Market, By Application, 2021-2029 (USD Mllion)

61 Taiwan LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

62 Rest of APAC LiDAR Market, By Application, 2021-2029 (USD Mllion)

63 Rest of APAC LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

64 Middle East and Africa LiDAR Market, By Application, 2021-2029 (USD Mllion)

65 Middle East and Africa LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

66 Middle East and Africa LiDAR Market, By Country, 2021-2029 (USD Mllion)

67 Saudi Arabia LiDAR Market, By Application, 2021-2029 (USD Mllion)

68 Saudi Arabia LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

69 UAE LiDAR Market, By Application, 2021-2029 (USD Mllion)

70 UAE LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

71 Israel LiDAR Market, By Application, 2021-2029 (USD Mllion)

72 Israel LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

73 South Africa LiDAR Market, By Application, 2021-2029 (USD Mllion)

74 South Africa LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa LiDAR Market, By Application, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

77 Central and South America LiDAR Market, By Application, 2021-2029 (USD Mllion)

78 Central and South America LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

79 Central and South America LiDAR Market, By Country, 2021-2029 (USD Mllion)

80 Brazil LiDAR Market, By Application, 2021-2029 (USD Mllion)

81 Brazil LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

82 Chile LiDAR Market, By Application, 2021-2029 (USD Mllion)

83 Chile LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

84 Argentina LiDAR Market, By Application, 2021-2029 (USD Mllion)

85 Argentina LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

86 Rest Of Central and South America LiDAR Market, By Application, 2021-2029 (USD Mllion)

87 Rest Of Central and South America LiDAR Market, By Product Type, 2021-2029 (USD Mllion)

88 Faro Technologies, Inc.: Products & Services Offering

89 Leica Geosystem Holdings AG: Products & Services Offering

90 Teledyne Optech Incorporated (A part of Teledyne Technologies): Products & Services Offering

91 Trimble Navigation Limited: Products & Services Offering

92 RIEGL USA, Inc.: Products & Services Offering

93 QUANTUM SPATIAL, INC.: Products & Services Offering

94 Velodyne LiDAR, Inc : Products & Services Offering

95 Sick AG: Products & Services Offering

96 YellowScan, Inc: Products & Services Offering

97 CompatibL: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global LiDAR Market Overview

2 Global LiDAR Market Value From 2021-2029 (USD Mllion)

3 Global LiDAR Market Share, By Application (2023)

4 Global LiDAR Market Share, By Product Type (2023)

5 Global LiDAR Market, By Region (Asia Pacific Market)

6 Technological Trends In Global LiDAR Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global LiDAR Market

10 Impact Of Challenges On The Global LiDAR Market

11 Porter’s Five Forces Analysis

12 Global LiDAR Market: By Application Scope Key Takeaways

13 Global LiDAR Market, By Application Segment: Revenue Growth Analysis

14 Corridor Mapping Market, By Region, 2021-2029 (USD Mllion)

15 Engineering Market, By Region, 2021-2029 (USD Mllion)

16 ExplorationMarket, By Region, 2021-2029 (USD Mllion)

17 Advanced Driver Assistance Systems (ADAS) Market, By Region, 2021-2029 (USD Mllion)

18 Environment Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global LiDAR Market: By Product Type Scope Key Takeaways

21 Global LiDAR Market, By Product Type Segment: Revenue Growth Analysis

22 Airborne Market, By Region, 2021-2029 (USD Mllion)

23 Terrestrial Market, By Region, 2021-2029 (USD Mllion)

24 Mobile & UAV Market, By Region, 2021-2029 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global LiDAR Market: Regional Analysis

27 North America LiDAR Market Overview

28 North America LiDAR Market, By Application

29 North America LiDAR Market, By Product Type

30 North America LiDAR Market, By Country

31 U.S. LiDAR Market, By Application

32 U.S. LiDAR Market, By Product Type

33 Canada LiDAR Market, By Application

34 Canada LiDAR Market, By Product Type

35 Mexico LiDAR Market, By Application

36 Mexico LiDAR Market, By Product Type

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 Faro Technologies, Inc.: Company Snapshot

40 Faro Technologies, Inc.: SWOT Analysis

41 Faro Technologies, Inc.: Geographic Presence

42 Leica Geosystem Holdings AG: Company Snapshot

43 Leica Geosystem Holdings AG: SWOT Analysis

44 Leica Geosystem Holdings AG: Geographic Presence

45 Teledyne Optech Incorporated (A part of Teledyne Technologies): Company Snapshot

46 Teledyne Optech Incorporated (A part of Teledyne Technologies): SWOT Analysis

47 Teledyne Optech Incorporated (A part of Teledyne Technologies): Geographic Presence

48 Trimble Navigation Limited: Company Snapshot

49 Trimble Navigation Limited: Swot Analysis

50 Trimble Navigation Limited: Geographic Presence

51 RIEGL USA, Inc.: Company Snapshot

52 RIEGL USA, Inc.: SWOT Analysis

53 RIEGL USA, Inc.: Geographic Presence

54 Quantum Spatial, Inc.: Company Snapshot

55 Quantum Spatial, Inc.: SWOT Analysis

56 Quantum Spatial, Inc.: Geographic Presence

57 Velodyne LiDAR, Inc : Company Snapshot

58 Velodyne LiDAR, Inc : SWOT Analysis

59 Velodyne LiDAR, Inc : Geographic Presence

60 Sick AG: Company Snapshot

61 Sick AG: SWOT Analysis

62 Sick AG: Geographic Presence

63 YellowScan, Inc.: Company Snapshot

64 YellowScan, Inc.: SWOT Analysis

65 YellowScan, Inc.: Geographic Presence

66 CompatibL: Company Snapshot

67 CompatibL: SWOT Analysis

68 CompatibL: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global LiDAR Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the LiDAR Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS