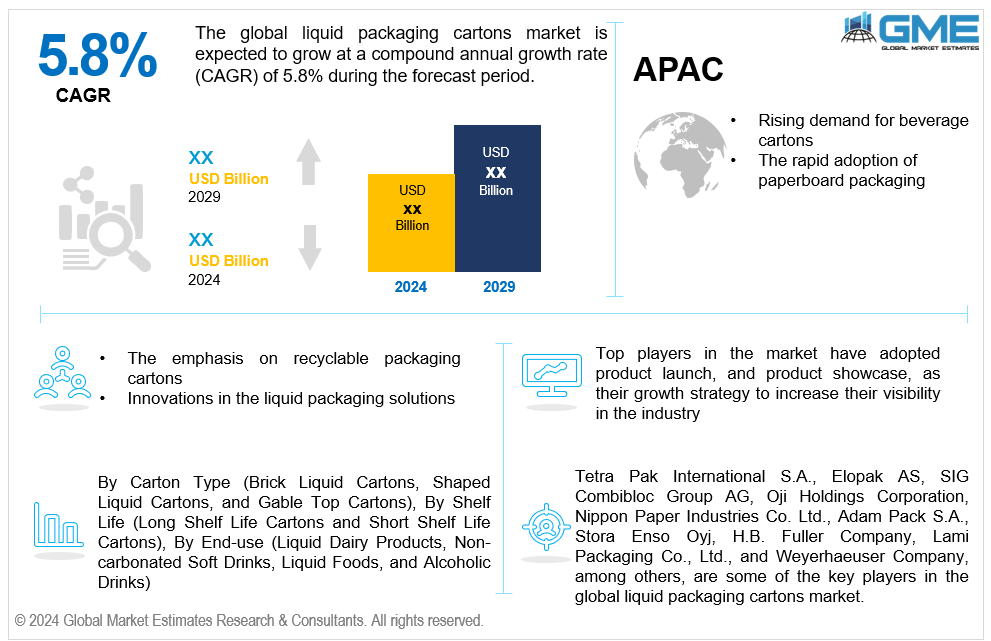

Global Liquid Packaging Cartons Market Size, Trends & Analysis - Forecasts to 2029 By Carton Type (Brick Liquid Cartons, Shaped Liquid Cartons, and Gable Top Cartons), By Shelf Life (Long Shelf Life Cartons and Short Shelf Life Cartons), By End-use (Liquid Dairy Products, Non-carbonated Soft Drinks, Liquid Foods, and Alcoholic Drinks), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global liquid packaging cartons market is estimated to exhibit a CAGR of 5.8% from 2024 to 2029.

The primary factors propelling the market growth are the rising demand for beverage cartons and the rapid adoption of paperboard packaging. The ease of use, longevity, and effectiveness of solutions like tetra pak cartons are major factors for rising demand. Since these cartons can increase shelf life and retain freshness, beverage producers are increasingly favoring them, especially regarding juice carton packaging. As the carton packaging industry evolves, innovations in liquid carton packaging materials and carton packaging design are playing a crucial role. While modern designs improve consumer appeal and utility, advanced materials offer superior barrier qualities and sustainability. These factors work together to stimulate the market as customers and companies look for cost-effective packaging options that preserve product integrity and address the rising environmental concerns. For instance, the United States revenue from non-alcoholic drinks was USD 447.38 billion in 2022, according to Zippia.

The growing emphasis on recyclable packaging cartons and the innovations in liquid packaging solutions are expected to support the market growth. Advancements in dairy packaging cartons ensure extended shelf life and freshness, critical for maintaining product quality. Innovations in liquid food packaging, such as improved barrier properties and leak-proof designs, enhance product safety and convenience. Moreover, the market is witnessing a shift toward eco-friendly carton packaging due to growing customer consciousness and need for sustainable methods. These eco-friendly solutions often incorporate recyclable and biodegradable materials, contributing to sustainable packaging solutions. Furthermore, carton packaging innovations, including smart packaging technologies and ergonomic designs, enhance consumer engagement and usability. These improvements cater to modern customer demands for efficiency and sustainability in addition to adhering to legal and environmental requirements.

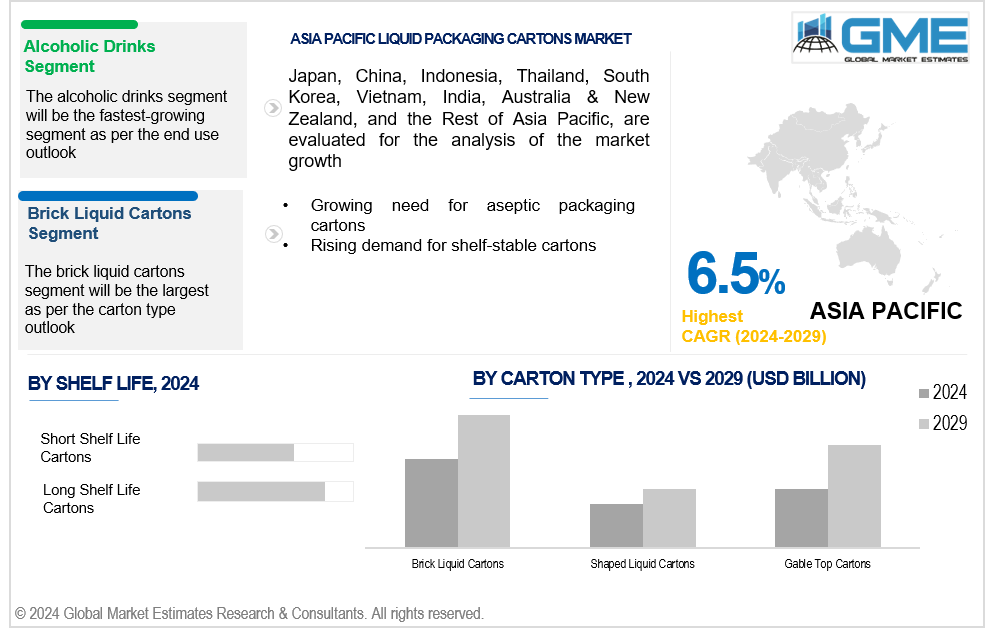

The rising need for aseptic packaging cartons and the rising demand for shelf-stable cartons propel market growth. Shelf-stable cartons are essential for extended shelf life without refrigeration, making them ideal for a wide range of products. This demand is boosting interest in tetra pak alternatives as manufacturers seek competitive and innovative packaging options that offer similar benefits. Current liquid carton packaging trends emphasize sustainability, convenience, and improved barrier properties, critical for shelf-stable solutions. Advances in carton packaging manufacturing are enhancing production efficiency and reducing costs, further supporting market growth. Liquid packaging carton suppliers are responding to this trend by expanding their portfolios with new and improved shelf-stable options that meet consumer and regulatory demands.

Developing and utilizing plant-based materials for liquid packaging cartons provides opportunities in the market, drawing in environmentally concerned consumers. These materials meet the increasing need for environmentally friendly packaging options while lowering carbon emissions. Moreover, customers can gain extra value from integrating smart packaging technology, such as freshness indicators and QR codes for traceability. This invention can increase consumer engagement and strengthen brand loyalty.

However, fluctuating raw material prices and stringent environmental regulations and standards may impede market growth.

The brick liquid cartons segment is expected to hold the largest share of the market over the forecast period. Brick liquid cartons are extremely adaptable and can be used to package several liquid goods, such as milk, juices, soups, and other drinks. Many manufacturers use them due to their capacity to serve a wide range of product categories.

The gable top cartons segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Gable top cartons are frequently connected to premium products like specialized drinks, fresh juices, and organic milk. The demand for this kind of packaging is driven by consumers' increasing preference for premium products.

The long shelf life cartons segment is expected to hold the largest share of the market over the forecast period. Products kept in cartons with long shelf lives are frequently aseptically processed, meaning they only need to be refrigerated once they are opened. Due to this characteristic, they are appropriate for all regions, including those with irregular electrical supplies or restricted access to refrigerated facilities.

The short shelf life cartons segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Freshness and quality are becoming increasingly important to consumers when choosing foods and beverages. Short shelf life cartons address this desire by offering items that are perceived to be fresher for short time and less processed than those with a longer shelf life.

The liquid dairy products segment is expected to hold the largest share of the market over the forecast period. This segment includes a broad range of products, such as yogurt drinks, dairy substitutes, flavored milk, and milk. Due to this diversity, there is a greater need for liquid packaging cartons to accommodate various product types.

The alcoholic drinks segment is anticipated to be the fastest-growing segment from 2024 to 2029. Ready-to-drink cocktails and mixed alcoholic beverages are becoming increasingly popular, particularly with younger customers seeking fresh tastes and convenience. For such products, liquid packing cartons provide lightweight and portable packaging options.

North America is expected to be the largest region in the global market. The North American market is significantly influenced by sustainability, as companies and customers are becoming more concerned about lessening their environmental effects. Market players are focusing on developing cartons for liquid packaging that are recyclable and composed of renewable materials, which aligns with environmental objectives.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The beverage industry, which includes the manufacturing of juices, dairy products, and ready-to-drink products, is expanding significantly in the Asia Pacific region. As they can increase shelf life and retain product freshness, liquid packaging cartons are the recommended option.

Tetra Pak International S.A., Elopak AS, SIG Combibloc Group AG, Oji Holdings Corporation, Nippon Paper Industries Co. Ltd., Adam Pack S.A., Stora Enso Oyj, H.B. Fuller Company, Lami Packaging Co., Ltd., and Weyerhaeuser Company, among others, are some of the key players in the global liquid packaging cartons market.

Please note: This is not an exhaustive list of companies profiled in the report.

In October 2023, SIG launched its distinctively new SIG DomeMini carton bottle for on-the-go use. The small-size carton pack combines the environmental advantages of a carton pack with all the convenience of a plastic bottle.

In September 2023, LUORO extended its Paperdent line of sustainable dental care products. LUORO was the first firm to introduce a mouthwash product in Elopack's D-PAKTM

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL LIQUID PACKAGING CARTONS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL LIQUID PACKAGING CARTONS MARKET, BY CARTON TYPE

4.1 Introduction

4.2 Liquid Packaging Cartons Market: Carton Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Brick Liquid Cartons

4.4.1 Brick Liquid Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Shaped Liquid Cartons

4.5.1 Shaped Liquid Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Gable Top Cartons

4.6.1 Gable Top Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL LIQUID PACKAGING CARTONS MARKET, BY SHELF LIFE

5.1 Introduction

5.2 Liquid Packaging Cartons Market: Shelf Life Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Long Shelf Life Cartons

5.4.1 Long Shelf Life Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Short Shelf Life Cartons

5.5.1 Short Shelf Life Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL LIQUID PACKAGING CARTONS MARKET, BY END-USE

6.1 Introduction

6.2 Liquid Packaging Cartons Market: End-use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Liquid Dairy Products

6.4.1 Liquid Dairy Products Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Non-carbonated Soft Drinks

6.5.1 Non-carbonated Soft Drinks Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Liquid Foods

6.6.1 Liquid Foods Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Alcoholic Drinks

6.7.1 Alcoholic Drinks Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL LIQUID PACKAGING CARTONS MARKET, BY REGION

7.1 Introduction

7.2 North America Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Carton Type

7.2.2 By Shelf Life

7.2.3 By End-use

7.2.4 By Country

7.2.4.1 U.S. Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Carton Type

7.2.4.1.2 By Shelf Life

7.2.4.1.3 By End-use

7.2.4.2 Canada Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Carton Type

7.2.4.2.2 By Shelf Life

7.2.4.2.3 By End-use

7.2.4.3 Mexico Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Carton Type

7.2.4.3.2 By Shelf Life

7.2.4.3.3 By End-use

7.3 Europe Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Carton Type

7.3.2 By Shelf Life

7.3.3 By End-use

7.3.4 By Country

7.3.4.1 Germany Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Carton Type

7.3.4.1.2 By Shelf Life

7.3.4.1.3 By End-use

7.3.4.2 U.K. Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Carton Type

7.3.4.2.2 By Shelf Life

7.3.4.2.3 By End-use

7.3.4.3 France Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Carton Type

7.3.4.3.2 By Shelf Life

7.3.4.3.3 By End-use

7.3.4.4 Italy Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Carton Type

7.3.4.4.2 By Shelf Life

7.2.4.4.3 By End-use

7.3.4.5 Spain Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Carton Type

7.3.4.5.2 By Shelf Life

7.2.4.5.3 By End-use

7.3.4.6 Netherlands Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Carton Type

7.3.4.6.2 By Shelf Life

7.2.4.6.3 By End-use

7.3.4.7 Rest of Europe Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Carton Type

7.3.4.7.2 By Shelf Life

7.2.4.7.3 By End-use

7.4 Asia Pacific Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Carton Type

7.4.2 By Shelf Life

7.4.3 By End-use

7.4.4 By Country

7.4.4.1 China Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Carton Type

7.4.4.1.2 By Shelf Life

7.4.4.1.3 By End-use

7.4.4.2 Japan Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Carton Type

7.4.4.2.2 By Shelf Life

7.4.4.2.3 By End-use

7.4.4.3 India Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Carton Type

7.4.4.3.2 By Shelf Life

7.4.4.3.3 By End-use

7.4.4.4 South Korea Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Carton Type

7.4.4.4.2 By Shelf Life

7.4.4.4.3 By End-use

7.4.4.5 Singapore Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Carton Type

7.4.4.5.2 By Shelf Life

7.4.4.5.3 By End-use

7.4.4.6 Malaysia Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Carton Type

7.4.4.6.2 By Shelf Life

7.4.4.6.3 By End-use

7.4.4.7 Thailand Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Carton Type

7.4.4.7.2 By Shelf Life

7.4.4.7.3 By End-use

7.4.4.8 Indonesia Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Carton Type

7.4.4.8.2 By Shelf Life

7.4.4.8.3 By End-use

7.4.4.9 Vietnam Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Carton Type

7.4.4.9.2 By Shelf Life

7.4.4.9.3 By End-use

7.4.4.10 Taiwan Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Carton Type

7.4.4.10.2 By Shelf Life

7.4.4.10.3 By End-use

7.4.4.11 Rest of Asia Pacific Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Carton Type

7.4.4.11.2 By Shelf Life

7.4.4.11.3 By End-use

7.5 Middle East and Africa Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Carton Type

7.5.2 By Shelf Life

7.5.3 By End-use

7.5.4 By Country

7.5.4.1 Saudi Arabia Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Carton Type

7.5.4.1.2 By Shelf Life

7.5.4.1.3 By End-use

7.5.4.2 U.A.E. Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Carton Type

7.5.4.2.2 By Shelf Life

7.5.4.2.3 By End-use

7.5.4.3 Israel Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Carton Type

7.5.4.3.2 By Shelf Life

7.5.4.3.3 By End-use

7.5.4.4 South Africa Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Carton Type

7.5.4.4.2 By Shelf Life

7.5.4.4.3 By End-use

7.5.4.5 Rest of Middle East and Africa Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Carton Type

7.5.4.5.2 By Shelf Life

7.5.4.5.2 By End-use

7.6 Central and South America Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Carton Type

7.6.2 By Shelf Life

7.6.3 By End-use

7.6.4 By Country

7.6.4.1 Brazil Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Carton Type

7.6.4.1.2 By Shelf Life

7.6.4.1.3 By End-use

7.6.4.2 Argentina Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Carton Type

7.6.4.2.2 By Shelf Life

7.6.4.2.3 By End-use

7.6.4.3 Chile Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Carton Type

7.6.4.3.2 By Shelf Life

7.6.4.3.3 By End-use

7.6.4.4 Rest of Central and South America Liquid Packaging Cartons Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Carton Type

7.6.4.4.2 By Shelf Life

7.6.4.4.3 By End-use

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Tetra Pak International S.A.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Elopak AS

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 SIG Combibloc Group AG

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Oji Holdings Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Nippon Paper Industries Co. Ltd.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 ADAM PACK S.A.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Stora Enso Oyj

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 H.B. Fuller Company

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Lami Packaging Co., Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Weyerhaeuser Company

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Mllion)

2 Brick Liquid Cartons Market, By Region, 2021-2029 (USD Mllion)

3 Shaped Liquid Cartons Market, By Region, 2021-2029 (USD Mllion)

4 Gable Top Cartons Market, By Region, 2021-2029 (USD Mllion)

5 Global Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Mllion)

6 Long Shelf Life Cartons Market, By Region, 2021-2029 (USD Mllion)

7 Short Shelf Life Cartons Market, By Region, 2021-2029 (USD Mllion)

8 Global Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Mllion)

9 Liquid Dairy Products Market, By Region, 2021-2029 (USD Mllion)

10 Non-carbonated Soft Drinks Market, By Region, 2021-2029 (USD Mllion)

11 Liquid Foods Market, By Region, 2021-2029 (USD Mllion)

12 Alcoholic Drinks Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

15 North America Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

16 North America Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

17 North America Liquid Packaging Cartons Market, By Country, 2021-2029 (USD Million)

18 U.S. Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

19 U.S. Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

20 U.S. Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

21 Canada Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

22 Canada Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

23 Canada Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

24 Mexico Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

25 Mexico Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

26 Mexico Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

27 Europe Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

28 Europe Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

29 Europe Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

30 Europe Liquid Packaging Cartons Market, By Country 2021-2029 (USD Million)

31 Germany Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

32 Germany Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

33 Germany Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

34 U.K. Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

35 U.K. Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

36 U.K. Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

37 France Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

38 France Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

39 France Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

40 Italy Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

41 Italy Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

42 Italy Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

43 Spain Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

44 Spain Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

45 Spain Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

46 Netherlands Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

47 Netherlands Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

48 Netherlands Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

49 Rest Of Europe Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

50 Rest Of Europe Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

51 Rest of Europe Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

52 Asia Pacific Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

53 Asia Pacific Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

54 Asia Pacific Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

55 Asia Pacific Liquid Packaging Cartons Market, By Country, 2021-2029 (USD Million)

56 China Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

57 China Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

58 China Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

59 India Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

60 India Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

61 India Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

62 Japan Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

63 Japan Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

64 Japan Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

65 South Korea Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

66 South Korea Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

67 South Korea Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

68 malaysia Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

69 malaysia Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

70 malaysia Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

71 Thailand Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

72 Thailand Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

73 Thailand Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

74 Indonesia Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

75 Indonesia Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

76 Indonesia Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

77 Vietnam Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

78 Vietnam Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

79 Vietnam Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

80 Taiwan Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

81 Taiwan Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

82 Taiwan Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

83 Rest of Asia Pacific Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

84 Rest of Asia Pacific Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

85 Rest of Asia Pacific Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

86 Middle East and Africa Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

87 Middle East and Africa Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

88 Middle East and Africa Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

89 Middle East and Africa Liquid Packaging Cartons Market, By Country, 2021-2029 (USD Million)

90 Saudi Arabia Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

91 Saudi Arabia Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

92 Saudi Arabia Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

93 UAE Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

94 UAE Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

95 UAE Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

96 Israel Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

97 Israel Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

98 Israel Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

99 South Africa Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

100 South Africa Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

101 South Africa Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

103 Rest of Middle East and Africa Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

105 Central and South America Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

106 Central and South America Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

107 Central and South America Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

108 Central and South America Liquid Packaging Cartons Market, By Country, 2021-2029 (USD Million)

109 Brazil Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

110 Brazil Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

111 Brazil Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

112 Argentina Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

113 Argentina Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

114 Argentina Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

115 Chile Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

116 Chile Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

117 Chile Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

118 Rest of Central and South America Liquid Packaging Cartons Market, By Carton Type, 2021-2029 (USD Million)

119 Rest of Central and South America Liquid Packaging Cartons Market, By Shelf Life, 2021-2029 (USD Million)

120 Rest of Central and South America Liquid Packaging Cartons Market, By End-use, 2021-2029 (USD Million)

121 Tetra Pak International S.A.: Products & Services Offering

122 Elopak AS: Products & Services Offering

123 SIG Combibloc Group AG: Products & Services Offering

124 Oji Holdings Corporation: Products & Services Offering

125 Nippon Paper Industries Co. Ltd.: Products & Services Offering

126 ADAM PACK S.A.: Products & Services Offering

127 Stora Enso Oyj: Products & Services Offering

128 H.B. Fuller Company: Products & Services Offering

129 Lami Packaging Co., Ltd., Inc: Products & Services Offering

130 Weyerhaeuser Company: Products & Services Offering

131 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Liquid Packaging Cartons Market Overview

2 Global Liquid Packaging Cartons Market Value From 2021-2029 (USD Mllion)

3 Global Liquid Packaging Cartons Market Share, By Carton Type (2023)

4 Global Liquid Packaging Cartons Market Share, By Shelf Life (2023)

5 Global Liquid Packaging Cartons Market Share, By End-use (2023)

6 Global Liquid Packaging Cartons Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Liquid Packaging Cartons Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Liquid Packaging Cartons Market

11 Impact Of Challenges On The Global Liquid Packaging Cartons Market

12 Porter’s Five Forces Analysis

13 Global Liquid Packaging Cartons Market: By Carton Type Scope Key Takeaways

14 Global Liquid Packaging Cartons Market, By Carton Type Segment: Revenue Growth Analysis

15 Brick Liquid Cartons Market, By Region, 2021-2029 (USD Mllion)

16 Shaped Liquid Cartons Market, By Region, 2021-2029 (USD Mllion)

17 Gable Top Cartons Market, By Region, 2021-2029 (USD Mllion)

18 Global Liquid Packaging Cartons Market: By Shelf Life Scope Key Takeaways

19 Global Liquid Packaging Cartons Market, By Shelf Life Segment: Revenue Growth Analysis

20 Long Shelf Life Cartons Market, By Region, 2021-2029 (USD Mllion)

21 Short Shelf Life Cartons Market, By Region, 2021-2029 (USD Mllion)

22 Global Liquid Packaging Cartons Market: By End-use Scope Key Takeaways

23 Global Liquid Packaging Cartons Market, By End-use Segment: Revenue Growth Analysis

24 Liquid Dairy Products Market, By Region, 2021-2029 (USD Mllion)

25 Non-carbonated Soft Drinks Market, By Region, 2021-2029 (USD Mllion)

26 Liquid Foods Market, By Region, 2021-2029 (USD Mllion)

27 Alcoholic Drinks Market, By Region, 2021-2029 (USD Mllion)

28 Regional Segment: Revenue Growth Analysis

29 Global Liquid Packaging Cartons Market: Regional Analysis

30 North America Liquid Packaging Cartons Market Overview

31 North America Liquid Packaging Cartons Market, By Carton Type

32 North America Liquid Packaging Cartons Market, By Shelf Life

33 North America Liquid Packaging Cartons Market, By End-use

34 North America Liquid Packaging Cartons Market, By Country

35 U.S. Liquid Packaging Cartons Market, By Carton Type

36 U.S. Liquid Packaging Cartons Market, By Shelf Life

37 U.S. Liquid Packaging Cartons Market, By End-use

38 Canada Liquid Packaging Cartons Market, By Carton Type

39 Canada Liquid Packaging Cartons Market, By Shelf Life

40 Canada Liquid Packaging Cartons Market, By End-use

41 Mexico Liquid Packaging Cartons Market, By Carton Type

42 Mexico Liquid Packaging Cartons Market, By Shelf Life

43 Mexico Liquid Packaging Cartons Market, By End-use

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Tetra Pak International S.A.: Company Snapshot

47 Tetra Pak International S.A.: SWOT Analysis

48 Tetra Pak International S.A.: Geographic Presence

49 Elopak AS: Company Snapshot

50 Elopak AS: SWOT Analysis

51 Elopak AS: Geographic Presence

52 SIG Combibloc Group AG: Company Snapshot

53 SIG Combibloc Group AG: SWOT Analysis

54 SIG Combibloc Group AG: Geographic Presence

55 Oji Holdings Corporation: Company Snapshot

56 Oji Holdings Corporation: Swot Analysis

57 Oji Holdings Corporation: Geographic Presence

58 Nippon Paper Industries Co. Ltd.: Company Snapshot

59 Nippon Paper Industries Co. Ltd.: SWOT Analysis

60 Nippon Paper Industries Co. Ltd.: Geographic Presence

61 ADAM PACK S.A.: Company Snapshot

62 ADAM PACK S.A.: SWOT Analysis

63 ADAM PACK S.A.: Geographic Presence

64 Stora Enso Oyj : Company Snapshot

65 Stora Enso Oyj : SWOT Analysis

66 Stora Enso Oyj : Geographic Presence

67 H.B. Fuller Company: Company Snapshot

68 H.B. Fuller Company: SWOT Analysis

69 H.B. Fuller Company: Geographic Presence

70 Lami Packaging Co., Ltd., Inc.: Company Snapshot

71 Lami Packaging Co., Ltd., Inc.: SWOT Analysis

72 Lami Packaging Co., Ltd., Inc.: Geographic Presence

73 Weyerhaeuser Company: Company Snapshot

74 Weyerhaeuser Company: SWOT Analysis

75 Weyerhaeuser Company: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global Liquid Packaging Cartons Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Liquid Packaging Cartons Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS